Derivatives

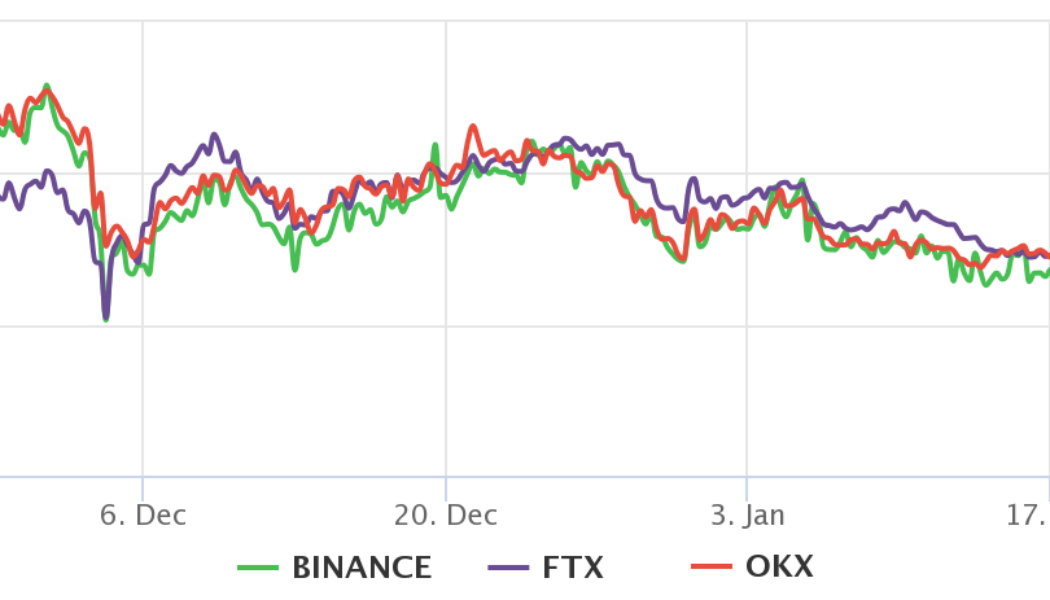

FTX expands to Europe with CySEC approval

The global crypto derivatives and spot trading exchange FTX is expanding to Europe after receiving approval from the Cyprus Securities and Exchange Commission (CySEC). The new venture called FTX Europe would offer leading products of the company to the European clients via a licensed investment firm across the European economic area. The new European venture is headquartered in Switzerland along with a regional headquarters in Cyprus. Cyprus is seen as one of the reputed jurisdictions that offers a regulated medium for financial firms to access the European economic area. Thus, FTX would be able to offer its derivative crypto products as well, which is a big breakthrough, given Binance had to shut all crypto derivatives products last year across Europe. Sam Bankman Fried said their new ven...

Ethereum futures premium hits a 7-month low as ETH tests the $2,400 support

Ether (ETH) reached a $3,280 local high on Feb. 10, marking a 51.5% recovery from the $2,160 cycle low on Jan. 24. That price was the lowest in six months, and it partially explains why derivatives traders’ main sentiment gauge plummeted to bearish levels. Ether’s futures contract annualized premium, or basis, reached 2.5% on Feb. 25, reflecting bearishness despite the 11% rally to $2,700. The worsening conditions depict investors’ doubts regarding the Ethereum network’s shift to a proof-of-stake (PoS) mechanism. As reported by Cointelegraph, the much-anticipated sharding upgrade that will significantly boost processing capacity should come into effect in late 2022 or early 2023. Analyzing Ether’s performance from a longer-term perspective provides a more appealing sentiment, as the crypto...

