Dollar

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...

Magic Internet Money token depegs as Terra (LUNA) domino effect persists

Magic Internet Money (MIM), a US dollar-pegged stablecoin of the Abracadabra ecosystem, joins the growing list of tokens losing their $1 value amid an untimely crypto winter. The sudden de-pegging of the MIM token commenced roughly on June 17, 7:40 pm ET, which saw the token’s price drop to $0.926 in just three hours. Terra’s LUNA and TerraUSD (UST) death spiral not only affected the investors but also had a negative impact on numerous crypto projects, including Abracadabra’s MIM token ecosystem — as alleged by Twitter handle @AutismCapital. Depegging of Magic Internet Money (MIM) token price chart. Source: CoinMarketCap Citing an insider scoop, AutismCapital claimed that Abracadabra accrued $12 million in bad debt as a direct result of Terra’s sudden downfall “because liquidations couldn&...

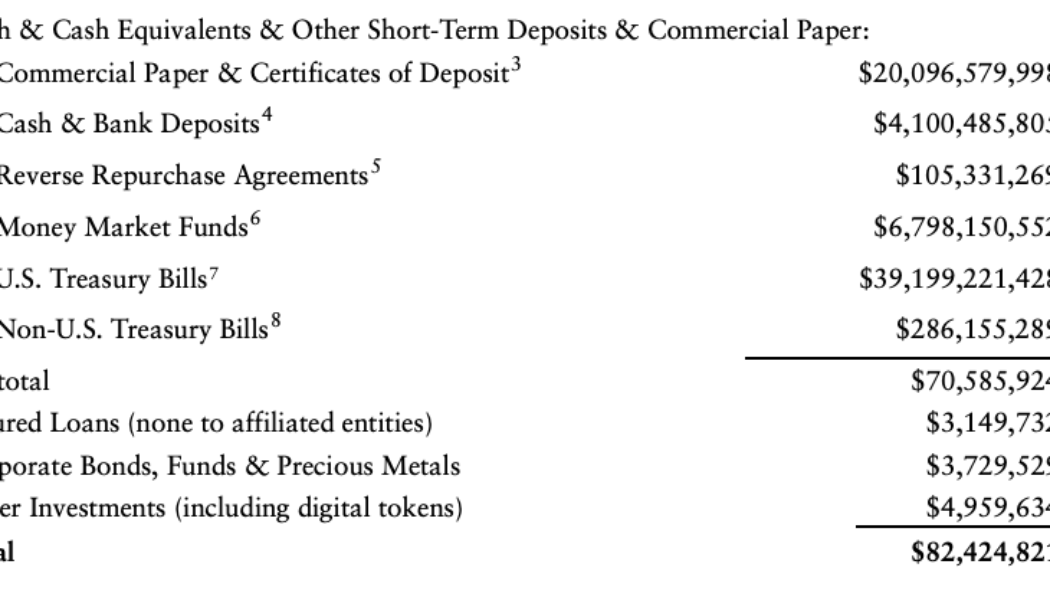

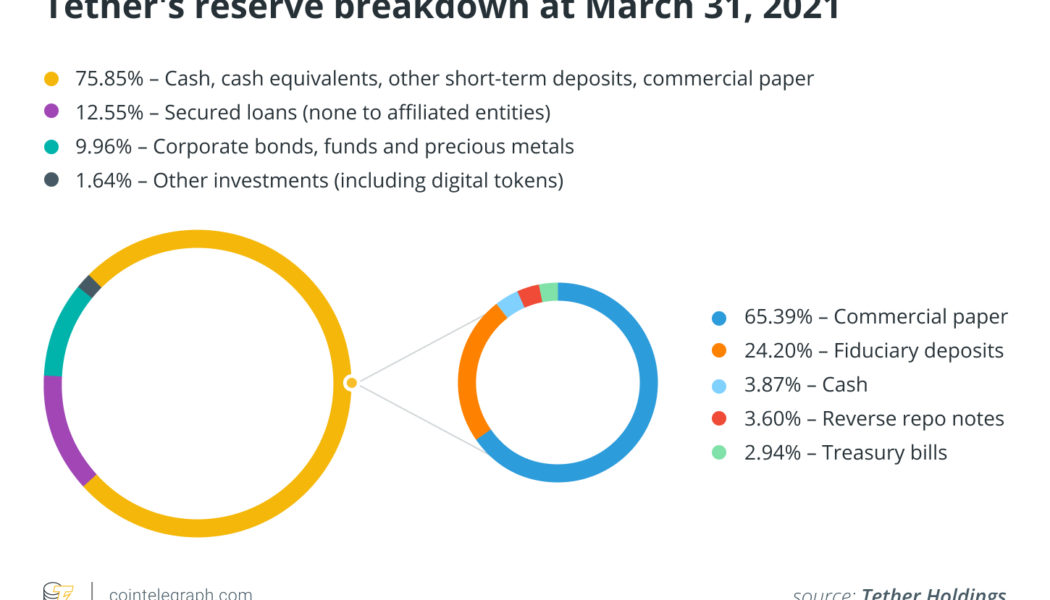

Tether aims to decrease commercial paper backing of USDT to zero

The major stablecoin company Tether is looking to eventually get rid of commercial paper backing for its U.S. dollar-based stablecoin Tether (USDT). Tether issued an official statement on Wednesday to deny reports alleging that Tether’s commercial paper portfolio is 85% backed by Chinese or Asian commercial papers and is being traded at a 30% discount. The stablecoin firm called such allegations “completely false,” reiterating that more than 47% of total USDT reserves are now the “United States Treasuries.” In its latest assurance opinion issued in May, Tether reported that commercial paper makes up less than 25% of USDT’s backing, amounting to around $21 billion as of March 31. USDT’s backing asset breakdown. Source: Tether’s assurance opinion released in May 2022 According to the latest ...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Spooky Solana breakdown begins with SOL price facing a potential 45% drop — Here’s why

