Ether Price

Ethereum’s Shanghai upgrade could supercharge liquid staking derivatives — Here’s how

The crypto market witnessed the DeFi summer of 2020, where decentralized finance applications like Compound and Uniswap turned Ether (ETH) and Bitcoin (BTC) into yield-bearing assets via yield farming and liquidity mining rewards. The price of Ether nearly doubled to $490 as the total liquidity across DeFi protocols quickly surged to $10 billion. Toward the end of 2020 and early 2021, the COVID-19-induced quantitative easing across global markets was in full effect, causing a mega-bull run that lasted almost a year. During this time, Ether’s price increased nearly ten times to a peak above $4,800. After the euphoric bullish phase ended, a painful cool-down journey was exacerbated by the UST-LUNA crash which began in early 2022. This took Ether’s price down to $800. A ray of hope eventually...

Ether exchange netflow highlights behavioral pattern of ETH whales

The exchange netflow of Ether (ETH) over the past couple of years highlights a behavioral pattern among Ether whales that market analysts believe is done to pump the price of the second-largest cryptocurrency. The “exchange netflow” is an indicator that measures the net amount of crypto entering or exiting wallets of all centralized exchanges. The metric’s value is simply calculated by taking the difference between the exchange inflows and the exchange outflows. Data shared by one of the pseudonymous traders of crypto analytic firm Cryptoquant indicates that ETH whales have consistently sent their holdings onto exchanges to raise the price of ETH and sell it at a higher market price. The Ethereum exchange netflow data confirmed the behavioral pattern among ETH whales and in...

Ethereum miners dump 30K ETH, stonewalling ‘ultra sound money’ deflation narrative

Ethereum’s switch to proof-of-stake (PoS) on Sept. 15 failed to extend Ether’s (ETH) upside momentum as ETH miners added sell pressure to the market. On the daily chart, ETH price declined from around $1,650 on Sept. 15 to around $1,350 on Sept. 20, an almost 16% drop. The ETH/USD pair dropped in sync with other top cryptocurrencies, including Bitcoin (BTC), amid worries about higher Federal Reserve rate hikes. ETH/USD daily price chart. Source: TradingView Ethereum remains inflationary The Ether price drop on Sept. 15 also coincided with an increase in ETH supply, albeit not immediately post-Merge. $ETH is now Ultra Sound Money pic.twitter.com/fKz6VmoWdR — DavidHoffman.eth (@TrustlessState) September 15, 2022 Roughly 24 hours later, the supply change flipped positi...

