ETH

Crypto awakening: Researcher explains ETH exodus from exchanges

Blockchain analytics carried out by a Nansen researcher has highlighted outflows of Ether (ETH) and stablecoins from centralized exchanges in the wake of FTX’s collapse. Nansen research analyst Sandra Leow posted a thread on Twitter unpacking the current state of decentralized finance (DeFi), with a specific focus on the movement of ETH and stablecoins from exchanges. As it stands, the Ethereum 2.0 deposit contract contains over 15 million ETH, while some 4 million Wrapped Ether (wETH) is held in the wETH deposit contract. Web3 infrastructure development and investment firm Jump Trading holds over 2 million ETH tokens and is the third largest holder of ETH in the ecosystem. The current state of DeFi in @nansen_ai charts — sandra lmeow (@sandraaleow) November 22, 2022 Binance, Kraken, Bitfi...

FTX hacker is now the 35th largest holder of ETH

The hacker that exploited the now-bankrupt FTX exchange last week made a tidy fortune that has propelled them to Ether (ETH) whale status. Just a day after the embattled FTX exchange filed for Chapter 11 bankruptcy, its wallets were drained for more than $663 million in various crypto assets, according to blockchain intelligence company Elliptic. Elliptic suspected $477 million of this was stolen, with a large chunk of those tokens being then converted into ETH, while $186 million worth of more than a hundred different tokens was believed to be moved into secure storage by FTX itself. As reported by Cointelegraph on Nov. 15, the attacker was still draining wallets four days later in what analysts called “on-chain spoofing.” According to blockchain security firm Beosin, the attacker has con...

Ethereum flashes a classic bullish pattern in its Bitcoin pair, hinting at 50% upside

Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023. Ether has a 61% chance of breaking out versus Bitcoin The bullish cues emerge primarily from a classic technical setup dubbed a “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline). Traditional analysts perceive the cup and handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level. The Ether-to...

Bitcoin hits new 6-week high as Ethereum liquidates $240M more shorts

Bitcoin (BTC) attempted to retake $21,000 on Oct. 29 as weekend trading began on a strong footing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar lurks as BTC price rebounds Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it rebounded overnight to local highs of $21,078 on Bitstamp — enough to clinch new six-week highs. The pair had seen a consolidatory phase ensue after its first trip to the $21,000 mark, the first time it had traded above $21,000 since Sep. 13. The subsequent retracement was modest in character, Bitcoin not even testing $20,000 before reversing higher once more. The end of the Wall Street trading week saw BTC price action follow United States equities, the S&P 500 and Nasdaq Composite Index finishing Oct. 28 up 2.5% and 2.9...

Transit Swap ‘hacker’ returns 70% of $23M in stolen funds

A quick response from a number of blockchain security companies has helped facilitate the return of around 70% of the $23 million exploit of decentralized exchange (DEX) aggregator Transit Swap. The DEX aggregator lost the funds after a hacker exploited an internal bug on a swap contract on Oct. 1, leading to a quick response from the Transit Finance team along with security companies Peckshield, SlowMist, Bitrace and TokenPocket, who were able to quickly work out the hacker’s IP, email address and associated-on chain addresses. It appears these efforts have already borne fruit, as less than 24 hours after the hack, Transit Finance noted that “with joint efforts of all parties,” the hacker has returned 70% of the stolen assets to two addresses, equating to roughly $16.2 million. These...

