ETH

Bitcoin returns to $40K, liquidating over $50M of shorts in hours

Bitcoin (BTC) returned to $40,000 for the first time in two weeks during Feb. 4 as Wall Street volatility proved a boon for BTC bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Liquidations mount for BTC shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly jumping past the $40,000 on Feb. 4, just two hours after the Wall Street open produced rapid gains. At the time of writing, the pair was up $3,000 in two hours — an unexpectedly strong performance, which naturally caused short sellers significant pain. According to on-chain monitoring resource Coinglass, BTC liquidations were $50 million over the most recent four-hour period, with cross-crypto liquidations passing $100 million. BTC liquidations chart. Source: Coinglass Analysts, who we...

Kiss this: You can buy Gene Simmons’ Las Vegas mansion with crypto

Rock legend Gene Simmons says he will accept crypto payments for the sale of his $13.5 million mansion in Las Vegas. The iconic bassist and co-lead singer of Kiss will accept payments in or a combination of Bitcoin, Ethereum, Litecoin, Uniswap, Polkadot, Aave or Try.Finance according to hard rock news site, Blabber Mouth. Listing broker Evangelina Duke-Petroni from Berkshire Hathaway Home Services told the Las Vegas Review-Journal in a Feb 1 interview that any potential crypto payment for the property would have to be “verified through closing costs, including taxes and commissions.” The three-level mansion sprawls across over 11,000 square feet in the Ascaya luxury community overlooking the Las Vegas skyline. Rock legend @GeneSimmons is selling his home in Henderson’s Ascaya communi...

First cross-chain governance proposal passes on Aave

On Monday, the first cross-chain governance proposal passed on decentralized finance, or DeFi, borrowing and lending platform Aave (AAVE). According to DeFi Llama, the amount of total value locked on Aave is approximately $12 billion. As told by its developers, a proposal executed on Aave, which is built on the Ethereum (ETH) network, was sent to the Polygon (MATIC) FxPortal. The mechanism then read the Ethereum data and passed it for validation on the Polygon network. Afterward, the Aave cross-chain governance bridge contract received this data, decoded it and queued the action, pending a timelock for finalization. The development team wrote: The Aave cross-chain governance bridge is built in a generic way to be easily adapted to operate with any chain that supports the EVM [Et...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

Blockchain enthusiast allegedly losses $500k by sending WETH to contract address

In a now-deleted deleted profile, an anonymous Reddit user allegedly lost close to $500 thousand on Sunday after sending wrapped Ether (WETH) directly into a WETH wrapping smart contract. WETH came into existence as a way for Ether (ETH) to conform to the ERC-20 token standard so that it can be traded directly with altcoins minted on the Ethereum blockchain. To wrap Ether, users first send ETH to the WETH smart contract address and receive an equivalent token in return. However, to unwrap WETH, users must either swap for ETH on a decentralized exchange like Uniswap (UNI) or call the withdrawal function in the WETH smart contract. Instead, the anonymous Reddit user sent the WETH directly back into the WETH smart contract address in the hopes of receiving ETH back. Unfortunately for the user...

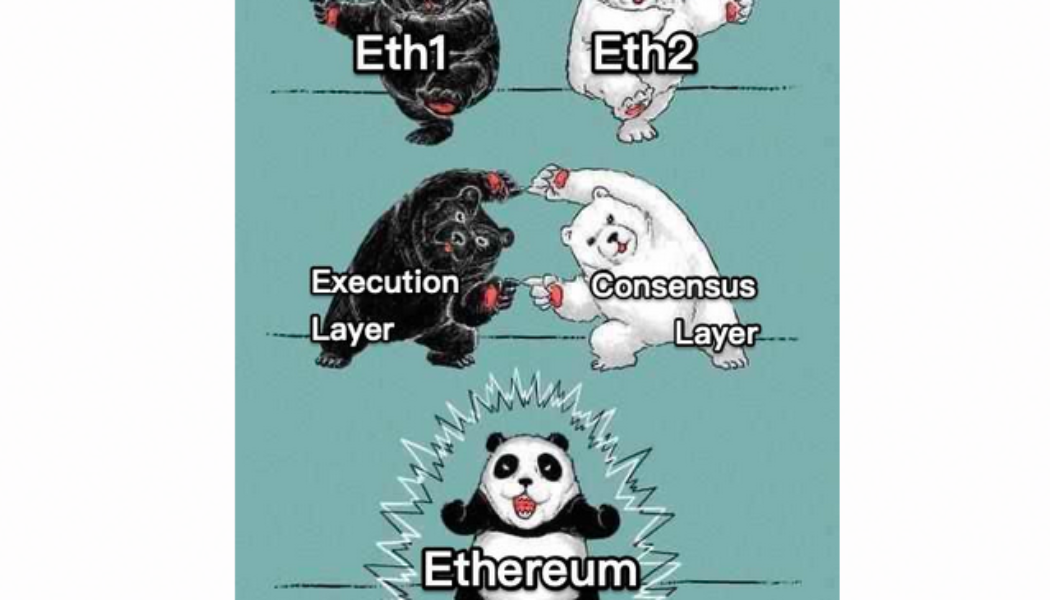

Eth2 is no more after Ethereum Foundation ditches name in rebrand

The Ethereum Foundation has removed all references to Eth1 and Eth2 in favor of calling the original blockchain the “execution layer” and the upgraded Proof of Stake chain the “consensus layer.” Ethereum’s long-awaited transition from a Proof-of-work mining model to a Proof-of-Stake (PoS) consensus mechanism is expected to go live around in the second or third quarter of this year. Announcing the change the foundation cited a number of rationales including a “broken mental model for new users,” scam prevention, inclusivity and staking clarity. In a Jan.24 blog post, the Ethereum Foundation noted that the branding of Eth2 failed to concisely capture what was happening to the network via its series of upgrades: “One major problem with the Eth2 branding is that it creates a broken mental mode...

