Dollar

Bitcoin price stays near $23K as data shows hodlers not selling BTC

Seasoned Bitcoin market participants are anything but willing to take profit, even with the BTC price up 40% in January. Market Update Own this piece of history Collect this article as an NFT Bitcoin (BTC) refused to surrender gains at the Jan. 23 Wall Street open as United States equities opened higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar sags as risk assets reject retracement Data from Cointelegraph Markets Pro and TradingView showed BTC/USD continuing to circle $22,800 at the time of writing. The pair had managed to conserve its trading range over the weekend, with a local low of $22,315 allowing bulls to avoid a major setback. The mood remained buoyant among risk assets on the day, with the S&P 500 up 1.3% and Nasdaq Composite Index trading 2% higher....

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

Bitcoin bulls protect $17K as trader eyes key China BTC price catalyst

Bitcoin (BTC) maintained $17,000 support into Dec. 10 ahead of a critical week of macro data. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print will make Fed “slow down” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it traded sideways after the close of trading on Wall Street. The pair looked set for a quiet weekend, with all eyes focused on United States inflation readings and policy updates due from Dec. 13 onward. With the Producer Price Index (PPI) November print behind it, the month’s Consumer Price Index (CPI) results took center stage. As Cointelegraph reported, expectations remain that CPI will show U.S. inflation continuing to abate, sparking renewed strength in risk assets, including crypto. “My personal expectations are t...

BTC price tests $17K on PPI as Bitcoin analysts eye CPI, FOMC catalysts

Bitcoin (BTC) fell on the Dec. 9 Wall Street open as United States economic data appeared to disappoint markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Attention turns to Bitcoin vs. CPI “big trigger” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to come closer to $17,000 after passing the level overnight. The pair reacted badly to U.S. Producer Price Index (PPI) data, which despite being above expectations still beat the readout from the month prior. “Bit of an over reaction towards PPI, which has been dropping significantly from last month, but less than expected,” Michaël van de Poppe, founder and CEO of trading firm Eight, responded. Van de Poppe, like others, noted that the crux of macro cues would come next week in the for...

Bitcoin price hits 1-week lows as Fed rate hike rumors unsettle market

Bitcoin (BTC) dipped further below $19,000 on Oct. 21 as rumors circulated over the United States Federal Reserve. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed still on track for major November rate hike Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly dropping before the Wall Street open, hitting lows of $18,660 on Bitstamp. A recovery took the pair higher, and it was attempting reclaim $19,000 as support at the time of writing. The action came as commentators claimed the Fed was softening its policy on rate hikes ahead of the Nov. 1–2 Federal Open Market Committee (FOMC) meeting. Citing mainstream media quotations from Fed officials, they suggested that the November hike could be the last 75-basis-point adjustment, with smaller ones following...

