deribit

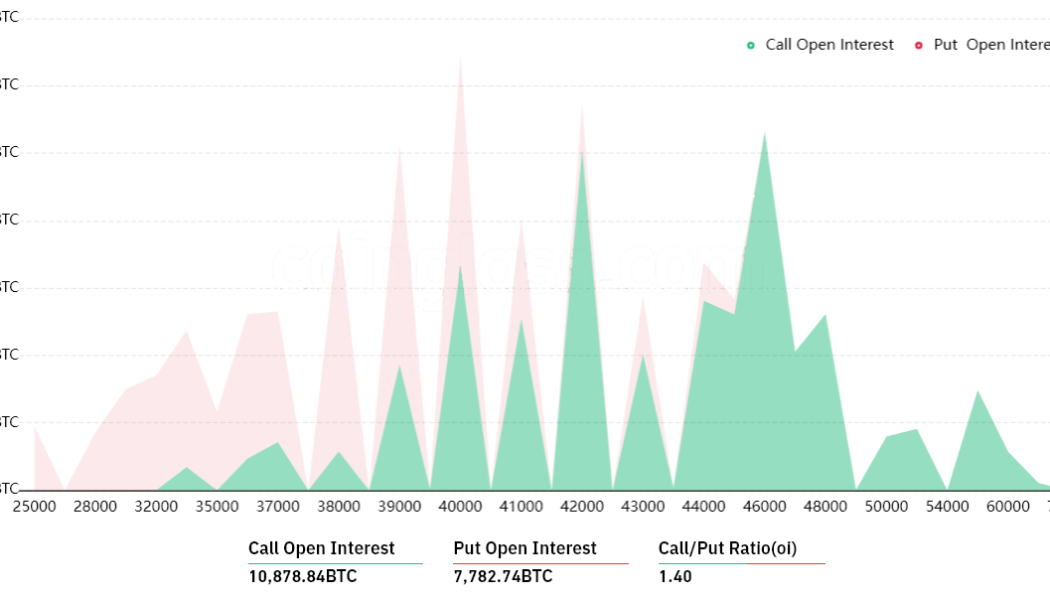

Bitcoin bulls to defend $40K leading into Friday’s $760M options expiry

Over the past two months, Bitcoin (BTC) has respected a slightly ascending trend, bouncing multiple times from its support. Even though that might sound positive, Bitcoin’s performance year-to-date remains a lackluster negative 14%. On the other hand, the Bloomberg Commodity Index (BCOM) gained 2% in the same period. Bitcoin/USD 1-day candle chart. Source: TradingView The broader commodity index benefited from price increases in crude oil, natural gas, gold, corn, and lean hogs. Worsening macroeconomic conditions pressured the supply curve, which, in turn, shifted the equilibrium price toward a higher level. Moreover, the United States approved a $1.5 trillion spending bill on March 15 that funds the government through September. President Joe Biden’s signing of the legislation...

How professional Ethereum traders place bullish ETH price bets while limiting losses

Being bullish on Ether (ETH) over the past four months did not pay off as its price dropped 44% from $4,600. The decentralized finance (DeFi) applications growth that fueled the rally faded away, partially due to network congestion and average transaction fees of $30 and higher. The cool-off period can also be attributed to excessive expectations as the fee burn mechanism implemented in August 2021 with the London hard fork. After drastically reducing the daily net issuance, investors jumped to the conclusion that Ether would become “ultrasound money.” The Ethereum network burned more ETH over the last 24 hours than was issued by both the PoW (eth1) and PoS (eth2) networks. This is the first time this has happened since EIP-1559 went live less than 3 months ago. ETH is ultra so...

Softer-than-expected crypto regulation and stocks’ rebound position Bitcoin for a $42K close

Bitcoin (BTC) bulls jumped in to defend the $40,000 level after a devastating retest of the $38,000 support on March 7. The confidence and momentum that was building up earlier in the month was suddenly shattered after BTC failed to break $44,500 for the third time this month on March 2. The Bitcoin price rally on March 9 has partially been attributed to this week’s expected United States inflation data report. Analysts expect another 40-year record high as the consumer price index (CPI) reaches 7.9% yearly gains. Furthermore, a statement from the U.S. Treasury Secretary Janet Yellen on President Biden’s executive order on digital assets was somewhat milder than expected. Although deleted from the website, the order will apparently call for “a coordinated and comprehensive approach to digi...

