Dollar

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

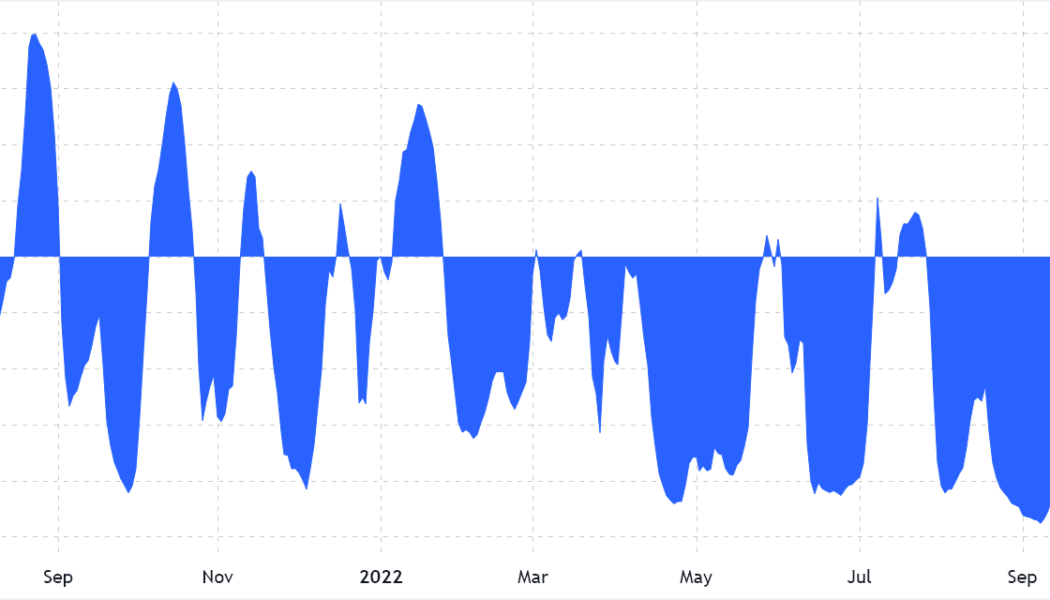

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is literally the only thing you need to look at: The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe. BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will...

Bitcoin price cracks $21K as trader says BTC buy now ‘very compelling’

Bitcoin (BTC) circled $21,000 at the Sep. 9 Wall Street open as newly-won gains endured. Meanwhile, the total cryptocurrency market capitalization has crossed back above the $1 billion mark. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price gives “confirmation” of trend change Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as its “short squeeze” punished late bears. After a brief consolidation, the pair set new multi-week highs of $21,254 on Bitstamp, and now faced resistance in the form of an old support level abandoned in late August. For market commentators, however, the latest move had already proved decisive — and should favor bulls beyond short timeframes. “This impulse up is THE confirmation,” popular Twitter trader and ange...

Bitcoin squeeze to $23K still open as crypto market cap holds key support

Bitcoin (BTC) returned to $20,000 on Sep. 2 amid renewed bets on a “short squeeze” higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader eyes $20,700 short squeeze trigger Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering from another dip below the $20,000 mark on the day, continuing rangebound behavior. The pair gave little insight into which direction the next breakout could be, with opinions differing on the surrounding environment. Amid downside pressure on risk assets and a strong U.S. dollar, overall consensus appeared to favor long-term weakness continuing. For popular trader Il Capo of Crypto, however, there was still reason to believe that a relief bounce could enter first. Thanks to the majority of the market expecting immediate lo...

US dollar smashes yet another 20-year high as Bitcoin price sags 2.7%

Bitcoin (BTC) faced familiar pressure on the Sept. 1 Wall Street open as the U.S. dollar hit fresh two-decade highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: DXY could hit 115 before ‘slowdown’ Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell to $19,658 on Bitstamp, down 2.7% from the day’s high. The pair faced stiff resistance trying to flip the important $20,000 mark to solid support, with macro cues further complicating the picture for bulls. That came in the form of a resurgent U.S. dollar index (DXY) on the day, which beat previous peaks to reach 109.97, its highest since September 2002. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView Risk assets thus broadly lost ground, with the S&P 500 and Nas...

Bitcoin erases latest gains with BTC price back below $20K as dollar spikes

Bitcoin (BTC) fell back below $20,000 after the Aug. 30 Wall Street open as data showed hodlers selling at a loss. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView June lows look increasingly attractive Data from Cointelegraph Markets Pro and TradingView captured the latest dive below the 2017 bull market peak for BTC/USD, with United States equities dropping in step. The S&P 500 and Nasdaq Composite Index lost 1.1% and 1.25% in the first hour, respectively, while BTC/USD shed 2.5% during a single hourly candle. The latest moves came as no surprise to traders already wary of a deeper correction for the largest cryptocurrency. Previously, many had called for a retracement toward the macro lows seen in June. For popular trader Crypto Ed, both Bitcoin and Ether (ETH) offered go...

