Ether Price

Crypto’s youngest investors hold firm against headwinds — and headlines

These can be anxious times for holders of cryptocurrencies, especially those who entered the market in late 2021 when prices were cresting. Bitcoin (BTC), Ether (ETH) and especially altcoins now appear to be undergoing a major reset, down 50% or more from November highs. Some worry that a whole generation of crypto adopters could be lost if things crumble further. “If the market decline continues, it will become too painful and retail investors will bail,” Eben Burr, president of Toews Asset Management, told Reuters earlier this month. “Everyone has a breaking point.” But, all the gloom and doom could be overdone. It’s “unnerving,” acknowledged Callie Cox, United States investment analyst at eToro, but it’s only par for the course for a market that scarcely existed a decade ago. Bitcoin, a...

Falling wedge pattern points to eventual Ethereum price reversal, but traders expect more pain first

The cryptocurrency market was hit with another round of selling on May 26 as Bitcoin (BTC) price dropped to $28,000 and Ether (ETH) briefly fell under $1,800. The ETH/BTC pair also dropped below what traders deem to be an important ascending trendline, a move that traders say could result in Ether price correcting to new lows. ETH/USDT 1-day chart. Source: TradingView Here’s a rundown of what several analysts in the market are saying about the move lower for Ethereum and what it could mean for its price in the near term. Price consolidation will eventually result in a sharp move A brief check-in on what levels of support and resistance to keep an eye on was provided by independent market analyst Michaël van de Poppe, who posted the following chart showing Ether trading near its range ...

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week. BTC/USDT 1-day chart. Source: TradingView As reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 based on its historical price performance fo...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

Altcoin Roundup: Analysts give their take on the impact of the Ethereum Merge delay

The rollout of Ethereum 2.0, or Eth2, includes a transition from proof-of-work to proof-of-stake that will supposedly transform Ether (ETH) into a deflationary asset and revolutionize the entire network. The event has been a trending topic for years and while anticipation for “The Merge” has been building over the past couple of months, this week Ethereum core developer Tim Beiko informed the world that “It won’t be June, but likely in the few months after. No firm date yet.” Delays in Ethereum network upgrades are nothing new and so far, the immediate effect on Ether’s price following the revelation has been minimal. Here’s what several analysts have said about what the merger means for Ethereum and how this most recent delay could affect ETH price moving forward. Staking Rewards ex...

Ethereum price hits $3.2K as anticipation builds ahead of the ‘Merge’

The week-long uptrend in the cryptocurrency market has begun to awaken bullish crypto investors and the successful March 15 launch of the Ethereum “merge” on the Kiln testnet has the community excited about the upcoming switch to proof-of-stake (POS). Data from Cointelegraph Markets Pro and TradingView shows that since the successful launch on Kiln, the price of Ether has climbed 25% from $2,500 to a daily high at $3,193 on March 25 as traders look to lock in their positions ahead of the merge. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts in the market are saying could happen with the price of Ether as the merge approaches and how the switch to POS could affect its price long term. A clear breakout from the downtrend The turnaround in Ether pri...

Ethereum price breaks through $3K, but analysts warn that a retest is needed

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio. Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term. Upcoming test of $3,125 A general overview of the recent...

Ether bulls eye resistance at $3K as the network prepares to undergo ‘The Merge’

A new week in the cryptocurrency market has brought more of the same sideways price action that the wider ecosystem has experienced in recent months, as Bitcoin (BTC) continues to hold support near $41,000 while some analysts warn that high inflation and rising interest rates could see the top cryptocurrency fall to $30,000. On the altcoin front, Ether (ETH) appears to be showing some signs of life as noted by cryptocurrency analyst Willy Woo, who recently tweeted that “Ether [is] setting up to break upwards out of a very long term, 3.5-month bearish trend line.” Data from Cointelegraph Markets Pro and TradingView shows that the ETH price is now trading above support at $2,900, with bulls looking to make another run at breaking the $3,000 resistance after being firmly rejected a...

