ETF

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

VanEck files for new ETF to track crypto and gold mining companies

VanEck, an investment firm with almost $82 billion in assets under management, has submitted an application to the United States Securities and Exchange Commission (SEC) for the launch of a new exchange-traded fund (ETF) that invests in gold mining and Bitcoin (BTC) mining companies. According to the SEC document filed on Thursday, the fund will focus on securities in an index that reflects the performance of gold mining and digital assets mining firms. It would not invest in cryptocurrencies directly or through derivatives. However, there was no ticker or cost ratio mentioned in the document. VanEck ETF Trust files with the SEC-VanEck Digital Assets Mining ETF https://t.co/pSaogEzRVW — Exchangetradedfunds (@ETFsinfo) March 8, 2022 The news of VanEck‘s proposed fund comes as concerns over ...

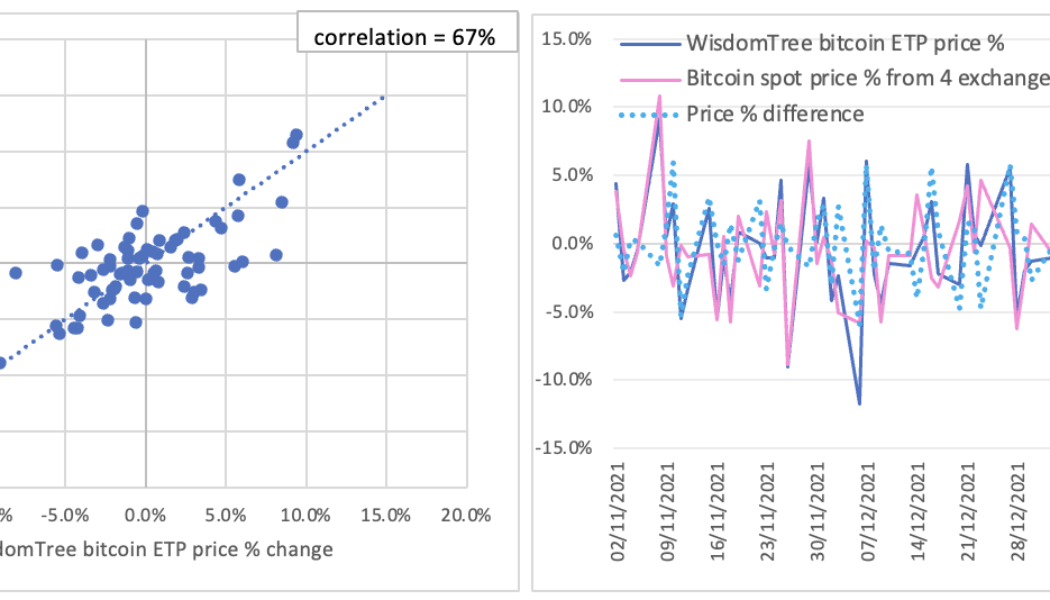

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

Overwhelming support for Grayscale BTC Trust ETF conversion proposal

The U.S. Securities and Exchange Commission has allowed comments and feedback on a proposed rule change that would convert Grayscale’s Bitcoin Trust to a spot-based exchange-traded fund (ETF). A notice of filing a proposed rule change to list and trade shares of Grayscale Bitcoin Trust as a spot-based ETF has generated a long list of comments with a large majority in approval. Bloomberg’s senior ETF analyst Eric Balchunas had a look through some of the more recent comments on Feb. 15 observing that 95% are in favor of the proposed conversion. Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R — Eric ...

SEC again delays decision on Grayscale’s Bitcoin ETF

The United States Securities and Exchange Commission (SEC) has once again delayed its ruling on whether to approve Grayscale’s application for a Bitcoin (BTC) exchange-traded fund (ETF), citing familiar concerns around manipulation, liquidity and transparency. In a notice published Friday afternoon, the SEC expressed concerns about how the digital asset manager intends to convert its Grayscale Bitcoin Trust (GBTC) into a spot ETF. Namely, the regulator wasn’t convinced that Grayscale’s proposal was designed to prevent alleged fraud and manipulation in the Bitcoin market. The SEC has invited the public to comment on these issues, giving interested parties 21 days to respond in writing. The SEC has just delayed their decision on whether GBTC can convert to a bitcoin ETF. — Pomp (@APomp...