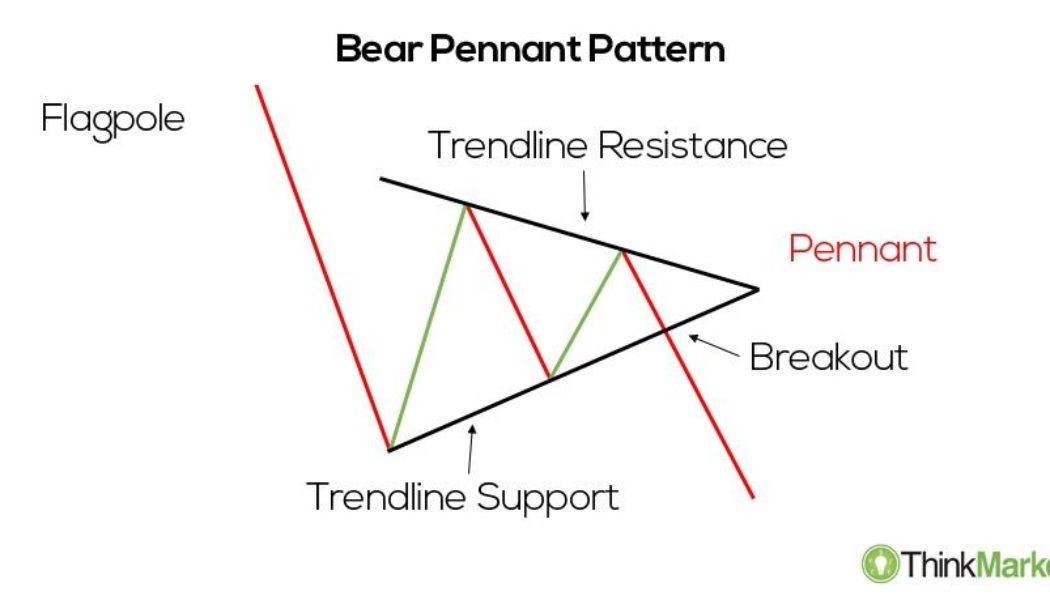

Solana (SOL) dropped on May 26, continuing its decline from the previous day amid a broader retreat across the crypto market. SOL price pennant breakdown underway SOL price fell by over 13% to around $41.60, its lowest level in almost two weeks. Notably, the SOL/USD pair also broke out of what appears to be like a “bear pennant,” a classic technical pattern whose occurrences typically precede additional downside moves in a market. In detail, bear pennants appear when the price trades inside a range defined by a falling trendline resistance and rising trendline support. Bear pennant pattern. Source: ThinkMarkets These patterns resolve after the price breaks below the lower trendline, accompanied by higher volumes. As a rule of technical analysis, traders decide the pennant’...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Do you have the right to redeem your stablecoin?

Stablecoins are often discussed with regard to their “stability.” It is usually questioned whether a stablecoin is sufficiently backed with money or other assets. Undoubtedly, it is a very important aspect of stablecoin value. But, does it make sense if the legal terms of a stablecoin do not give you, the stablecoin holder, the legal right to redeem that digital record on blockchain