ethereum classic

Charles Hoskinson and ETH dev get into a war of words post-Vasil upgrade

Charles Hoskinson, the founder of Cardano and co-founder of Ethereum blockchain, got into a war of words with Ethereum developers on the implementation of proof-of-stake (PoS) consensus via Merge. On Sunday, Web3 investor Evan Van Ness shared an unpopular opinion claiming that the Ethereum Merge could have been shipped earlier. Vitalik Buterin, the co-founder of Ethereum, agreed to Van Ness’s comments and said they should have implemented NXT-like chain-based PoS. Hoskinson joined in the conversation claiming the Ethereum developers should have implemented snow white protocol instead to ensure a faster migration to proof-of-stake (PoS) consensus. You should have just implemented snow white with Elaine’s help. It would have saved you a heck of a lot of pain and effort. — Charles Hoski...

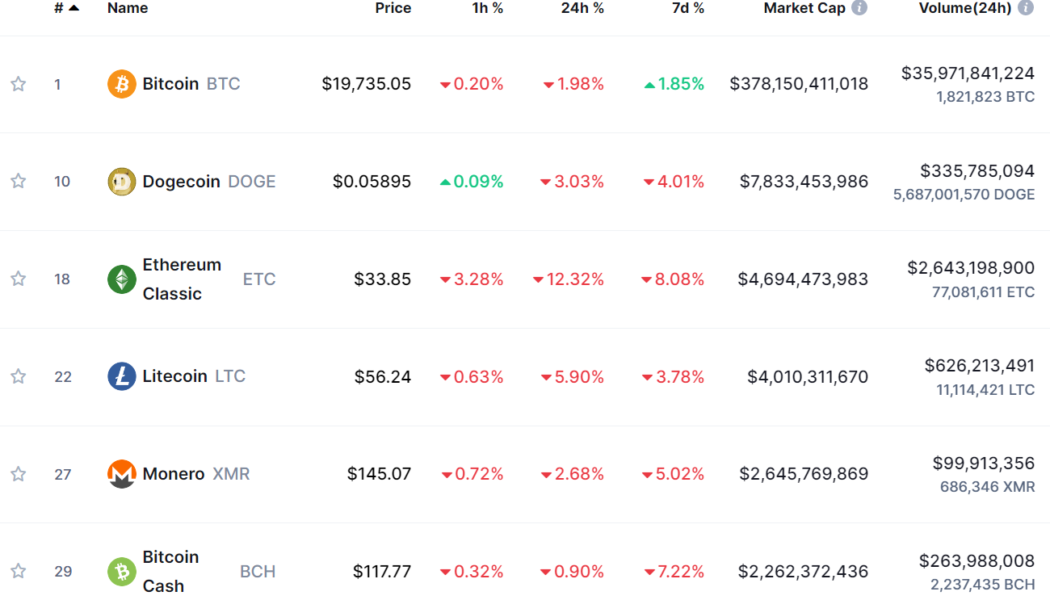

Dogecoin becomes second largest PoW cryptocurrency

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Ethereum’s potential fork ETHPOW has crashed 80% since debut — More pain ahead?

The listing of ETHPOW (ETHW) across multiple crypto exchanges has been followed by a huge drop in price despite some initial success. ETHPOW drops 80% On the daily chart, ETHW’s price dropped by more than 80% to $25 on Sept. 10, over a month after its market debut. ETHW/USD daily price chart. Source: TradingView For starters, ETHPOW only exists as a futures ticker, for now, conceived in anticipation that an upcoming network update on Ethereum could result in a chain split. Ethereum will undergo a major protocol change called the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Therefore, Ethereum will obsolete its army of miners, replacing them with “validators,” which are nodes that woul...

Ethereum Classic books 12% rally as mining support for ETC gains pace

Ethereum Classic (ETC) price rallied on Sept. 5 on back-to-back positive reports concerning its adoption among crypto miners. Top mining pool supports Ethereum Classic On the daily chart, ETC’s price surged 14.5% to nearly $37.25 per token. Its massive gains came days after BTC.com, a blockchain explorer and crypto mining pool, launched a specialized Ethereum Classic pool with “zero-fee” mining for three months. ETC/USD daily price chart. Source: TradingView The announcement appeared after “the Merge,” a long-awaited network update that would switch Ethereum’s energy-intensive proof-of-work (PoW) protocol to a “cost-efficient” and scalable alternative, the proof-of-stake (PoS), on Sept. 19 or before. But the switch to PoS will make Ether...

Australian regulators rattle their saber as adoption takes a major leap: Law Decoded, Aug. 22–29

Australia’s financial regulator, the Securities and Investments Commission (ASIC), has pledged to put crypto assets and decentralized finance (DeFi) firmly in its sights over the next four years. The regulator intends to focus on “digitally enabled misconducts” and to protect investors “from harms posed by crypto-assets.” Given the ASIC’s history of anti-crypto sentiments, such an announcement could be perceived as hostile, but at least it contains a promise to implement some regulatory framework that is still absent. And it is hardly a coincidence that the announcement came only days after Australia’s new ruling government announced plans to move forward with regulation of the crypto sector by conducting a “token mapping” exercise by the end of the year. At the same time, Australia’...

