ETH 2.0

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

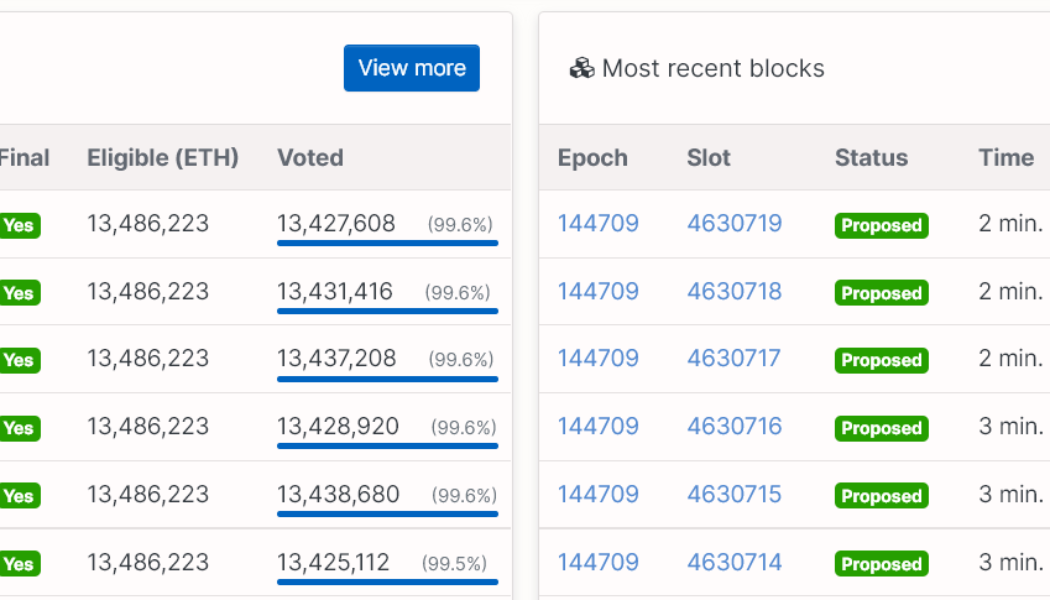

Ethereum gone wrong? Here are 3 signs to keep an eye on during the Merge

The assumption that Ethereum will just transition to a fully functional proof-of-stake (PoS) network after the Merge somewhat ignores the risk and effort necessary to move an asset that has a $193 billion market capitalization and 400 decentralized applications (DApps). That is precisely why monitoring vital network conditions is essential for anyone willing to trade the event which is scheduled for Sept. 14, according to ethernodes.org. More importantly, traders should be prepared to detect any alarming developments in case things go wrong. Apart from the $34.2 billion in total value locked in smart contracts, another $5.3 billion in Ether is staked on the Beacon Chain. The network is currently used by many tokens, oracle providers, stablecoins, layer-2 scalability solutions, synthetic as...

Lower costs, higher speeds after Ethereum’s Merge? Don’t count on it

As we approach the date of Ethereum’s Merge, users have speculated about what it will mean for projects and the wider ecosystem. Some argue the Merge will have little impact on gas fees and believe transaction speeds might improve. However, in general, most ordinary users will not notice much change. The real changes for average users will only be seen after the sharding mechanism is introduced six months later. The Merge will reduce energy consumption and increase security The Merge is a planned update to the Ethereum network scheduled for Sept. 15. It will move transaction validation from proof-of-work (PoW) to proof-of-stake (PoS). PoS has been part of Ethereum’s plans for many years, but the level of technical sophistication it requires has taken time to develop. It means a transition ...

What’s next for the future of Ethereum? Mihailo Bjelic from Polygon explains

With the transition to a scalable, energy light proof-of-stake blockchain (dubbed “the Merge”) at play for Ethereum, many have cast doubts on the popular coin’s future given the magnitude and complexity of the upgrade involved. But among prominent stakeholders, one particular project remains heavily bullish on Ethereum’s future, which is non-other than layer-two scaling solution Polygon. At the annual Ethereum Community Conference in Paris, Cointelegraph’s Events Manager Maria A. spoke to Polygon’s vice president of growth Mihailo Bjelic regarding the topic. Here’s what Mihailo had to say with regards to the Merge: “This is an upgrade on a live network that has millions of users, billions in capital, and tens of thousands of applications. It is never easy, but the Merge has been in t...

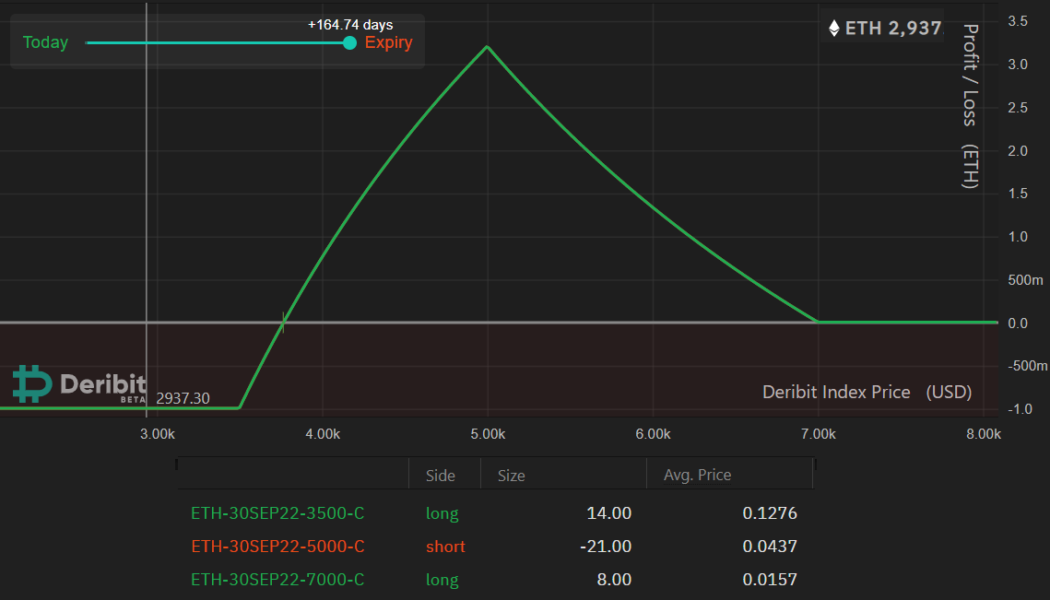

A key Ethereum price metric hits a 6 month low as ETH falls below $3K

Ether (ETH) price lost the $3,600 support on Jan. 5 as minutes from the Federal Reserve’s December FOMC meeting showed that the regulator was committed to decreasing its balance sheet and increasing interest rates in 2022. Even with that looming overhead, Ether has problems of its own, more specifically, the ongoing $40 and higher average transaction fees. On Jan. 3 Vitalik Buterin said that Ethereum needs to be more lightweight in terms of blockchain data so that more people can manage and use it. The concerning part of Vitalik’s interview was the status of the Ethereum 2.0 upgrade, which is merely halfway implemented after six years. The subsequent roadmap phases include the “merge” and “surge” phases, followed by “full sharding implementation.&#...