Digital Transformation

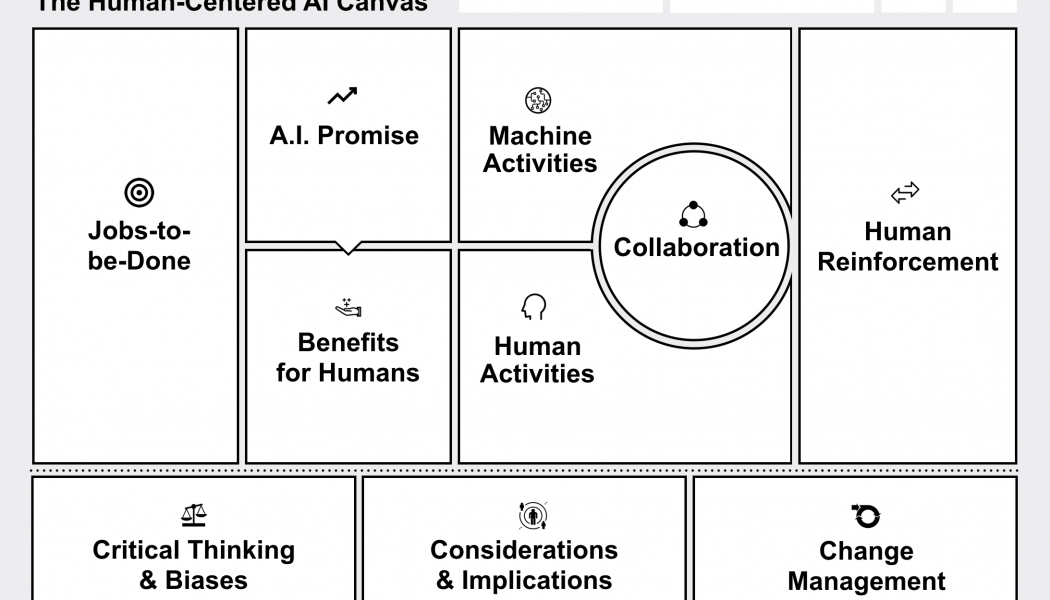

Why Responsible AI is Built Around Human-Centred Design

Responsible artificial intelligence (AI) provides a framework for building trust in the AI solutions of an organisation, according to a report from Accenture. It is defined as the practice of designing, developing, and deploying AI with good intention to empower employees and businesses, and fairly impact customers and society. In turn, this allows companies to stimulate trust and scale AI with confidence. With technology starting to become commonplace, more organisations around the world are seeing the need to adopt responsible AI. For example, Microsoft relies on an AI, Ethics, and Effects in Engineering and Research (Aether) Committee to advise its leadership on the challenges and opportunities presented by AI innovations. Some of the elements the committee examines is how fairly AI sys...

Tackling Trends and Challenges for Black Friday in 2020

With the Black Friday shopping frenzy around the corner, the digital economy this year is expected to receive an enormous boost as many people will want to avoid crowds and take their shopping online. After a difficult year marked by severe disruptions and decreased demand, businesses will also be relying on this period to make up for losses due to the pandemic. As Black Friday is set to be so different, what can businesses expect to see? The opportunity for increased sales has led to many businesses treating November as ‘Black Friday Month’, giving customers a lot more time to find exactly what they want at the best price. Physical stores may see a lot less foot traffic as customers who opt for the safety and convenience of online retail platforms instead. Adobe predicts that online Blac...

O-CITY Drives Contactless Bus Payment Initiative in Kenya

O-CITY is driving contactless payments across bus services in Nairobi, Kenya. The pilot initiatve, designed to reduce the use of cash in response to the COVID-19 pandemic, was launched in partnership with transport savings and credit specialists, NikoDigi, and Kenyan payments firm, Tracom, to accelerate the deployment of cashless fare collection. Used by 70% of the population in Kenya, Matatu buses are a dominant transport mode across the country whereby passengers traditionally pay in cash. O-CITY’s automated fare collection platform leverages the M-Pesa mobile wallet, which is used by 90% of the population in Kenya. Passengers enter a code on their phone and a debit is made on their wallet, which can be instantly seen by drivers to grant access to ride. The platform removes unnecessary t...

How COVID-19 is Driving eCommerce in South Africa

The COVID-19 pandemic has taken a serious toll on shopper behaviour, not only from a decline in spending but also in how they shop. With social distancing restrictions, a possible second wave of infections, and adaptations to new lifestyles, the crisis is driving more traffic to South African eCommerce merchants than before. Recently, the GetApp SA Customer Experience Survey asked South Africans how the pandemic is changing the way they shop – here’s what they had to say: How has shopper behaviour changed during lockdown? During the various levels of lockdown, there have been varying degrees of social and merchandise restrictions as well as depreciating disposable income. Many people can’t shop as they did before and this has led to 42% of people saying that they have spent les...