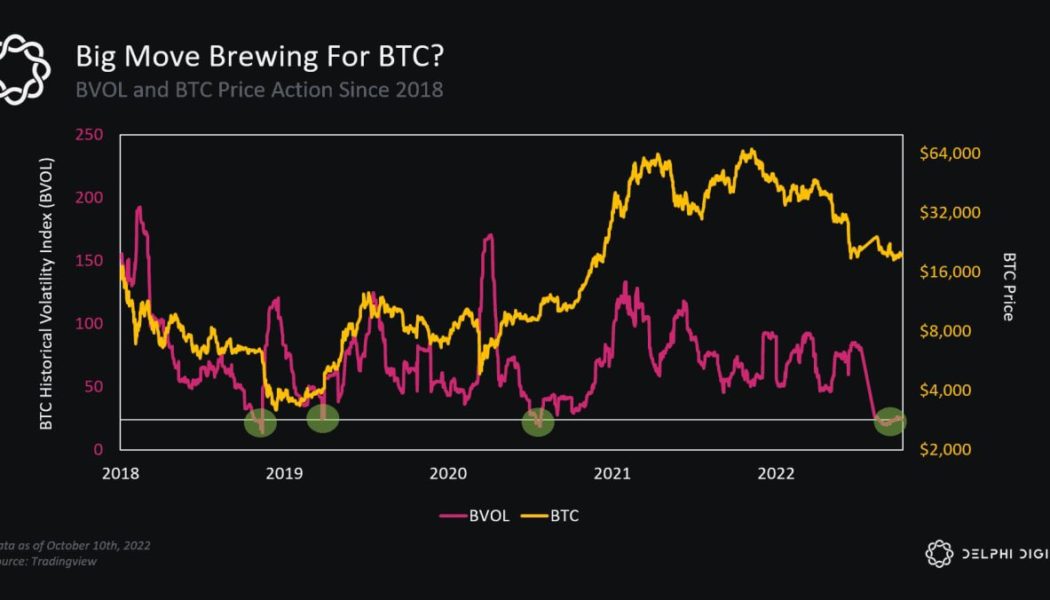

‘Get ready’ for BTC volatility — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week keeping everyone guessing as a tiny trading range stays in play. A non-volatile weekend continues a familiar status quo for BTC/USD, which remains just above $19,000. Despite calls for a rally and a run to lower macro lows next, the pair has yet to make a decision on a trajectory — or even signal that a breakout or breakdown is imminent. After a brief spell of excitement seen on the back of last week’s United States economic data, Bitcoin is thus back at square one — literally, as price action is now exactly where it was at the same time last week. As the market wonders what it might take to crack the range, Cointelegraph takes a look at potential catalysts in store this week. Spot price action has traders dreaming of breakout For Bitcoin traders, it is a ca...

Bitcoin ‘bear trap’ sees BTC price near $20K as daily gains top 9%

Bitcoin (BTC) delivered more surprises into Oct. 14 as the reaction to macro triggers saw a sudden run at $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto smoke shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to one-week highs, gaining almost $2,000 in hours. After the United States Consumer Price Index (CPI) print for September came in above expectations, an initial crypto rout put bulls on edge, but the pain was short lived. Bitcoin ultimately ran higher than its pre-CPI levels, following stocks which were described as delivering the “biggest bear trap of 2022.” “That’s gotta be the biggest bear trap I’ve seen so far,” popular Twitter trading account Stockrocker reacted. “Even I was starti...

Next few weeks are ‘critical’ for stock market and Bitcoin, analyst says

The stock market’s movements in the next few weeks will be critical for determining whether we are heading towards a short-term recession or a long term-one, according to forex trader and crypto analyst Alessio Rastani. During the October-December 2022 period, the analyst expects to see the S&P rallying. “If that bounces or rally fails and drops back down again, then very likely, we’re entering a long-term recession and something very close to similar to 2008”, said Rastani in the latest Cointelegraph interview. [embedded content] According to the analyst, such a recession could last until 2024 and would inevitably negatively impact the price of Bitcoin (BTC). Talking about the latest Pound sterling crisis, Rastani opined that its principal cause is the rally of...

Bitcoin price loses $20K as trader warns US dollar ‘not quite topped out’

Bitcoin (BTC) crossed under $20,000 after the Sept. 27 Wall Street open as United States equities inched higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. dollar has room to run — trader Data from Cointelegraph Markets Pro and TradingView confirmed the $20,000 mark barely remaining as tentative support on the day. BTC/USD had managed local highs of $20,344 on Bitstamp overnight, while retracing U.S. dollar strength gave modest relief to risk assets across the board. The S&P 500 and Nasdaq Composite Index had been up 0.4% and 0.65%, respectively, after two hours’ trading, but subsequently reversed. At the same time, the U.S. dollar index (DXY) was down 0.15% on the day, back below the 114 mark but still near its highest since mid-2002. “U.S. open coming up. Green ...

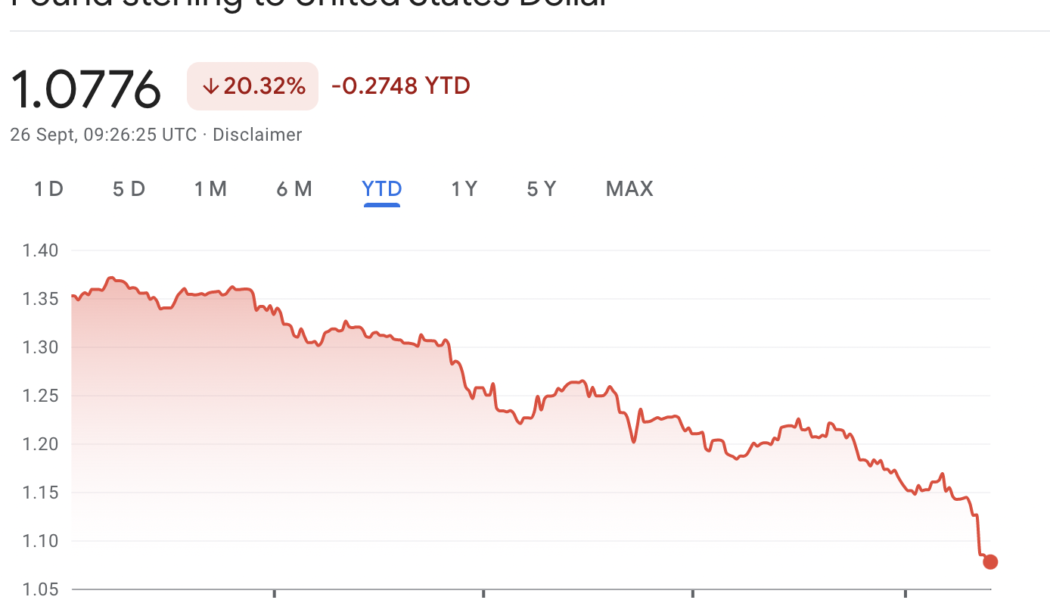

Is it Bitcoin’s time to shine? British pound drops to all-time low against the dollar

