DeFi

What are flash loans in DeFi?

Similar to traditional loans, flash loans are expected to be paid back in full eventually. However, there are also marked differences. In typical lending processes, a borrower loans money from a lender. The amount is expected to be paid back in full eventually, with interest, depending on the terms discussed between the lender and the borrower. Flash loans operate on a similar framework but have some unique terms and premises: Use of smart contracts A smart contract is a tool used in most blockchains to ensure that funds do not change hands until a specific set of rules are met. When it comes to flash loans, the borrower is required to repay the full amount of the loan before the completion of the transaction. If this rule is not followed, the transa...

Finance Redefined: Secret’s $400M fund, and 1inch expanding, Jan. 14–21

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. Following a bearish decline for many of the leading decentralized finance (DeFi) tokens, it is within the fundamental news where the optimism for growth and prosperity lies. Read on to hear about the most impactful DeFi stories of the last seven days. What you’re reading is the shorter, snappier version of the newsletter. For the full roundup of DeFi developments across the week delivered directly to your inbox, subscribe below. Secret Network offers $400M community fund scheme Secret Network, a privacy-oriented layer-one blockchain, announced the launch of a $400 million funding pot this week in a bid to expand their application and network infrastructure, and tooling mechanisms in addition to accelerating ...

The life cycle of smart contracts in the blockchain ecosystem

The formation of a smart contract, freezing of the smart contract, execution of the smart contract and finalization of the smart contract are the four significant steps of a smart contract’s life cycle. It is different from the blockchain development life cycle, which begins with defining the issue you want to resolve with your blockchain product and ends with a minimum viable product. Create Iterative contract negotiation and an implementation phase make up the creation phase. First, the parties must agree on the contract’s overall content and goals. This is similar to traditional contract negotiations and can be done online or offline. On the underlying ledger platform, all participants must have a wallet. Its identifier is pseudonymous in most circumstances, and it is used t...

ImmuneFi report $10B in DeFi hacks and losses across 2021

Decentralized finance, or DeFi, security platform and bug bounty service ImmuneFi published an official report on Thursday, which calculated the total volume of losses in the cryptocurrency markets in 2021. According to its report, the company found that losses resulting from hacks, scams and other malicious activities exceeded $10.2 billion dollars over the past year. Responsible for protecting over $100 billion worth of assets for a number of well-established DeFi protocols, including Synthetix, Chainlink, SushiSwap and PancakeSwap, among others, ImmuneFi has regularly facilitated seven-figure pay-outs to whitehat hackers and other good-willed entities for preventing protocol compromises. According to the report, across 2021, there were 120 instances of crypto exploits or fraudulent rug-...

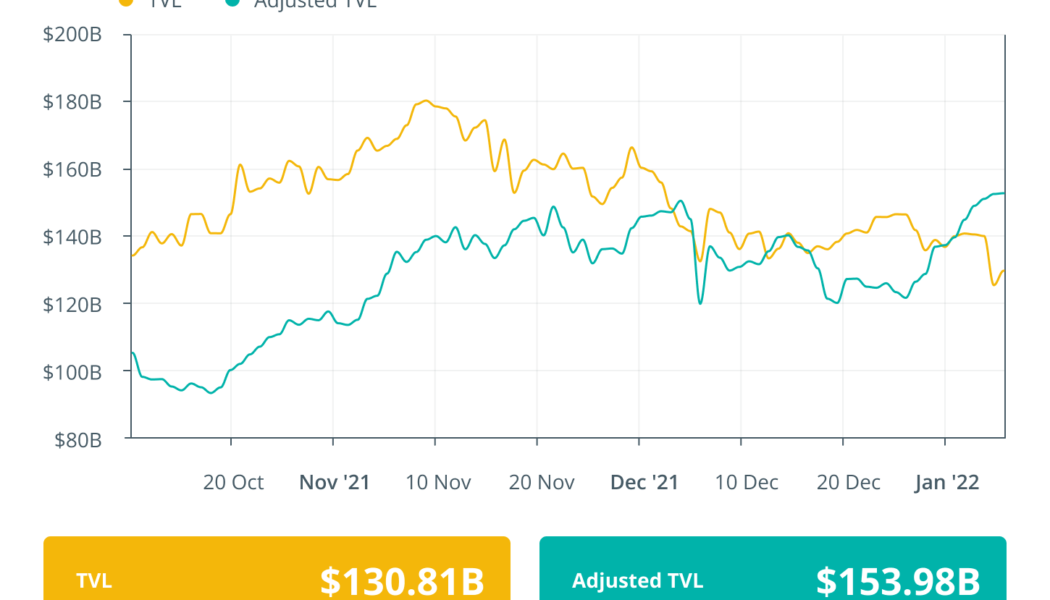

Finance Redefined: Terra expanding UST and LUNA, and Aave Arc seeks institutional adoption, Dec. 31–Jan. 7

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. The new year is upon us, and the expectations for DeFi innovation, utility and mainstream adoption are greater than ever. Read on to hear about the inaugural stories of 2022. Reading this article, you’re only receiving a portion of the content from our DeFi newsletter. Drop your email below for the full copy. Terra Research proposes new utility for TerraUSD and LUNA Decentralized algorithmic stablecoin issuer Terra published an ambitious proposal via its research team this week to expand the interchain deployment of its TerraUSD (UST) stablecoin across five projects on Ethereum, Polygon and Solana. Titled “UST Goes Interchain: Degen Strats Part Three,” the lengthy governance post extensively detailed t...

