Dogecoin

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

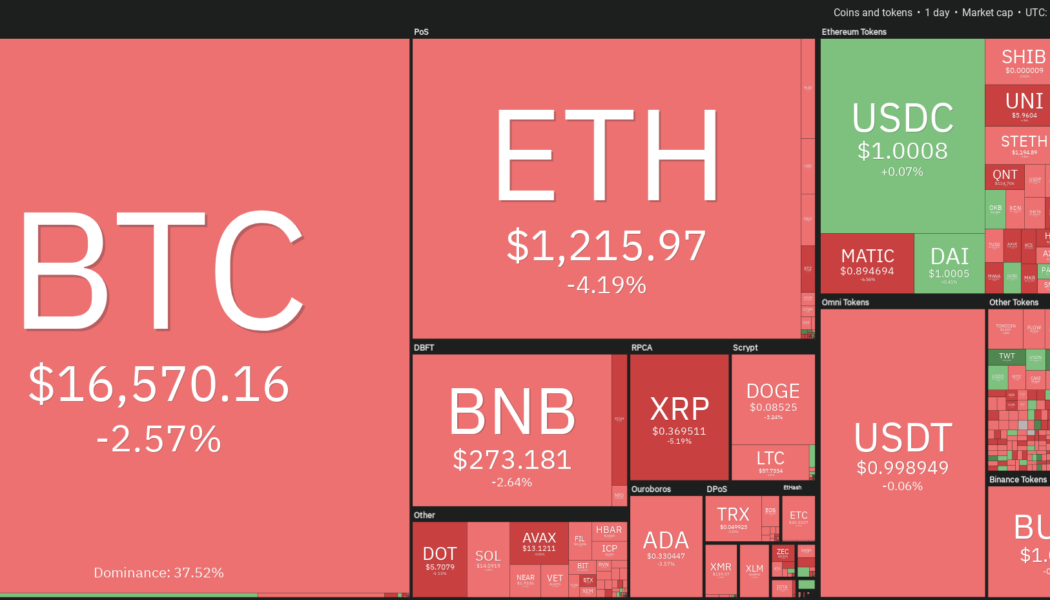

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

Dogecoin trader explains why shorting DOGE now makes sense

Dogecoin (DOGE) has surged nearly 100% quarter-to-date (QTD) on hopes that Elon Musk would integrate the token onto the Twitter platform. However, DOGE’s potential to continue its uptrend in the coming weeks is low, one popular market analyst argues. Short Dogecoin hard? Independent market analyst GCR said he is moderately short on DOGE based on its price’s recent reaction to a Musk tweet. Notably, DOGE formed a local top at $0.158 on Nov. 1. The same day, Musk shared a picture of his pet Shiba Inu wearing a t-shirt with the Twitter logo. pic.twitter.com/eaIYaDRBnu — Elon Musk (@elonmusk) November 1, 2022 GCR argues that the Musk-effect is wearing off when it comes to Dogecoin’s potential integration into Twitter, meaning that most of the gains are already priced in....

Bitcoin resistance mounts pre-FOMC as Dogecoin sets 17-month BTC high

Bitcoin (BTC) stayed motionless at the Nov. 1 Wall Street open as traders rooted for clues over a possible direction. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopes of a breakout remain despite BTC sell wall Data from Cointelegraph Markets Pro and TradingView showed a narrow range in place for BTC/USD overnight, the day seeing local highs of $20,681 on Bitstamp. Markets were keenly awaiting news from the United States Federal Reserve on interest rates, which is scheduled for 2:00 pm Eastern Time on Nov. 2. Until then, it i a case of “wait and see,” while on-chain monitoring resource Material Indicators noted sell-orders already increasing. “The binance order book is starting to look like a game of Tetris,” it summarized. A chart showed resistance being added just below $...

BTC price struggles at $21K as trader says ‘top is in’ for Bitcoin, Ethereum

Bitcoin (BTC) continued consolidating into the Oct. 30 weekly close as concerns over a deeper retracement became vocal. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader avoids new longs below $21,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling levels just below $21,000 on the day. Weekend trading had produced an early return above the $21,000 mark, this being short-lived as Bitcoin bulls failed to offer the volume to sustain higher levels. Now, popular pseudonymous trader and analyst il Capo of Crypto sensed a change of direction was ultimately due for Bitcoin and altcoins alike. Altcoins themselves had also performed strongly through the weekend, notably led by Dogecoin (DOGE), which was up another 25% in the past 24 hours at the time of w...