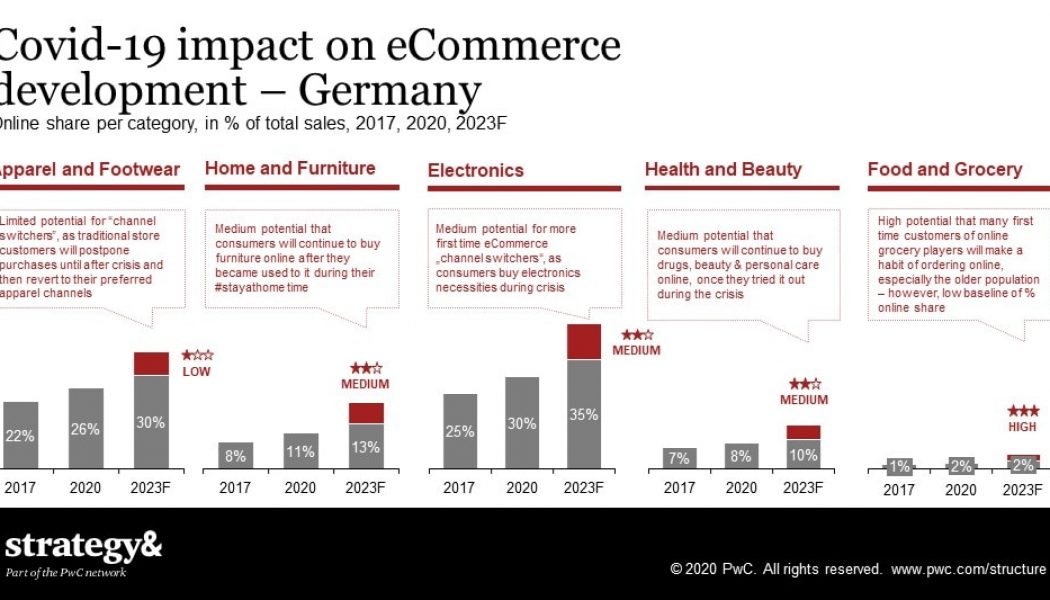

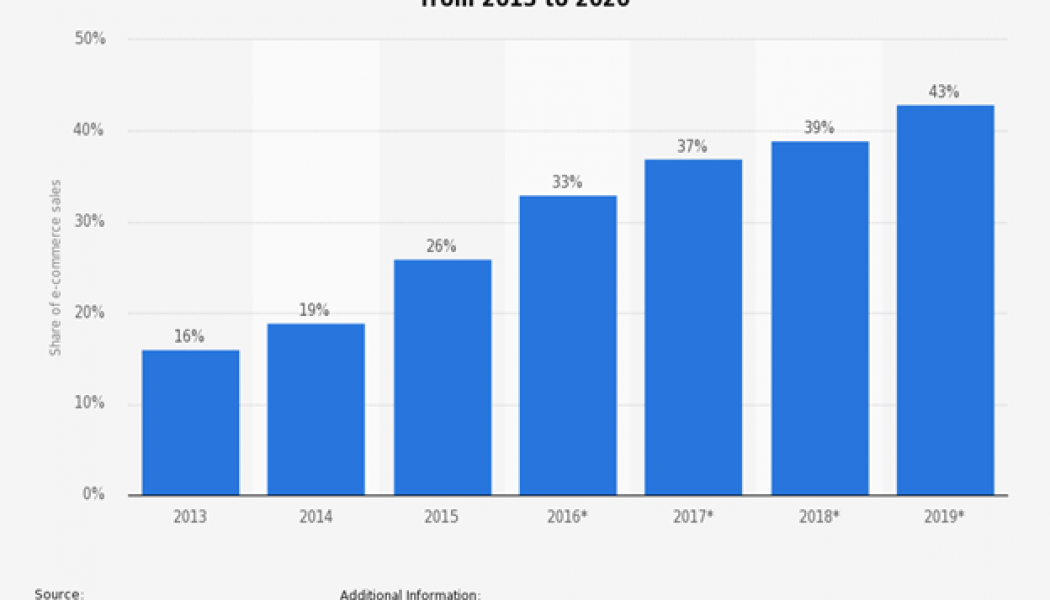

3 Predictions for the Future of Retail

For many industries, predicting the future during a pandemic would be difficult – if not impossible. Retail is different. Why? Because COVID-19 has acted as an accelerant for digital transformation – fuelling and amplifying trends that have been creeping in for years. You could even call this “Covid acceleration.” McKinsey recently determined that, over a 10-week period in 2020, digital business penetration had increased by the same amount as in the previous 10 years. So, considering this supercharged digital trend, here are three predictions for retail in the coming year: 1. Automation everywhere The COVID-19 crisis took almost every business by surprise, decimating many which were not prepared for a move to online sales. It has prompted many operational changes that create efficien...

