ETH

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

3 reasons why Ethereum price can hit $4K in April

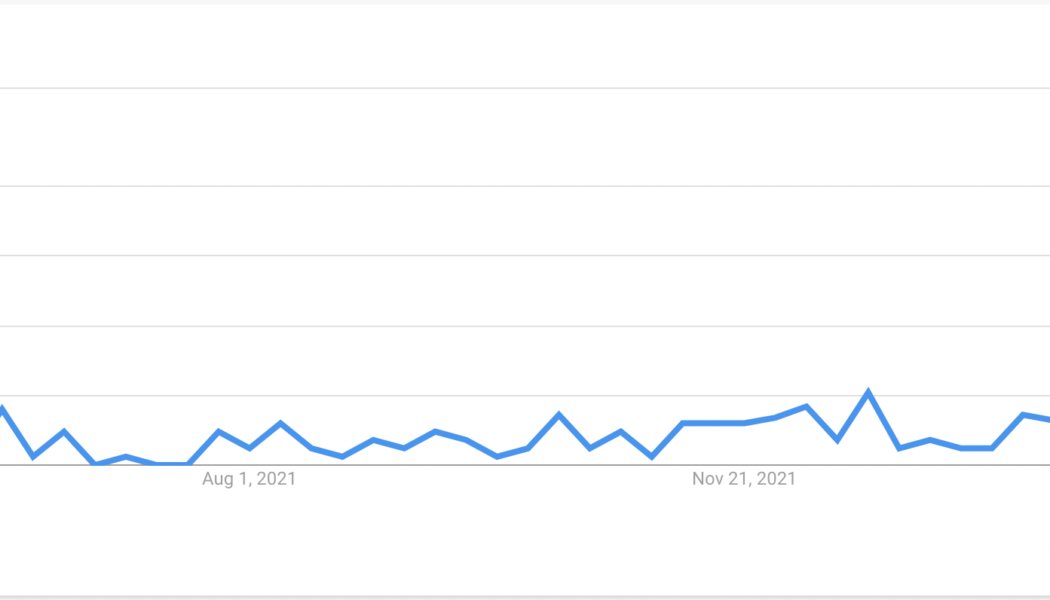

Three market catalysts suggest that Ethereum’s native token Ether (ETH) is well-positioned to reach $4,000 this month. Google searches for “Ethereum merge” spike Internet users’ interest in Ethereum’s upcoming network upgrade, dubbed “the Merge,” surged substantially in the week ending April 2, Google Trends’ data shows. Searches for the keyword “Ethereum Merge” reached a perfect Google Trends score of 100 on a 12-month timeframe with most traffic coming from the U.S., Singapore, Canada, and Australia. Internet trend score for the keyword ‘Ethereum Merge.’ Source: Google Trends Merge, also called ETH 2.0, refers to the Ethereum network’s full transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW),...

