Ethereum merge

ETHW confirms contract vulnerability exploit, dismisses replay attack claims

Post-Ethereum Merge proof-of-work (PoW) chain ETHW has moved to quell claims that it had suffered an on-chain replay attack over the weekend. Smart contract auditing firm BlockSec flagged what it described as a replay attack that took place on Sept. 16, in which attackers harvested ETHW tokens by replaying the call data of Ethereum’s proof-of-stake (PoS) chain on the forked Ethereum PoW chain. According to BlockSec, the root cause of the exploit was due to the fact that the Omni cross-chain bridge on the ETHW chain used old chainID and was not correctly verifying the correct chainID of the cross-chain message. Ethereum’s Mainnet and test networks use two identifiers for different uses, namely, a network ID and a chain ID (chainID). Peer-to-peer messages between nodes make use of network ID...

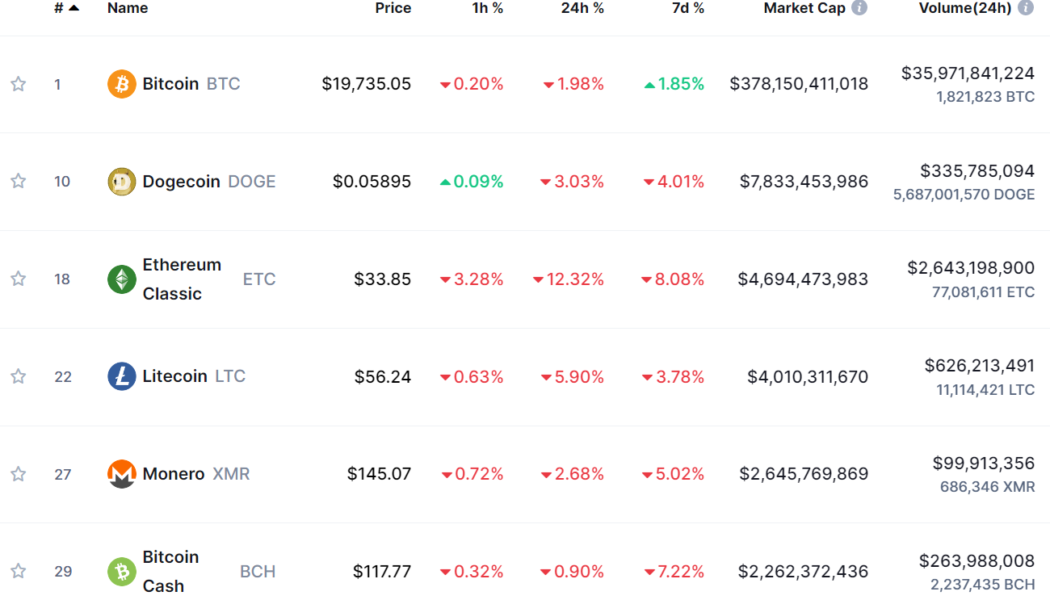

Dogecoin becomes second largest PoW cryptocurrency

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Merge ‘jitters’ sees outflow from Ether-based investment products

Institutional investors may be wavering ahead of the Ethereum Merge, with Ether-based digital asset investment products seeing an outflow of $61.6 million, signaling concerns about the success of the upgrade. In its digital asset fund flows weekly report, fund manager CoinShares reported that Ether-based investment products made up for the majority of total outflows over the Sept. 5-11 week — leading to the market’s fifth consecutive week of outflows. Report author James Butterfill said the outflows have come “despite the improved certainty of the Merge,” which could highlight a concern amongst investors that the “event might not go as planned,” referring to the upcoming Ethereum Merge set for Sept. 15. This is despite the likelihood of a successful Merge improving over the last week...

Ether price could ‘decouple’ from other crypto post Merge — Chainalysis

Crypto analytics firm Chainalysis has suggested that the price of Ether (ETH) could decouple from other crypto assets post-Merge, with staking yields potentially driving strong institutional adoption. In a Sept. 7 report, Chainalysis explained that the upcoming Ethereum upgrade would introduce institutional investors to staking yields similar to certain instruments such as bonds and commodities, while also becoming much more eco-friendly. The report said ETH staking is expected to offer a 10-15% yield annually for stakers, therefore making ETH an “enticing bond alternative for institutional investors” considering that treasury bonds yields offer much less in comparison. “Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make...