for fiat currency? This article aims to look into the legal terms of the two largest stablecoins — Tether (USDT) by Tether and USD Coin (USDC) by Centre Consortium, established by Coinbase and Circle — to answer the question: Do they owe you anything? Related: Stablecoins will have to reflect and evolve to live up to their name Tether Article 3 of Tether’s Terms of Service explicitly states: “Tether reserves th...

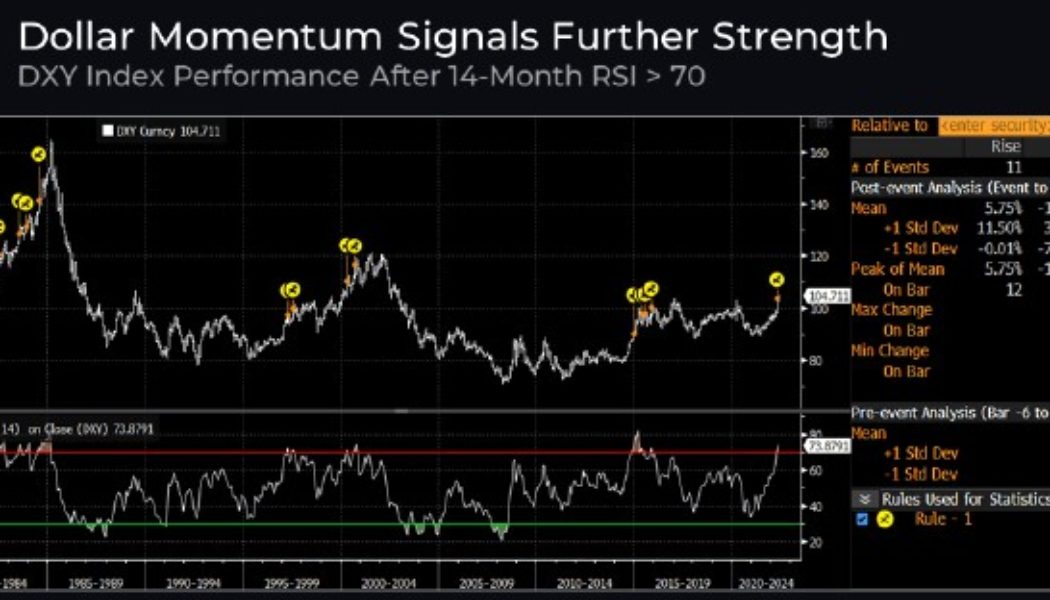

Buy the dip, or wait for max pain? Analysts debate whether Bitcoin price has bottomed

It has been a rough week for the cryptocurrency market, primarily because of the Terra ecosystem collapse and its knock-on effect on Bitcoin (BTC), Ethereum (ETH) and altcoin prices, plus the panic selling that took place after stablecoins lost their peg to the U.S. dollar. The bearish headwinds for the crypto market have been building since late 2021 as the U.S. dollar gained strength and the United States Federal Reserve hinted that it would raise interest rates throughout the year. According to a recent report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the first time since its late 2014 to 2016 run up.” DXY index performance. Source: Delphi Digital This is notable because 11 out of the 14 instances where this previously occurred “led to a strong...

