DeFi

Eth2’s Rocket Pool reaches $350M TVL and 635 node operators in five weeks

Rocket Pool, a decentralized Ethereum 2.0 staking platform has surpassed $350 million worth of total value locked (TVL) within five weeks of its official launch. The project aims to remove the barriers to entry for Eth2 stakers and node operators. It allows any user to run a node for 16 ETH ($59,000), which is half of the 32 ETH ($119,000) required in the Eth2 deposit contract. Users with as little as 0.01 ETH can also stake their funds and receive yield. According to data from DefiLlama, Rocket Pool has surged up the decentralized finance (DeFi) staking platform rankings to sit at third with a TVL of $355.64 million at the time of writing. The project is currently behind the Keep3r Network at $584.34 million, and Lido Finance in first place with $6.04 billion. Lido Finance was launched in...

Here’s why Cardano founder believes a DeFi extinction wave is on the way

The software developer and entrepreneur forecasted that many projects in the DeFi sector wouldn’t last the next five to ten years In a recent YouTube session, Cardano founder Charles Hoskinson shared his outlook on the future of decentralised finance. Hoskinson, who has seemingly vowed to redefine the sector, predicted that many active DeFi projects would fall off the grid within the next five to ten years. He cited the lack of long-term vision and rigorous engineering as the factor that will drive the majority of these projects to the ground. Hoskinson averred that the industry is flooded with many projects run by the ‘hope and prayer’ mindset, which he emphasised isn’t enough to keep them afloat. ‘ “It’s very hard to do this kind of engineering and to ...

Cardano and Ripple tokens will crash out of the top 10 chart in 2022: Arcane Research

The blockchain research firm also predicts Bitcoin to continue recording better returns than the S&P 500 index in the incoming year Crypto market analytics company Arcane has laid out its 2022 predictions for various digital assets and the industry at large. The research firm compiled a report highlighting numerous predictions around various aspects, including token prices, regulations, and the performance of different crypto coins. Most notably, Arcane crowned Binance coin as the winner of 2021, explaining that it crushed both Ethereum and Bitcoin in returns. Here’s a look at the other major predictions: The fate of Ripple (XRP) and Cardano (ADA) According to the research firm, the two alts will slip and lose their spot among the top 10 coins by market cap next year. Arcane note...

New to crypto trading? Here are 5 tips on how to start 2022 on the right foot

It doesn’t matter how experienced you are at trading because nothing can be done to protect a person against the might of cryptocurrencies’ price swings. Currently, Bitcoin’s (BTC) volatility, the standard measure for daily fluctuations, stands at 64% annualized. As a comparison, the same metric for the S&P 500 stands at 17%, while the volatility spec for WTI crude oil is at 54%. However, it is possible to avoid the psychological impact of an unexpected 25% intraday price swing by following five basic rules. Fortunately, these tactics do not require advanced tools or large sums of money to hold through periods of high volatility. Plan to refrain from withdrawing money in less than 2 years Let’s assume that you’ve got $5,000 to invest, but there’s a good possibility that you might need ...

How to store crypto in 2022, explained

Cryptocurrency holders can seek out wallets that offer the best of security, functionality and usability –– features that cater to any set of users. Users must be careful to consider factors including security, functionality and ease of use when determining where they will keep their funds. Although this typically means a choice between hot or cold storage, newer wallet releases give users many of these features within a single offering. The HitBTC team has since released their own wallet, branded by its security and clean interface, with the driving force to ensure that cryptocurrencies are universally accessible. The wallet itself is designed for anyone to use, whether it’s a first-time cryptocurrency user or an avid investor. It offers diverse functionality...

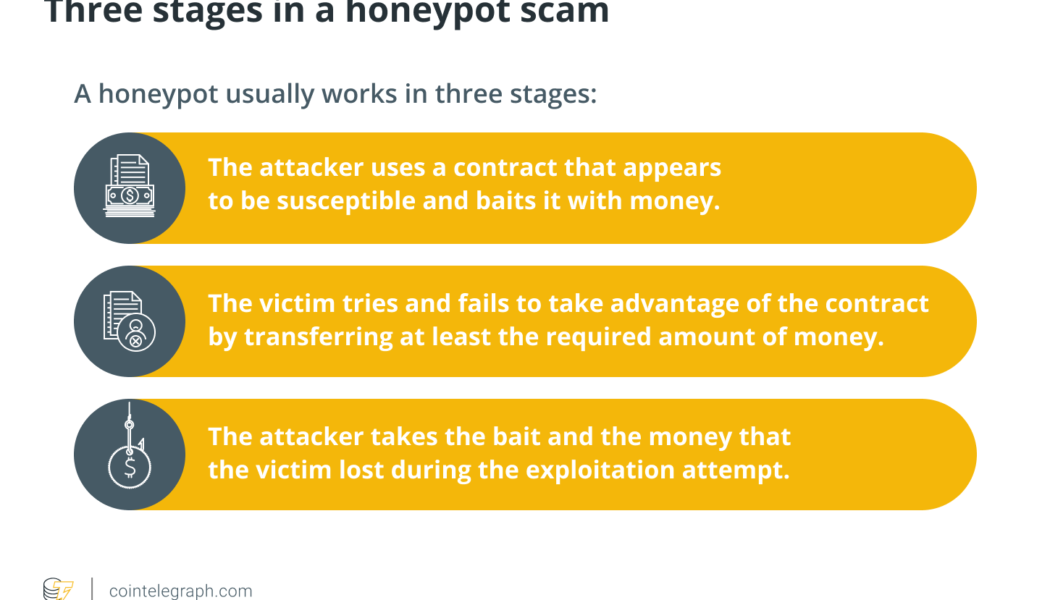

What is a honeypot crypto scam and how to spot it?

