Dogecoin

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

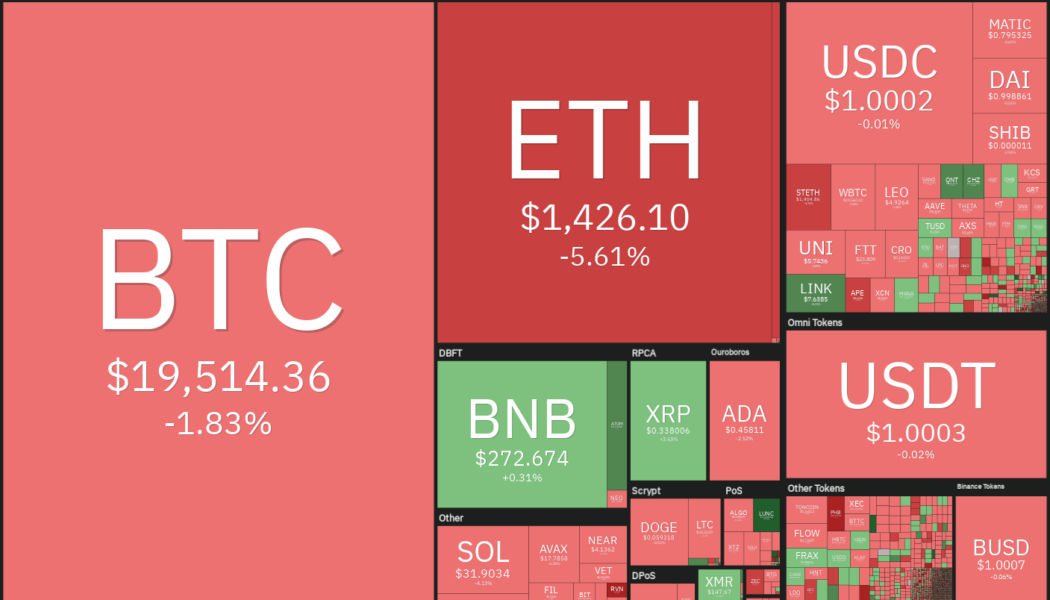

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

Dogecoin has crashed 75% against Bitcoin since Elon Musk’s SNL appearance

Dogecoin (DOGE) may be back in the top-ten cryptocurrency by market capitalization, but its loses in both USD and Bitcoin (BTC) terms since Elon Musk’s SNL appearance are considerable. Dogecoin loses Musk-effect The DOGE/BTC trading pair has fallen 75% after peaking out at 1,287 satoshis on May 9, 2021, a day after Musk was a guest host on Saturday Night Live, including a sketch titled “The Dogefather.” DOGE/BTC daily price chart. Source: TradingView Before his appearance, the billionaire entrepreneur was relentlessly tweeting Dogecoin memes, images, which helped DOGE — a cryptocurrency that started out as a joke — to attain a market capitalization north of $90 billion in May 2021. That’s more than 36,000% gains in just two years. But things have gone downhill ever since. ...

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

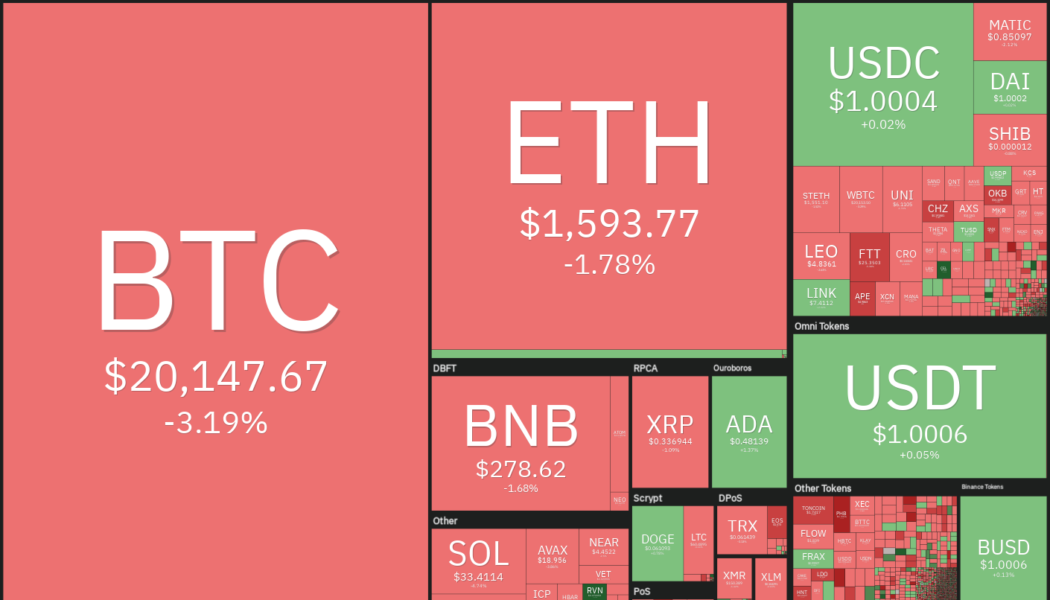

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Ethereum Merge: Community reacts with memes, GIFs and tributes