United Texas Bank CEO wants to ‘limit the issuance of US dollar-backed stablecoins to banks’

Scott Beck, chief executive officer of United Texas Bank, called on members of the state’s blockchain working group to recommend policy for leaving stablecoins to banks rather than crypto firms. Speaking before the Texas Work Group on Blockchain Matters in Austin on Friday, Beck suggested limiting the issuance of U.S. dollar-backed stablecoins to licensed banks rather than issuers like Circle. The United Texas Bank CEO cited a November report from the President’s Working Group on Financial Markets, in which the group said stablecoin issuers should be held to the same standards as insured depository institutions including state and federally chartered banks. “If such stablecoins are defined to be ‘money’, banks are the proper economic actor to issue and manage stablecoins,” said Beck. “Bank...

Best monthly gains since October 2021 — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week and a new month on a cautiously positive footing after protecting crucial levels. After an intense July in which macro factors provided significant volatility, BTC price action managed to provide both a weekly and monthly candle favoring the bulls. The road to some form of recovery continues, and at some points in recent weeks, it seemed like Bitcoin would suffer even harder on the back of June’s 40% losses. Now, however, there is already a sense of optimism among analysts, but one thing remains clear — this “bear market rally” does not mean the end of the tunnel yet. As Summer 2022 enters its final month, Cointelegraph takes a look at the potential market triggers at play for Bitcoin as it lingers near its highest levels since mid-June. Spot price snatches ...

Bitcoin traders eye levels to hold as ‘decision time’ looms for BTC price

Bitcoin (BTC) recovered above $23,000 into July 22 as attention increasingly focused on the upcoming weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price needs to preserve at least $22,400 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD finding renewed strength after briefly dipping towards $22,000. The pair traded in a critical zone for bulls on the day, with the 50-day and 200-week moving averages (MAs) still yet to flip from resistance to support. Analysts were holding out for the weekly candle close to determine the strength of Bitcoin’s latest uptrend which at one point delivered weekly gains of up to 25%. “To perform a reclaim of the 200-week MA as support, $BTC needs to Weekly Close above $22800,” popular trader and analyst Rekt Capi...

Bitcoin lurks by $22K as US dollar falls from peak, Ethereum gains 20%

Bitcoin (BTC) hugged $22,000 on July 19 as macro conditions slowly turned to favor risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto rise as dollar weakens Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cooling volatility immediately below the crucial 200-week moving average (WMA). The Wall Street open saw further gains for United States equities in the face of a declining U.S. dollar, which extended its retracement after hitting its latest two-decade peak. The U.S. dollar index (DXY) stood at around 106.5 at the time of writing, down 2.6% from the high seen July 14. For Bitcoin analysts, it was thus a case of wait and see as markets bided their time between buy and sell levels. $BTC / $USD – Update These are the op...

Bitcoin fights key trendline near $20K as US dollar index hits new 20-year high

Bitcoin (BTC) found a new focus just under $20,000 on July 14 as U.S. dollar strength hammered out yet another two-decade high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView DXY moves bring yen, euro into focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding from lows sparked by a fresh 40-year high for U.S. inflation as per the Consumer Price Index (CPI). After briefly dipping under $19,000, the pair took a flight above $20,000 before consolidating immediately below that psychologically significant level. For on-chain analytics resource Material Indicators, it was now “do or die” for BTC price action when it came to a key rising trendline in place since mid-June. On the day, that trendline stood at around $19,600, with BTC/USD n...

Bitcoin price indicator that marked 2015 and 2018 bottoms is flashing

Bitcoin (BTC) could undergo a massive price recovery in the coming months, based on an indicator that marked the 2015 and 2018 bear market bottoms. What’s the Bitcoin Pi Cycle bottom indicator? Dubbed “Pi Cycle bottom,” the indicator comprises a 471-day simple moving average (SMA) and a 150-period exponential moving average (EMA). Furthermore, the 471-day SMA is multiplied by 0.745; the outcome is pitted against the 150-day EMA to predict the underlying market’s bottom. Notably, each time the 150-period EMA has fallen below the 471-period SMA, it has marked the end of a Bitcoin bear market. For instance, in 2015, the crossover coincided with Bitcoin bottoming out near $160 in January 2015, followed by an almost 12,000% bull run toward $20,000 in December 2017....