DeFi

Ethereum gas fees drop to lowest levels since August 2021

Gas fees for transactions on the Ethereum (ETH) blockchain have dropped to the lowest levels since August. But they’re still not cheap. According to data sourced from Coinmetrics and shared by CryptoRank Platform, the seven-day moving average cost of an Ethereum transaction as of March 9 totaled $11.14, placing it back amongst the levels recorded mid-last year before it surged dramatically to as high as $55 at the tail end of 2021. The cost of transactions on the @Ethereum network has not been this low since Aug 2021. Notably, gas prices surged after staying in this range for about 3 months with experts attributing the spike to a rise in interest in the #NFT and #DeFi ecosystems. https://t.co/oLDJyfSea2 pic.twitter.com/ieigvLT4Gz — CryptoRank Platform (@CryptoRank_io) March 9, 2022 At the ...

DeFi ‘Godfather’ Andre Cronje calls it quits as associated projects tank

Andre Cronje has officially left DeFi and crypto, with plans to move back into traditional finance Following the news, projects associated with the iconic DeFi builder plunged Founder of Yearn Finance Andre Cronje and technical advisor at the Fantom Foundation alongside his partner Anton Nell, a senior solutions architect at the Foundation, are leaving the crypto and DeFi scene. It had become apparent last week that Cronje, who quickly became an icon in DeFi with his yield optimisation protocol, was planning to leave since he cleared all of his Twitter activity, deactivated his profile, and updated his LinkedIn status to indicate he had left both Yearn Finance and Fantom Foundation. The exit of the two developers leaves a huge dent In a series of tweets, Nell explained that following their...

Income generation on DeFi, explained

Modern tools can improve the earning process by diversifying asset exposure and empowering AI for quicker reaction times. Although DeFi returns appear promising, investors must continue to air on the side of caution and remember even in DeFi, “get-rich-quick” schemes do not exist. Instead, a minimum level of awareness on topics such as how the blockchain works and what an automated market maker (AMMs) is are necessary for users to deploy passive income generation methods. Furthermore, early DeFi projects required users to be highly experienced while having adequate capital at their disposal. SingularityDAO is one of the few platforms that generate yield by trading cryptocurrency assets through an AI-powered DeFi portfolio, giving users access to a diverse range of crypt...

