DeFi

Crypto is going mainstream: Here’s how the future founders will build on it

Crypto has long been criticized for its lack of inherent value. However, the shift toward contactless transactions amid the pandemic has emphasized the value of digital currencies and blockchain technology in the modern world. For this reason, merchants have been slow to adopt cryptocurrencies as a form of payment. As it gains widespread usage, however, we can expect to see more businesses accepting crypto in the future. The global pandemic has changed the way a lot of us do business. The shift away from cash and face-to-face transactions toward digital cashless ones has introduced many people to the convenience of paying digitally. So, it’s no surprise that crypto is starting to gain traction as a viable payment option — one that will only continue to evolve. While sti...

Tornado Cash says it’s using Chainalysis oracles to block access from OPAC sanctioned addresses

On Friday, Tornado Cash announced that it was using oracle contracts from Chainalysis to block wallet addresses sanctioned by the U.S. Office of Foreign Assets Control, or OFAC. The move comes after the U.S. Department of the Treasury linked North Korean cybercriminal Lazarus Group as an alleged perpetrator for the recent $600 million+ Ronin Bridge exploit. As told by blockchain analytics firm Elliptic, the hackers have sent approximately $80.3 million worth of Ether (ETH) through Tornado Cash. “Maintaining financial privacy is essential to preserving our freedom; however, it should not come at the cost of non-compliance,” said the Tornado Cash team. Tornado Cash is a popular cryptocurrency mixture used to obfuscate the trail of transactions for privacy. The Chainalysis S...

Solana NFT marketplace integration and DApp metrics shine even after SOL’s 20% drop

Solana (SOL) price reached $143.50 on April 2 after an incredible 82% rally over a 20 day period. This positive performance can be attributed to recent NFT markets-related news and a marketwide bounce, but the current 22.7% decline could have investors confused. Solana/USDT at FTX. Source: TradingView The rally started after Coinbase Wallet added support for SOL and other Solana-based blockchain tokens on March 18. The crypto exchange also outlined plans to “further integrate” with Solana by connecting the Coinbase Wallet with the decentralized applications (DApps) and nonfungible tokens (NFTs) hosted on the network. The expectation of OpenSea’s integration of the Solana network also excited investors. This means Solana will join Ethereum, Polygon and Klaytn as the ...

DeFiChain adds Intel, Disney, iShares MSCI China ETF, and MicroStrategy dTokens

DeFiChain, the world’s leading blockchain built on the Bitcoin blockchain has announced that it has added four new decentralized tokens (dTokens) after a Ticker voting by the community. The four newly added dTokens are based on four assets namely Walt Disney Co, iShares MSCI China ETF, Intel Corporation, and MicroStrategy Incorporated. The tokens shall be denoted as follows: $dINTC – Intel Corporation $dMCHI – iShares MSCI China ETF $dDIS – Walt Disney Co $dMSTR – MicroStrategy Incorporated Following the addition of the four new dTokens, the Lead Engineer at DeFiChain, Prasanna Loganathar said: “DeFiChain is continuously expanding the dToken universe to give users a serious alternative to the traditional financial broker – all whilst offering the flexibility and benefits of decentralizatio...

