digital currency

Which Terra-based coins have the most explosive potential? | Find out now on The Market Report live

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss which Terra-based coins you should be looking out for in 2022. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they debate which Terra-based coin has the most explosive potential. Will it be Bourgi’s pick of StarTerra, which capitalizes on blockchains’ biggest trends — play-to-earn, nonfungible tokens (NFTs) and staking — basically combining multiple multibillion-dollar industri...

US Treasury Dept lists digital currencies as part of effort to sanction Russia’s government

The Treasury Department and reportedly the White House are warning U.S.-based companies and individuals not to facilitate crypto transactions sent to certain Russian nationals and banks. According to regulations from the Treasury Department’s Office of Foreign Assets Control scheduled to go into effect on March 1, U.S. residents may not use digital currencies to benefit Russia’s government — including the country’s central bank — as an attempt to circumvent U.S. sanctions in response to the invasion of Ukraine. The guidelines equated crypto transactions to “deceptive or structured transactions or dealings” in attempting to evade sanctions. Treasury Secretary Janet Yellen said the department’s actions were aimed at “significantly limit[ing] Russia’s ability to use assets to finance its dest...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...

Love in the time of crypto: Does owning cryptocurrency make daters more desirable?

Cryptocurrency has become one of the most widely discussed topics of 2022. As such, it shouldn’t come as a surprise that mentioning “crypto” in an online dating profile may generate additional attention. A newstudy from brokerage firm eToro found that 33% of Americans who were surveyed would be more likely to go on a date with someone who mentioned crypto assets in their online dating profile. Out of the 2,000 adult residents in the United States between the ages of 18 and 99 surveyed, more than 40% of men and 25% of women indicated that their interest in a potential date is stronger when crypto is written on a dating profile. Crypto: What’s love got to do with it? Callie Cox, U.S. investment analyst at eToro, told Cointelegraph that the findings from eToro’s inaugural “Crypto & ...

Investors underestimate Bitcoin’s “huge upside potential”, Fidelity researcher says

Chris Kuiper, Head of Research at Fidelity Digital Assets, is convinced that Bitcoin (BTC) should be treated separately from other digital assets and believes it plays an exclusive role in investors’ portfolios. Fidelity Digital Assets’ latest report, titled Bitcoin First, targets two main concerns that Fidelity’s clients have raised towards BTC — eventually being replaced by some other cryptocurrencies and lower upside potential left compared to other coins. According to Kuiper, BTC offers a unique value proposition as the most decentralized and censorship-resistant monetary network. That, according to him, is a non-incremental sort of innovation similar to the invention of the wheel. “You can’t reinvent something that’s already been invented in terms of the m...

Russian gov’t and central bank agree to treat Bitcoin as currency

The government and central bank in Russia have reached an agreement on how to regulate cryptocurrencies, according to a Tuesday announcement. Russia’s government and central bank are now working on a draft law that will define crypto as an “analogue of currencies” rather than digital financial assets, set to be launched on Feb. 18. Cryptocurrencies would function in the legal industry only if they have complete identification through the banking system or licensed intermediaries. Kommersant notes that Bitcoin (BTC) transactions and possession of cryptocurrency in the Russian Federation are not prohibited; however, they must be done through a “digital currency exchange organizer” (a bank) or a peer-to-peer exchange licensed in the country. The report also highl...

Myanmar’s military government considers launching digital currency: Report

The armed forces of Myanmar, which have been in control of the government since forcibly detaining many elected leaders in 2021, is reportedly planning to release a digital currency to help the local economy. According to a Thursday report from Bloomberg, Major General Zaw Min Tun said rolling out a digital currency would “help improve financial activities in Myanmar,” but military officials were undecided on whether to work with local companies or release the token on their own. Tun, the chief of the military government’s “True News Information Team,” acts as a spokesperson for the Myanmar army. The digital currency is aimed at supporting payments within Myanmar as well as improving the economy. According to a Jan. 25 report, the World Bank estimated that the country’s economy...

