Dogecoin

Crypto vs. physical: Musk-Saylor inflation debate boils down to scarcity

As rising inflation threatens to eat up further the purchasing power of the global fiat ecosystem, finding the perfect hedge against a falling economy has become the need of the hour — especially for the general public across the world. Joining this discussion online, Tesla CEO Elon Musk asked publicly about the probable inflation rate over the next few years to gauge the notion of global investors. Sharing his thoughts on the matter, American billionaire and MicroStrategy CEO Michael J. Saylor opined that with rising inflation, he expects the capital cash flow will move away from traditional fiat into scarce assets such as Bitcoin (BTC). USD consumer inflation will continue near all time highs, and asset inflation will run at double the rate of consumer inflation. Weaker currencies ...

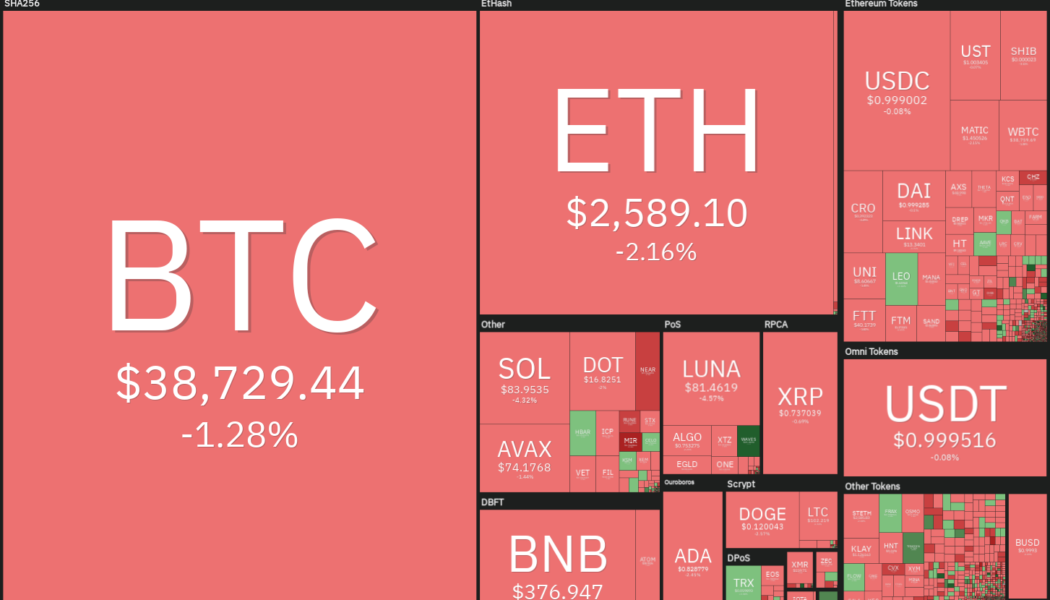

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

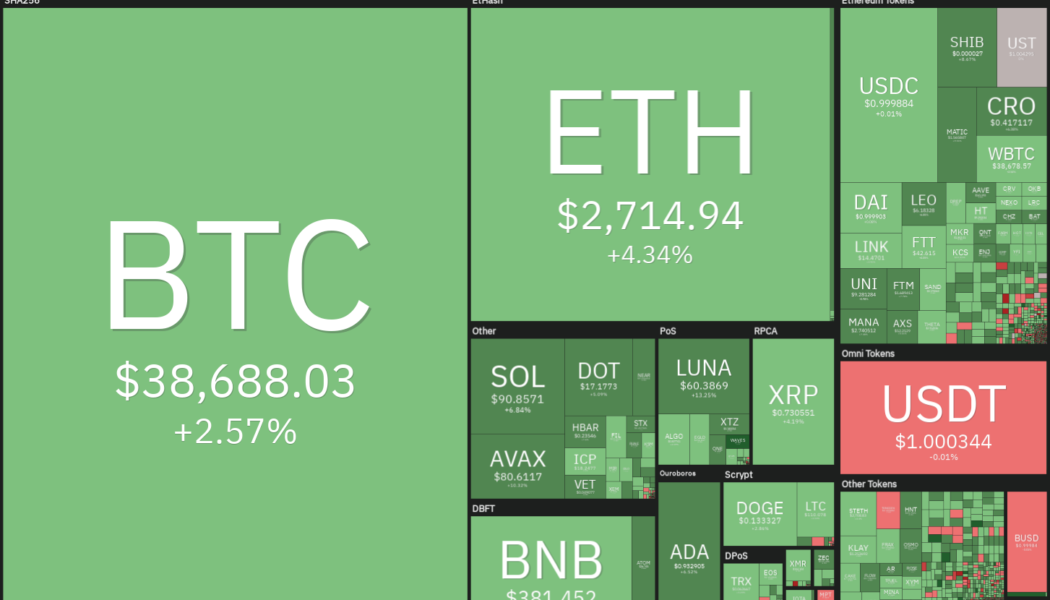

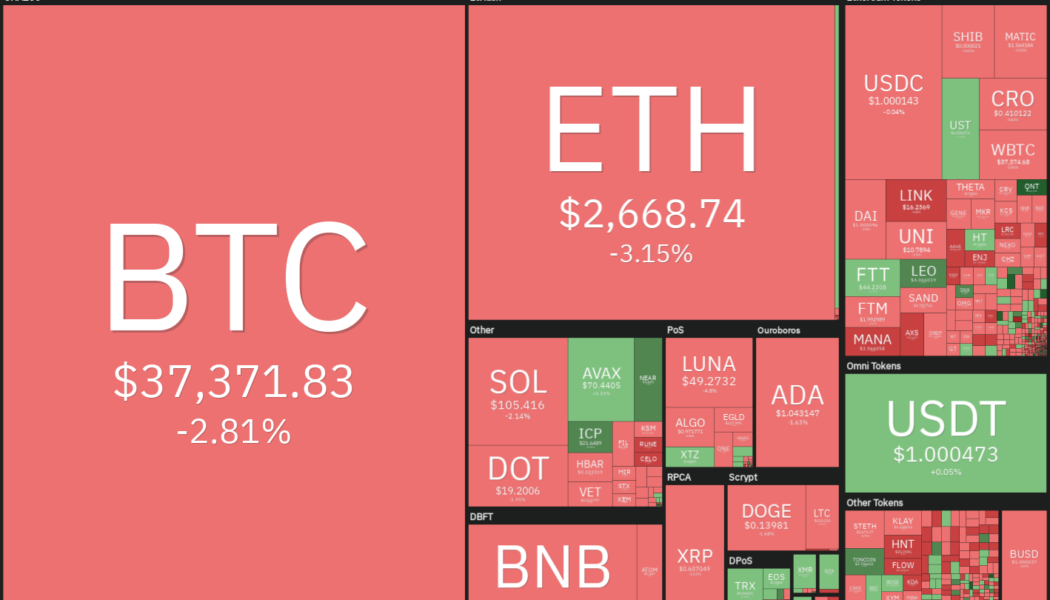

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

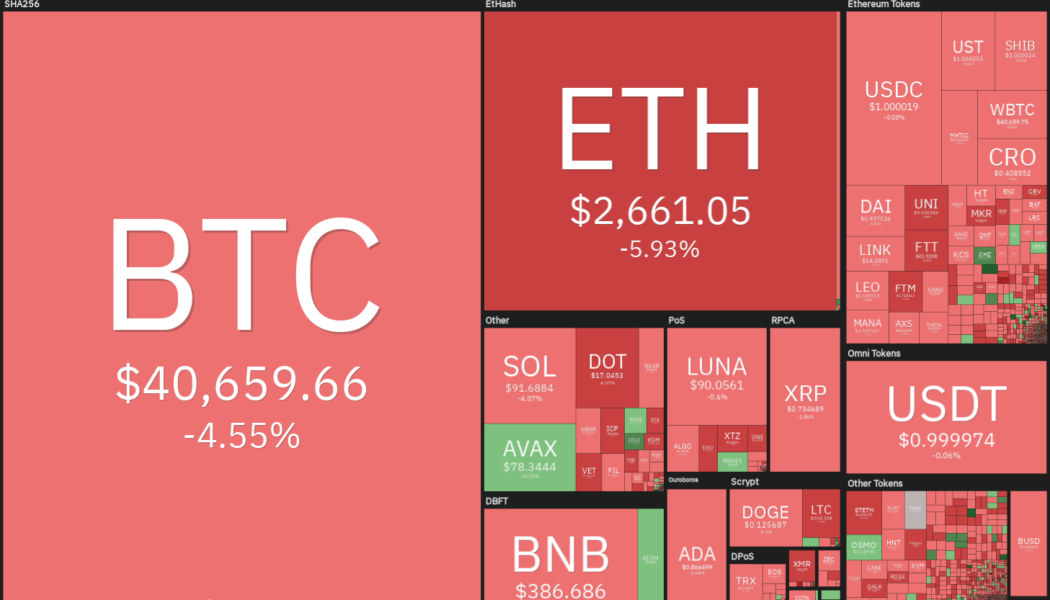

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

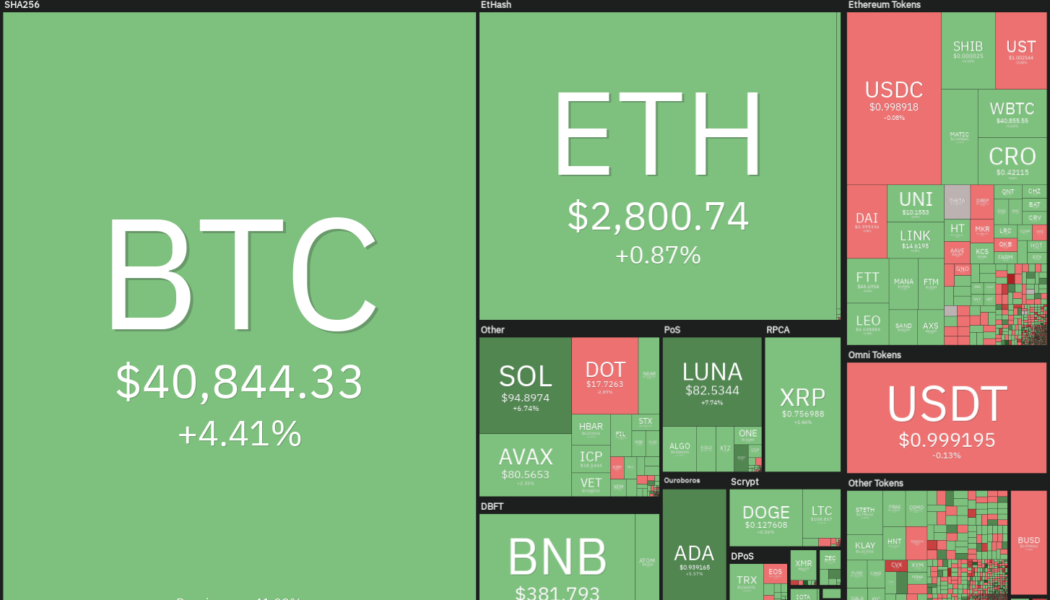

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

Dogecoin community donates $53K to Ukraine as country hints at upcoming airdrop

With the price of the meme-based token Dogecoin (DOGE) higher than that of the Russian ruble, Ukraine opened to DOGE donations for the first time. Ukraine’s Minister of Digital Transformation Mikhail Fedorov announced on Wednesday that the token had “exceeded Russian ruble in value” — though the ruble has dropped significantly against the U.S. dollar in the wake of U.S. and EU sanctions, its price has been lower than DOGE’s since January 2021. According to data from Cointelegraph Markets Pro, the price of Dogecoin is roughly $0.13 at the time of publication, having fallen by less than 1% over the last 24 hours. However, Fedorov’s message on Twitter also called for DOGE proponents including Tesla CEO Elon Musk and Dogecoin founder Billy Markus to donate to Ukraine’s militar...

