Economy

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

Budget Deficit: Buhari’s Government To Borrow N11 trillion, Sell Nation Assets In 2023

Share 12 Whatsapp reddit Tweet 0 12Shares The Minister of Finance and National Planning, Zainab Ahmed, has said the federal government will borrow over N11 trillion and sell national assets to finance the budget deficit in 2023. She also said the government’s budget deficit is expected to exceed N12.42 trillion if it should keep petroleum subsidy for the entire 2023 fiscal cycle. Mrs Ahmed disclosed this on Monday while appearing before the House of Representatives Committee on Finance to defend the 2023-2025 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP). Explaining two scenarios of the budget deficit to the committee, the minister said the first option involves retaining the petroleum subsidy for the entire 2023 fiscal year. According to her, in the first scenar...

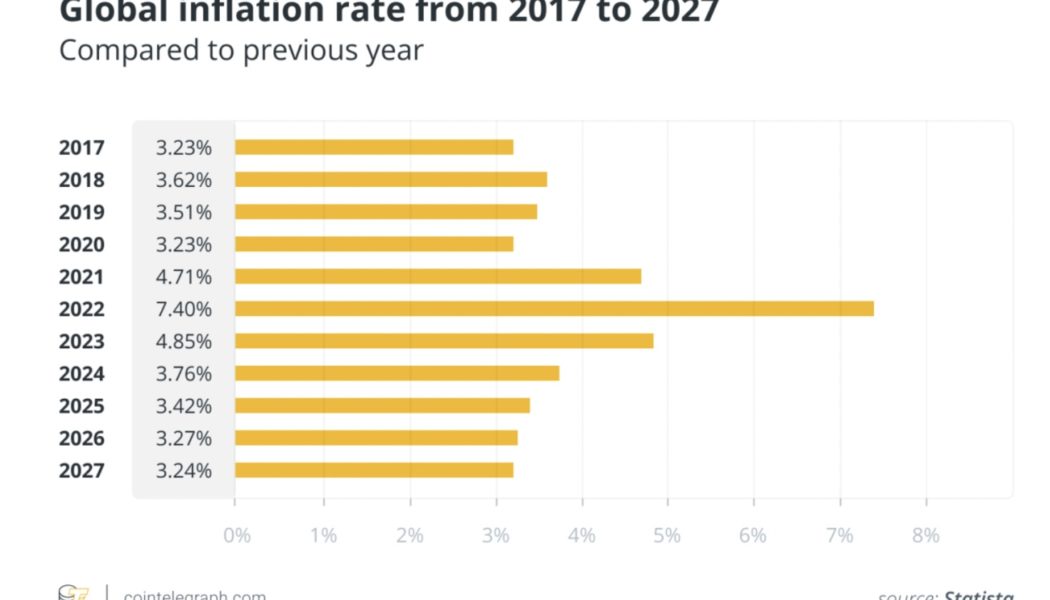

Crypto will become an inflation hedge — just not yet

In theory, Bitcoin (BTC) should serve as a hedge against inflation. It’s easy to access, its supply is predictable, and central banks cannot arbitrarily manipulate it. However, investors aren’t treating it that way. Instead, the cryptocurrency market is mirroring the stock market. Why is that? Let’s dive into what prevents cryptocurrencies from acting as a hedge against inflation, and what needs to happen to make them a hedge in the future. Crypto could be a hedge, but it comes with inconveniences Cryptocurrencies present a unique solution, given their lack of a central governing bank. You can’t lose trust in something that doesn’t exist. Its supply is finite, so it naturally appreciates in value. People using a blockchain with proof-of-stake protocols can access their funds at any time, w...

How to Make Money From Real Estate in Lagos – Dennis Isong

Share Whatsapp reddit Tweet 0 Shares It has been a little bit hard after the pandemic and Nigeria hasn’t found its feet yet. It’s even a lot more complicated with the constant rise in dollar and inflation which don’t seem to have any feasible solution yet. But despite all these, the Real Estate sector in Lagos has strongly stood the test of time. Of course, we have testimonies of people investing and cashing out big from this sector. Lagos is currently the most populous city in Africa and alone is ranked the 5th largest economy in Africa. Properties in Lagos can yield double the return on investment only if you are ready to play the long-term investment game and know how it works and what you are doing. There are enough opportunities in Lagos for anyone who wants to make money ...

