ETH

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% loss

Bitcoin (BTC) saw further losses on June 12 as thin weekend trading volumes fueled an ongoing sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst likens risk asset ‘pump’ to 1929 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $27,150 on its sixth straight day of downside. With hours to go until the weekly close, the pair was in danger of resuming the losing streak, which had previously seen a record nine weeks of red candles in a row. To avoid that outcome and put in a second “green” close, BTC/USD needed to gain over $2,000 from current spot price, which at the time of writing was $27,400. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView With support levels failing to change the mood thanks to the thinner...

Is It Profitable to Swap ETH to XNO?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Brandt’s bearish ETH call — But community predicts $3K before Merge

Veteran futures trader Peter Brandt has suggested that the price of Ether (ETH) could drop to as low as $1,268 in the coming month, but the consensus view of 15,500 members of the CoinMarketCap community is that the price will have hit roughly $3,131 by June 30. The Ethereum network is now in the final steps of its long-awaited Merge with the Beacon Chain and transition to proof-of-stake (PoS), with developers confirming on Wednesday that they successfully completed the Ropsten testnet merge. The Ropsten testnet has now been merged! What a historic and thrilling day for the Ethereum community and what a thrilling day for Next up, 2 more public testnet merges and then mainnet The Merge is coming — sassal.eth (@sassal0x) June 8, 2022 While the timeframe has often been subject to delays, the ...

Nifty News: ‘Blue-chips’ halve in value, free-to-mint Goblintown NFT volume surges

“Blue-chip” nonfungible token (NFT) collections have seen their floor prices and market capitalization slide over the past 30 days, with some of the most well-recognized projects halving in value for these key metrics. Data collected on key Ethereum NFT projects by DappRadar shows the floor prices of established collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Moonbirds are at most down around 55% over 30 days. The MAYC is the worst off of the four, with the floor price diving 55% to 16.7 Ether (ETH), or $31,300 at the time of writing. The more popular BAYC has fallen over 47% to 86.7 ETH, or $163,000, and CryptoPunks by almost 49% to 45 ETH, $85,000. The only collection to gain in the month was Moonbirds, up 22% with a 19.6 ETH floor...

OpenEthereum support ends with the Merge fast approaching

One of the most popular Ethereum (ETH) clients, OpenEthereum has ended support for its software in preparation for the upcoming Ethereum Merge. OpenEthereum creates “clients” or software used to interact with the Ethereum network allowing anyone to create an Ethereum node to mine the cryptocurrency which is currently using a proof-of-work (PoW) consensus mechanism. In a Twitter thread the OpenEthereum team explained that with the Merge approaching and the legacy codebase becoming “increasingly difficult to manage” due to its age that it was the right time to end support. OpenEthereum support has officially ended. The repo is now archived, and all maintenance and updates have stopped. Why? And what next? Read the — OpenEthereum is Deprecated (@OpenEthereumOrg) May 24, 2022 The project was f...

Targeted phishing scam nets $438K in crypto and NFTs from hacked Beeple account

Digital artist and popular non-fungible token (NFT) creator Mike Winkelmann, more commonly known as Beeple, had his Twitter account hacked on Sunday, May 22 as part of a phishing scam. Harry Denley, a Security Analyst at MetaMask, alerted users that Beeple’s tweets at the time containing a link to a raffle of a Louis Vuitton NFT collaboration were in fact a phishing scam that would drain the crypto out of users’ wallets if clicked. ⚠️ Beeple’s Twitter account has been compromised (ATO) to post a phishing website to steal funds. 0x7b69c4f2ACF77300025E49DbDbB65B068b2Fda7D0xF305F6073CFa24f05FF15CA5b387DD91f871b983 pic.twitter.com/0MPNwOPlEu — harry.eth (whg.eth) (@sniko_) May 22, 2022 The scammers were likely looking to capitalize on a real recent collaboration betwe...

Ethereum preparing a ‘bear trap’ ahead of the Merge — ETH price to $4K next?

Ethereum’s native token, Ether (ETH), continues to face downside risks in a higher interest rate environment. But one analyst believes that the token’s next selloff move could turn into a bear trap as the market factors in the possible release of the Merge this coming August. ETH to $4K? Ether’s price could reach $4,000 by 2022’s end, according to a technical setup shared on May 20 by Wolf, an independent market analyst. The analyst envisioned ETH moving inside a multi-month ascending triangle pattern, which comprises a horizontal trendline resistance and rising trendline support. Notably, ETH’s latest retest of the structure’s lower trendline could initiate a big rebound toward its upper trendline, which sits around the $4,000-level, as s...