BNB jumps to new BTC all-time high as Elon Musk’s Twitter fuels DOGE bulls

BNB (formerly known as Binance Coin) has hit new all-time highs against Bitcoin (BTC) as excitement grows over the cryptocurrency’s future role on Twitter. BNB/BTC 1-month candle chart (Binance). Source: TradingView BNB sets new record against BTC Data from Cointelegraph Markets Pro and TradingView confirms that BNB/BTC briefly spiked above 0.15 BTC to a record 0.15267 BTC on Oct. 30. BNB, the in-house token of Binance, the largest crypto exchange by volume, has gained around 10% in the past 72 hours. The strong performance came on the back of reports that Binance was preparing to assist Twitter in eradicating bots as part of its new direction under Elon Musk. Binance had contributed $500 million to Musk’s takeover of the social media platform. “Our intern says we wired the $500 ...

Dogecoin price rallies 150% in 4 days, but DOGE now most ‘overbought’ since April 2021

The Dogecoin (DOGE) price rally extended further on Oct. 29 in hopes that the cryptocurrency would get a major boost from Elon Musk’s Twitter acquisition. Elon Musk boosts Dogecoin price again Dogecoin price jumped by nearly 75% to reach $0.146 on Oct. 29, the biggest daily gain since April 2021. DOGE/USD daily price chart. Source: TradingView Notably, the meme-coin’s massive intraday rally came as a part of a broader uptrend that started earlier this week on Oct. 25. In total, DOGE’s price gained 150% during the Oct. 25-29 price rally. The surge was also accompanied by a decent increase in its daily trading volumes. That coincided with a spike in the number of DOGE transactions exceeding $100,000, according to Santiment. Both indicators sugges a growing demand for Dogeco...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

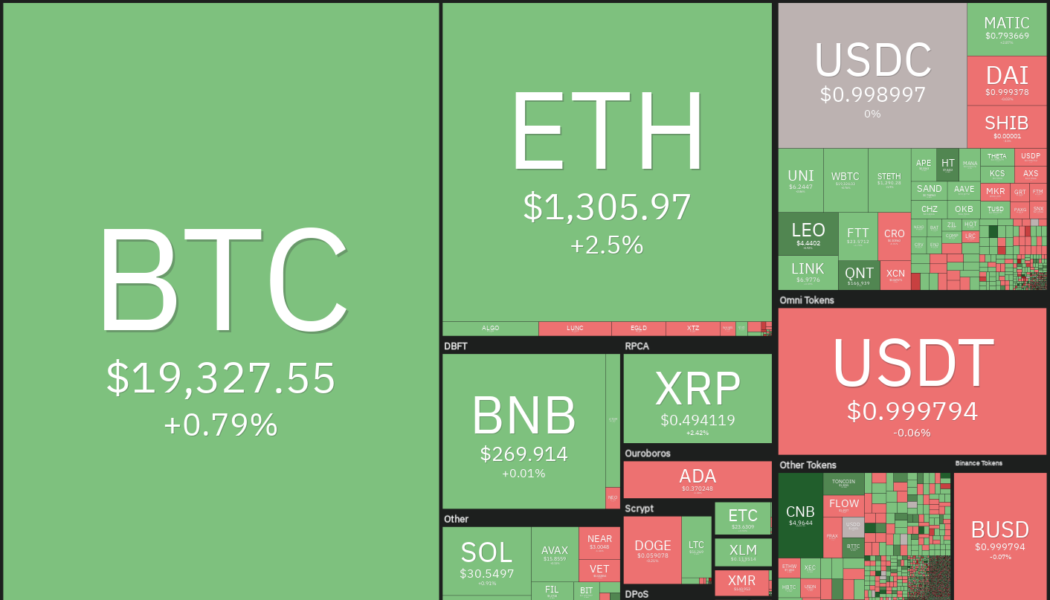

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

HODL! Tesla hangs onto all its remaining $218M in Bitcoin in Q3

Electric vehicle manufacturer Tesla has made no further changes to its remaining stash of Bitcoin (BTC) in the third quarter of 2022, despite nearly a $1 billion sell-off in the previous quarter. The company’s Q3 report released Oct. 19 shows $218 million worth of “digital assets” remains on its balance sheet, with no reported losses in the value of its holdings. Based on current prices, it’s estimated that Tesla still holds around 9,720 BTC. In Q2 earnings report, Tesla said it sold 75% of its Bitcoin during the quarter, adding $936 million in cash to its books and recording a $64 million profit from the sale. Tesla CEO Elon Musk explained at the time that the sell-off was due to liquidity concerns from the COVID-19 lockdowns in China. The sell-off during the quarter took a large chunk of...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...