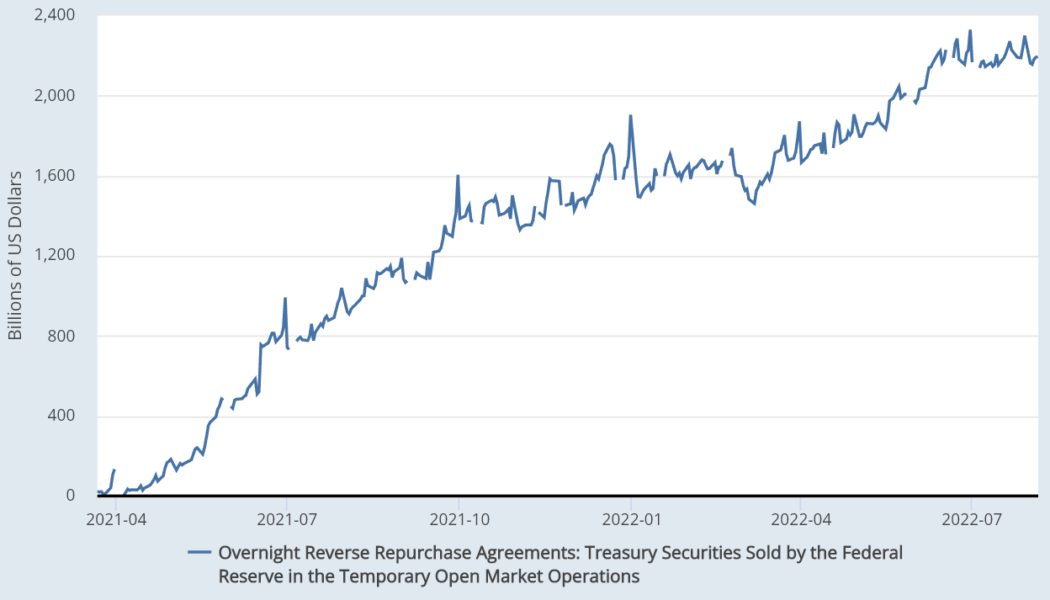

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

Advantages of Buying an Apartment Near Shopping Malls – Dennis Isong

Share Whatsapp reddit Tweet 0 Shares Buying a property is not as much as knowing where to buy the property. You can buy a property and end up discovering that the chosen area is a big mistake because of the lack of its profitability. There are certain features you should look out for when buying a property and one of them is its proximity to general amenities such as a popular hotel, shopping mall, etc. But we are focusing on a shopping mall in this article. Buying an apartment is always the first choice for people who are interested in getting started with a real estate investment. But with most investments, you have to start it right. An obvious choice for your real estate investment would be an apartment in a highly-urbanized area, specifically properties that are near shopping ma...

Worst quarter in 11 years as Bitcoin price and activity plunges

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months. The second quarter ending June 30 saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight ET on June 30 according to CoinGecko, representing a 56.2% loss according to crypto analytics platform Coinglass. It’s the steepest price fall since the third quarter of 2011, when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018, when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively. The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a draw down of over 37%, the heaviest monthly losses sin...

