Derivatives

Ethereum on-chain data hints at further downside for ETH price

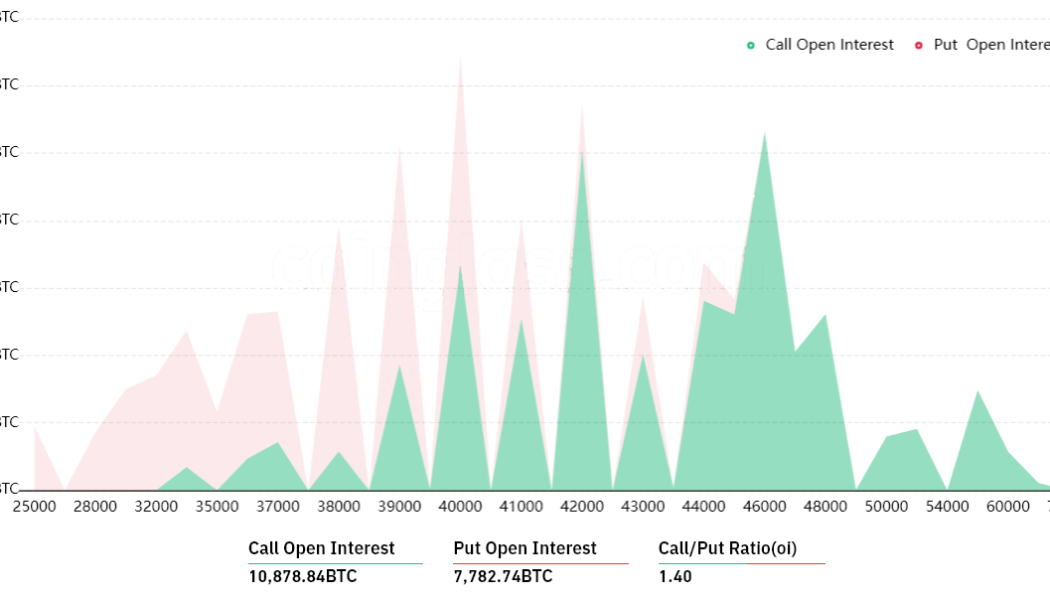

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

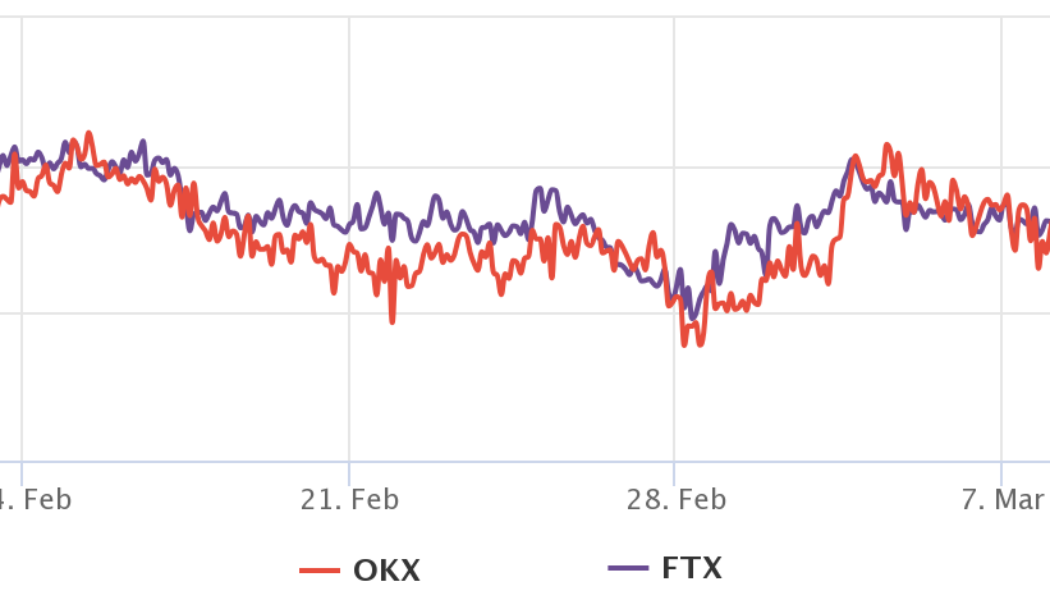

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

Bitcoin’s got 3 strikes, but investors remain calm despite price drop

After Bitcoin (BTC) faced its third consecutive rejection, investors became more confident in adding altcoin positions. For the leading cryptocurrency, the path to $50,000 appears more challenging than previously expected. According to Euronews Next, on March 14, the European Union rejected a proposed rule that could have banned the energy-intensive proof-of-work (PoW) mining algorithm used by Bitcoin and other cryptocurrencies. Several EU parliamentarians have been pushing to ban PoW mining over energy concerns. BTC/USD price at FTX. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptos was relatively flat over the past seven days, registering a modest 0.4% gain to $1.77 trillion. However, the apparent lack of performance in the overall market doe...