Ethereum Classic soars 100% in nine days outperforming ETH as ‘the Merge’ approaches

Ethereum Classic (ETC) has been outperforming its arch-rival Ethereum’s native token Ether (ETH) during the current crypto market rebound with the ETC/ETH pairs at 10-month highs. Why is ETC beating ETH? ETC’s price has risen to $27 on July 22, amounting to a 100% gain in nine days after bottoming out at $13.35. Comparatively, ETH’s price has seen a 64% rally in U.S. dollar terms. ETC/USD versus ETH/USD daily price chart. Source: TradingView Ethereum’s rebound has been among the sharpest among the top cryptocurrencies, primarily due to the euphoria surrounding its potential network upgrade in September. Dubbed “the Merge,” the long-awaited technical update will switch Ethereum from proof-of-work (PoW) to proof-of-stake (PoS). Anyone who believes the #Eth...

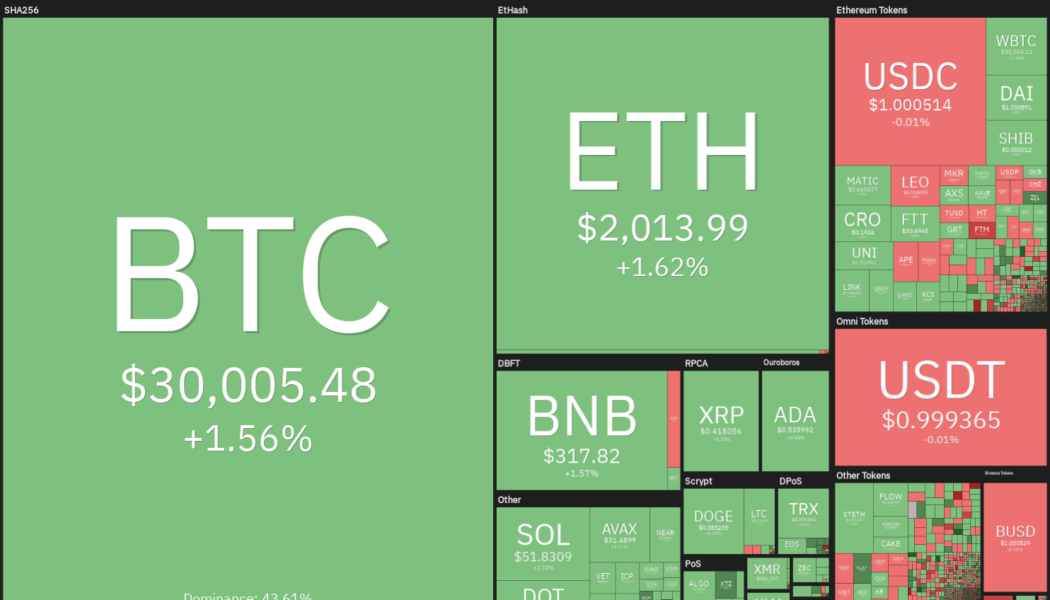

Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

The United States equities markets recovered from their intra-week lows last week, suggesting demand exists at lower levels. On similar lines, Bitcoin (BTC) also recovered from $18,910 last week, indicating that traders may be getting back into risky assets. However, analysts remain divided in their opinion on the recovery in Bitcoin. While some believe that the relief rally is a bull trap, others expect the up-move to retest the crucial resistance at the 200-week moving average ($22,626). Crypto market data daily view. Source: Coin360 The current bear phase has damaged sentiment as seen from the Crypto Fear and Greed Index, which has remained in the “extreme fear” zone since May 6. According to Philip Swift, creator of on-chain analytics platform LookIntoBitcoin, the time spent...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, FTT, ETC, XMR

Bitcoin (BTC) dropped from a high of $47,200 on April 5 to a low of $42,107 on April 8, indicating possible selling by short-term traders who may have preferred to lock in their profits. However, the price action is still stuck in a tight range during the weekend, indicating that supply and demand are in balance. Although the Crypto Fear & Greed Index is in the fear zone, Bitcoin whales on crypto exchange Bitfinex remained unfazed and continued to purchase BTC. Interestingly, one large investor continued to buy $1 million of Bitcoin every day, without attempting to time the market, using the strategy of dollar-cost averaging. Crypto market data daily view. Source: Coin360 Another whale that utilized the dip to add more Bitcoin to its existing stockpile was Terra. This week, the wallet ...

Bitcoin Cash and Ethereum Classic up double digits as 24-hour trading volume eclipses $100 BN

Ethereum has cleared resistance at $3,000 on Tuesday morning Other top altcoins including ADA, DOT, and XRP are trading in the green as well The majority of top cryptocurrencies appear to be gaining ground on Tuesday with the total market capital peaking above $2 trillion. Bitcoin price shot up to a multi-week high of $43,116 in the early Asian trading hours, CoinMarketCap data shows. Although the OG crypto has retreated to around $42,470 as of this writing, it is still trading in the green – up approximately 3% in the last 24 hours. Ether price crossed $3,00o on the strength of the sharp overnight ascent, touching a five-week high of $3,040. Market data further shows that ETH’s 24 hr trading volume has swelled by almost 42% to $19.688 billion. Bitcoin Cash and Ethereum Classic leading gai...

- 1

- 2