This bullish Ethereum options trade targets $3.1K ETH price with zero liquidation risk

Ether price (ETH) spent the last two months stuck in a rut and even the most bullish trader will admit that the possibility of trading above $4,400 in the next couple of months is dim. Of course, cryptocurrency traders are notoriously optimistic and it is not unusual for them to expect another $4,870 all-time high, but this seems like an unrealistic outcome. Despite the current bearish trend, there are still reasons to be moderately bullish for the next couple of months and using a “long condor with call options” strategy might yield a positive outcome. Options strategies allows the investor to set upside limits Options markets provide more flexibility to develop custom strategies and there are two instruments available. The call option gives the buyer upside price protection, and th...

Bears target new lows for Ethereum as Friday’s $1.1B options expiry approaches

Ether (ETH) price tumbled below the $3,000 support on Jan. 21 as regulatory uncertainty continues to weigh down the sector and rumors that the United States Securities and Exchange Commission is reviewing DeFi’s high-yield crypto lending products continue to circulate. On Jan. 27, the Russian Finance Ministry submitted a crypto regulatory framework for review. The proposal suggests that crypto operations are carried out within the traditional banking infrastructure and that mechanisms to identify traders’ personal data are included. Further bearish news came as Ryan Korner, a top special agent from the United States Internal Revenue Service (IRS) Criminal Investigation’s Los Angeles field office, issued negative remarks during a virtual event hosted by the USC Gould School of Law. Ac...

Is the bottom in? Data shows Bitcoin derivatives entering the ‘capitulation’ zone

Analysts love to issue price predictions and it seems that 9 out of 10 times they are wrong. For example, how many times did analysts say “we will never see Bitcoin back at X price again,” only to see it plunge well below that level a few months later? It doesn’t matter how experienced a person is or how connected in the industry. Bitcoin’s (BTC) 55% volatility must be taken seriously and the impact this has on altcoins is usually stronger during capitulation-like movements. I was undeniably wrong about how much crypto could fall from macro contagion. I remain bullish on the space as a whole and think it is the most important mega-trend of our times. I joined CT during 2018 and I will be here with you guys in the coming yrs, bull or bear. — Zhu Su (@zhusu) Jan...

Bulls aim to turn the tide in Friday’s $580M options expiry after BTC tops $43K

Bitcoin (BTC) investors seem uncomfortable with adding positions after the most recent 40% correction from the $69,000 all-time high made on Nov. 10. In addition to the prolonged downtrend, remarks from the United States Federal Reserve on Dec. 15 about rising interest rates are also weighing on risk-on assets. The Fed signaled that it could raise its benchmark rate three times this year and there are plans to increase the pace of its asset purchasing taper. Consequently, traders are worried that these plans will negatively impact traditional and crypto markets because liquidity will no longer be “easily” available. Bitcoin price at Coinbase, USD (right) vs. China stock market MSCI index (left) Cryptoasset regulation in the U.S. has been in the spotlight and recently a member o...

Bitcoin price bounces to $41.5K, but derivatives data shows traders lack confidence

