Dollar

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

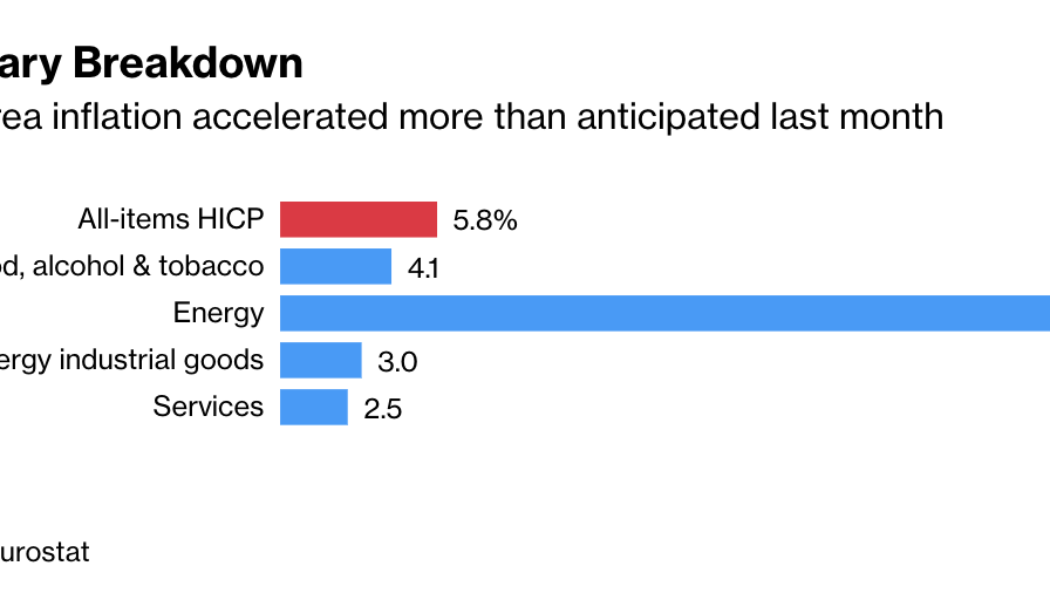

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings. Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy. The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday. “If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official st...

