Eth2

Ethereum strives to migrate into a brighter future: Report

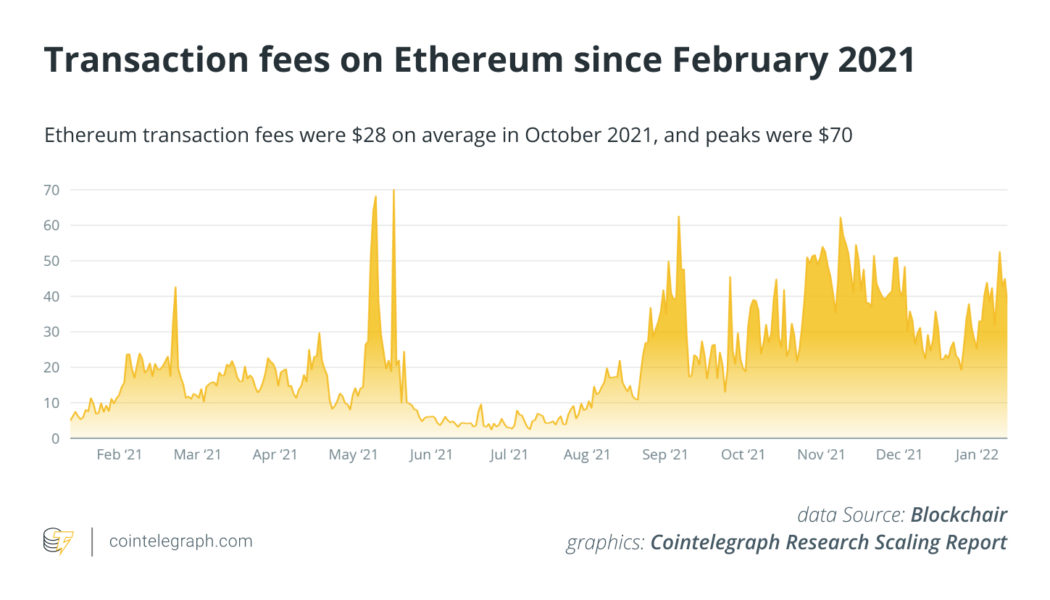

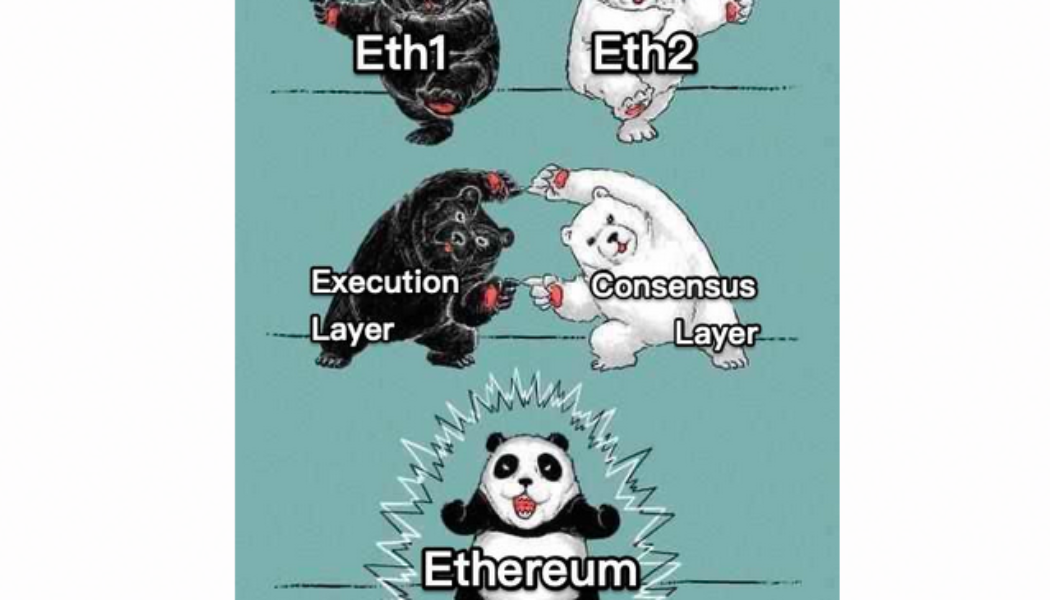

Ethereum 2.0 has been a highly anticipated development in the crypto industry. A recent Cointelegraph research report asks if Ethereum is still on track to defend its crown as the prime network backing the decentralized finance world. The report cuts through popular misconceptions investors may hold and offers a comparative analysis of Ethereum and its competitors. Meanwhile, the Ethereum foundation rebranded the Eth2 project at the start of this year. Is it trying to manage expectations or educate? New talk of consensus and execution layers In a blog post in January, the Ethereum foundation stated that developers had been moving away from the Eth1-Eth2 terminology since late 2021. Instead, Eth1 will now be called the “execution layer” and Eth2 the “consensus layer.” This is not a minor tw...

Ethereum’s ‘consensus layer’ contract hits 10M ETH staked

Quantitative analysis conducted on popular blockchain site Etherscan indicates that 184,441 transactions have been responsible for 10.2 million Ether (ETH) staked into the Eth2 (consensus layer) deposit contract since inception on Nov. 4 last year. This figure is equivalent to over $26 billion, based upon current Ethereum prices. Mathematical calculations suggest that the milestone was surpassed during block 14348729 in the evening of March 8, identified by mainstream cryptocurrency publications and community advocates in the last few hours. In late January of this year, the Ethereum Foundation published an alteration to the network’s terminology, with the initial proof-of-work blockchain, or Eth1, now being referred to as the execution layer, and the upcoming proof-of...

Eth2 is no more after Ethereum Foundation ditches name in rebrand

The Ethereum Foundation has removed all references to Eth1 and Eth2 in favor of calling the original blockchain the “execution layer” and the upgraded Proof of Stake chain the “consensus layer.” Ethereum’s long-awaited transition from a Proof-of-work mining model to a Proof-of-Stake (PoS) consensus mechanism is expected to go live around in the second or third quarter of this year. Announcing the change the foundation cited a number of rationales including a “broken mental model for new users,” scam prevention, inclusivity and staking clarity. In a Jan.24 blog post, the Ethereum Foundation noted that the branding of Eth2 failed to concisely capture what was happening to the network via its series of upgrades: “One major problem with the Eth2 branding is that it creates a broken mental mode...

Eth2’s Rocket Pool reaches $350M TVL and 635 node operators in five weeks

Rocket Pool, a decentralized Ethereum 2.0 staking platform has surpassed $350 million worth of total value locked (TVL) within five weeks of its official launch. The project aims to remove the barriers to entry for Eth2 stakers and node operators. It allows any user to run a node for 16 ETH ($59,000), which is half of the 32 ETH ($119,000) required in the Eth2 deposit contract. Users with as little as 0.01 ETH can also stake their funds and receive yield. According to data from DefiLlama, Rocket Pool has surged up the decentralized finance (DeFi) staking platform rankings to sit at third with a TVL of $355.64 million at the time of writing. The project is currently behind the Keep3r Network at $584.34 million, and Lido Finance in first place with $6.04 billion. Lido Finance was launched in...