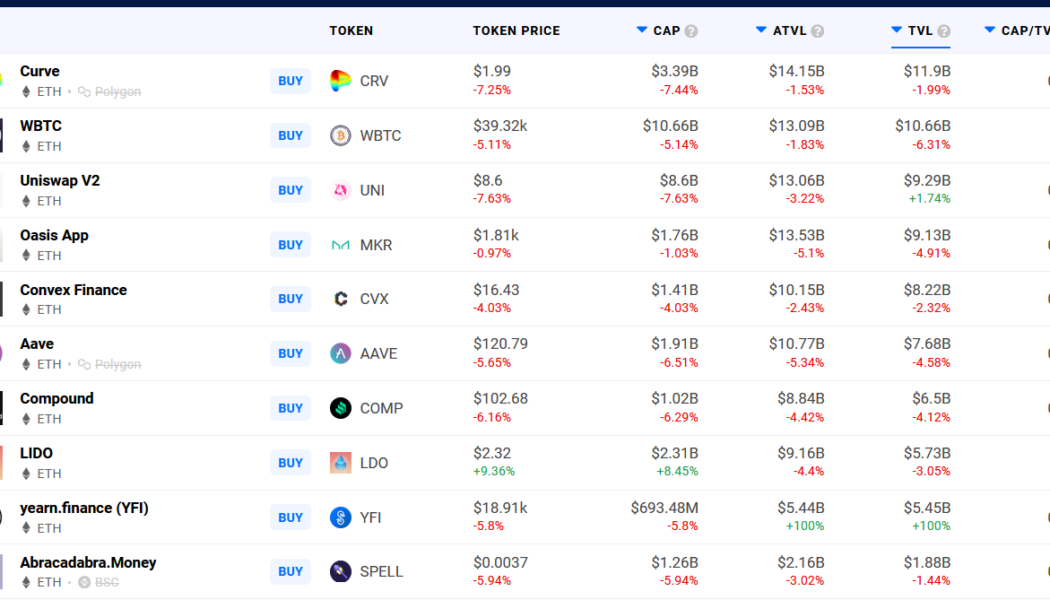

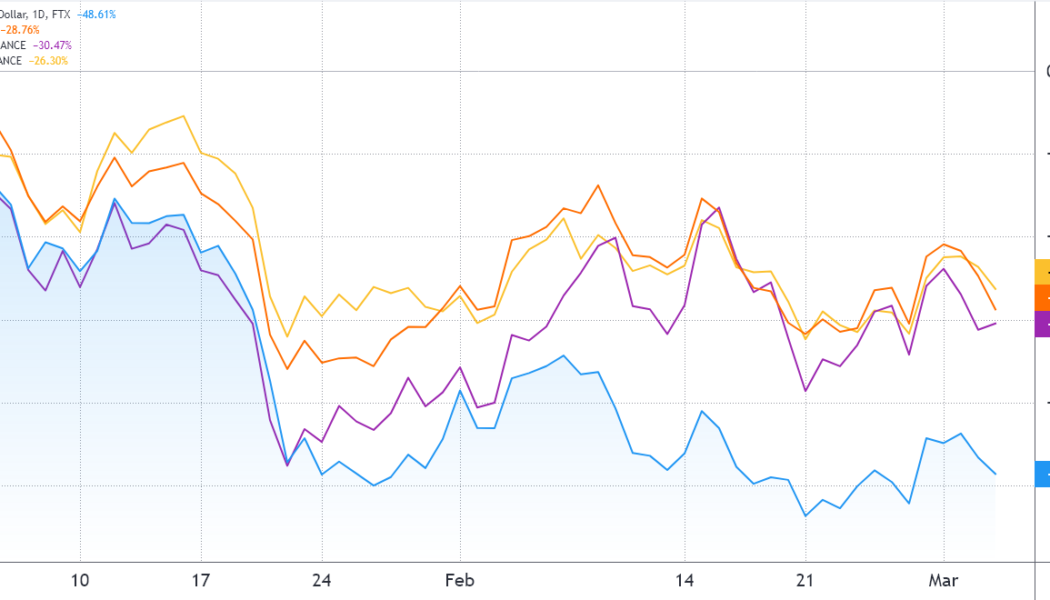

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...

Maverick Protocol closes $8M strategic fundraising led by Pantera Capital

The investment round featured several VC firms that will have a significant role in the network’s planned mainnet launch The funds obtained will be used to advance the proprietary Automated Liquidity Placement algorithm and strengthen Maverick’s position in the DeFi derivatives space Decentralised derivatives protocol Maverick on Tuesday announced it had successfully completed an external funding round netting $8 million. The fundraising was led by California-based crypto-focused fund Pantera with participation from other names, including Circle Ventures, Coral Ventures, Altonomy, Tron Foundation, Gemini Frontier Fund, Jump Crypto, LedgerPrime and Spartan Group. Maverick intends to use the funds to release its Automated Liquidity Placement model and open asset-listing function ...

Hashstack launches Open Protocol Testnet, the first-ever under-collateralized DeFi loans

Hashstack Finance, a decentralized finance (DeFi) platform, has launched the first-ever under-collateralized DeFi loans protocol called Open Protocol. The Open Protocol aims at disrupting the DeFi space by allowing DeFi participants to get up to 3X the amount of the collateral. The Open Protocol testnet marks a great milestone within the DeFi world where crypto investors are forced to deposit crypto assets worth more than the loans they are taking. It is also a significant accomplishment in Hashstack’s roadmap with the mainnet slotted for launch in coming weeks. The Open Protocol Open Protocol is an autonomous lending solution that allows users to access under-collateralized loans that are three times larger than the value of the used collateral. The ratio of collateral to loan is 1:3. In ...