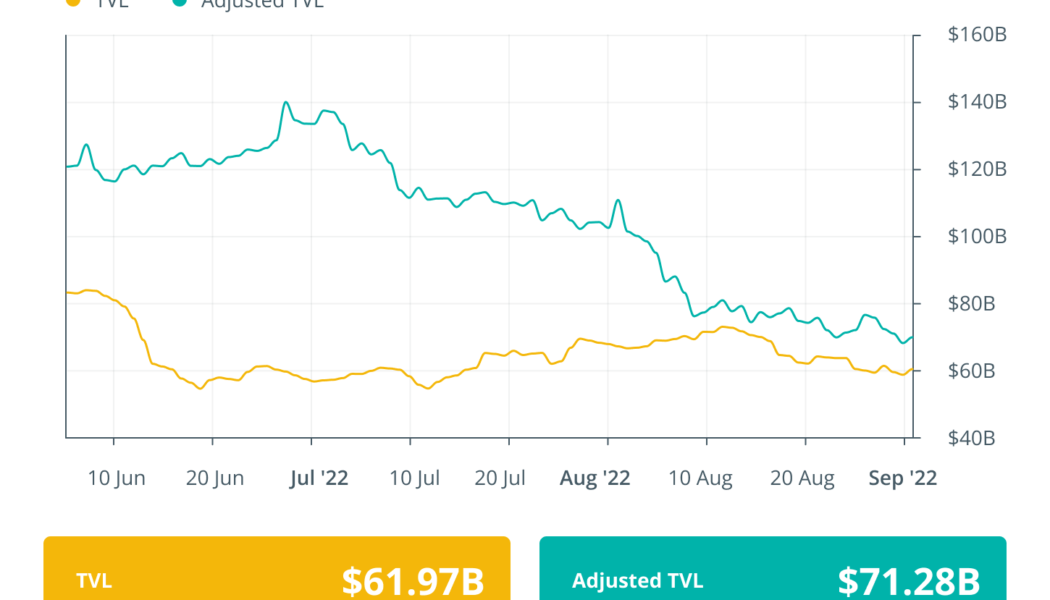

Experts weigh in on the Ethereum vulnerabilities after Merge: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The past week in the DeFi ecosystem saw major developments centered around the Ethereum Merge. Aave (AAVE) community proposed temporarily suspending Ether (ETH) lending before the Merge, citing the potential issue of high ETH utilization that may result in liquidations being hard or impossible and annual percentage yields (APYs) reaching negative figures. An industry expert shared his opinion on possible censorship vulnerabilities that the Ethereum network could eventually face in the wake of its transition to a proof-of-stake (PoS) blockchain. Moving ahead of the Ethereum Merge developments, some other major even...

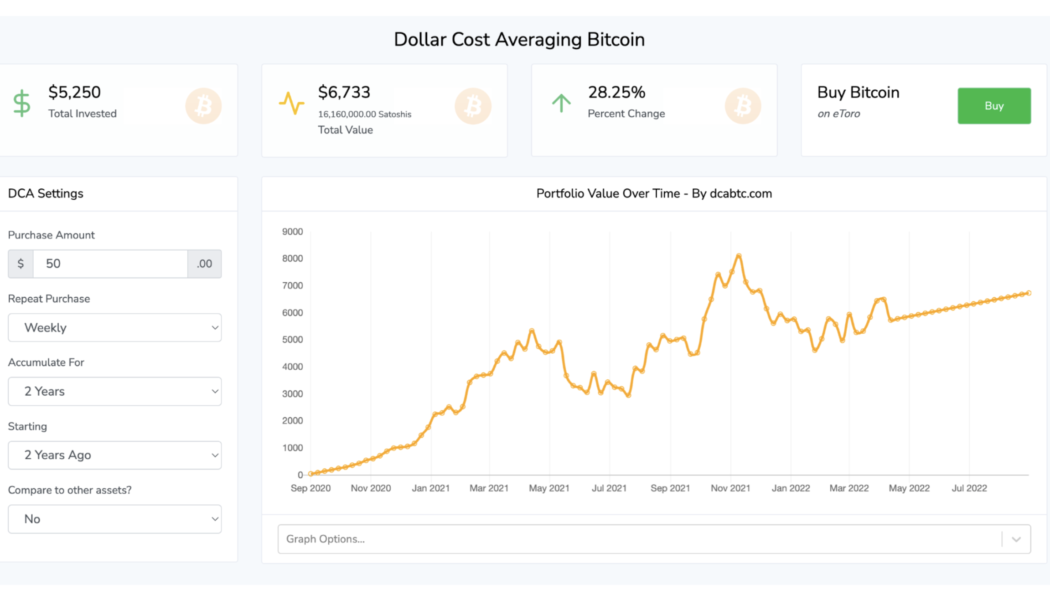

3 ways to trade Bitcoin and altcoins during a bear market

Markets are scary right now, and while the situation is likely to worsen, it doesn’t mean investors need to sit out and watch from the sidelines. In fact, history has proven that one of the best times to buy Bitcoin (BTC) is when no one is talking about Bitcoin. Remember the 2018–2020 crypto winter? I do. Hardly anyone, including mainstream media, was talking about crypto in a positive or negative way. It was during this time of prolonged downtrend and lengthy sideways chop that smart investors were accumulating in preparation for the next bull trend. Of course, nobody knew “when” this parabolic advance would take place, but the example is purely meant to illustrate that crypto might be in a crab market, but there are still great strategies for investing in Bitcoin. Let’s take a look at th...