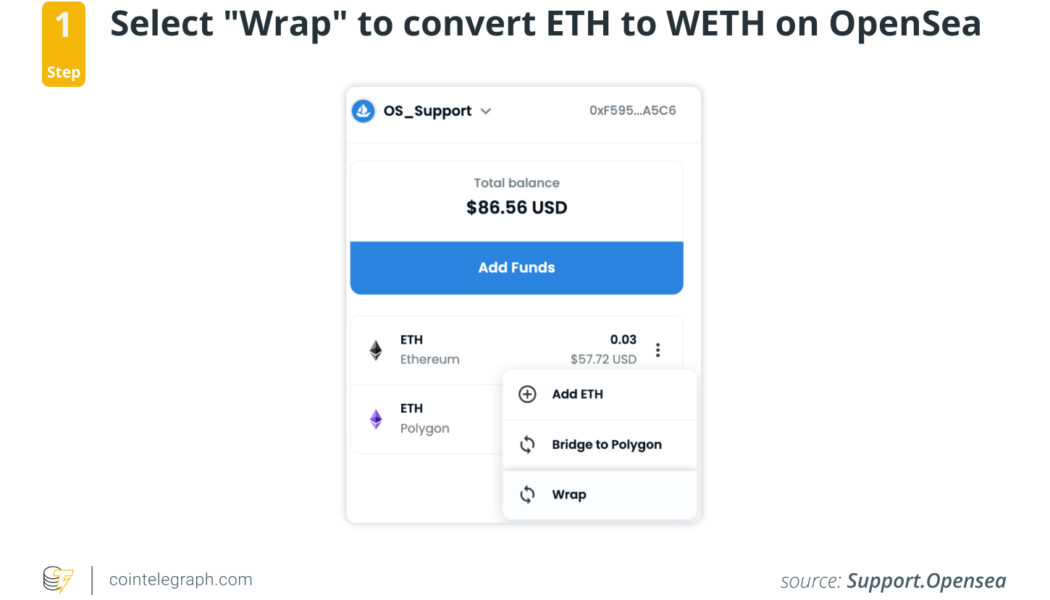

What is wrapped Ethereum (wETH) and how does it work?

Traders who use the Ethereum network are familiar with the ERC-20 technical standard and have most likely traded and invested in tokens that utilize it. After all, its practicality, transparency and flexibility have made it the industry norm for Ethereum-based projects. As such, many decentralized applications (DApps), crypto wallets and exchanges natively support ERC-20 tokens. However, there’s one problem: Ether (ETH) and ERC-20 do not exactly follow the same rules, as Ether was created way before ERC-20 was implemented as a technical standard. So, why does wrapped ETH matter? Briefly put, ERC-20 tokens can only be traded with other ERC-20 tokens, not Ether. In order to bridge this gap and enable the exchange of Ether for ERC-20 tokens (and vice versa), the Ethereum network introduced wr...

Bitcoin risks worst weekly close since 2020 as BTC price dices with $19K

Bitcoin (BTC) headed for its lowest weekly close since 2020 on Sep. 25 as a week of macro turmoil took its toll. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader prepares for “important week” for BTC Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading near $19,000 with hours left to run on the weekly candle. While only down $400 since the week began, the pair offered traders little optimism amid fears that the coming days would continue the bleedout across risk assets. “The whole week traded within the monday range. Weekly close gonna be bearish, looking like a pin bar,” popular trading account Crypto Yoddha told Twitter followers in a summary post. “Also consolidating at the range low. So need a bounce first before taking a position. Ne...