SEC pushes decision on ARK 21Shares Bitcoin ETF to April 3

The U.S. Securities and Exchange Commission has extended its window to approve the ARK 21Shares Bitcoin exchange-traded fund (ETF) originally proposed in July 2021. According to a Tuesday filing from the SEC, the regulatory body will push the deadline for approving or disapproving the ARK 21Shares Bitcoin ETF from Feb. 2 for an additional 60 days, to April 3. SEC Assistant Secretary J. Matthew DeLesDernier noted in the filing that it was “appropriate to designate a longer period” for the regulatory body to consider the proposed rule change, allowing the ETF to be listed on the Cboe BZX Exchange. The exchange originally filed the paperwork to apply for the ARK 21Shares Bitcoin ETF in July 2021, with the SEC able to delay its decision and open the offering to public comment for up to 180 day...

Valkyrie aims for ETF linked to Bitcoin mining firms on Nasdaq

Crypto asset manager Valkyrie has filed an application with the United States Securities and Exchange Commission to trade an exchange-traded fund (ETF) with exposure to Bitcoin mining firms on the Nasdaq Stock Market. In a Wednesday SEC filing, Valkyrie said its Bitcoin Miners ETF will not invest directly in Bitcoin (BTC) but at least 80% of its net assets would offer exposure to the crypto asset through the securities of companies that “derive at least 50% of their revenue or profits” from BTC mining or providing hardware or software related to mining. The filing added Valkyrie would invest up to 20% of the ETF’s net assets in companies holding “a significant portion of their net assets” in Bitcoin. Valkyrie launched a Bitcoin Strategy ETF in October 2021, which offered indirect exposure ...

Indian INX exchange reportedly plans to list Bitcoin futures ETF

Despite the ongoing uncertainty about cryptocurrency regulation in India, local financial firms are backing new ventures aiming to launch Bitcoin (BTC) exchange-traded funds (ETF). Torus Kling Blockchain, a joint venture between Cosmea Financial Holding, a financial firm backed by former Reliance Capital CEO Sam Ghosh, and Kling Trading India, is preparing to launch Bitcoin and Ether (ETH) futures ETFs in India, The Economic Times reported Thursday. The company has signed a memorandum of understanding with India’s major stock exchange, the India International Exchange (INX), to launch crypto ETFs alongside investment products tracking major metaverse-related companies listed in the United States. According to the report, Torus Kling Blockchain is planning to set up the ETFs in the Gujarat ...

Crypto funds attracted $9.3B in inflows in 2021 as institutional adoption grew

Institutional cryptocurrency funds attracted record inflows in 2021, as demand for digital assets such as Bitcoin (BTC) and Ether (ETH) continued to grow during a volatile and often unpredictable bull market. Crypto investment products registered $9.3 billion in inflows during the year, up from $6.8 billion in 2020, according to the latest CoinShares data, which was released on Tuesday. Bitcoin funds attracted $6.3 billion worth of capital last year, while Ether products saw inflows totaling nearly $1.4 billion. Multi-asset funds were also popular, attracting $775 million in investor capital. A total of 37 investment products launched in 2021, compared with 24 that hit the market the year before. Notably, crypto assets that were included in investment products expanded to 15 from nin...