ProLabs Enables Networking Upgrades for Healthcare Industry

Technology is transforming the way people shop, bank and travel, and perhaps one of its next big challenges is to make major inroads into how they receive healthcare. But reports on progress in the area of healthcare and technology uptake are conflicting. According to global consultants McKinsey, based on their healthcare research released in 2019, “The adoption of digitally enabled tools for diagnosis, treatment, and management… has been modest”. On the other hand, German-based global consultancy firm Roland Berger, in the same year, released a study entitled “Future of Health: An industry goes digital – faster than expected”. According to the 2019 Roland Berger paper, in which 400 international healthcare experts were asked to predict the medium to long-term changes in healthcare, the he...

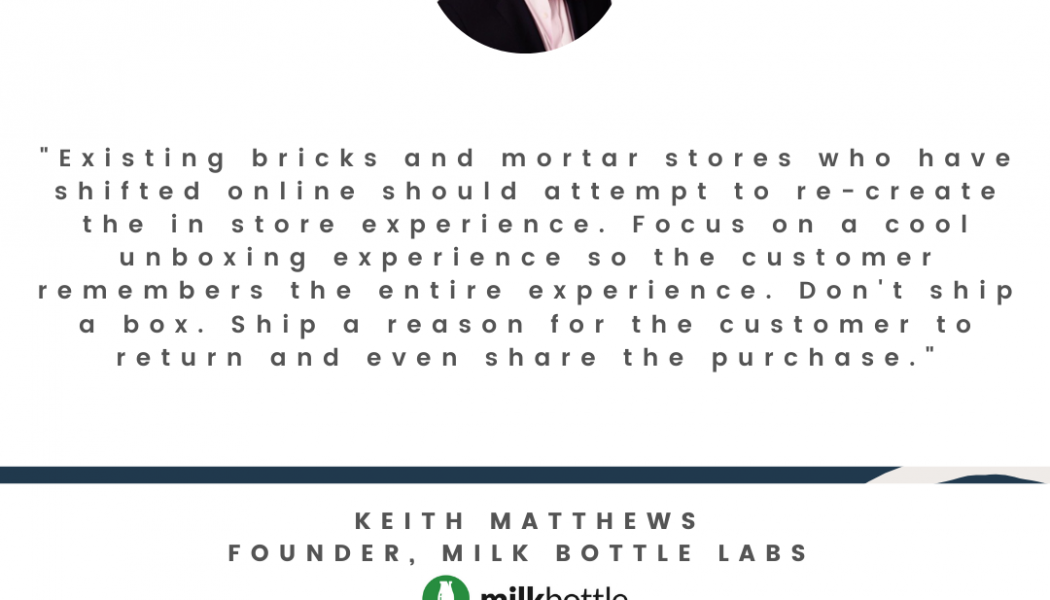

Digital Transformation is not just about Technology, it’s about the Experience

While many businesses were on the road to Digital Transformation (DX), there is no doubt that the COVID-19 pandemic accelerated these strategies and projects. ‘Nice to have’ technology became ‘must-have’ practically overnight, and the entire business model had to shift in many cases. However, DX is not just about implementing new technology. It is about choosing the right technology to solve a business problem or leverage an opportunity, or both. Ultimately it is about the experience, for both the end user and the customer. Technology with a purpose DX should always be about improving business efficiency and effectiveness rather than implementing technology for the sake of it. However, during the panic caused by the pandemic, this has been overlooked in many instances. /* custom css */ .td...

How Telcos are Bringing Inclusion to Africa’s Financial Landscape

Sourced from IDG Connect Mobile financial services are a global game-changer with an open money network being the connection needed between the financial industry and telecom to increase both the commercial and social benefits. As the world grapples with an unprecedented crisis in the form of the COVID-19 pandemic, consumers are cautious to use cash or making a withdrawal from an ATM and agent network. This has given mobile money a new dimension as customers can make payment anywhere at any time with their mobile devices as easy as sending a text message in geographies that are normally unable to benefit from banking structures. This allows customers to seamlessly purchase products or services without having to physically hand over cash or swipe a card. The freedom to send, spend and recei...

4 Ways to Safely and Securely Navigate Black Friday Online

Black Friday in 2020 is expected to see more South Africans than ever before shopping, and paying, online. According to a recent McKinsey & Company consumer sentiment survey, 40% of consumers intend to continue online shopping spend even when the COVID-19 pandemic is over. Thomas Pays, CEO and co-founder of digital payments company Ozow, says the sharp rise in online shopping and eCommerce has highlighted the need for innovative technology-driven solutions that allow shoppers to shop and pay safely online – including consumers who don’t have credit or debit cards. With this year’s Black Friday deals running over four weeks at many retailers, Pays’ says the way to successfully navigate Black Friday responsibly relies on four factors: Stick to a plan and set budget. The overwhelming numb...