Cryptocurrencies against the ‘silent thief.’ Can Bitcoin protect capital from inflation?

The world is becoming increasingly volatile and uncertain. The assertion that “inflation is the silent thief” is becoming less relevant. In 2021, inflation has turned into a rather loud and brazen robber. Now, inflation is at its highest in the last forty years, already exceeding 5% in Europe and reaching 7.5% in the United States. The conflict between Russia and Ukraine affects futures for gold, wheat, oil, palladium and other commodities. High inflation in the U.S. and Europe has already become a real threat to the capital of tens of thousands of private investors around the world. Last week at the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell said that he would recommend a cautious hike in interest rates. At the same time, Powell mentioned that he ...

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

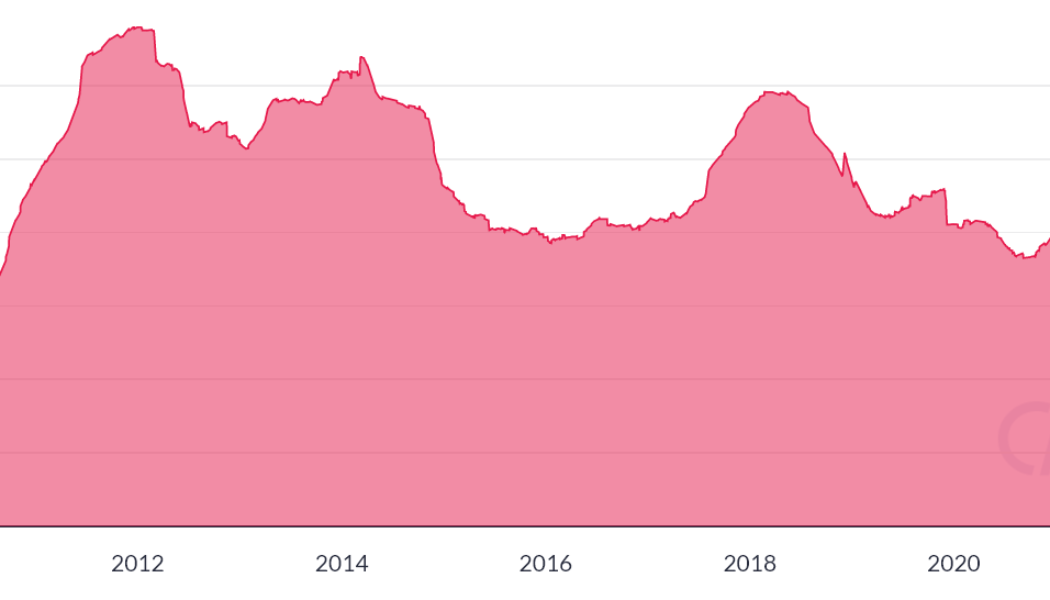

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...