Derivatives

‘Binance is the crypto market’: Arcane crowns the exchange 2022’s winner

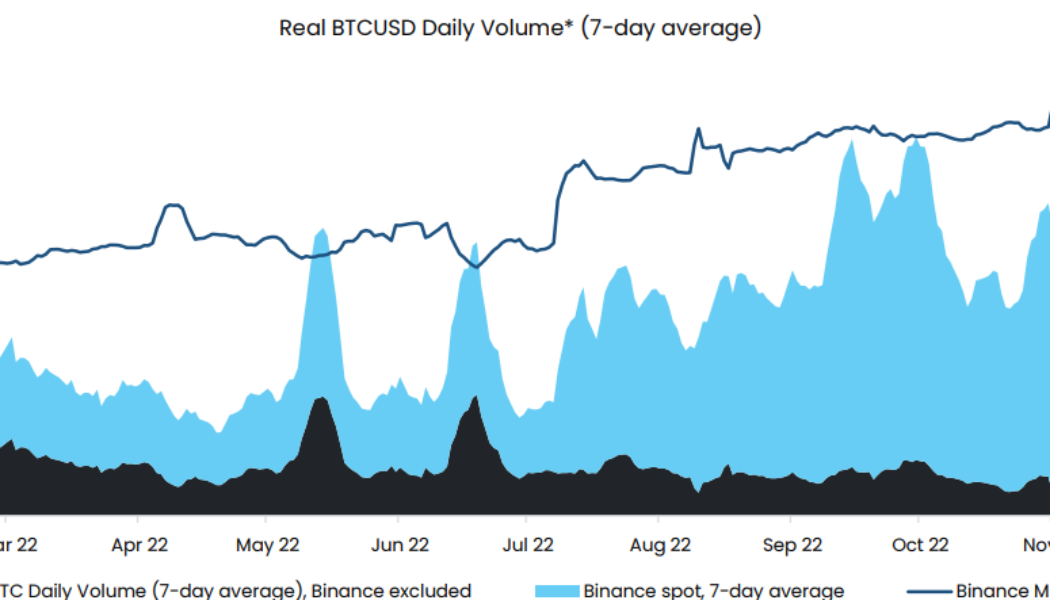

During a year plagued by crises such as the collapse of FTX and Celsius, data shows that crypto exchange Binance has emerged as the clear “winner” of 2022 according to Arcane Research. A Jan. 3 report from Arcane highlighted that Binance saw its market dominance soar throughout 2022. As of Dec. 28 last year it had captured 92% of the Bitcoin (BTC) spot market and 61% of the BTC derivatives market by volume: “There are no other evident ‘winners’ of 2022 other than Binance when it comes to the crypto market structure and market dominance. No matter how you look at it in terms of trading activity, Binance is the crypto market.” Binance’s BTC spot market dominance was 45% at the start of 2022 meaning that it more than doubled, while its share of the BTC derivatives market increased by almost o...

Bitcoin rebound to $18.4K? BTC price derivatives show strength at key support zone

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance. The move followed a seven-day correction of 8% in the S&P 500 futures after United States Federal Reserve Chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14. Bitcoin price retreats to channel support Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the five-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan’s efforts to contain inflation. Bitcoin 12-hour price index, USD. Source: TradingView The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015. However, not everything has be...

$16K retest the most likely path for Bitcoin, according to 2 derivative metrics

Bitcoin (BTC) broke below $16,800 on Dec. 16, reaching its lowest level in more than two weeks. More importantly, the movement was a complete turnaround from the momentary excitement that had led to i$18,370 peak on Dec. 14. Curiously, Bitcoin dropped 3.8% in seven days, compared to the S&P 500 Index’s 3.5% decline in the same period. So from one side, Bitcoin bulls have some comfort in knowing that correlation played a key role; at the same time, however, it got $206 million of BTC futures contracts liquidated on Dec. 15. Some troublesome economic data from the auto loan industry has made investors uncomfortable as the rate of defaults from the lowest-income consumers now exceeds 2019 levels. Concerns emerged after the average monthly payment for a new car reached $718, a 26% in...