On Sept. 26, the British pound hit a record low against the U.S. dollar following the announcement of tax cuts and further debt increases to curb the impact of a possible economic recession. The volatility simply reflects investors’ doubts about the government’s capacity to withstand the growing costs of living across the region. The U.S. dollar has been the clear winner as investors seek shelter in the largest global economy, but the British pound’s weakness could be a net positive for Bitcoin. The GBP, or British pound, is the world’s oldest currency still in use and it has been in continuous use since its inception. Fiat currencies are a 52-year old experiment The British pound, as we currently know, started its journey in 1971 after its convertibility with gold ...

GBP follows euro: The pound-dollar rate hits all-time low

The Great British pound sterling has fallen to the lowest level ever against the United States dollar. In a flurry of overnight trading activity, the pound reached lows of 1 pound = $1.04. It lost 5% of its value in a spiral. The United Kingdom’s sovereign currency, the pound sterling, is the world’s oldest currency that is still in use today. It is currently clinging above USD-pound parity, since regaining $.03 cents, bouncing to 1 pound = $1.07. Source: Google The pound has been on a steady decline against the USD since 2007 and the subsequent financial crisis. While it has lost 20% of its value this year, it has lost half of its value against the dollar over the past 20 years. Deputy Leader for the Labour Party, the government’s opposition party, was quick to compare the pou...

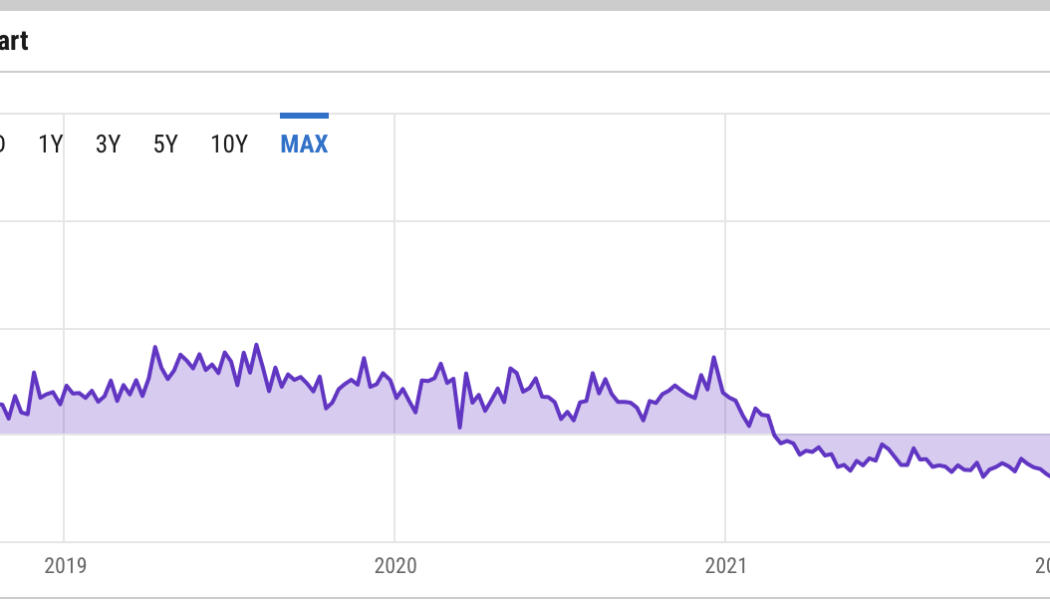

The biggest Bitcoin fund just hit a record -35% discount — A warning for BTC price?

Grayscale Bitcoin Trust (GBTC), a cryptocurrency fund that currently holds 3.12% of the total Bitcoin (BTC) supply, or over 640,000 BTC, is trading at a record discount compared to the value of its underlying assets. Institutional interest in Grayscale dries up On Sep. 23, the $12.55 billion closed-end trust was trading at a 35.18% discount, according to the latest data. GBTC discount versus spot BTC/USD price. Source: YCharts To investors, GBTC has long served as a great alternative to gain exposure in the Bitcoin market despite its 2% annual management fee. This is primarily because GBTC is easier to hold for institutional investors because it can be managed via a brokerage account. For most of its existence, GBTC traded at a hefty premium to spot Bitcoin prices. But It starte...