Do Kwon

Terra peg mechanism in doubt as UST crashes to 67 cents

The third-largest stablecoin by market cap Terra USD (UST) appears to be in a catastrophic tailspin which has seen it de-peg from the dollar and drop to as low as $0.67 on May 10. As its price has fallen, so has its market capitalization along with that of Terra (LUNA) which backs the majority of the value of UST. Adding further insult to injury, the market cap of UST has vastly surpassed that of LUNA, drawing extreme scrutiny from the crypto community. UST price chart from CoinGecko As of the time of writing, UST price is $0.78 with a market cap of $14.1 billion while LUNA has been in a freefall, collapsing to $35.07. This has caused massive liquidations on leveraged positions, dropping its market cap to $12.3 billion according to CoinGecko data. If the market cap of LUNA is lower than US...

Bitcoin price target now $29K, trader warns after Terra weathers $285M ‘FUD’ attack

Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC circles $34,400 lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing. The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility. Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets. Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at aroun...

Terra’s UST flips BUSD to become third-largest stablecoin

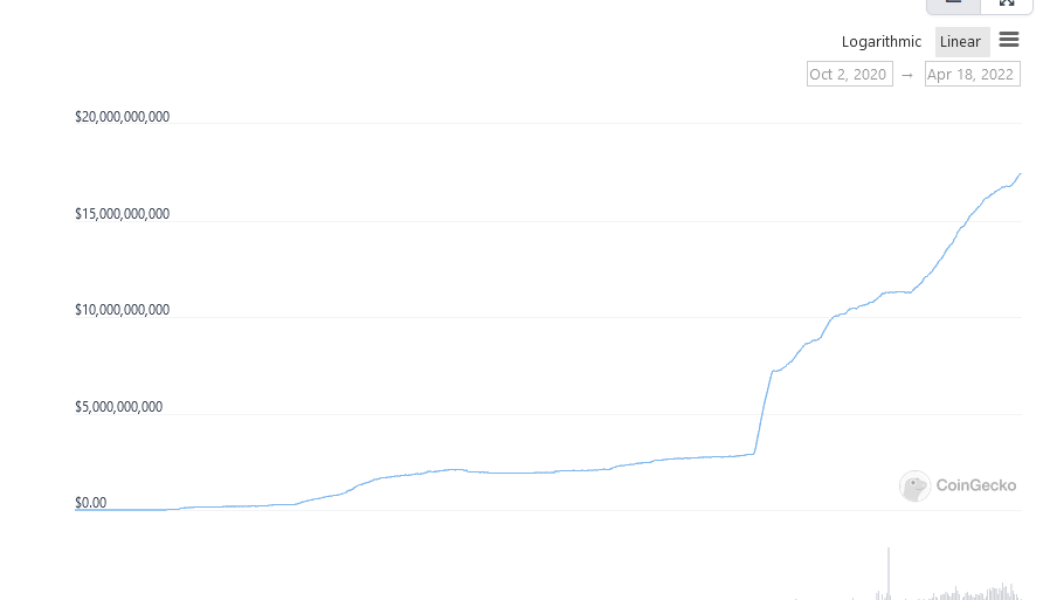

The Terra (LUNA) blockchain’s algorithmic stablecoin Terra USD (UST) has flipped Binance USD (BUSD) to become the third-largest stablecoin on the market. UST is a USD-pegged stablecoin that was launched in September 2020. Its minting mechanism requires a user to burn a reserve asset such as LUNA to mint an equivalent amount of UST. According to Coingecko, UST’s total market capitalization has surged 15% over the past 30 days to sit at roughly $17.5 billion at the time of writing. The figure currently places UST as the third-largest stablecoin after it flipped BUSD with a slightly lower market cap of $17.46 billion. The asset now trailing only behind industry giants Tether (USDT) at $82.8 billion, and USD Coin (USDC) at $50 billion, however, the gap is quite substantial at this stage. The d...

Terraform Labs gifts another $880M to Luna Foundation Guard

Terra (LUNA) blockchain developer Terraform Labs (TFL) has gifted the Luna Foundation Guard 10 million LUNA worth around $820 million at current prices. The Luna Foundation Guard (LFG) is a nonprofit organization attached to Terra that is tasked with collateralizing the network’s algorithmic stablecoin Terra USD (UST) to keep it pegged with the U.S. dollar. Terraform Labs’ latest announcement came via Twitter on April 14, but did not outline what the funds will go towards specifically. However, transaction data from Terra Finder shows that 7.8 million LUNA (roughly $630 million) was promptly transferred out of the LFG’s reserve wallet yesterday. TFL has gifted an additional 10 million $LUNA to the @LFG_org. https://t.co/tNirkgGGm0 — Terra (UST) Powered by LUNA (@terra_money) April 14, 2022...

Terra founder reveals what will happen to UST if Bitcoin price crashes

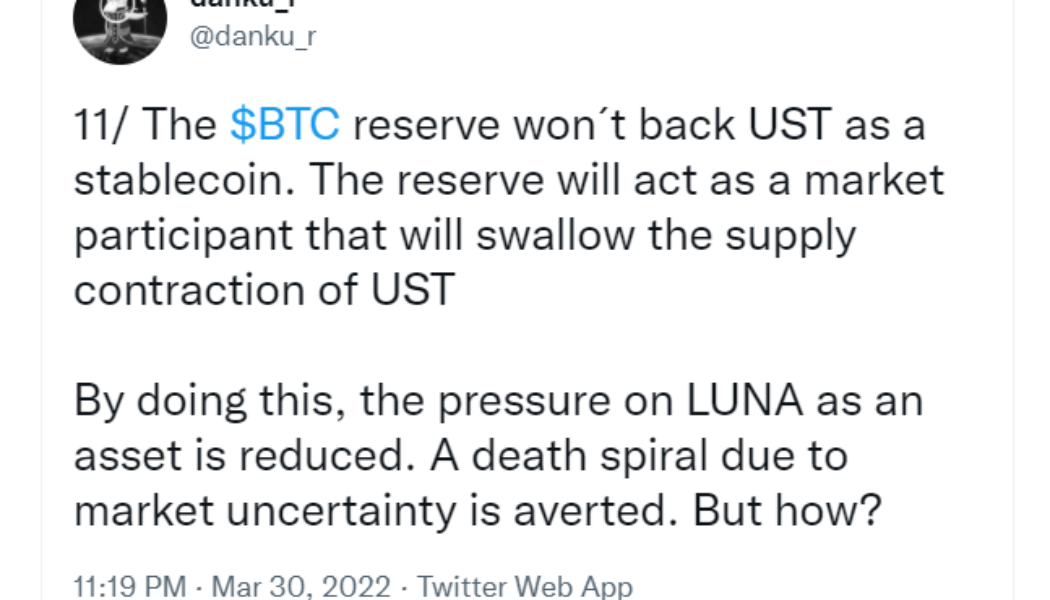

Terraform Labs CEO Do Kwon has conceded that a crash in the price of Bitcoin would be “negative” for the stability of the UST stablecoin, but that he expects Bitcoin to go up. Terraform Labs is the entity behind the Terra (LUNA) blockchain platform which plans on buying a total of $3 billion in Bitcoin as a reserve for the UST stablecoin. Kwon made the comments in an interview on the Unchained podcast on Mar. 29. Host Laura Shin asked Kwon what the short term implications of holding so much BTC will be for the stability of UST. Kwon said “the worst case would be if we were buying Bitcoin and a crash happens six months later, and it’s correlated with a massive fall in demand for UST” which would be, as he modestly put it, “negative.” However, that scenario isn’t keeping him up at nigh...

- 1

- 2