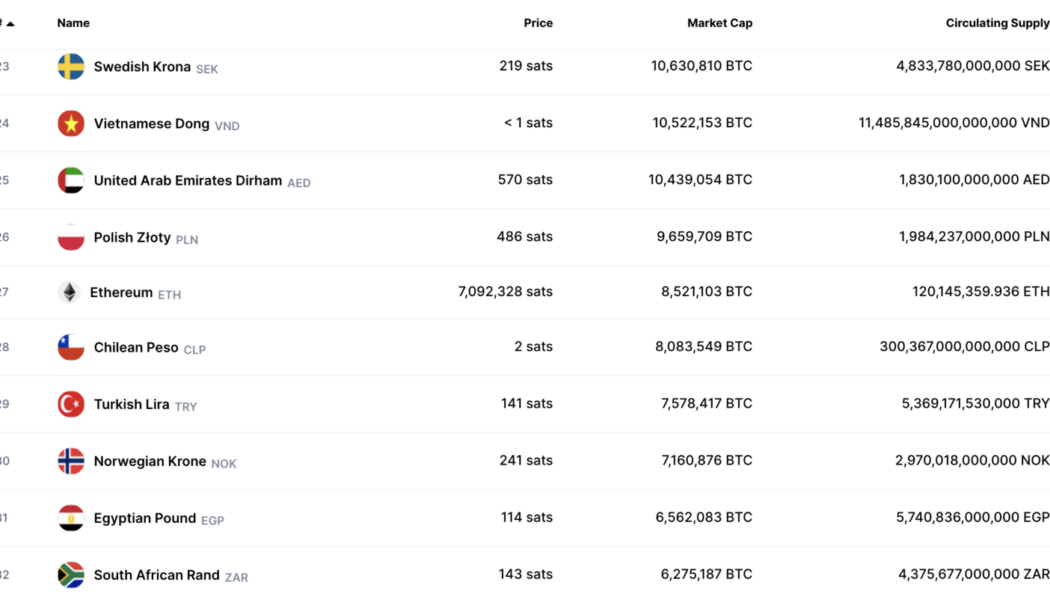

Ethereum worth more than Turkish lira and Norwegian krone

A little over two weeks ago, I wrote about the value of ETH versus fiat money, with an emphasis on the Russian ruble. ETH is up 35% during this period, so a good time to look back. Ethereum in 27th place As can be seen from Coinmarketcap’s data, Ethereum is ranked number 27 by market value. This is 13 spots below bitcoin, which has not moved a single spot in the same time period. Ethereum is four spots higher than two weeks ago. Ethereum is under the Polish zloty, which is still number 26. But ETH has gained territory against the Chilean peso, the Norwegian krone and the Turkish lira. These fiat currencies are now worth less than Ethereum, and that is a big win. Russian ruble is crawling back up In total, there are 101 currencies on Coinmarketcap’s list, with Bitcoin bein...

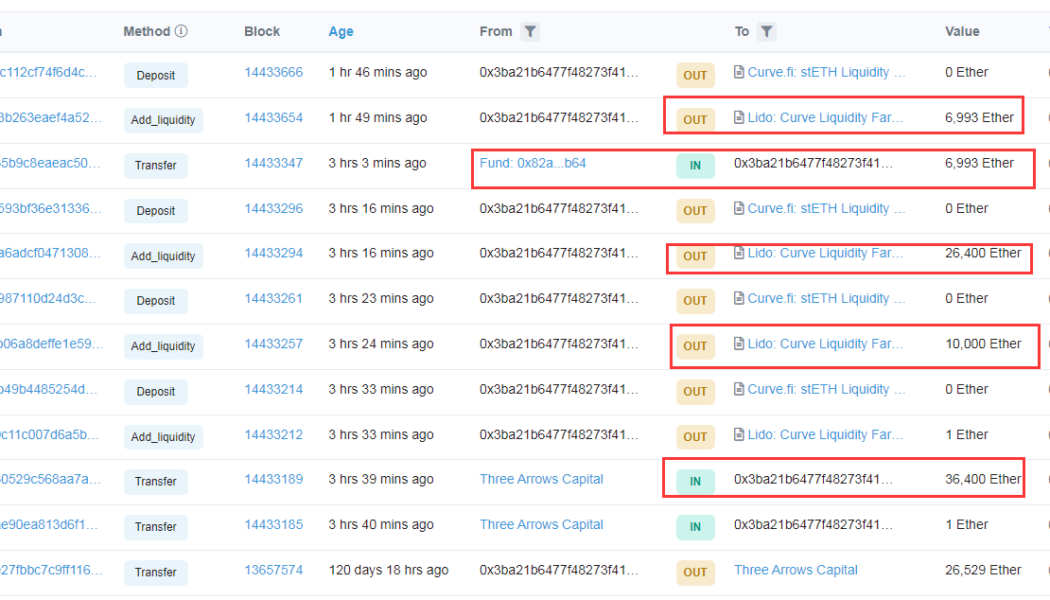

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Ethereum Merge testing on Kiln mostly successful, save for one minor bug