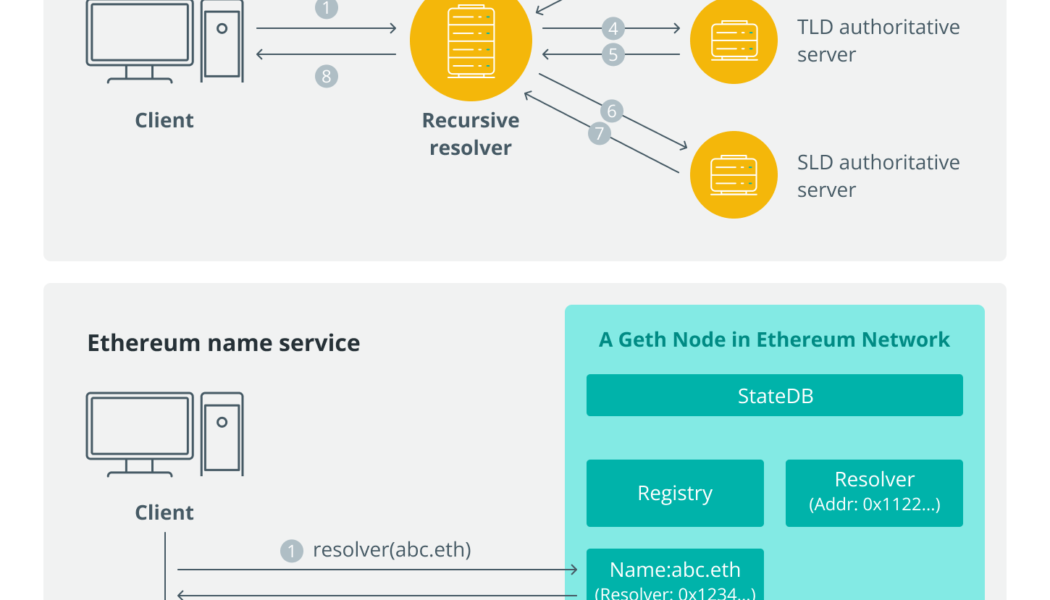

The concept and future of decentralized Web3 domain names

The primary purpose of the Ethereum name service (ENS) is to convert machine-readable identifiers like Ethereum addresses to human-readable names. The web began as a decentralized system based on the DNS, with anybody able to buy, own and manage their domain name and move it from one host to another as needed, with complete control and ownership over all underlying data. But, how does a decentralized Web3 name service work? The community has shown a lot of interest in ENS, which is a new name service built on top of Ethereum. The Ethereum Name Service is a Web3 blockchain system that allows users to establish their own unique and memorable usernames. Therefore, ENS intends to provide a complementary solution to DNS by utilizing Ethereum smart contracts to govern domain name regis...

Aussie fintech to offer mainstream direct access to DeFi with a fixed rate

Australian fintech company Block Earner has officially gone live, offering everyday investors a 7% fixed rate investment product by utilizing decentralized finance (DeFi) technology. Block Earner has already attracted attention from big names in the crypto industry, finalizing a $6.4 million seed funding round in December last year. It was led by Framework Ventures and joined by Coinbase Ventures, DeFi Alliance, LongHash Ventures and crypto veteran Kain Warwick, the founder of Synthetix, an Australia-based crypto derivatives exchange. Jordan Momtazi, the co-founder of Block Earner, said in an interview to Cointelegraph that Australia’s current economic climate makes products that offer yields on savings attractive, especially when it is practically impossible to achieve similar returns usi...

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...

Waves Protocol hits all-time high TVL after crossing $2 BN twice this month

Waves Protocol has grown by about 80% in TVL since the start of the year Neutrino and Vires Finance have been the main assets leading the recent bloom Currently ranked tenth – in terms of Total Value Locked – out of all chains, Waves Protocol, a platform for building Web 3.0 dApps early last week surpassed a TVL figure of $2 billion for the first time since October 2021. Though the TVL briefly fell below the mark the next day (last Wednesday), it rose again and has retested last October’s record figure. As one of the few assets enjoying high-value growths despite the recent market fluctuations, Waves has defied the plunge it saw in the early days of February that took its TVL to as low as $700 million. It currently has a TVL of $2.4 billion, which represents a gain of over 150% on th...

What is Solana (SOL) Pay, and how does it work?

PayPal was a massive innovation in the payments processing industry. The financial brainchild of Peter Thiel, Max Levchin and eventually, Elon Musk aimed far ahead of its time, facilitating instant payments between customers, businesses and more while utilizing the internet. Solana (SOL) Pay is considered by many to be the next innovation in the payments processing arena, facilitating payments while taking nonfungible tokens (NFTs) and Web3 into account. Some are going so far as to call Solana’s new payment protocol the Visa or PayPal of Web3. This post will break down Solana Pay and how it works so you can decide whether the project is all it’s cracked up to be. But first, it’s vital to understand Solana before getting into the digital payment platform Solana Pay. Related: What is Web3: A...

Stacks price plunges hard after rallying 70% in a day — more STX losses ahead?

Stacks (STX) pared a considerable portion of the gains it made on March 10 as the euphoria surrounding its $165 million pledge to support Bitcoin (BTC) projects showed signs of fading. STX’s price dropped by over 30% to reach a level as low as $1.33 on Friday when measured from its week-to-date high of $1.94. The selloff, in part, appeared technical as the $1.94-top fell in the same range that served as solid support between October 2021 and January 2022, only to flip later to become a resistance area. STX/USD daily price chart. Source: TradingView It also appears that traders spotted selling opportunities due to STX’s long wick candlestick on March 10. Stacks rallied by as much as 73% into the day while forming a disproportionally long bullish wick on the daily chart that hint...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

What happened Solana, and what is next?

Perhaps no coin symbolises the rollercoaster ride of crypto better than Solana (SOL). It’s been a journey filled with meteoric highs and crushing lows – so let’s dive in to exactly what has happened over the last year, and what the future holds for Solana. Ethereum’s Problems The phrase “Ethereum-killer” gets thrown around a lot in crypto. For the most part, I roll my eyes. Sure, ETH has its fair share of problems. Even amid the recent parabolic rise in oil prices, gas in the real world still looks like a bargain compared to Ethereum. Given the extent of these fees, it has very much become the blockchain of the elites, with transactions completely unfeasible unless in very large amounts. Still cheaper than Ethereum though… Having said that, the network effects and first mover advantage wit...