‘Regulations are in place to help crypto businesses understand operations,’ says The Bahamas PM Philip Davis

The Bahamas Prime Minister Philip Davis told Cointelegraph that the region has a regulatory regime in place that will enable crypto businesses to operate within its jurisdiction. During an interview at SALT’s Crypto Bahamas conference, Davis shared that The Bahamas recently published a white paper framework that will allow crypto businesses to “grow and prosper,” while letting companies understand the region’s expectations. He added: “The policy also takes into account the balance between concerns people have about cryptocurrency and the risks that come along with it. [The] policy is to protect consumers, [the] integrity of the space and at [the] same time, ensure that we minimize all risks that may be associated with these businesses.” Davis pointed out that crypto innovation is already w...

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

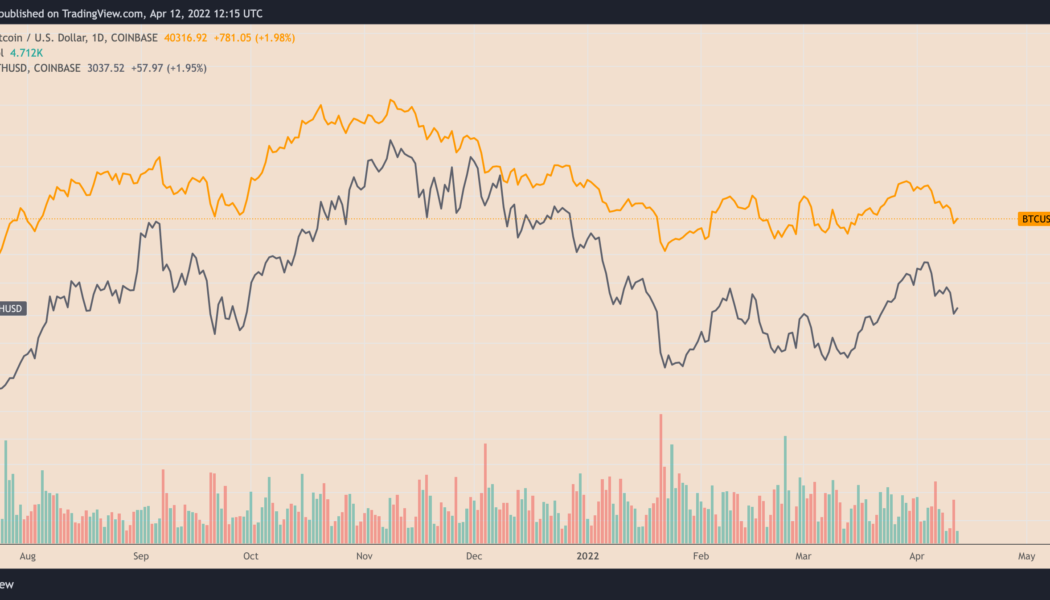

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

US exceptionalism could be tested as digital assets find footing worldwide — Sheila Warren

Sheila Warren, CEO of the Crypto Council for Innovation and former head of data, blockchain and digital assets at the World Economic Forum, said the digital yuan may present certain challenges for the United States. However, regulators and lawmakers may want consider how to encourage digital innovation, as China is already “massively tech forward” for its residents. Speaking to Cointelegraph during Austin’s SXSW festival, Warren said that though she believed China’s digital yuan was unlikely to significantly affect retail payments in the United States, the adoption of the technology surrounding it could impact the dollar’s global dominance. The CCI CEO added that the Federal Reserve could make a “strong move” in preserving the dollar’s role by introducing a central ...