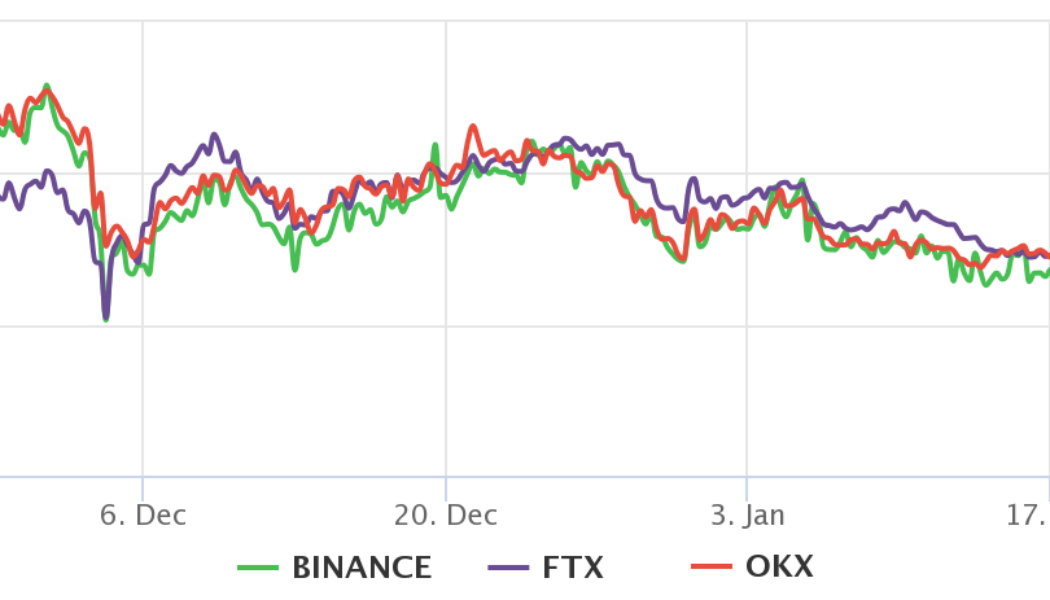

Bitcoin (BTC) briefly reached its lowest level in five months this Monday at $39,650, marking a 42.6% drawdown from the all-time high present on Nov 22, 2022. Some argue that a “crypto winter” has already begun citing the $2.1 billion leverage-long aggregate crypto futures contracts that were liquidated over the past seven days. Bitcoin/USD price at FTX. Source: TradingView The descending channel guiding Bitcoin’s negative performance for the past 63 days indicates that traders should expect sub-$40,000 prices by February. Confidence from investors continued to decline after the United States Federal Reserve’s December FOMC session on Jan. 5. The monetary policy authority showed commitment to decrease its balance sheet and increase interest rates in 2022. On Jan. 5, Kazakhstan’s political ...

Bitcoin’s $6.1 billion options expiry was not enough to break the bearish sentiment

Bitcoin’s (BTC) price has been ranging between $46,000 and $52,000 for 26 days. Despite the large nominal $6.1 billion year-end options expiry, the bullish and bearish instruments were evenly balanced between $44,000 and $49,000. Therefore, it was no surprise that the $47,175 price at 8:00 am UTC on Dec. 31 brought little change to the price structure. Even the 3% rally to $48,500 following the event failed to sustain itself, signaling that bears are unwilling to cede their upper hand. Bitcoin/USD price on Coinbase. Source: TradingView Bulls might have interpreted the 9,925 BTC leaving Coinbase in 24 hours as a positive trigger, considering fewer coins are available on exchanges for newcomers. Besides, the first week of the year has been positive for the past four years, averaging 18...

Here’s why Ethereum traders could care less about ETH’s current weakness

Since hitting an all-time high at $4,870 on Nov. 10, Ether (ETH) price has been posting lower lows over the past 50 days. If this downtrend continues, the lower trendline support suggests that the altcoin will bottom at $3,600. Still, derivatives data is signaling that pro traders are not concerned about the seemingly bearish market structure. Ether/USD price on FTX. Source: TradingView Notice how the price peaks are getting lower on the 12-hour time frame as mounting regulatory concerns drive investors away from the sector. In a press conference on Dec. 17, Russia’s Central Bank governor, Elvira Nabiullina, stated that banning crypto in the country is “quite doable.” Nabiullina cited crypto’s frequent use for illegal operations and significant risks for retail inve...

Markets rally after FOMC meeting, but Bitcoin bears still have a short-term advantage

Bitcoin’s (BTC) price has been in a down-trend since the $69,000 all-time high on Nov. 10, when the the Labor report showed inflation pushing above 6.2% in the United States. While this news could be beneficial for non-inflationary assets, the VanEck physical Bitcoin exchange-traded fund (ETF) denial by the U.S. Securities and Exchange Commission (SEC) on Nov. 12 threw some investors off-guard. Bitcoin/USD price on Coinbase. Source: TradingView While the ETF request denial was generally expected, the reasons given by the regulator may be worrisome for some investors. The U.S. SEC cited the inability to avoid market manipulation on the broader Bitcoin market due to unregulated exchanges and heavy trading volume based on Tether’s (USDT) stablecoin. Analyzing the broader market st...

2 key Bitcoin trading metrics suggest BTC price has bottomed

Bitcoin (BTC) has been struggling to sustain the $47,500 support since the Dec. 4 crash, a movement that wiped out over $840 million in leveraged long futures contracts. The downside move came after the emergence of the Omicron variant of the Coronavirus and recent data showing U.S. inflation hitting a 40-year high. Bitcoin/USD price at FTX. Source: TradingView While newcomers might have been scared by the 26% price correction over the past month, whales and avid investors like MicroStrategy added to their positions. On Dec. 9, MicroStrategy announced that they had acquired 1,434 Bitcoin, which increased their stake to 122,478 BTC. According to some analysts, the rationale behind Bitcoin’s weakness was the contagion fear that Evergrande, a leading Chinese property developer, defaulte...

- 1

- 2