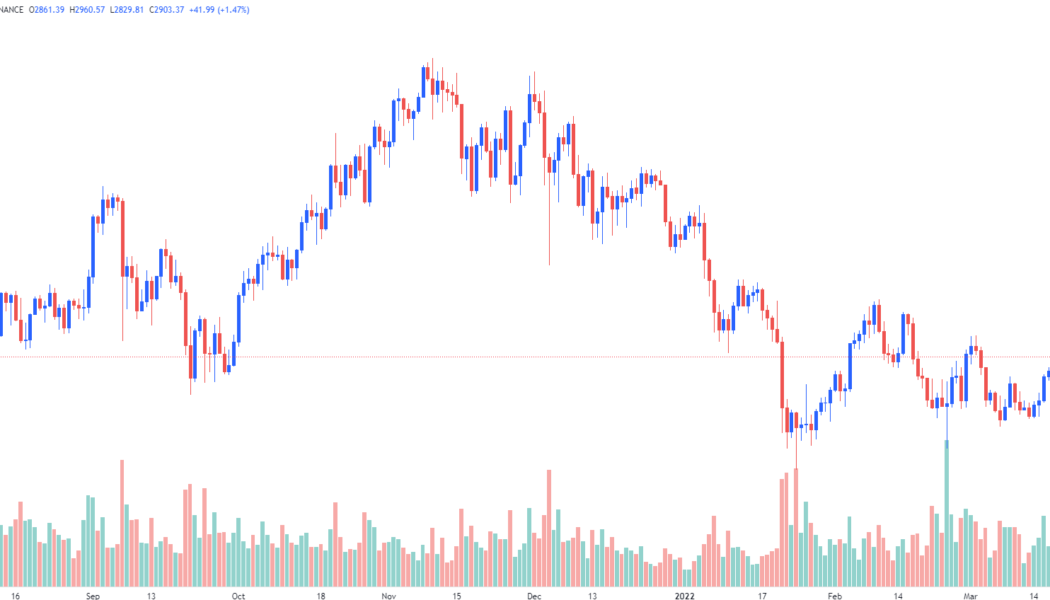

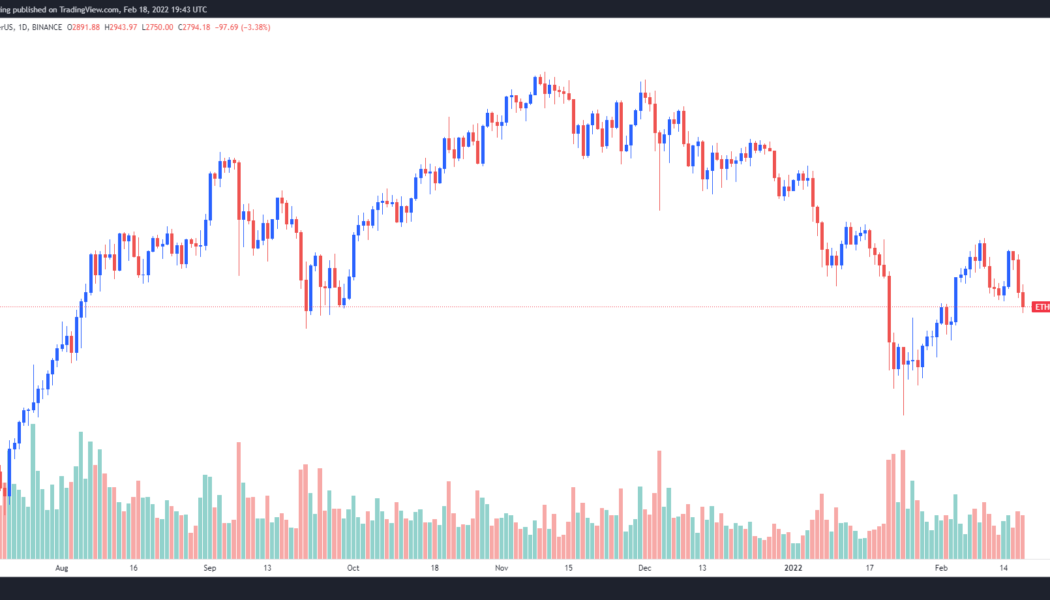

Analyst say Ethereum price could fall to $1,700 if the current climate prevails

Bitcoin (BTC) and Ether (ETH) price are still being hard hit by the current wave of volatility and this is leading traders to go back to the drawing board and readjust their short-term expectations. On Feb.17, Bitcoin price briefly dipped below $40,000 and Ether failed to hold support at $2,900, raises the chance of a drop to $2,500. Data from Cointelegraph Markets Pro and TradingView shows that after hovering near the $2,900 support level through the morning trading hours, Ether was hit with a wave of selling that dropped it to an intraday low of $2,752. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about the price drop for Ether and whether or not more downside is expected as global tensions continue to rise. Ethereum’s nex...