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

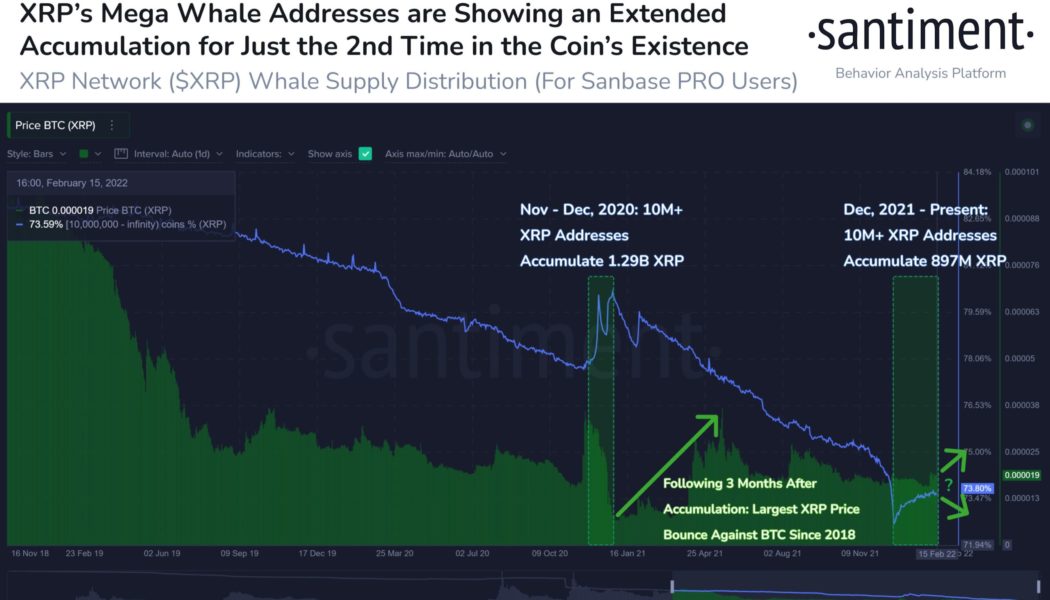

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

BTC price returns to $43K — 5 things to watch in Bitcoin this week

Bitcoin (BTC) is in a fighting mood this week as the weekly close buoys bulls’ cause and wipes out several weeks of downside — can it continue higher? After challenging $42,000 over the weekend, there was a cautious sense of optimism as higher levels remained in play. Sunday saw a fresh push, with overnight progress attacking $43,000 before fresh consolidation. With Monday’s Wall Street open primed to deliver more of the turbulence in big tech stocks seen late last week, the environment for crypto traders is an interesting one in February. With its notable positive correlation, Bitcoin is thus sensitive to moves up and down — but equities refuse to move unanimously in the same direction. Looking for guidance, hodlers will still remember January’s lows, and these are also fresh in the mind ...

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...

Naira appreciates at N493 to dollar in parallel market

The naira, on Thursday, appreciated by 1.8 percent to N493 to a dollar at the parallel market as the Central Bank of Nigeria (CBN) increased forex supplies to banks. The local currency, which opened at N502 per dollar, gained N17 to N485 during midday trading before closing at N493/$1, according to data on abokiFX.com, a website that collates parallel rates in Lagos. It also appreciated against the pound sterling to close at N710 and N600, gaining N3 and N6, respectively, on the street. At the importer and exporter (I&E) window, it appreciated 0.13 percent to close at N411.50 to the dollar. Last week, Godwin Emefiele, CBN governor, met with bank CEOs and agreed to increase the amount of foreign exchange allocated to banks to meet legitimate needs. Emefiele cautioned them to ensure that...

Naira slides again at official market

Naira for the second day in a row fell against the U.S. dollar at the official market Wednesday, but managed a rebound at the parallel market, a day after hitting its lowest black-market rate in at least four years. Data on the FMDQ Security Exchange where forex is officially traded showed that the naira closed at N412.00 per $1 at the Nafex window. The local currency performance on Wednesday represents a N0.25 or 0.06 per cent decrease from N411.75 the rate it traded in the previous session on Tuesday. The trading session on Wednesday witnessed a forex turnover of $131.86 million, this translates to a 23.44 per cent depreciation from $172.24 million posted in the previous session on Tuesday. The domestic currency experienced an intraday low of N420.97 and a high of N400.00 before closing ...

Naira stable at parallel, official market

Nigeria’s naira remained stable against the U.S. dollar at the unofficial market on Friday, data posted on abokiFX .com, a website that collates parallel market rates in Lagos showed. The data posted showed that the naira closed at N485.00 at the black market, the same rate it exchanged hands with the greenback in the previous session on Thursday. Similarly, the local unit remained stable at the official market. Data posted on the FMDQ Security Exchange window where forex is officially traded showed that the domestic unit again closed at N410.00 at the trading session of the NAFEX window on Friday. Friday’s performance came to be as forex supply slumped significantly. The naira experienced an intraday high of N394.00 and a low of N436.40 before closing at N410.00 on Friday, the same rate i...

NNPC declares N13.43 billion trading surplus for November 2020

The Nigerian National Petroleum Corporation, NNPC, has declared a trading surplus of N13.43billion for November 2020, 54 per cent more than the N8.71billion recorded in October 2020. This is contained in the November 2020 edition of the NNPC Monthly Financial and Operations Report (MFOR), according to a press release by the Group General Manager, Group Public Affairs Division of the Corporation, Dr. Kennie Obateru Obateru said the trading surplus or trading deficit is derived after deduction of the expenditure profile from the revenue in the period under review. The report indicated that in November, NNPC Group’s operating revenue as compared to October 2020, decreased slightly by 0.02 per cent or N0.09billion to stand at N423.08 billion. Similarly, expenditure for the month decreased by 1...