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...

Three new crypto ETFs to begin trading in Australia this week

Australians will soon have more options for spot cryptocurrency exchange-traded funds (ETFs) after a previous hold-up was given the green light this week and new funds entered the ETF market. The latest update came late on May 9 as Cboe Australia issued a round of market notices that three funds previously delayed are expected to begin trading on Thursday, May 12. They include a Bitcoin ETF from Cosmos Asset Management, plus Bitcoin (BTC) and Ethereum (ETH) spot ETFs from 21Shares. Cboe Australia and Cosmos did not immediately respond to a request for comment, but a spokesperson from 21Shares confirmed to Cointelegraph: “We’re listing on May 12, this Thursday. The downstream issues are resolved.” On April 26, a day before three of the first crypto ETFs were set to launch, the Cboe Au...

Could XRP price lose another 70% by Q3?

Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to reach $0.64, its lowest level since Feb. 28. More XRP price downside ahead? The plunge increased the possibility of triggering a bearish reversal setup called descending triangle. While these patterns form usually during a downtrend, their occurrences following strong bullish moves usually mark the end of the uptrend. XRP has been in a similar trading channel since April 2022, bounded by two trendlines: a lower horizontal and an upper downward sloping. The pattern now nears its resolve as XRP pulls back toward the support trendline that’s also coinciding with the 50-week exponential moving average (50-week EMA; the blue wave), five weeks after testing the upper trendline as resistance. XRP/USD weekl...

Ethereum price ‘bear flag’ could sink ETH to $2K after 20% decline in three weeks

Ethereum’s native token Ether (ETH) has dropped by nearly 20% in the last three weeks, hitting monthly lows near $2,900 on April 19. But despite rebounding above $3,000 since, technicals suggest more downside is possible in the near term, according to a classic bearish pattern. Ethereum price ‘bear flag’ setup activated Dubbed “bear flag,” the bearish continuation signal appears as the price consolidates higher inside an ascending parallel channel after a strong downward move (called the flagpole). It resolves after the price breaks out of the channel to drop further. ETH’s price turned lower after testing its bear flag’s upper trendline on April 4 and now eyes an extended decline towards its lower trendline near $2,700. If the pattern pans out as ...

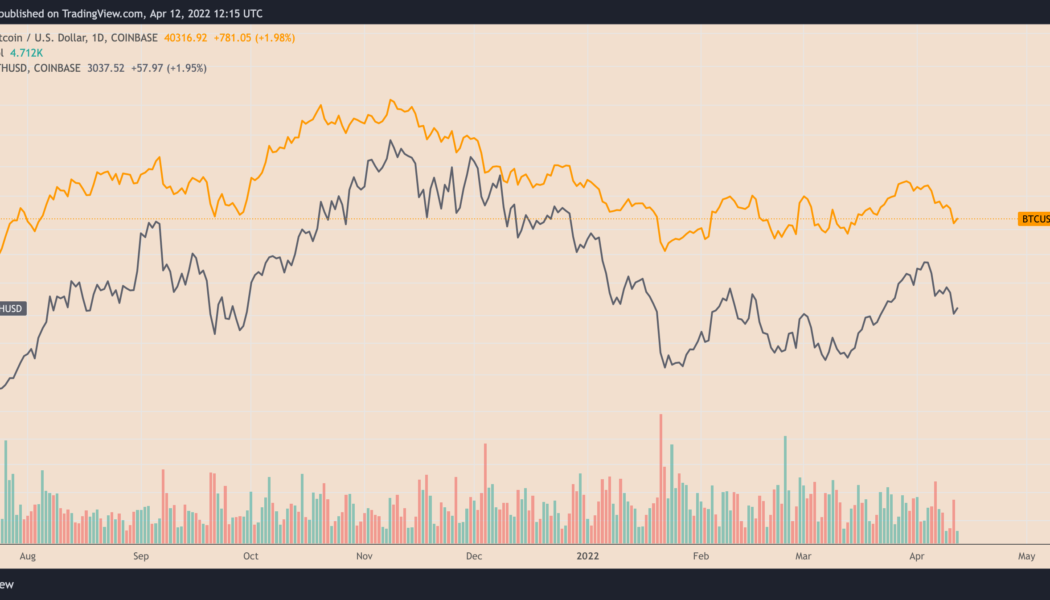

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...