ETF

Two crypto-related ETFs were the worst-performing in Australia for 2022

Cryptocurrency-related exchange-traded funds (ETFs) have taken the two top spots for the worst-performing ETFs in Australia for the year, with the same story playing out in the United States. BetaShares Crypto Innovators ETF (CRYP) and Cosmos Global Digital Miners Access ETF (DIGA) have provided investors Down Under with respective negative returns of nearly 82% and 72% year to date (YTD) throughDec. 30. BetaShares launched its ETF on the Australian Securities Exchange (ASX) in October 2021, mere weeks before most cryptocurrencies hit all-time highs that they’re yet to regain. CRYP was down slightly over 81.8% YTD at the time of writing. Image: Google Finance CRYP provides exposure to publicly listed blockchain and crypto companies such as Coinbase and mining company Riot Blockchain, among...

Canada crypto regulation: Bitcoin ETFs, strict licensing and a digital dollar

In October, Toronto-based Coinsquare became the first crypto trading business to get dealer registration from the Investment Industry Regulatory Organization of Canada (IIROC). That means a lot as now Coinsquare investors’ funds enjoy the security of the Canadian Investment Protection Fund in the event of insolvency, while the exchange is required to report its financial standing regularly. This news reminds us about the peculiarities of Canadian regulation of crypto. While the country still holds a rather tight process of licensing the virtual asset providers, it outpaces the neighboring United States in its experiments with crypto exchange-traded funds (ETFs), pension funds’ investments and central bank digital currency (CBDC) efforts. An era of restricted dealers Coinsquare, which...

Approving a spot crypto ETF is ‘all about political power’ — Perianne Boring

Perianne Boring, founder and CEO of blockchain advocacy group Chamber of Digital Commerce, placed the lack of approval of a Bitcoin exchange-traded fund in the United States squarely on Securities and Exchange Commission chair Gary Gensler, suggesting politics played more of a role than economics. Speaking to Cointelegraph at the Texas Blockchain Summit in Austin on Nov. 18, Boring said the events surrounding FTX’s collapse may have “emboldened the regulation by enforcement approach” from the U.S. Securities and Exchange Commission and Treasury, with Republican lawmakers likely to focus on oversight using their House majority in the next Congress. According to the Chamber of Digital Commerce CEO, passing any kind of legislation — including bills on crypto, blockchain, and stablecoins — wil...

SEC pushes deadline to decide on ARK 21Shares spot Bitcoin ETF to January 2023

The United States Securities and Exchange Commission, or SEC, has extended its window to decide on whether shares of ARK 21Shares’ Bitcoin exchange-traded fund could be listed on the Chicago Board Options Exchange BZX Exchange. In a Nov. 15 announcement, the SEC issued a notice for a longer designation period for the application of ARK 21Shares’ Bitcoin (BTC) ETF, originally filed with federal regulator on May 13. The SEC twice extended its window to approve or disapprove of the crypto investment vehicle in July with an extension and in August with a comment period. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and...