Why $20.8K is a critical level for Bitcoin | Find out now on Market Talks with Charlie Burton

In this week’s episode of Market Talks, we welcome professional trader Charlie Burton. Charlie is a professional trader with 24 years of experience and has been trading full-time since 2001. He is the founder of EzeeTrader and Charlie Burton Trading. He is also undefeated in the annual London Forex show live trade-off for the five years it was running. He has also been featured in the hugely popular BBC documentary “Trader, Millions by the Minute.” Charlie is one of the very few trading educators who is also a professional money manager trading FCA-regulated capital. The main topic of discussion with Charlie will be the current support level for Bitcoin (BTC) and why it is so critical. If Bitcoin goes below its current support, what are other major price levels you should...

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin (BTC) price remains pinned below $22,000 as the lingering impact of the Aug. 19 sell-off at $25,200 continues to be felt across the market. According to analysts from on-chain monitoring resource Glassnode, BTC’s tap at the $25,000 level was followed by “distribution” as profit-takers and short-term holders sold as price encountered a trendline resistance following a 23-consecutive-day uptrend that saw BTC trading above it’s realized price ($21,700). Bitcoin total inflows and outflows to all exchanges (USD). Source: glassnode The firm also noted that the “total inflows and outflows to all exchanges” metric shows exchange flows at multi-year lows and back to “late-2020 levels,” which reflects a “general lack of speculative interest.” Stocks and crypto clearly risk off until we...

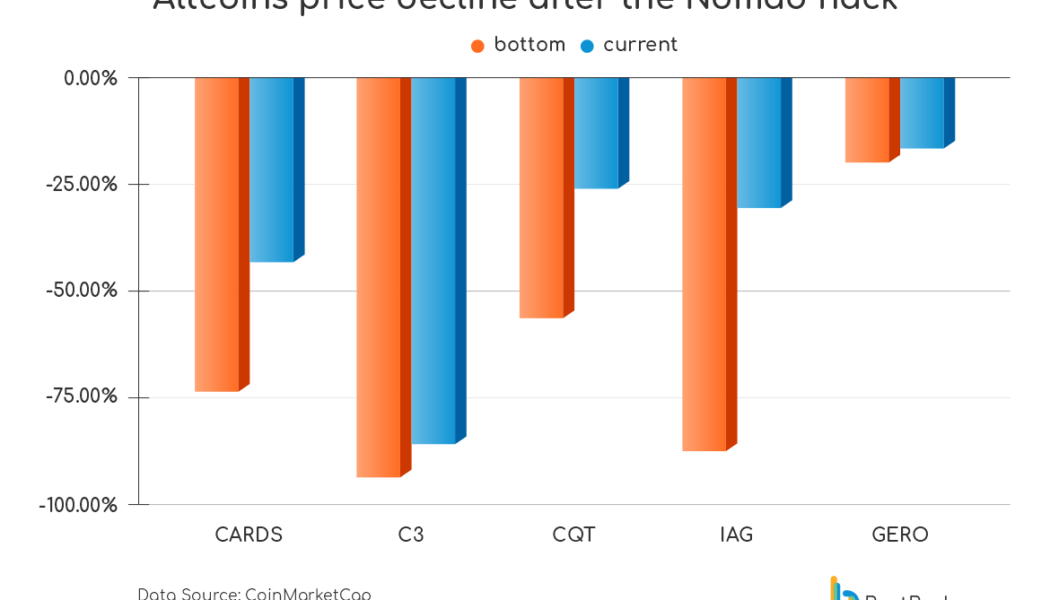

Nomad reportedly ignored security vulnerability that led to $190M exploit

The Nomad token bridge hack on Aug. 3 was the fourth largest crypto hack in history that saw nearly $200 million worth of crypto assets drained from the platform. However, more than the hack, the methodology behind it garnered widespread attention. The exploit took place due to a smart contract vulnerability that saw hundreds of users other than the hacker also get involved, taking away as much as they can by simply copy-pasting the transaction data used by the initial hacker and changing the wallet address to theirs. The event was later deemed as a decentralized robbery by many due to the involvement of normal community members. Later, the Nomad team revealed to Cointelegraph that some of the people who took funds were acting benevolently to protect the crypto from getting into the w...