Report finds crypto crime resulted in $14 billion worth of losses in 2021

Chainalysis findings show that there is currently more than $10 billion in illicit money (mostly stolen) held in crypto wallets A new report from the blockchain data platform Chainalysis has revealed that crime involving cryptocurrencies last year hit an all-time high of $14 billion. This figure is almost twice the sum ($7.8 billion) recorded in 2020. This upsurge in funds lost to fraudulent activity was, however, majorly attributed to the growth of the crypto markets. The markets saw transaction volumes rise by more than 550% to reach $15.8 trillion. The $14 billion sum lost represents just a mere figure of 0.15% of all the blockchain transactions seen in 2021. “We had an explosion in the amount of on-chain activity (in 2021). It’s just that the amount of crime didn’t gr...

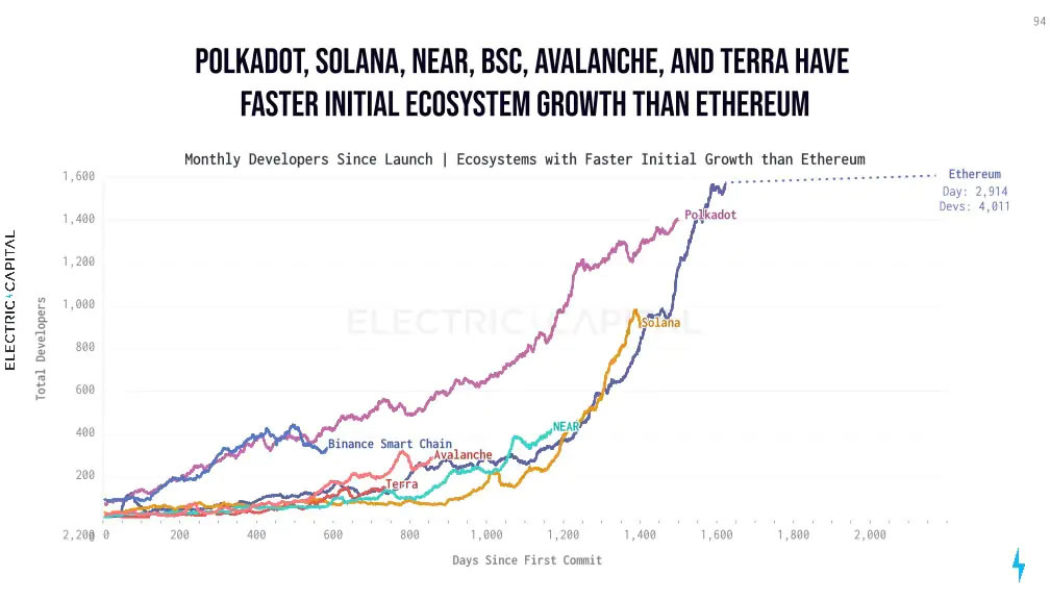

Ethereum dominates among developers but competitors growing faster

The Ethereum ecosystem still has far more developers than rival networks, but they are catching up with a faster rate of growth. Ethereum competitors such as Polkadot, Solana, and Binance Smart Chain are growing faster in terms of development activity according to crypto research firm Electric Capital which released its findings on the blockchain development ecosystem in a new report on Jan. 6. It revealed that more than 4,000 monthly active open-source developers work on Ethereum — considerably more than the 680 who work on the Bitcoin network. Across all chains, the total monthly active developers measured was more than 18,400 and the record was broken for the number of code commits by new developers in 2021 with more than 34,000. The measurements were gleaned by analyzing around 500,000...

Crypto predictions platform Polymarket fined $1.4M by CTFC

New York-based crypto predictions platform Polymarket has reached a settlement with the Commodity Futures Trading Commission (CFTC) to pay a fine of $1.4 million. Polymarket is a decentralized platform that enables users to bet on the outcomes of event markets such as pro-sports games and political elections via binary options contracts. On Jan. 3, the CFTC announced that it had entered an order filing and simultaneously settling charges against Polymarket, with the platform found to have operated an “illegal unregistered or non-designated facility” since June 2020. Under the order, Polymarket is required to pay a civil monetary penalty of $1.4 million along with winding back any markets on the platform that do not comply with CFTC and Commodity Exchange Act (CEA) regulations. Polymarket r...

Grayscale rebalances DeFi Fund dropping Balancer (BAL) and UMA

Crypto asset manager Grayscale Investments has rebalanced its Grayscale DeFi Fund and adjusted weightings of its Digital Large Cap Fund. A Jan. 3 announcement detailed the changes Grayscale made to its two funds. The DeFi Fund’s weightings have been rebalanced with AMP, the native collateral token of the Flexa payment network being added, while Bancor’s (BNT) and Universal Market Access (UMA) have been removed. Flexa uses the AMP token to collateralize crypto payments and settles them in fiat to recipients enabling merchants to accept crypto easily. Grayscale reshuffled weightings but did not change the token list of The Grayscale Digital Large Cap Fund (GDLC). We have just announced updated component weightings for Grayscale #DeFi Fund, which now includes $AMP. This is the first time AMP ...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...