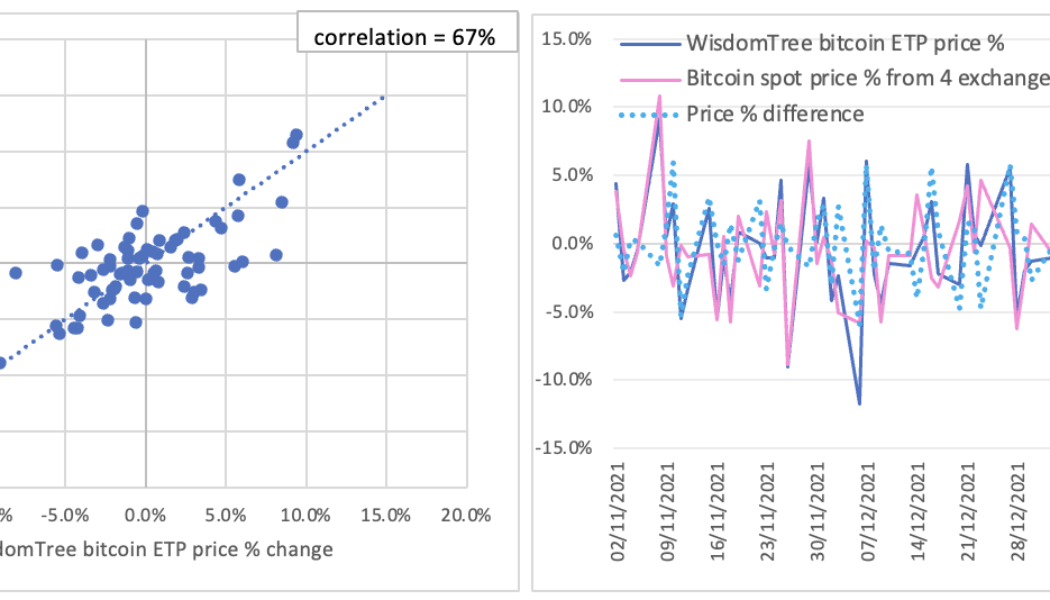

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

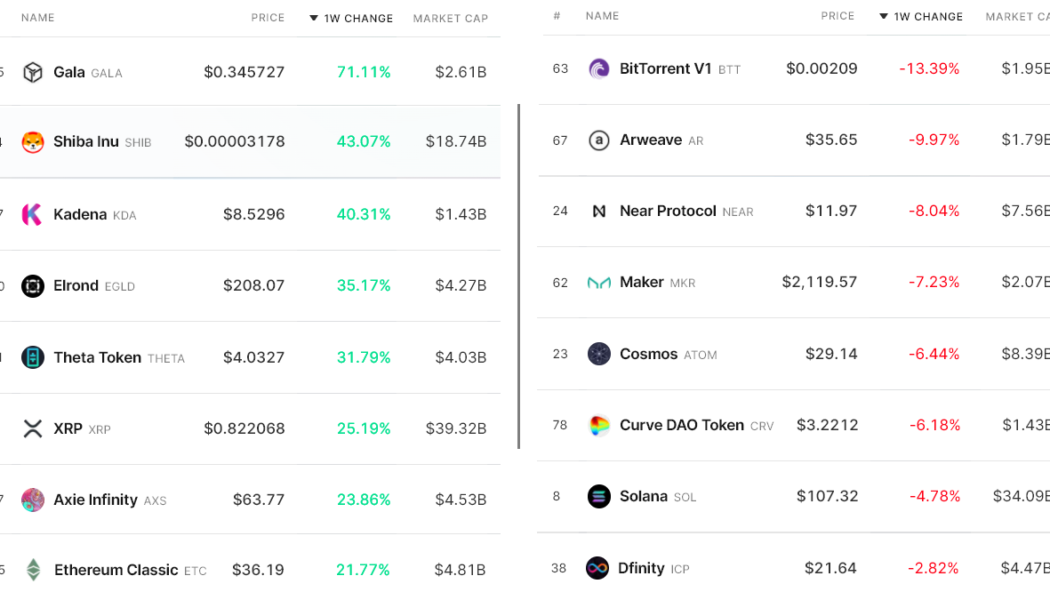

2 key indicators cast doubt on the strength of the current crypto market recovery

Analyzing the aggregate cryptocurrency market performance over the past 7 days could give investors the impression that the total market capitalization grew by a mere 4% to $2.03 trillion, but this data is heavily impacted by the top 5 coins, which happen to include two stablecoins. Excluding Bitcoin (BTC), Ether (ETH), Binance Coin (BNB) and stablecoins reflects a 9.3% market capitalization increase to $418 billion from $382 billion on Feb 4. This explains why so many of the top-80 altcoins hiked 25% or more while very few presented a negative performance. Winners and losers among the top-80 coins. Source: Nomics Gala Games (GALA) announced on Feb. 9 a partnership with world renowned hip-hop star Snoop Dogg to launch his new album and exclusive non-fungible token (NFT) campaign. Gala Game...

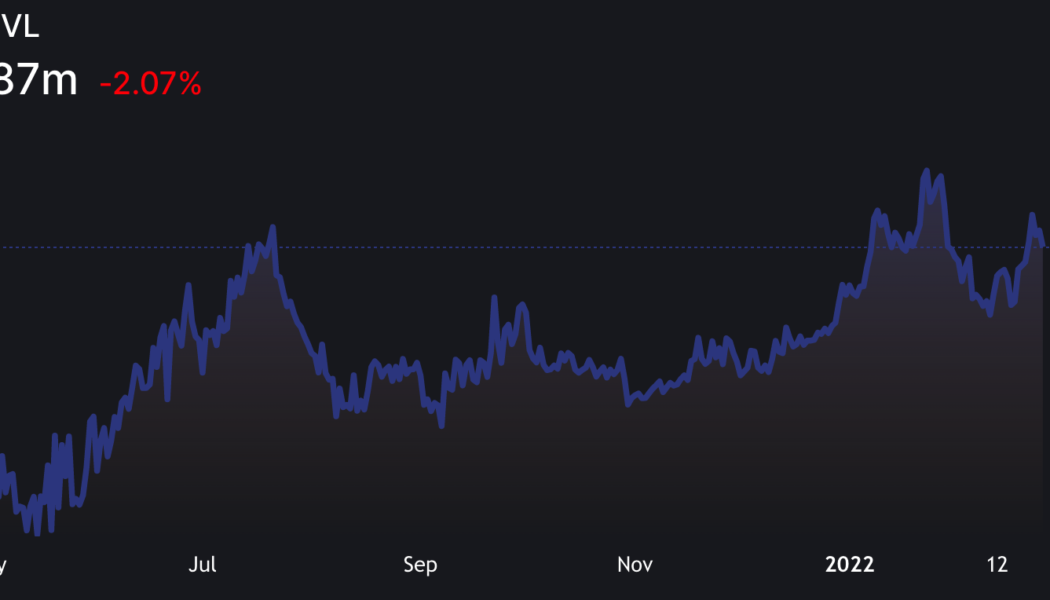

Ether drops below $3,800, but traders are unwilling to short at current levels

Even though Ether (ETH) reached a $4,870 all-time high on Nov. 10, bulls have little reason to celebrate. The 290% gains year-to-date have been overshadowed by Dec.’s 18% price drop. Still, Ethereum’s network value locked in smart contracts (TVL) increased nine-fold to $155 billion. Looking at the past couple of months’ price performance chart doesn’t really tell the whole story, and Ether’s current $450 billion market capitalization makes it one of the world’s top 20 tradable assets, right behind the two-century-old Johnson & Johnson conglomerate. Ether/USD price at FTX. Source: TradingView 2021 should be remembered by the decentralized exchanges’ sheer growth, whose daily volume reached $3 billion, a 340% growth versus the last quarter of 202...