UK tax agency cracks down on rules around DeFi lending and staking

Her Majesty’s Revenue and Customs (HMRC), the U.K.’s tax agency, on Wednesday, has released a controversial set of guidance that could affect innovation in Decentralized Finance (DeFi). The updated regulation focuses on the treatment of digital assets specifically for DeFi lending and staking in the UK, and whether returns or rewards from these services are deemed as capital or revenue for taxation purposes. Owing to the cutting edge nature of DeFi these services had fallen into a grey area with tax professionals unsure of how the existing rules apply. “The lending/staking of tokens through decentralized finance (DeFi) is a constantly evolving area, so it is not possible to set out all the circumstances in which a lender/liquidity provider earns a return from their activities and the natur...

SEC’s proposed rule on exchanges could threaten DeFi, says Crypto Mom

Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission known by many in the space as Crypto Mom, is warning that a proposed rule from the agency could potentially affect the regulation of firms involved with decentralized finance. According to a Tuesday Bloomberg report, Peirce said that the 654-page proposal recently released by the SEC to amend the definition of “exchange” as defined by the Securities Exchange Act of 1934 could impact the digital asset space. The SEC commissioner reportedly opposed opening the proposal to public comment and said the text could impose additional regulations on decentralized finance, or DeFi, firms. “The proposal includes very expansive language, which, together with the chair’s apparent interest in regulating all things crypto, sugg...

DFINITY-based Internet Computer unveils Bitcoin and Ethereum integration plans

Internet Computer will integrate Bitcoin via the ‘Chromium Satoshi Release’ before the end of Q1 this year The Ethereum integration would not come until Q3 when the ‘Vanadium Vitalik Release’ is run DFINITY Foundation, a non-profit organisation that supports the public blockchain Internet Computer, has released its roadmap for 2022. The release detailed that Internet Computer plans to develop Bitcoin and Ethereum blockchains integrations. This would effectively cut out the current need for a bridge, eliminating a potential loophole for ill-intentioned actors. “The ICP [and] BTC integration will prompt a new wave of DeFi applications built to leverage the world’s largest cryptocurrency,” a tweet from the DFINITY Foundation read. Unlocking the power ...

Daniele Sestagalli discusses Wonderland’s future after QuadrigaCX co-founder dox

On Friday, Daniele Sestagalli, co-founder of decentralized finance, or DeFi, protocol Wonderland and stablecoin protocol Abracadabra, issued a statement on the path forward after the doxing of his colleague Michael Patryn: “Do we wind down or continue to fight for the aspect of an investment DAO [decentralized autonomous organization] being a revolutionary new organization? For the option that I am for, which is to fight and bring someone new and experienced to manage the treasury.” The day prior, an investor uncovered the identity of Wonderland’s chief financial officer to be Patryn, who was the former co-founder of defunct Canadian cryptocurrency exchange QuadrigaCX. Over $145 million worth of QuadrigaCX customers’ funds are still missing after the mysterious death of its co-...

Binance Smart Chain cedes third-place ranking to Fantom decentralised ecosystem

Fantom ranks only behind Terra and Ethereum ecosystems in total value locked as per latest DeFi market data Binance Smart Chain, Solana and Avalanche gave way to Fantom as the blockchain rose to third spot in total value locked (TVL). Gaining more than 60% in 48 hours, Fantom’s DeFi ecosystem leapfrogged Binance Smart Chain (BSC) earlier today with $12.4 billion in TVL ($500 million more than the BSC). The growth of the network has been propelled by activity in its 129 protocols, with dApps such as Matrixswap and Chainstack heavily using the chain in their expansion efforts. At the time of press, the TVL of the Fantom blockchain is $11.97 billion, up 49.5% in the last seven days. Data from DefiLlama indicates that Fantom controls 6.25% of the TVL in DeFi compared to BSC’s 6.07%...