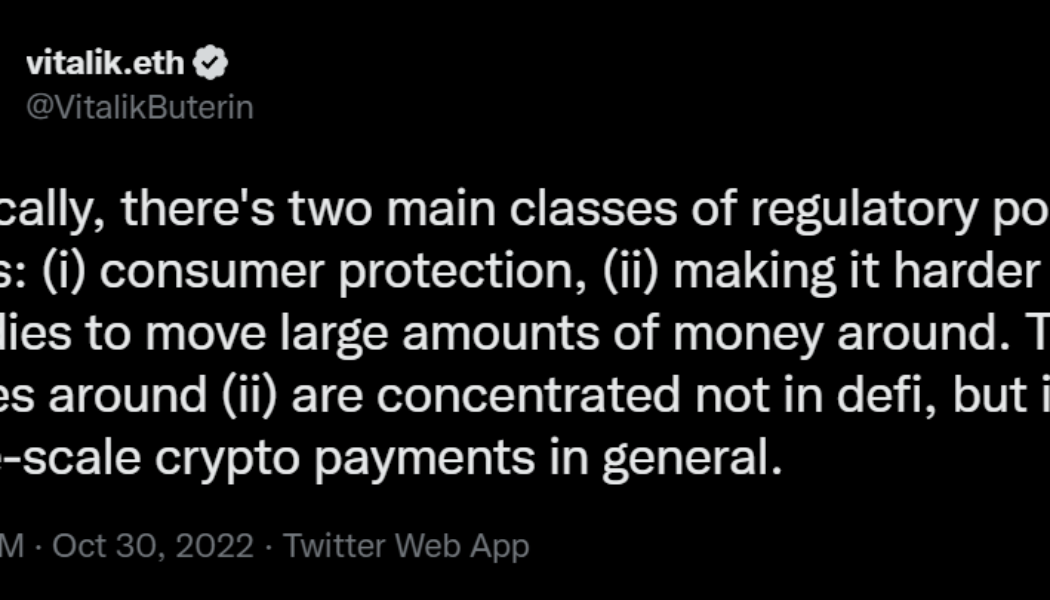

Vitalik Buterin ‘kinda happy’ with ETF delays, backs maturity over attention

The co-founder of Ethereum (ETH), Vitalik Buterin, believes that the crypto ecosystem needs to mature and be in tune with the regulatory policies that allow crypto projects to operate internally freely. Sharing his opinion around crypto regulations, Buterin spoke against the regulations that have an impact on the inner workings of a crypto ecosystem. Considering the current circumstances, he believed it was better to have regulations that allow inner independence to crypto projects, even if it hampers mainstream adoption. Buterin opined: “I’m actually kinda happy a lot of the exchange-traded funds (ETFs) are getting delayed. The ecosystem needs time to mature before we get even more attention.” The use of know-your-customer (KYC) on decentralized finance (DeFi) frontends was another ...

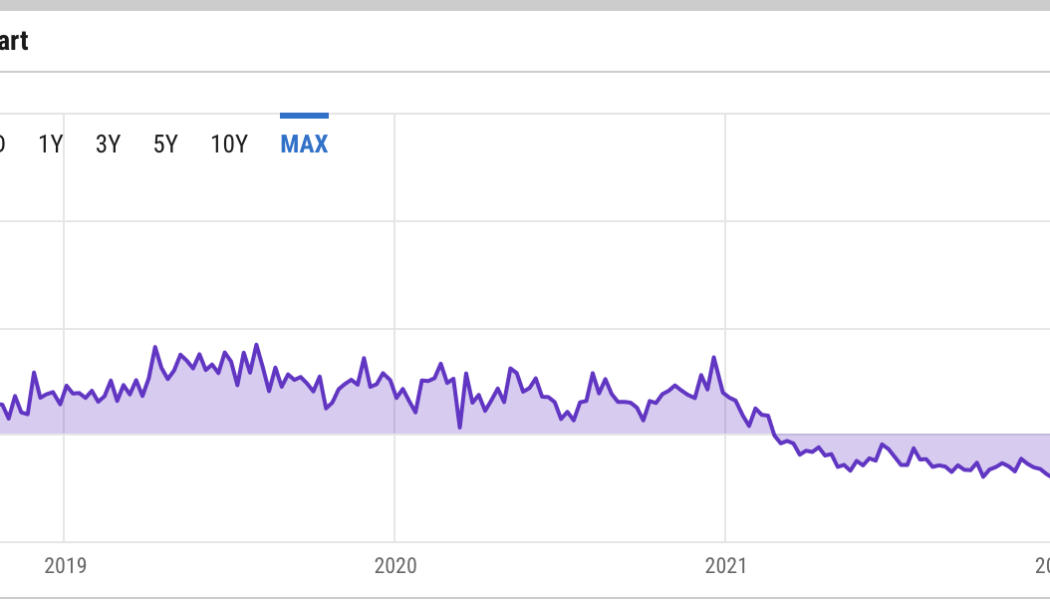

Grayscale BTC Trust trades at a record 36.7% discount, but is it justified?

U.S. investors have been waiting for a Bitcoin exchange-traded fund (ETF) approval since May 2014 when the Winklevoss Bitcoin Trust filed an amendment request at the Securities and Exchange (SEC). Over the years, the SEC has rejected every applicant and the latest denial was issued to WisdomTree’s application for a spot Bitcoin ETF on Oct. 11. The SEC concluded that the offer did not have the ability “to obtain information necessary to detect, investigate, and deter fraud and market manipulation, as well as violations of exchange rules and applicable federal securities laws and rules.” Bitcoin investment trust vehicles have existed since 2013, but they have been restricted to accredited investors. Launching a spot-based BTC ETF would open the market to retail investors and a broader ...

The biggest Bitcoin fund just hit a record -35% discount — A warning for BTC price?

Grayscale Bitcoin Trust (GBTC), a cryptocurrency fund that currently holds 3.12% of the total Bitcoin (BTC) supply, or over 640,000 BTC, is trading at a record discount compared to the value of its underlying assets. Institutional interest in Grayscale dries up On Sep. 23, the $12.55 billion closed-end trust was trading at a 35.18% discount, according to the latest data. GBTC discount versus spot BTC/USD price. Source: YCharts To investors, GBTC has long served as a great alternative to gain exposure in the Bitcoin market despite its 2% annual management fee. This is primarily because GBTC is easier to hold for institutional investors because it can be managed via a brokerage account. For most of its existence, GBTC traded at a hefty premium to spot Bitcoin prices. But It starte...