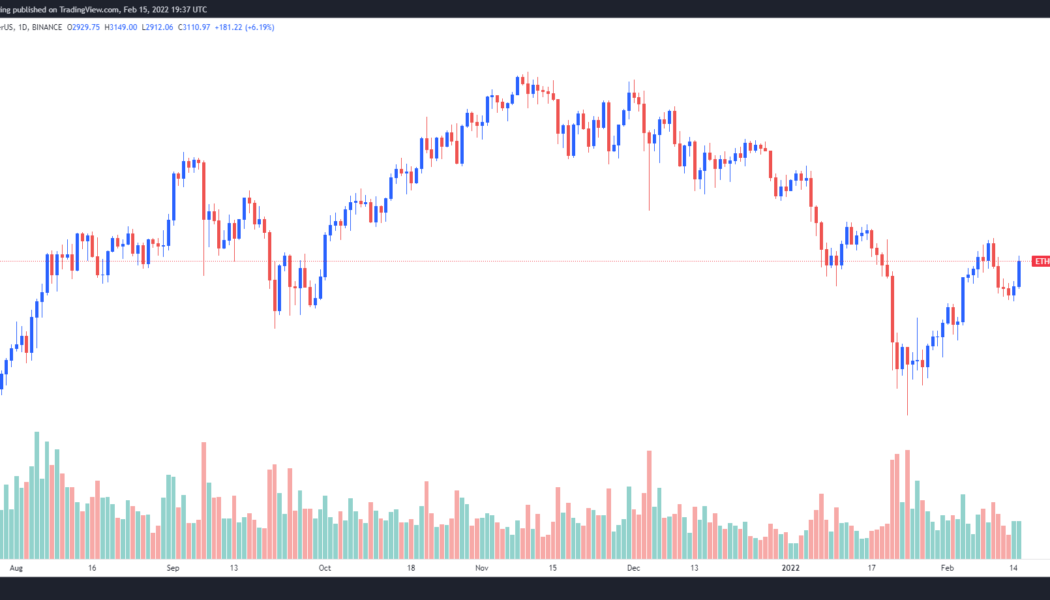

Traders say $4,000 Ethereum back on the cards ‘if’ this bullish chart pattern plays out

Global and macroeconomic concerns ranging from rising inflation rates in the United States to the prospect of Russia invading Ukraine continue to spark volatility in financial markets. To the surprise of many analysts, the mood in the cryptocurrency market shifted in a positive direction on Feb. 15 after Bitcoin (BTC) climbed to $44,500 and Ether (ETH) regained support at $3,100. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2,826 in the early trading hours on Feb. 15, the price of Ether rallied 11.4% to a daily high of $3,148. ETH/USDT 4-hour chart. Source: TradingView Here’s a look at what several traders in the market are saying about the recent price action for Ether and what to be on the lookout for in the weeks ahead. Ether is in a heavy ...

Ethereum eyes $3.5K as ETH price reclaims pandemic-era support with 40% rebound

Ethereum’s native token Ether (ETH) looks poised to hit $3,500 in the coming sessions as it reclaimed a historically strong support level on Feb. 5. Ethereum price back above key trendline ETH price rising above its 50-week exponential moving average (50-week EMA; the red wave in the chart below) means the price also inched above $3,000, a psychological support level that may serve as the ground for Ether’s next leg up. ETH/USD weekly price chart. Source: TradingView The 50-week EMA was instrumental in maintaining Ether’s bullish bias across 2020 and 2021. For instance, it served as a strong accumulation zone during the market correction in the second and third quarters last year, pushing ETH price from around $1,700 to as high as $4,951 (data from Binance). As a result, ...

Crypto donations jumped nearly 16x in 2021, new report says

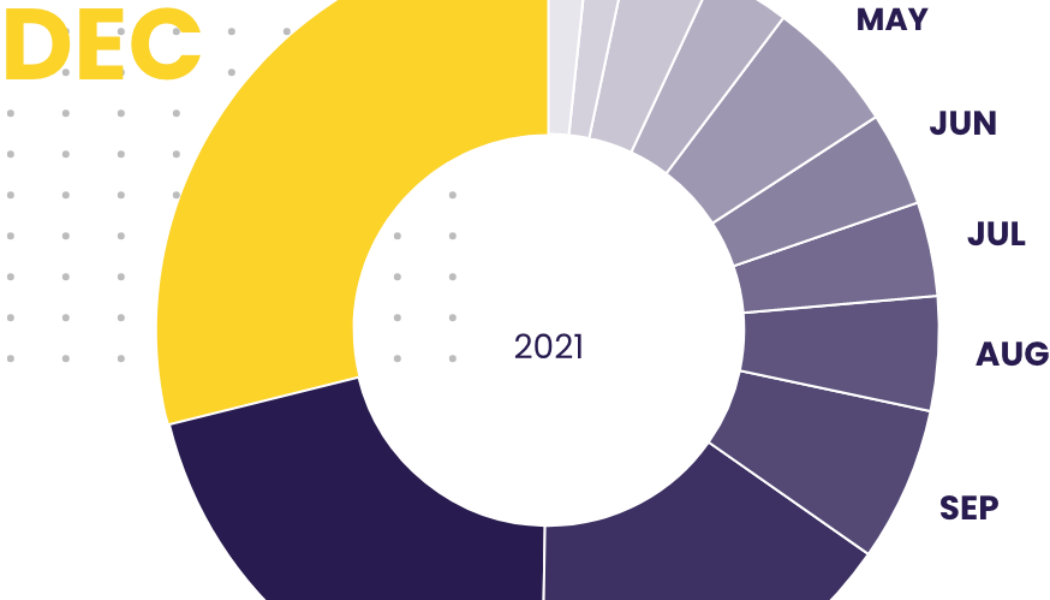

2021 was not just the year of institutionalization of crypto and new all-time highs; it also turned out to be the biggest year for crypto philanthropy. According to research data from The Giving platform, crypto donation volume rose to $69.6 million in 2021 compared to $4.2 million in 2020. Crypto donation volume spiked 1,558% or nearly 16x over the same period. The average crypto donations also saw a 236% increase, rising from an average of $3,109 in 2020 to $10,445 in 2021. The data further revealed that the average crypto donation size was 82x larger than an average cash donation. The average donation in crypto was estimated at $10,455 compared to $128 in cash. The monthly donation data revealed several interesting aspects about crypto donors. The report highlighted that the crypto...