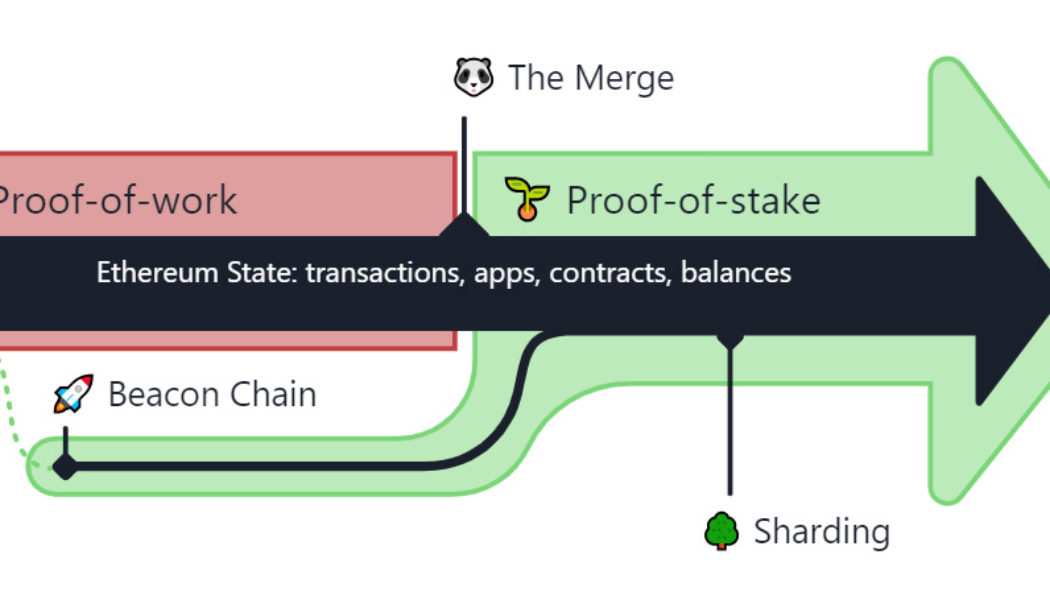

74% of Ethereum nodes ‘Merge ready’ ahead of Bellatrix upgrade

As many as 73.5% of Ethereum nodes are now marked as “Merge ready” ahead of the upcoming Bellatrix upgrade for Ethereum on Sept. 6, according to data from Ethernodes. The Bellatrix upgrade is seen as one of the last necessary steps prior to the official Merge, which will see Ethereum transition to a proof-of-stake consensus mechanism between Sept. 10-20. To become Merge ready, Ethereum node operators must comply with the Bellatrix upgrade by updating its consensus layer clients prior to epoch 144896 on the Beacon Chain, which is scheduled to take place on 11:34:47am UTC on Sept. 6, 2022, according to the Ethereum Foundation. Percentage of Ethereum clients that are Merge Ready. Source: Ethernodes. However, with as many as 26.7% of nodes marked “Not-Ready” for the Ethereum Merge, Ether...

Ethereum Classic books 12% rally as mining support for ETC gains pace

Ethereum Classic (ETC) price rallied on Sept. 5 on back-to-back positive reports concerning its adoption among crypto miners. Top mining pool supports Ethereum Classic On the daily chart, ETC’s price surged 14.5% to nearly $37.25 per token. Its massive gains came days after BTC.com, a blockchain explorer and crypto mining pool, launched a specialized Ethereum Classic pool with “zero-fee” mining for three months. ETC/USD daily price chart. Source: TradingView The announcement appeared after “the Merge,” a long-awaited network update that would switch Ethereum’s energy-intensive proof-of-work (PoW) protocol to a “cost-efficient” and scalable alternative, the proof-of-stake (PoS), on Sept. 19 or before. But the switch to PoS will make Ether...

US dollar smashes yet another 20-year high as Bitcoin price sags 2.7%

Bitcoin (BTC) faced familiar pressure on the Sept. 1 Wall Street open as the U.S. dollar hit fresh two-decade highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: DXY could hit 115 before ‘slowdown’ Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell to $19,658 on Bitstamp, down 2.7% from the day’s high. The pair faced stiff resistance trying to flip the important $20,000 mark to solid support, with macro cues further complicating the picture for bulls. That came in the form of a resurgent U.S. dollar index (DXY) on the day, which beat previous peaks to reach 109.97, its highest since September 2002. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView Risk assets thus broadly lost ground, with the S&P 500 and Nas...

Scaramucci highlights key factors why crypto market will soon recover

Founder and managing partner of Skybridge Capital, Anthony Scaramucci, has an optimistic outlook for the future of crypto markets, advising investors to “see through the current environment” and “stay patient and stay long term.” In an interview with CNBC, the hedge fund manager spoke about his belief that several recent developments in the crypto space could spark “a lot more commercial activity.” In particular, he highlighted the ever-improving Lightning Network, the two-layer payment protocol layered on top of Bitcoin (BTC), BlackRock’s partnership with Coinbase, and their subsequent establishment of a BTC Private Trust Fund as positive signs for the future. Finally, CEO Larry Fink is seeing institutional demand for digital assets. Otherwis...

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

Ethereum Beacon Chain experiences 7 block reorg: What’s going on?

Ahead of the Merge tentatively penciled in for August, Ethereum’s Beacon Chain experienced a seven-block reorganization (reorg) yesterday. According to data from Beacon Scan, on May 25 seven blocks from number 3,887,075 to 3,887,081 were knocked out of the Beacon Chain between 08:55:23 to 08:56:35 AM UTC. The term reorg refers to an event in which a block that was part of the canonical chain, such as the Beacon Chain, gets knocked off the chain due to a competing block beating it out. It can be the result of a malicious attack from a miner with high resources or a bug. Such incidents see the chain unintentionally fork or duplicate. On this occasion, developers believe that the issue is due to circumstance rather than something serious such as a security issue or fundamental flaw, with a “p...

OpenEthereum support ends with the Merge fast approaching

One of the most popular Ethereum (ETH) clients, OpenEthereum has ended support for its software in preparation for the upcoming Ethereum Merge. OpenEthereum creates “clients” or software used to interact with the Ethereum network allowing anyone to create an Ethereum node to mine the cryptocurrency which is currently using a proof-of-work (PoW) consensus mechanism. In a Twitter thread the OpenEthereum team explained that with the Merge approaching and the legacy codebase becoming “increasingly difficult to manage” due to its age that it was the right time to end support. OpenEthereum support has officially ended. The repo is now archived, and all maintenance and updates have stopped. Why? And what next? Read the — OpenEthereum is Deprecated (@OpenEthereumOrg) May 24, 2022 The project was f...