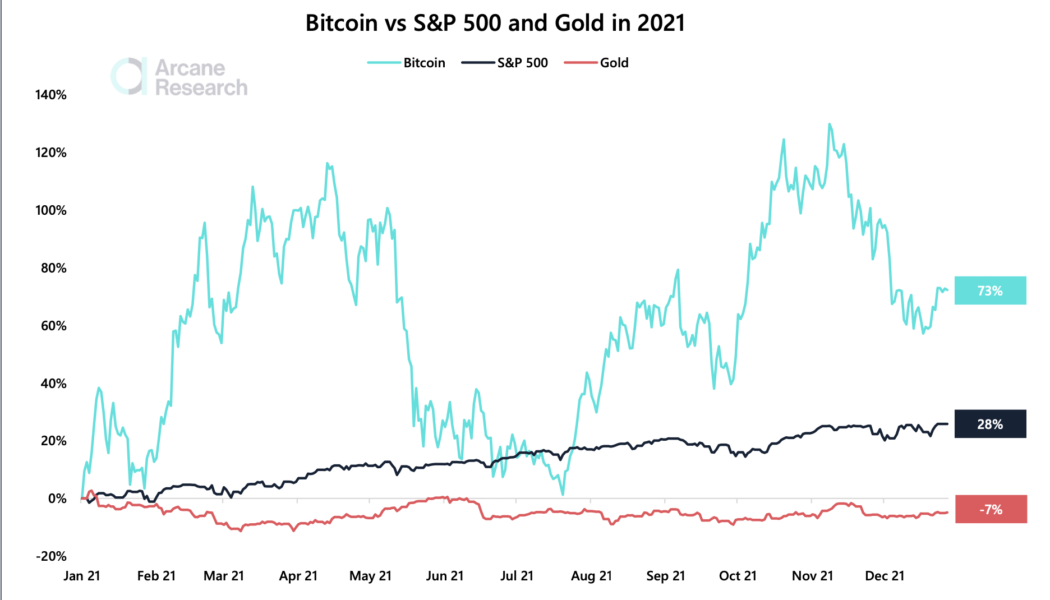

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...

Crypto regulation is coming, but Bitcoin traders are still buying the dip

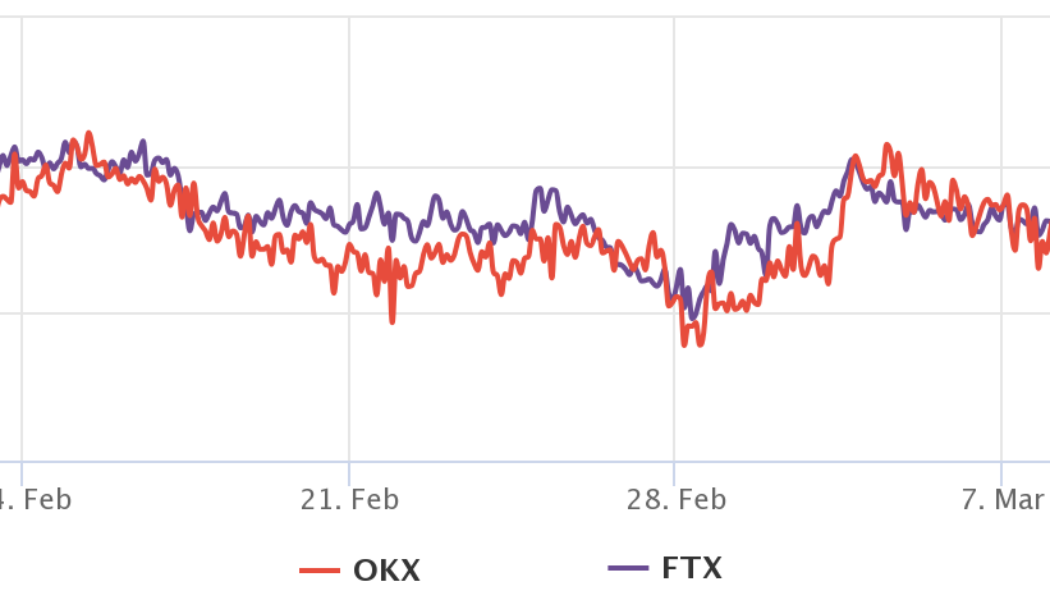

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....