Ethereum 2.0

Crypto Biz: Goldman Sachs tip-toes into ETH, Mar. 4-10

Wall Street’s embrace of digital assets is showing no signs of slowing down. In fact, they don’t even need to tell us about it as the proof is in the fine print. This week, a United States Securities and Exchange Commission (SEC) filing revealed that multinational investment bank Goldman Sachs has been quietly offering clients exposure to Ether (ETH) through Galaxy Digital, a crypto-focused financial services provider headed by billionaire Mike Novogratz. Of course, this isn’t the first time Goldman has worked with Galaxy Digital to offer clients a gateway to digital assets. In June 2021, the investment giant began trading a Bitcoin (BTC) futures project in collaboration with Galaxy Digital. Like other financial services giants, Goldman Sachs sees the writing on the wall and realizes...

Andreessen Horowitz invests $70M in Ethereum staking protocol Lido

Ethereum staking solution Lido Finance has raised $70 million from venture capital giant Andreessen Horowitz, marking the protocol’s first funding round since May 2021. Andreessen Horowitz’s investment in Lido is intended to further support the adoption of decentralized staking solutions for Ethereum 2.0, a spokesperson for the venture capital firm said. Ethereum 2.0 marks a significant shift in the network’s consensus algorithm by ushering in the adoption of proof-of-stake (PoS) and other upgrades that could enhance scalability and reduce fees. The transition to Ethereum 2.0, which began in November 2020, is still ongoing. Excited to share that @a16z has invested $70M in @LidoFinance, one of the easiest ways to stake ETH and other PoS assets, and we used Lido to stake a portion of o...

3 reasons why Lido DAO Token could be on the verge of breaking its downtrend

Ethereum (ETH) and decentralized finance (DeFi) are undergoing a seismic shift as the transition to Eth2 and a proof-of-stake consensus mechanism is helping to increase the value proposition for the network which has historically has been plagued with scaling issues and high transaction costs. Alongside this transition has been the introduction of liquid staking, which is helping to add utility to DeFi and giving investors the option to do more with their assets than just lock them up indefinitely. Liquid staking could also help investors build more capital efficient portfolios. One protocol that has benefited from the shift toward liquid staking is Lido (LDO), a platform that allows investors to earn staking rewards on their tokens while also enabling them to put the resulting...

Crypto community welcomes Ethereum zkSync testnet

zkSync, a provider of zero-knowledge blockchain solutions, has announced the successful deployment of its Rollup protocol on the Ethereum (ETH) testnet. The deployment is seen as a positive development by proponents of Ethereum, as it removes the need for human operators to validate transactions. Last year, the creators of zkSync described their vision for a permissionless, Turing-complete rollout that allows decentralized applications (DApps) to be deployed in a low-cost and scalable layer-2 environment. Users will supposedly have “a better” experience on this network, according to the official announcement by Matter Labs. One of the major issues when utilizing the Ethereum blockchain is its prohibitively high gas fees. As a result, many users and developers have mig...

Ethereum white paper predicted DeFi but missed NFTs: Vitalik Buterin

Rounding up the last decade, Ethereum co-founder Vitalik Buterin revisited his predictions made over the years, showcasing a knack for being right about abstract ideas than on-production software development issues. Buterin started the Twitter thread by addressing his article dated Jul. 23, 2013 in which he highlighted Bitcoin’s (BTC) key benefits — internationality and censorship resistance. Buterin foresaw Bitcoin’s potential in protecting the citizens’ buying power in countries such as Iran, Argentina, China and Africa. However, Buterin also noticed a rise in stablecoin adoption as he saw Argentinian businesses operating in Tether (USDT). He backed up his decade-old ideas around the negative impacts of Bitcoin regulation. My views today: sure, Bitcoin’s decentralizatio...