Ethereum futures backwardation hints at 30% ‘airdrop rally’ ahead of the Merge

Ether (ETH) bulls like a positive spread between its spot and ETH futures prices because the so-called contango reflects optimism about a higher rate in the future. But as of Aug. 1, the Ethereum futures curve slid in the opposite direction. Ethereum quarterly futures in backwardation On the daily chart, Ethereum futures quarterly contracts, scheduled to expire in December 2022, have slipped into backwardation, a condition opposite to contango, wherein the futures price becomes lower than the spot price. The spread between Ethereum’s spot and futures price grew to -$8 on Aug. 1. ETH230-ETHUSD daily price chart. Source: TradingView One one hand, the current ETH spot price being higher than its year-end outlook appears like a bearish sign. However, the conditions surrou...

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

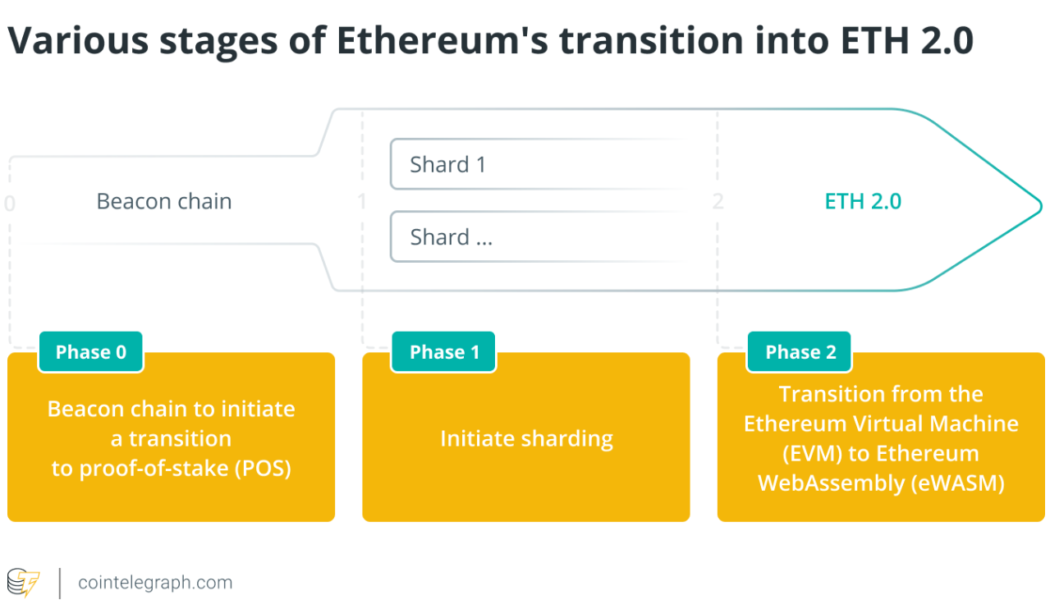

Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2. Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later. The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the...

A short-term BTC rally or trend reversal? Find out now on ‘Market Talks’ with Crypto Jebb

The latest episode of Market Talks welcomes Nicholas Merten, the founder of DataDash, one of the largest cryptocurrency YouTube channels. Merten is an international speaker, thought leader and crypto analyst. He has utilized his 10-plus years of experience in traditional markets to understand the potential of cryptocurrencies and help his 515,000 YouTube subscribers make better investment decisions. One of the topics up for discussion with Merten isthe recent Bitcoin (BTC) price rally. Are the markets finally out of the sideways trend it’s been stuck in for months, or is this just another bull trap forming, with BTC to head back down below $20,000? With all seasoned traders and experts eyeing the BTC 200-week moving average, Merten is asked the significance of this indicator and why many c...