It’s been less than a day since Ethereum’s historic transition to proof-of-stake, with most of the crypto community still abuzz with excitement following the successful Merge. On Sept. 15 at 06:42:42 UTC, the last Ethereum block using the old proof-of-work consensus mechanism was mined. Replacing it is an energy-efficient proof-of-stake consensus mechanism. Many crypto enthusiasts and climate advocates worldwide have been thrilled by the positive impact it will have on the environment and thus, crypto’s reputation. Others have just been in awe of the technological feat of upgrading an entire blockchain network without any stoppages. Ethereum Ethereum30 minutes ago Now pic.twitter.com/cyQb3pAdtt — WolfOfEthereum.eth ️ (@Crypto_Wolf_Of) September 15, 2022 Uniswap Labs founder and CEO ...

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

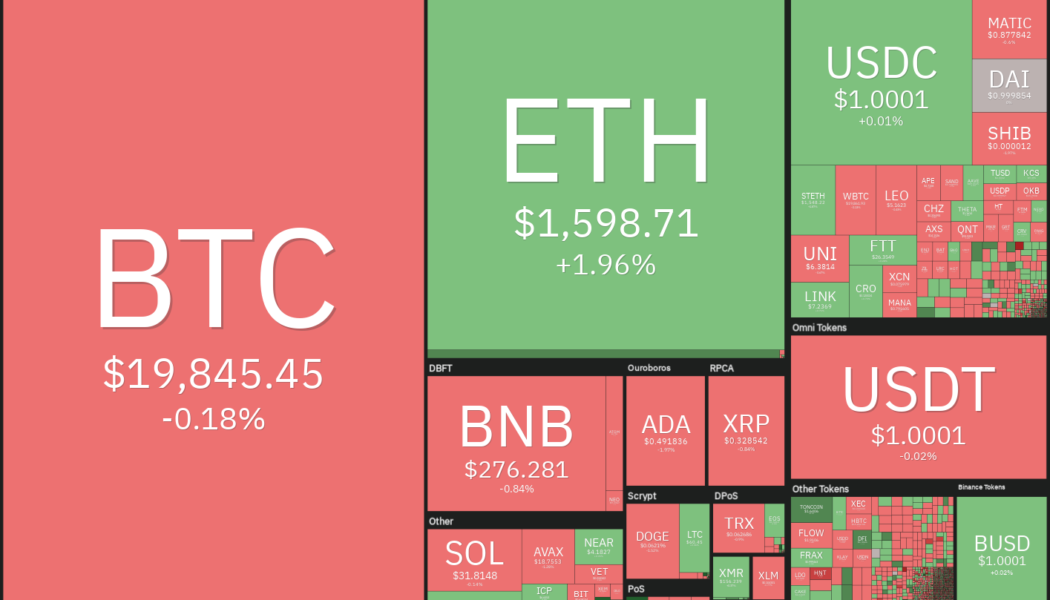

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...

Price analysis 8/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) has been witnessing a tough battle between the bulls and the bears near the $25,000 level. A clear winner may not emerge in the short term due to a lack of a catalyst and because there is no major macroeconomic data scheduled for this week in the United States. Data points from Asia or Europe may increase volatility, but they are unlikely to start a new directional move. Anthony Scaramucci, founder and managing partner of Skybridge Capital, in an interview with CNBC, advised investors to ride out the current uncertainty in cryptocurrencies and “stay patient and stay long term.” He expects Bitcoin to reward investors immensely with a sharp uptrend over the next six years. Daily cryptocurrency market performance. Source: Coin360 Along with the focus on Bitcoin, investors are al...

Price analysis 8/12: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) could not overcome the barrier at $25,000 on Aug. 11 even though it had two catalysts in the form of a “favorable” Consumer Price Index print and news that BlackRock — the world’s largest asset manager, overseeing over $10 trillion in total assets — had launched a spot Bitcoin investment product. In comparison, Ether (ETH) has managed to hold on to its recent gains on news that the Goerli testnet had successfully activated proof-of-stake, clearing the path for Ethereum’s mainnet transition planned for Sept. 15 or 16. Data from Santiment shows that Ether whale transactions have increased along with possible whale accumulation. Daily cryptocurrency market performance. Source: Coin360 However, analysts remain divided about the prospects of the current rec...