European stock exchange to list Bitcoin carbon neutral ETP

A subsidiary of DeFi Technologies, Valour, will debut its new Carbon Neutral Bitcoin Exchange Traded Product (ETP) on the Frankfurt Stock Exchange. Trading of the ETP begins on Sept. 23. The company positions its ETP as a “sustainable and climate-friendly” exposure to Bitcoin with a management fee of 1.49%. The alignment with global environmental goals and Environmental, Social and Corporate Governance (ESG) is reportedly achieved through funding certified carbon removal and offset initiatives to neutralize the associated BTC carbon footprint. To structure the ETP, Valour partnered with Patch — a platform that provides climate action infrastructure and has previously worked with Andreessen Horowitz and other notable institutional investors. The announcement states: “All carbon emissi...

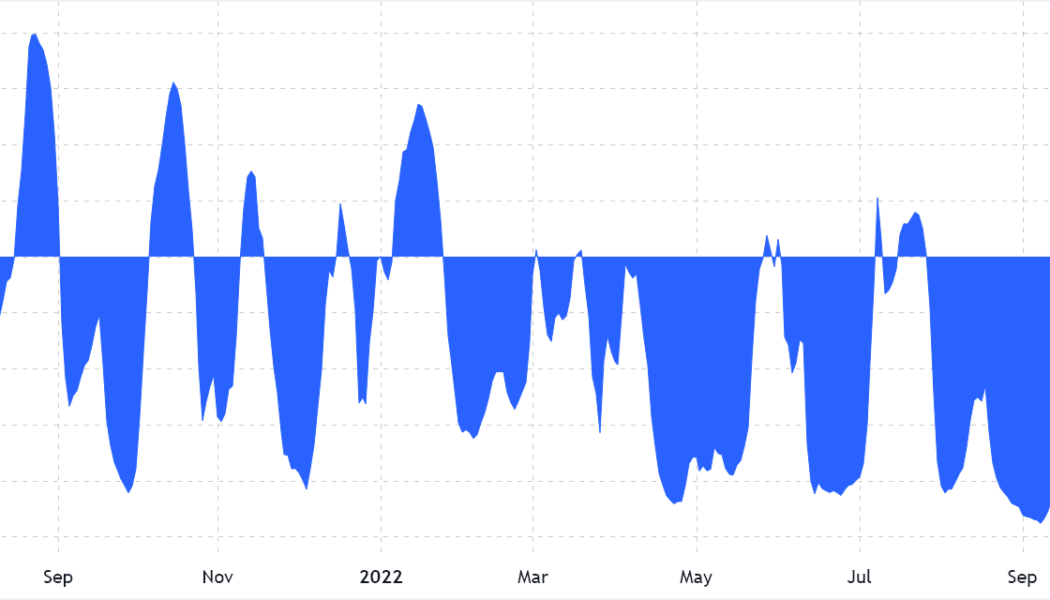

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is literally the only thing you need to look at: The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe. BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will...

Crypto investment product firm 21.co raises $25M to reach $2B valuation

21.co, the new parent firm of exchange-traded products (ETP) provider 21Shares, has become “Switzerland’s largest crypto unicorn,“ the firm announced on Tuesday. It raised $25 million in a funding round led by London-based hedge fund Marshall Wace. The new funding brings the firm’s valuation to $2 billion. 21.co is designed to unite 21Shares with third-party token provider Amun and other upcoming crypto projects aiming to build bridges into the crypto world, 21.co founder Hany Rashwan told Cointelegraph. All crypto ETP products launched by 21Shares will maintain the same nomenclature, Rashwan said. He also said that the new name won’t change much about the way 21Shares does business. According to Rashwan, the newly raised funds will help 21.co to continue expanding its business...

Aussie asset manager to offer crypto ETF using unique license variation

Australian asset manager Monochrome Asset Management has landed the country’s first Australian financial services license (AFSL) for a spot crypto exchange-traded fund (ETF). Speaking to Cointelegraph, Jeff Yew, CEO of Monochrome Asset Management, said the AFSL approval is significant, as until this point, approved crypto ETFs in Australia only operate under general financial asset authorization and only indirectly hold crypto-assets. Yew noted that Monochrome’s crypto ETFs, on the other hand, will directly hold the underlying crypto-assets and is specifically authorized by the Australian Securities & Investments Commission (ASIC) to do so. The Monochrome executive said the approval represents a significant step forward for both the advice industry and retail investors: “We see c...

Charles Schwab’s asset management arm launches crypto-linked ETF

Schwab Asset Management, the asset management arm of financial giant Charles Schwab, has launched an exchange-traded fund (ETF) with exposure to firms linked to cryptocurrencies. In a Friday announcement, Schwab said its Crypto Thematic ETF was expected to be available for trading on the New York Stock Exchange’s Arca under the ticker STCE on Aug. 4. The fund tracks Schwab’s Crypto Thematic Index, providing an investment vehicle with exposure to companies “that may benefit from the development or utilization of cryptocurrencies and other digital assets.” Likely because the United States Securities and Exchange Commission, or SEC, has not given the green light to ETFs providing direct exposure to Bitcoin (BTC), the Schwab fund will indirectly invest in crypto through companies. Schwab...