Eth2’s Rocket Pool reaches $350M TVL and 635 node operators in five weeks

Rocket Pool, a decentralized Ethereum 2.0 staking platform has surpassed $350 million worth of total value locked (TVL) within five weeks of its official launch. The project aims to remove the barriers to entry for Eth2 stakers and node operators. It allows any user to run a node for 16 ETH ($59,000), which is half of the 32 ETH ($119,000) required in the Eth2 deposit contract. Users with as little as 0.01 ETH can also stake their funds and receive yield. According to data from DefiLlama, Rocket Pool has surged up the decentralized finance (DeFi) staking platform rankings to sit at third with a TVL of $355.64 million at the time of writing. The project is currently behind the Keep3r Network at $584.34 million, and Lido Finance in first place with $6.04 billion. Lido Finance was launched in...

Ether’s growth as independent asset fuels ETH-BTC flippening narrative

The narrative surrounding Ether (ETH) of it fast transforming into an independent asset has been around for some time now. However, the last few months have seen this notion gain an increasing amount of mainstream traction, as is best highlighted by the fact that, since Oct. 1, ETH has showcased substantial northbound movement against Bitcoin (BTC). To put things into perspective, toward the beginning of November, the one-month realized correlation between the BTC/ETH pair dipped as low as 60%, its lowest ever in the currency’s decade-old history. Furthermore, since the start of the year, while Bitcoin registered gains of 105%, Ether went up by a whopping 505%, thus outperforming the flagship crypto by nearly five times. Ether gaining an upper hand is perhaps best reflected in that, ...

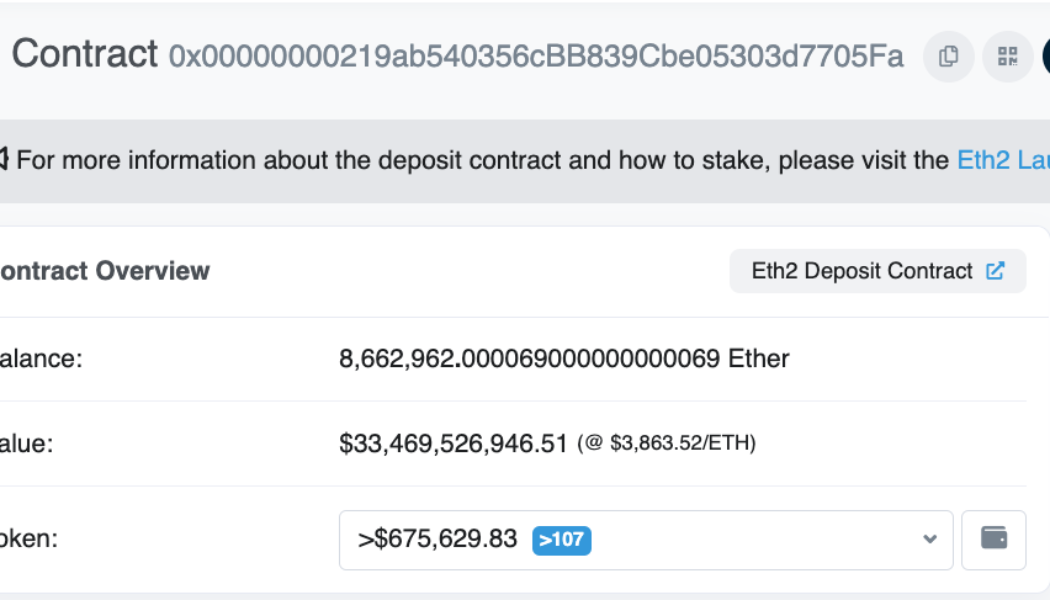

$33.5 billion worth of ETH ‘trapped’ in largest Ethereum contract

The single largest Ethereum contract containing 8,641,954 Ether (ETH) worth $33.5 billion is sitting idle because it cannot be spent or sent. A Twitter user highlighted the Beacon chain contract claiming it to be the largest Ethereum contract with billions of dollars worth of ETH “trapped” inside it. BREAKING: 8,641,954 ETH ($32 billion) trapped in single largest Ethereum contract and unable to be sent or spent. Will require hard fork that hasn’t been written or specified yet. Timing and terms of hard fork still unknown.https://t.co/xcXPwbS93v — Tomer Strolight | Not interested in your trades. (@TomerStrolight) December 14, 2021 The contract in question is an Ethereum 2.0 Beacon Chain staking contract launched in November 2020, and it cannot be spent without a hardfork. Beacon ...