Renewed interest in the Metaverse sends Decentraland (MANA) price 75% higher

The influence of blockchain technology on the ongoing digital revolution cannot be overstated as the rise of the Metaverse and the integration of virtual reality is transforming the way humans interact on a global scale. One project that is beginning to gain traction in its effort to bridge the old world with the new is Decentraland (MANA), a virtual reality (VR) ecosystem built on the Ethereum network that allows users to create, engage with and monetize digital content through a variety of interactive experiences. Data from Cointelegraph Markets Pro and TradingView shows that over the past two weeks, the price of MANA has climbed 70% from a low of $1.70 on Jan. 22 to a daily high of $2.90 on Feb. 1 as the wider crypto market struggled under bearish pressure. MANA/USDT 1-day chart. ...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

Central Bank of Jordan reveals CBDC plans

Central Bank of Jordan (CBJ) has revealed that it is researching issuing a digital currency. The central bank digital currency (CBDC) would be linked to the Jordanian dinar and have legal standing. Adel Al Sharkas, the governor of CBJ, has reportedly stated that his institution is researching the option of creating a legal digital currency. He also predicted that cryptocurrency trading might eventually be permitted in Jordan once the appropriate legislation is in place. He said: “With regards to the plans to issue a Jordanian digital currency, a study is underway to develop a legal digital currency linked to Jordanian dinar. It is possible in the future to allow cryptocurrency trading, after enacting [the] legislation and regulations.” Per the report, Sharkas’ comments were made duri...

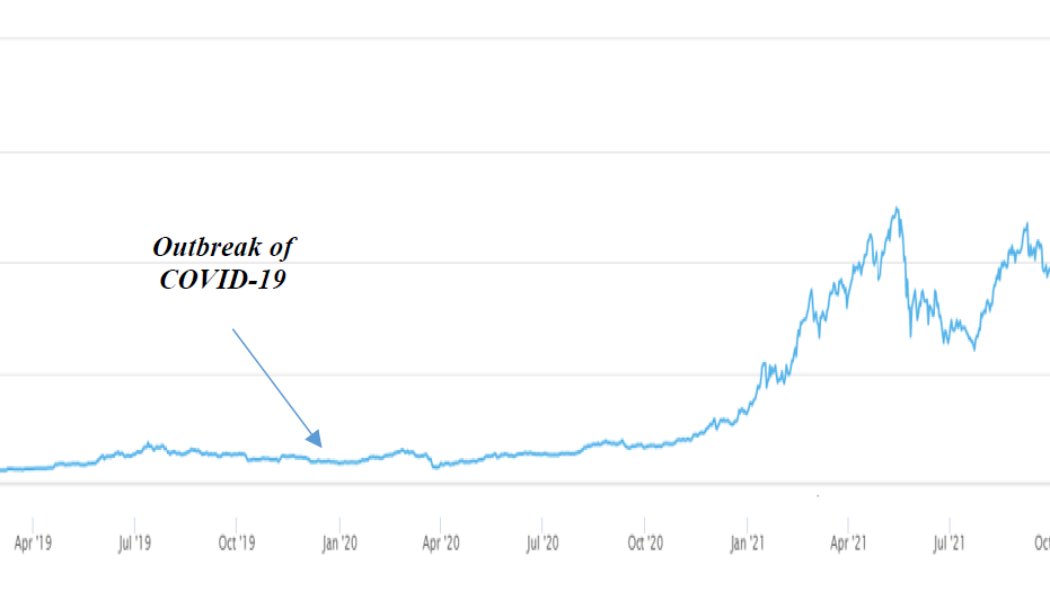

Hong Kong begins discussions to introduce stablecoin regulatory framework

Hong Kong’s central banking institution, the Hong Kong Monetary Authority (HKMA), released a questionnaire to gauge public opinion on regulations for crypto-assets and stablecoins. The state-backed regulator intends to establish a regulatory framework by 2023-24. HKMA’s “Discussion Paper on Crypto-assets and Stablecoins” highlights the explosive growth of the stablecoin market in terms of market capitalization since 2020 and the concurrent regulatory recommendations put forth by international regulators including the United States’ Financial Action Task Force (FATF), the Financial Stability Board (FSB) and The Basel Committee on Banking Supervision (BCBS). Market Capitalization of Crypto-assets. Source: HKMA According to the HKMA, the current size and trading activity of crypto-asset...