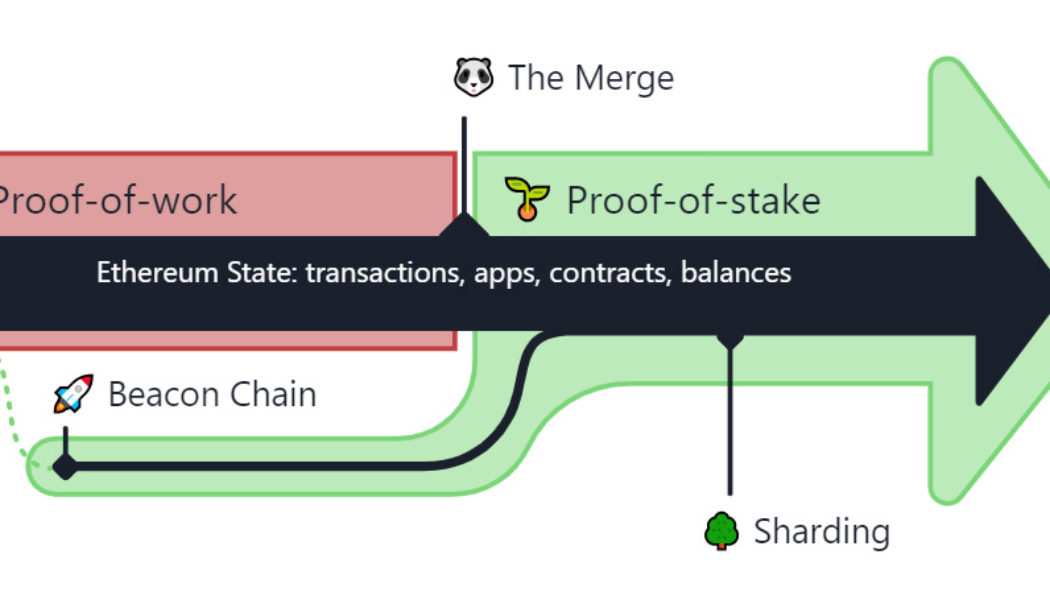

Post-Merge ETH has become obsolete

For years, various blockchain projects were rumored to be future “Ethereum killers,” projects that would unseat Ether from its throne and usurp its title as the top digital asset. That day seems to have come, though it appears it was an inside job. Lido-staked Ethereum (stETH) and other liquid staking derivatives are primed to render Ether (ETH), as an asset, obsolete. The transition from proof-of-work (PoW) to proof-of-stake (PoW) allows everyday decentralized finance (DeFi) users to benefit from rewards previously reserved for miners simply by holding stETH or any other ETH liquid-staking derivative. This has given way to a wave of interest across the industry, from individuals to institutions across centralized finance (CeFi) and DeFi. In the past month, the ETH liquid staking der...

White hat finds huge vulnerability in ETH to Arbitrum bridge: Wen max bounty?

A self-described white hat hacker has uncovered a “multi-million dollar vulnerability” in the bridge linking Ethereum and Arbitrum Nitro and received a 400 Ether (ETH) bounty for their find. Known as riptide on Twitter, the hacker described the exploit as the use of an initializing function to set their own bridge address, which would hijack all incoming ETH deposits from those trying to bridge funds from Ethereum to Arbitrum Nitro. Riptide explained the exploit in a Medium post on Sept. 20: “We could either selectively target large ETH deposits to remain undetected for a longer period of time, siphon up every single deposit that comes through the bridge, or wait and just front-run the next massive ETH deposit.” The hack could have potentially netted tens or even hundreds of millions worth...