On Tuesday, Ethereum (ETH) developer Tim Beiko tweeted that Kiln successfully passed the Ethereum Merge, with validators producing post-merge blocks containing transactions. Kiln will be the last Merge testnet (formerly Ethereum 2.0) before existing public testnets are upgraded. “Merge” involves taking Ethereum’s Execution Layer from the existing Proof of Work layer and merging it with the Consensus Layer from the Beacon chain, turning the blockchain into a proof-of-stake network. The Foundation writes: “This merge signals the culmination of six years of research and development in Ethereum and will result in a more secure network, predictable block times, and a 99.98%+ reduction in power use when it is released on mainnet later in 2022.” However, it app...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

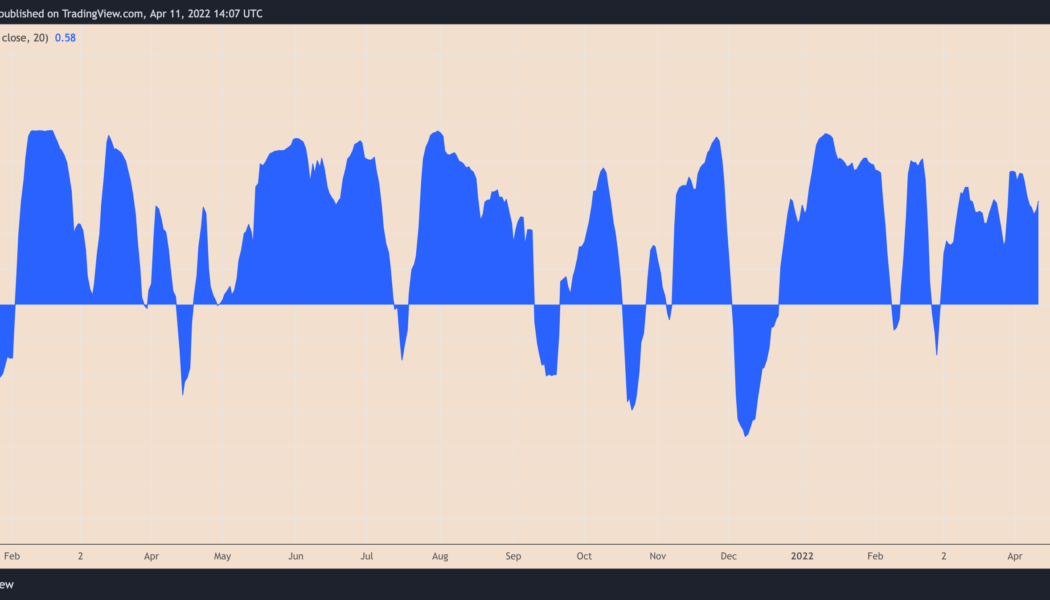

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

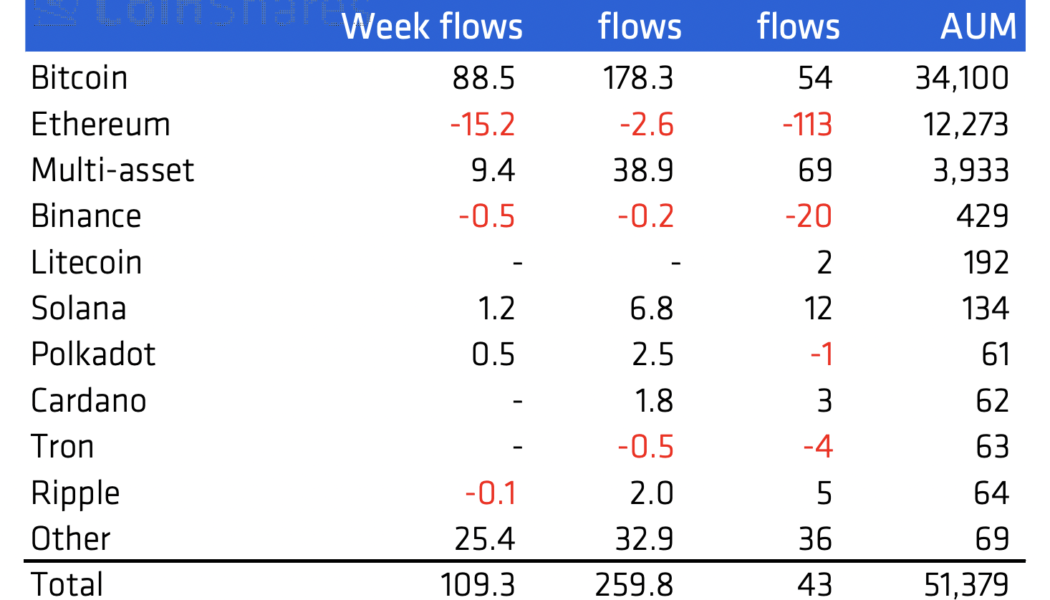

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Ethereum to $10K? Classic bullish reversal pattern hints at potential ETH price rally

Ethereum’s native token, Ether (ETH), could reach above $10,000 in the coming weeks as it paints what appears to be an “ascending triangle” technical pattern. Ether’s price technicals: Bullish signs Ascending triangles are bullish continuation setups that appear during an uptrend. Analysts confirm their presence after the price rises upward inside a rising right-angle triangle structure, thus forming a sequence of lower highs on the lower trendline with resistance in place at the upper one. As the pattern develops, volumes typically drop. So far, Ether has been forming a similar upside pattern on its weekly chart. In detail, the triangle’s lower trendline has been acting as an accumulation range since the beginning of 2021, with high selling pressure at the upper trendline, as shown b...

Bitcoin price circles $44K as analyst asks, ‘Who remains to sell here?’

Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView OBV sparks 2021 recovery comparisons Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp. In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot. While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside. “When I consider everything BTC HODLers withstood in 2021- When I observe ...

$4K Ethereum by July? ETH price posts fastest recovery to date from 50% drawdown