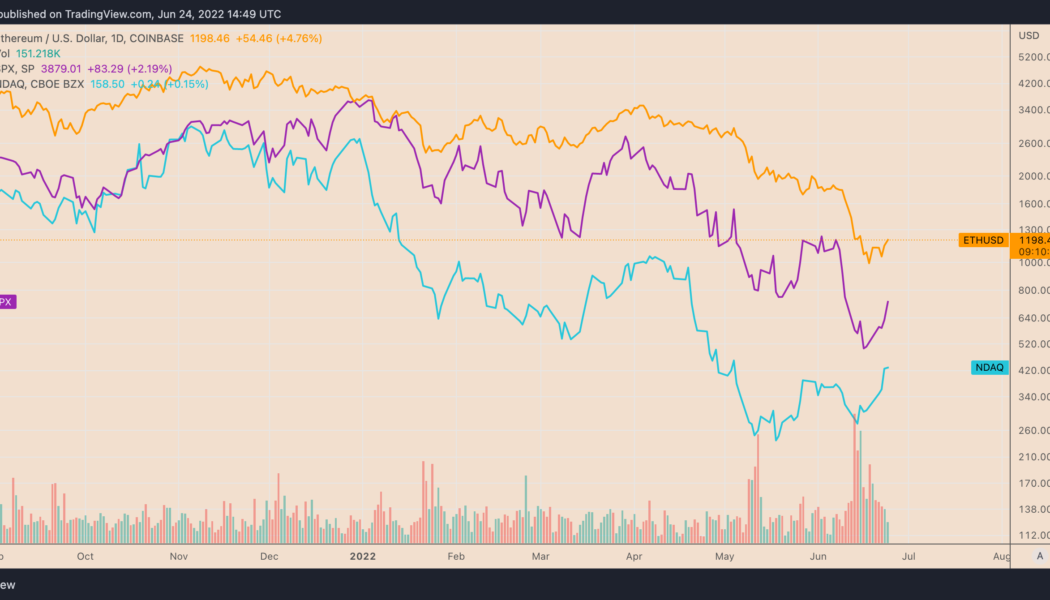

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

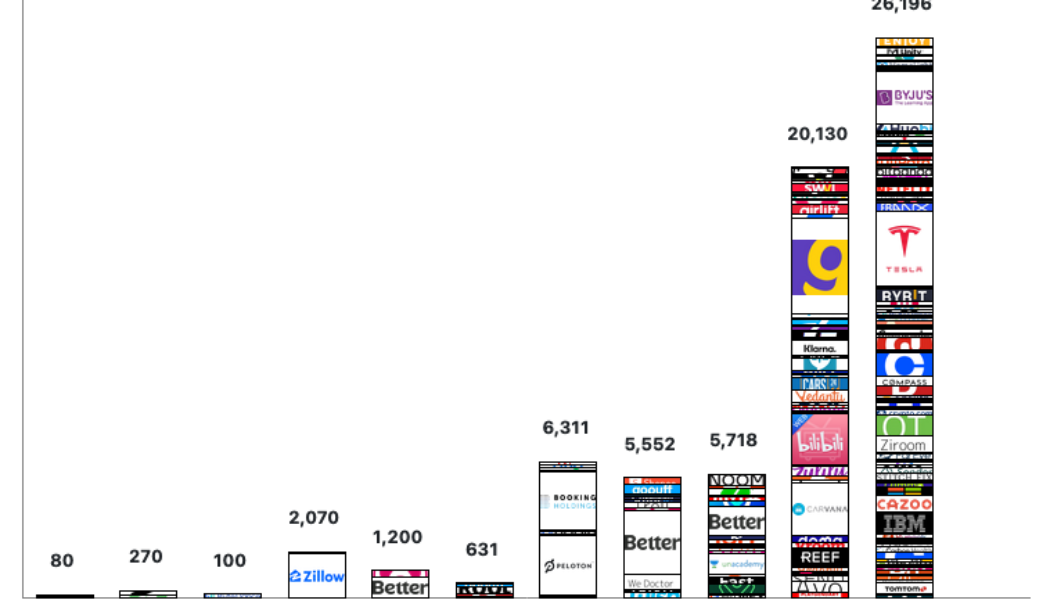

Sweeping layoffs, hiring and firing as crypto prices take a massive downturn

Many in the crypto world have been glued to their screens with eyes dead set on financial conditions this week. That isn’t the case for everyone though, as thousands are suddenly experiencing thewoes of sudden unemployment. Words of encouragement and sympathy also poured out across Twitter and LinkedIn consoling individuals released from their responsibilities. Some expressed frustration, confusion and anger while others expressed gratitude, renewed vision and reflections. My heart is with those recently laid off. I too have been one of the lucky ones to be spared by massive layoffs on days where friends have been let go. This privileged situation has its own anxiety, displacement and upheaval. Sorry you’re going through this moment. — Matt Murray (@vintageneon) June 16, 2022 As...

As labor struggle takes center stage, can DAOs democratize work?

Web3 has given rise to a number of innovative business models. In particular, decentralized autonomous organizations (DAOs) have started gaining traction as Web3 as the creator economy comes to fruition. Natalie Salemink, CEO and founder of Prismatic — a tooling and treasury management platform for DAOs — told Cointelegraph that DAOs are internet-native organizations that utilize smart contracts to facilitate coordination and governance in pursuit of a common goal. When it comes to traditional businesses, though, one of the most interesting aspects a DAO structure can provide is leadership based on computer-generated code rather than individual authority. The idea of operating a business without any central governance has become especially intriguing to brick and mortar compani...

Why the rise of a Bitcoin standard could deter war-making

Alex Gladstein, the CSO at the Human Rights Foundation, says that if Bitcoin was adopted as a global reserve currency, nation-states would be less incentivized to start wars. According to Gladstein, the U.S. was able to sustain its “forever wars” in Iraq and Afghanistan mainly by borrowing capital. That was possible largely because of the Federal Reserve’s monetary policy, which has been keeping interest rates relatively low through quantitative easing. “We literally print money, we sell bonds to the open market for a promise to pay in the future and we use the income from the bond sales to pay for these wars.”, explained Gladstein in a latest interview with Cointelegraph. Unlike fiat currency, Bitcoin’s total supply is immutable. That ...