Bitcoin bears beware! BTC holds $17K as support while the S&P 500 drops 1.5%

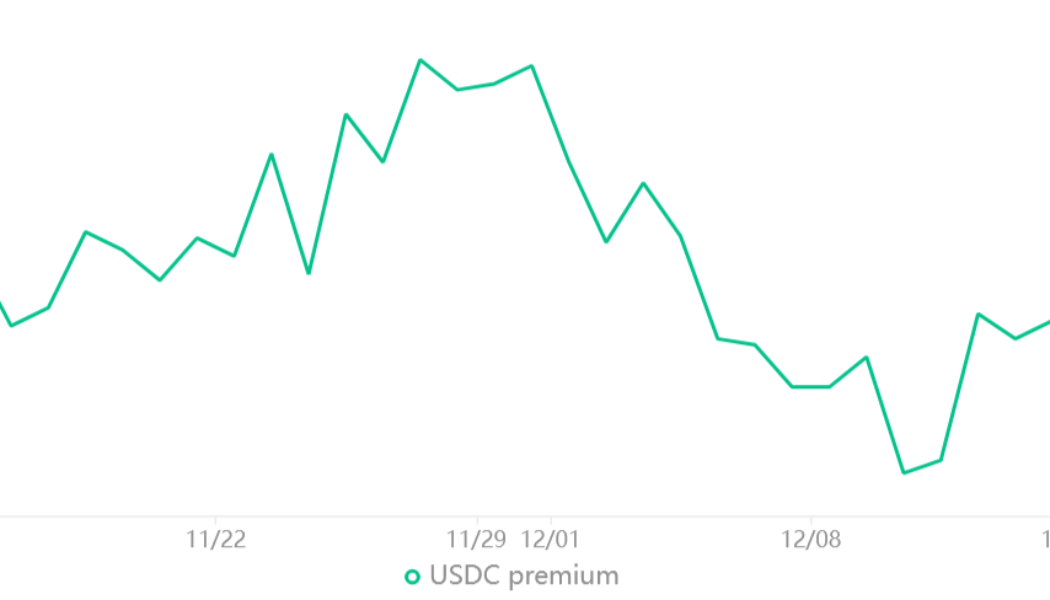

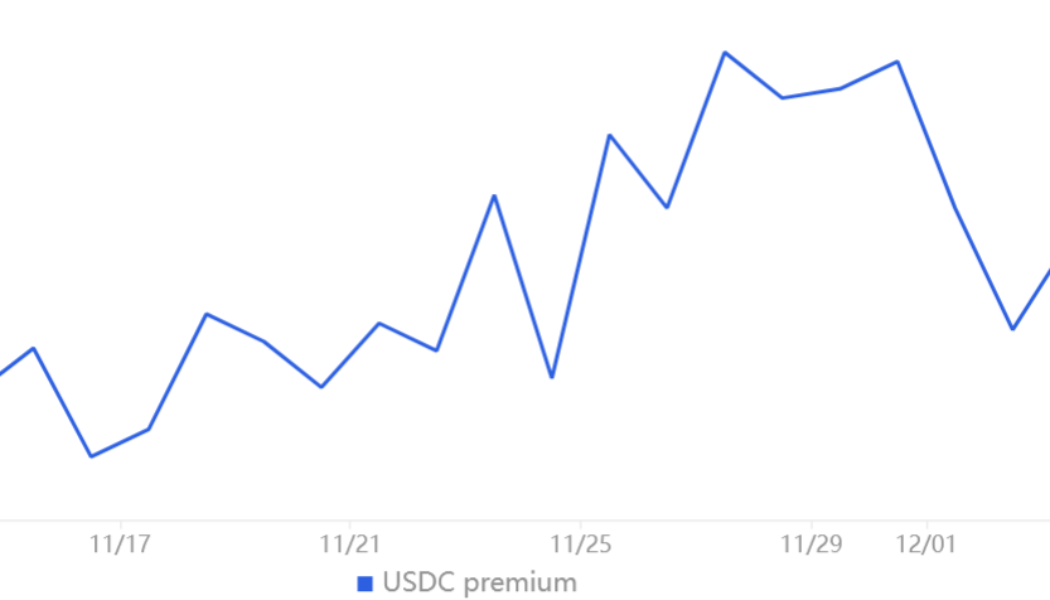

Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises. One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.” Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain ...

Ethereum price weakens near key support, but traders are afraid to open short positions

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...