Rune’s upcoming mainnet launch and Terra (LUNA) integration set off a 74% rally

2021 was a roller coaster of a year for THORChain (RUNE), which saw its price top out at $20.31 only to come crashing down below $4 as a series of hacks and declining interest in decentralized finance had the token limping into 2022. Data suggests that investors could be taking a closer look at Rune and a few potentially bullish factors could include the protocol’s recent integration with the Terra and Cosmos ecosystem, an upcoming mainnet launch and the attractive yields offered to liquidity providers. RUNE/USDT 4-hour chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.00 on Feb. 24, the price of RUNE has rallied 74.2% to a daily high at $5.23 on March 1 amid a 388% surge in its 24-hour trading volume. Rune integrates ...

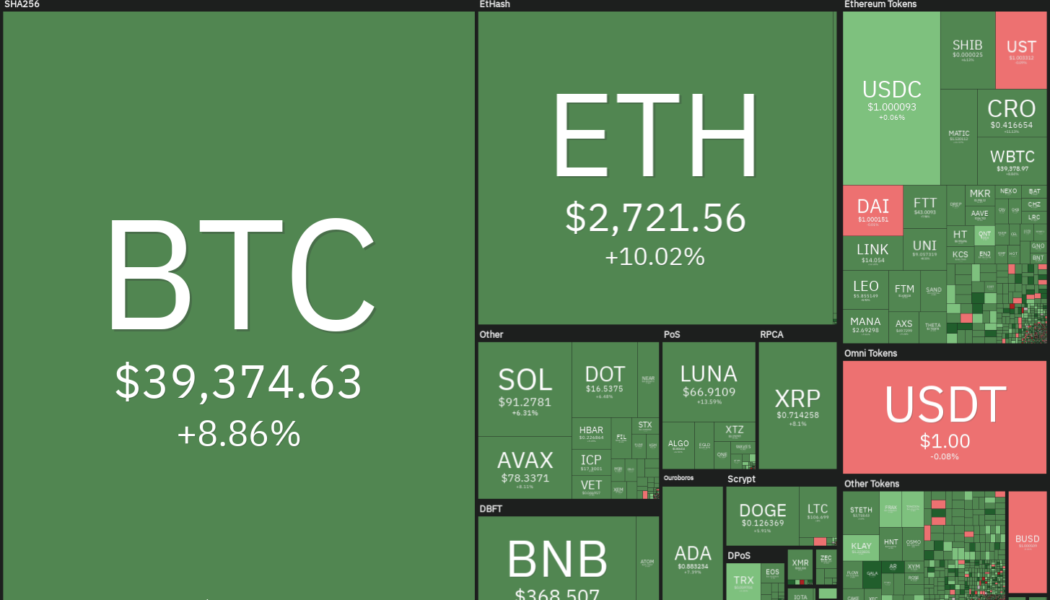

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...

Shiba Inu leading Dogecoin in gains, SHIB up over 23% on the day

The crypto market is once again showing signs of a fresh run on Monday morning Almost all coins are trading in the green with decent gains in the past 24 hours Bitcoin and Ethereum trading on solid grounds Bitcoin is currently swinging at around $42,700 and based on market sentiment; it could make an attempt at $43,000 early this week. Ether cleared resistance at $3,000 at the start of the weekend on the back of an end-week rally. The native token on Ethereum is currently trading at $3,076.05, having gained 2.45% in the last 24 hours. Shiba Inu leads the meme-coin chart with over 23% gains Notably, Shiba Inu has posted the biggest swell among the top 20 crypto assets by market capital. SHIB has gained a whopping 23% in the last 24 hours and is trading at $0.00002792. The meme coin tanked t...

Dogecoin set to adopt a unique Proof of Stake model with Vitalik Buterin’s help

The Proof-of-Work (PoW) blockchain consensus mechanism has come under heavy criticism in recent days owing to its energy-intensive nature Though many are in favour of Dogecoin switching to Proof-of-Stake (PoS) mechanism, the Ethereum community feels that Buterin is becoming too involved with Dogecoin The recent European Securities and Markets Authority’s (ESMA) proposal to outlaw Proof of Work-based mining in Europe is only but one of the many calls to bin the mechanism. For a while now, several individuals and institutions in the crypto sector have censured cryptocurrencies using PoW because of the mechanism’s high energy consumption. Dogecoin is ditching PoW Dogecoin, one of the networks currently using PoW, is the latest name to reveal plans to transition to PoS. The Dogecoi...

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...