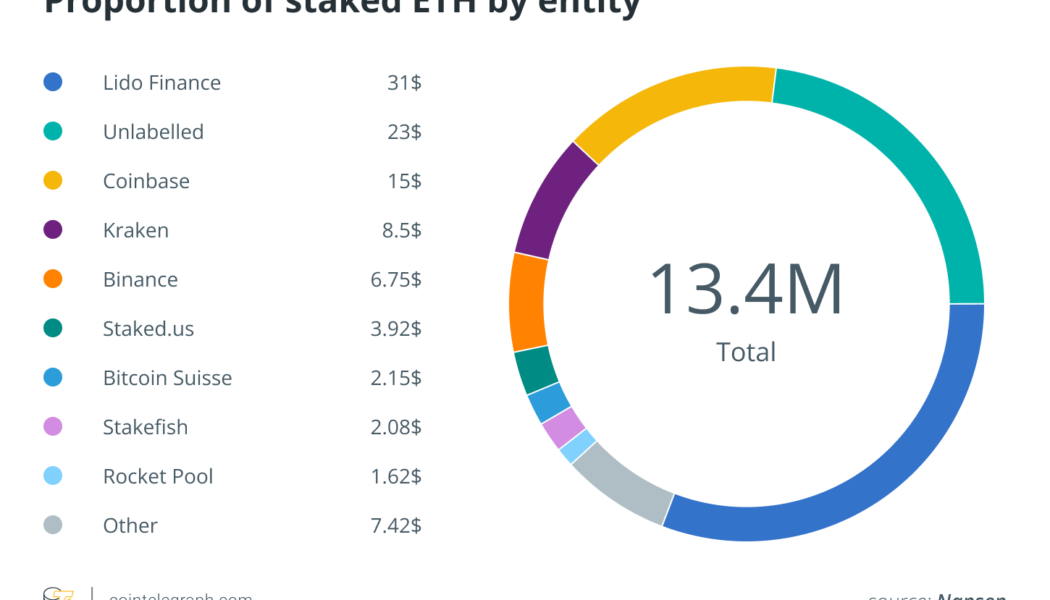

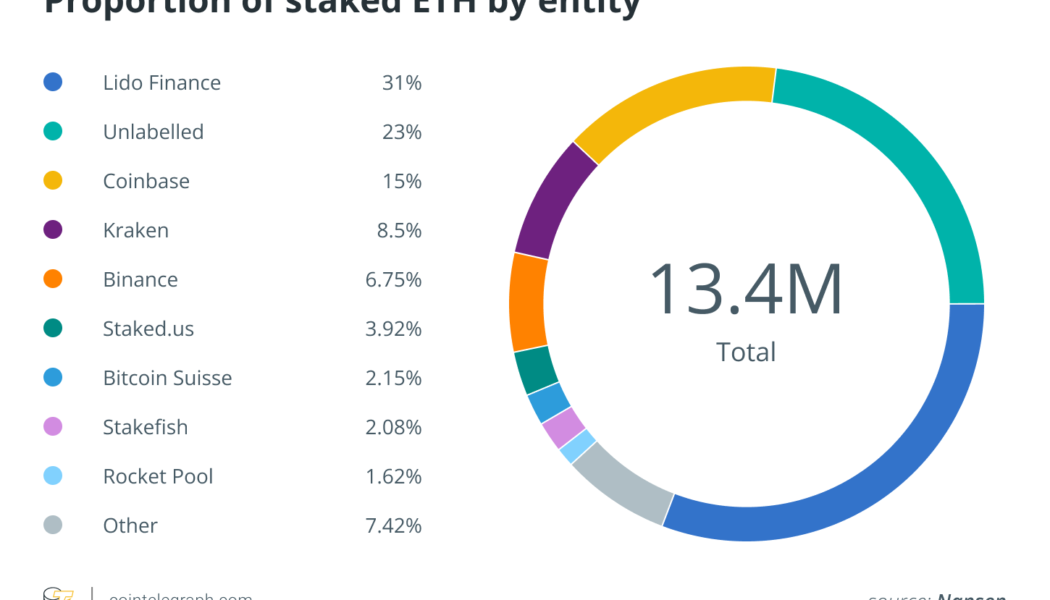

64% of staked ETH controlled by five entities — Nansen

A report from blockchain analytics platform Nansen highlights 5 entities that hold 64% of staked Ether (ETH) ahead of Ethereum’s highly anticipated Merge with the Beacon Chain. Ethereum’s shift from proof-of-work to proof-of-stake is set to take place in the coming days after final updates and shadow forks have bee completed in early September. The key component of The Merge sees miners no longer used as validators, replaced by stakers that commit ETH to maintain the network. Nansen’s report highlights that just over 11% of the total circulating ETH is staked, with 65% liquid and 35% illiquid. There are a total of 426,000 validators and some 80,000 depositors, while the report also highlights a small group of entities that command a significant portion of staked ETH. Three major crypt...

Ether price could ‘decouple’ from other crypto post Merge — Chainalysis

Crypto analytics firm Chainalysis has suggested that the price of Ether (ETH) could decouple from other crypto assets post-Merge, with staking yields potentially driving strong institutional adoption. In a Sept. 7 report, Chainalysis explained that the upcoming Ethereum upgrade would introduce institutional investors to staking yields similar to certain instruments such as bonds and commodities, while also becoming much more eco-friendly. The report said ETH staking is expected to offer a 10-15% yield annually for stakers, therefore making ETH an “enticing bond alternative for institutional investors” considering that treasury bonds yields offer much less in comparison. “Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make...