Crypto DAO spends €2.66M on Jodorowsky’s Dune thinking they would own its copyright, receives mass ridicule on Twitter

Late Saturday, Spice DAO, a decentralized autonomous organization that owns a copy of an unpublished manuscript of Frank Herbert and Alejandro Jodorowsky’s never-completed film Dune, announced its roadmap going forward. In the tweet, Spice DAO said it would “Make the book public, produce an original animated limited series inspired by the book and sell it to a streaming service, and support derivative projects from the community.” The group had previously won the Christie’s auction in November for the copy’s sale at 2.66 million euros (a little over $3 million), or about 89 times its price estimates at the midpoint. However, there was just one problem, buying a copy of a book does not grant the purchaser its copyright. In the United States and European Union, ...

Cathie Wood’s ARK ETF reportedly buys 6.93M shares of SPAC merging with Circle

Cathie Wood’s Ark Invest has reportedly purchased 6.93 million shares of the special purchase acquisition company, or SPAC, that is merging with Circle, for $70.6 million through the company’s ARK Fintech Innovation exchange-traded fund (ETF). This purchase would represent a new position for the ETF, according to MarketWatch. Ark Invest’s ETFs have a history of bold purchases within the tech industry as indicated by their move to buy $80 million in Robinhood shares after the prices dipped back in October 2021. Wood is also bullish on crypto despite passing on buying the first Bitcoin futures ETF that same month. Circle is the principal operator of USD Coin (USDC), which is currently the second-largest stablecoin in terms of market capitalization. Circle announced its inte...

Bitcoin drops below $40K for first time in 3 months as fear set to ‘accelerate’

Bitcoin (BTC) fell below the landmark $40,000 mark for the first time since September 2021 on Jan. 10, heightening a rout that began six weeks ago. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bollinger bands step in Data from Cointelegraph Markets Pro and TradingView showed BTC/USD encountering predictable volatility as bears finally steered the market back into the $30,000 zone. The move had been long preempted, with forecasts even calling for an identical floor to that of July — just below $30,000. “And we’re dipping into the $40K region for Bitcoin, through which the fear will only accelerate even more,” Cointelegraph contributor Michaël van de Poppe reacted. For trader and analyst Rekt Capital, the first point of support lay in the lower of the tw...

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

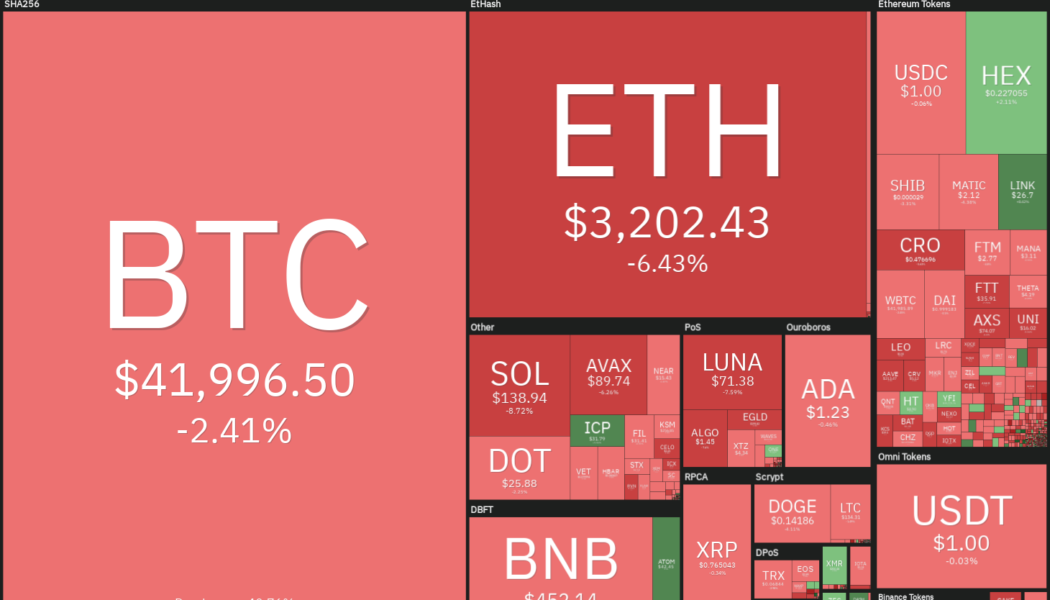

Price analysis 1/7: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and the U.S. equity markets fell sharply on Jan. 5, reacting negatively to the minutes from the Federal Reserve’s December FOMC meeting, which showed that the members expect the balance sheet reduction to start after the Fed begins hiking interest rates in early 2022. Adding to the negative sentiment was the shutdown of the world’s second-biggest Bitcoin mining hub in Kazakhstan, where the internet has been shut down following massive protests by citizens. This caused a dip of about 13.4% in the Bitcoin network’s overall hash rate from 205,000 petahash per second (PH/s) to 177,330 PH/s. Daily cryptocurrency market performance. Source: Coin360 According to Galaxy Digital Holdings CEO Mike Novogratz, the current decline was with low volumes and he believes that the market...

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...