What is a crypto honeypot and why is it used? Smart contracts programs across a decentralized network of nodes can be executed on modern blockchains like Ethereum. Smart contracts are becoming more popular and valuable, making them a more appealing target for attackers. Several smart contracts have been targeted by hackers in recent years. However, a new trend appears to be gaining traction; namely, attackers are no longer looking for susceptible contracts but are adopting a more proactive strategy. Instead, they aim to trick their victims into falling into traps by sending out contracts that appear to be vulnerable but contain hidden traps. Honeypots are a term used to describe this unique sort of contract. But, what is a honeypot crypto trap? Honeypots are smart contracts that appear to ...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 3

Tristan is the core contributor to Zeta Markets, an under-collateralized DeFi derivatives platform, providing liquid derivatives trading to individuals and institutions alike. “We’ve seen a Cambrian explosion in the DeFi ecosystem in 2021, with peak TVL approaching $300 billion vs the 2020 peak of $21 billion. This sounds like the growth surely has to slow. Yet, DeFi still represents just a fraction of CeFi trading volumes. At Zeta, we see a clear opportunity for more and more CeFi infrastructure to be built on-chain in a permissionless manner. This will unlock innovative products that have previously been impossible to implement. The following has already started to happen: Composability trumps the siloed products of CeFi, which has created really powerful network effe...

DeFi protocol Grim Finance lost $30M in 5x reentrancy hack

The decentralized finance (DeFi) protocol Grim Finance reported $30 million in losses due to a reentrancy exploit of the platform’s deposits. Grim Finance officially announced on Dec. 18 that an “external attacker” had exploited the DeFi platform, stealing “over $30 million” worth of cryptocurrencies. According to Grim Finance, the hack was an “advanced attack,” with the attacker exploiting the protocol’s vault contract through five reentrancy loops, which allowed them to fake five additional deposits into a vault while the platform is processing the first deposit. Grim paused all vaults after the attack to minimize the risk for future funds: “We have paused all of the vaults to prevent any future funds from being placed at risk, please withdraw all of your funds immediately.” Grim no...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 1

Dominik is the co-founder and chairman of the Iota Foundation, an open-source distributed ledger and cryptocurrency designed for the Internet of Things. “The biggest difference between crypto in 2017 and crypto in 2022 is the establishment of tangible business models and use cases within our ecosystem thanks to DeFi. We no longer have to wait for external parties such as large companies to drive adoption. We can do it ourselves with applications that introduce much-needed innovation to the base level of our economy — finance. 2021 has been a tremendous year for early-stage validation and growing excitement toward DeFi’s potential. But it’s still early stages. DeFi isn’t yet comparable to fintech companies like Revolut or N26 (2 million to 5...

Finance Redefined: 83% of 7-figure Millennials own crypto, Sen. Warren criticizes DeFi, Dec. 10–17

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. As the market attempted to recover from last week’s pummeling, decentralized finance (DeFi) was once again the topic of discussion in high-profile U.S. governmental offices. Read on to learn more about this news and much more from the world of decentralized finance. What you’re about to read is the smaller version of this newsletter designed for brevity. For the full version of DeFi’s developments over the last week, drop your email below. Senator Warren warns about supposed DeFi dangers Senator Elizabeth Warren publicly scrutinized the decentralized finance sector this week in a hearing with the Senate Banking Committee. Speaking on the topic of “Stablecoins: How Do They Work, How Are They Us...

Genius Yield raises $118M via ISPO in first 48 hours

On Dec. 15, Genius Yield, a decentralized automated market maker and liquidity management protocol built on the Cardano (ADA) blockchain, announced the launch of its initial stake pool offering, or ISPO. The fundraising will continue for six months until June 15, 2022. At the time of publication, more than 95.8 million ADA, worth approximately $118 million at the time of writing, have been delegated to the stake pools. In an ISPO, blockchain enthusiasts stake their cryptos in a protocol and receive tokens of the new project they fund as rewards. After a lockup period, investors can then reclaim their staked cryptos. By utilizing this method, investors not only harvest yields, but they also, on paper, get back their initial investments. Of course, the setup is still susceptible to ris...

YFI price gains 46% in just four days after Yearn Finance’s $7.5M buyback

Yearn Finance (YFI) emerged as one of the best performers in the crypto market this week, rallying by over 46% in just four days to reach a two-week high above $29,100. YFI/USD daily price chart featuring its four-day bull run. Source: TradingView The gains surfaced primarily as Yearn Finance revealed that it has been buying back YFI en masse since November in response to a community vote to improve the YFI token’s economics. The decentralized asset management platform purchased 282.40 YFI at an average price of $26,651 per token — a total of over $7.50 million. Furthermore, Yearn Finance noted that it has more than $45 million saved in its Treasury and has “stronger than ever” earnings. As a result, it would — in the future — could deploy its income to buy...