The price of Ether (ETH) has pulled back to retest $3,000 support levels on Feb. 9 after Ethereum’s native token reached a three-week high. ETH price climbs to three-week high To date, ETH price has recovered by roughly 50% after the ETH/USD trading pair bottomed near $2,150 on Jan. 24. ETH/USD daily price chart. Source: TradingView ETH price jumped on Feb. 7 in part due to KPMG, one of the world’s four accounting giants, announcing that the firm is adding Bitcoin (BTC) and Ether to its Canadian division’s balance sheet. Bitcoin rallied to over $45,500 in the wake of the news, its best level in almost a month. However, the Big Four accounting giant chose not to disclose the degree of its exposure in the Bitcoin and Ether markets. But KPMG did s...

Bitcoin rebound hits $45.5K as focus switches to future support retests

Bitcoin (BTC) hit new multi-week highs above $45,000 on Feb. 8 as the largest cryptocurrency’s comeback continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $40,000 becomes popular retest target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $45,500 on Bitstamp in its latest surge before consolidating. Volatility was once again in evidence as the pair fluctuated by $1,000 on intra-hour timeframes, circling $44,800 at the time of writing. Fears of a major correction were nonetheless left unfounded on the day, despite theories that $40,000 could see a retest next. lol okay a couple hundred dollars lower than previous tweet but I’m back to thinking we run it back to retest 40K idk honestly listening to this space has my brain all...

Ethereum eyes $3.5K as ETH price reclaims pandemic-era support with 40% rebound

Ethereum’s native token Ether (ETH) looks poised to hit $3,500 in the coming sessions as it reclaimed a historically strong support level on Feb. 5. Ethereum price back above key trendline ETH price rising above its 50-week exponential moving average (50-week EMA; the red wave in the chart below) means the price also inched above $3,000, a psychological support level that may serve as the ground for Ether’s next leg up. ETH/USD weekly price chart. Source: TradingView The 50-week EMA was instrumental in maintaining Ether’s bullish bias across 2020 and 2021. For instance, it served as a strong accumulation zone during the market correction in the second and third quarters last year, pushing ETH price from around $1,700 to as high as $4,951 (data from Binance). As a result, ...