Digital Financial Services

MultiChoice Zambia Partners with MTN Mobile Money

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

3 Crucial Reasons Why Financial Services Need to Accelerate Digital

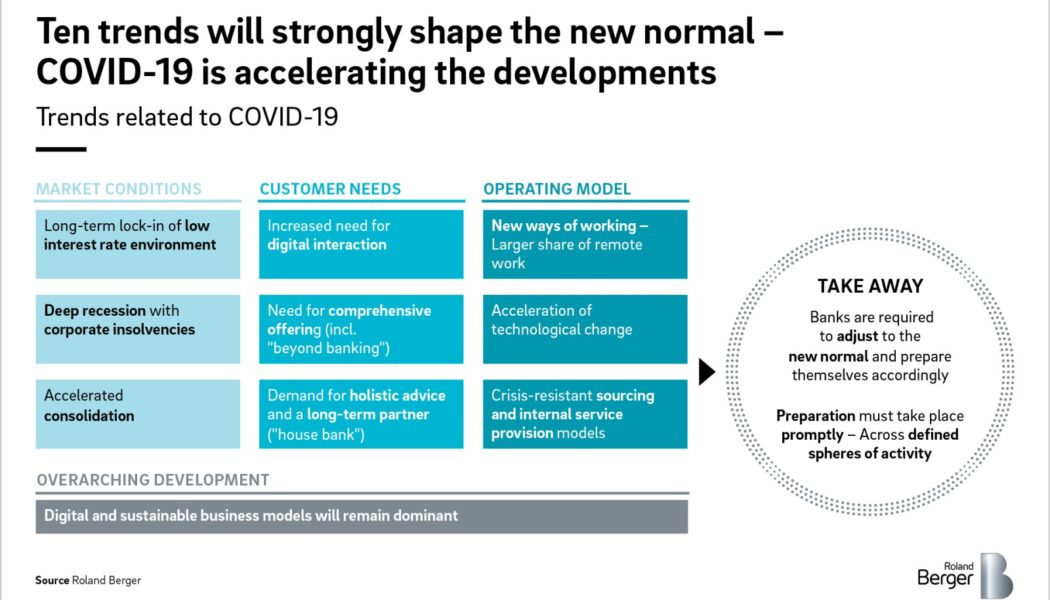

Image sourced from Planful. “Go digital or go dark” – Companies that fail to heed this advice, irrespective of sector, run a great risk in the age of technological revolution. Consumers prioritise convenience and will often not see the need to step out of their houses to use a service that could be achieved with a few taps on their phones. Add to that a pandemic that has led to even further restrictions and the need to embrace digital ways of doing business becomes clearer. Historically, digital transformation has been a process that happens over the course of several years. COVID-19 has dramatically accelerated that timeline. Companies were forced to adapt in order to survive, with financial services having to evolve quicker than most. That’s because every business relies on payments and ...

The Future of Micro-finance in Emerging Markets

The pandemic has emphasised, beyond a point of reasonable doubt, the importance of technology to our modern world. Just as video calling and messaging have allowed us to work, study and socialise, fintech has played a similarly critical role in ensuring that people can still access the banking system. However, entirely too many people still lack access to financial services, leaving them without recourse in these unprecedented times. Financial inclusion is vital if we are to ignite economic growth, yet major obstacles remain. Reports suggest that as many as 40% of Nigerians are excluded from the banking system. To bring basic banking to everybody, we must still contend with limited access to technology, insufficient infrastructure, isolated areas, jealous hoarding of data by traditional in...

CBN: Nigeria far from financial inclusion target

A report by the Central Bank of Nigeria and the Enhancing Financial Innovation & Access has said that Nigeria is far from achieving its financial inclusion target in 2020. The CBN disclosed this in the report titled ‘Assessment of women’s financial inclusion in Nigeria’ for December 2019 period which was released on Monday. Part of the report read, “Not surprisingly, financial exclusion stands at 36 per cent for women and 24 per cent for men. “The relative gender gap related to financial inclusion is ~20-30 per cent, placing Nigeria below its peers. “Since 2012, although women’s exclusion has dropped, the gender gap has grown, revealing that men’s inclusion has improved more rapidly than women’s. “The National Financial Inclusion Strategy was launched in 2012 to reduce financial exclus...