DeFi

DeFi summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms

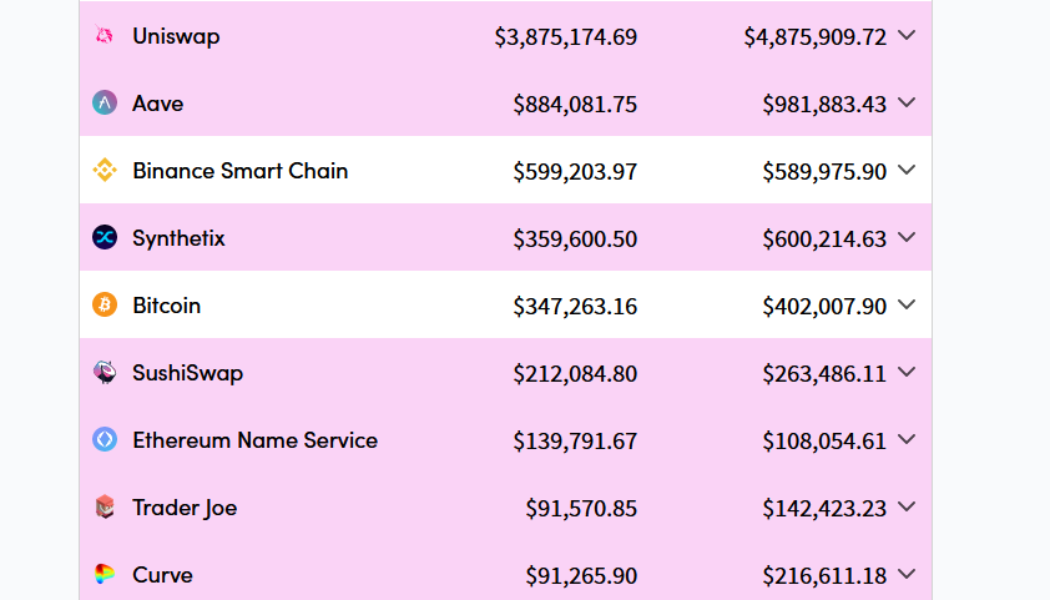

Decentralized exchange (DEX) Uniswap has overtaken its host blockchain Ethereum in terms of fees paid over a seven-day rolling average. The surge appears part of a recent spate of high demand for DeFi amid the current bear market. Decentralized finance (DeFi) platforms such as AAVE and Synthetix have seen surges in fees paid over the past seven days, while their native tokens, and others such as Compound (COMP) have also boomed in price too. According to data from Crypto Fees, traders on Uniswap accounted for an average daily total of $4.87 million worth of fees between June 15 and June 21, overtaking the average fees from Ethereum users which accounted for $4.58 million. Uniswap’s most advanced V3 protocol (based on the Ethereum mainnet) accounted for the lion’s share of the total f...

Avalanche (AVAX) price drops 45% in a month and data points to further downside

Avalanche (AVAX) is down 45% in 30 days and in the same time the cryptocurrencies’ total market capitalization shrank by 29%. Despite the recent downturn, this decentralized application (DApp) platform remains a top contender in the layer1 and layer2 race and it ranks high in terms of smart contract deposits and active addresses. Yet, the lackluster token price is still causing investors to rethink whether the network remains a “serious” competitor. AVAX token/USD at FTX. Source: TradingView The brutal sell-off on risk assets caused AVAX to test the $14.80 support multiple times, while the current market capitalization stands at $4.8 billion. It’s important to also note that the network’s total value locked (TVL) holds an impressive $3.2 billion. As a comparison, Solana (SOL) o...

Ethereum risks another 60% drop after breaking below $1K to 18-month lows

The price of Ethereum’s native token, Ether (ETH), careened below $1,000 on June 18 as the ongoing sell-off in the crypto market continued despite the weekend. Ether reached $975, its lowest level since January 2021, losing 80% of its value from its record high in November 2021. The decline appeared amid concerns about the Federal Reserve’s 75 basis points rate hike, a move that pushed both cryptocurrencies and stocks into a strong bear market. “The Federal Reserve has barely started raising rates, and for the record, they haven’t sold anything on their balance sheet either,” noted Nick, an analyst at data resource Ecoinometrics, warnings that “there is bound to be more downside coming.” ETH/USD weekly price chart. Source: TradingView Ethereum...

Cake DeFi offers hope as uncertainty rocks the crypto DeFi space

This week has been nothing short of “Maniac Week’ for the crypto community as crypto prices continue to fall. Bitcoin (BTC) has been leading the fall and it is currently barely holding above $20,000. Alongside the plunge, crypto services providers are starting to become shaky with a few already being forced to pause services. On Monday, DeFi participants woke to the shocking news that the crypto lending giant Celsius was pausing withdrawals, transfers, and swaps indefinitely and the services are yet to resume to date. There are also rumors that the crypto lender may be insolvent; although the company has not responded to this. But fast forward to Cake DeFi, a Singapore-based staking, lending, and liquidity pool platform that enables users to deposit and earn a yield on a variety of digital...

Ethereum price falls below $1.1K and data suggests the bottom is still a ways away

Ether (ETH) price nosedived below $1,100 in the early hours of June 14 to prices not seen since January 2021. The downside move marks a 78% correction since the $4,870 all-time high on Nov. 10, 2021. More importantly, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and the last time a similar event happened was mid-2021. ETH/BTC price at Binance, 2021. Source: TradingView Even though Bitcoin oscillated in a narrow range two weeks before the 0.082 ETH/BTC peak, this period marked the “DeFi summer” peak when Ethereum’s total value locked (TVL) catapulted to $93 billion from $42 billion two months earlier. What’s behind Ether’s 2021 underperformance? Before jumping to conclusions, a broader set of data is needed to understand what led to the 3...

Ethereum price enters ‘oversold’ zone for the first time since November 2018

Ethereum’s native token Ether (ETH) entered its “oversold” territory this June 12, for the first time since November 2018, according to its weekly relative strength index (RSI). This is the last time $ETH went oversold on the weekly (hasn’t confirmed here yet). I had no followers, but macro bottom ticked it. Note, you can push way lower on weekly rsi, not trying to catch a bottom. https://t.co/kLCynTKTcS — The Wolf Of All Streets (@scottmelker) June 12, 2022 ETH eyes oversold bounce Traditional analysts consider an asset to be excessively sold after its RSI reading fall below 30. Furthermore, they also see the drop as an opportunity to “buy the dip,” believing an oversold signal would lead to a trend reversal. Ether’s previous oversold reading appeared i...

Cake DeFi’s customers take home record US$317 million in rewards

Cake DeFi, the fastest growing decentralized exchange (DeFi) platform based in Singapore, is celebrating its third anniversary in style after it announced that it has paid out more than US$317 million in rewards to its customers by the end of the first fiscal quarter of 2022. Cake DeFi has seen robust business growth since it was launched. It has grown by about 90% since 2019. While making the announcement, the CEO and Co-Founder of Cake DeFi, Dr Julian Hosp, said: “Our third anniversary is an important milestone for us. Despite the recent downturn in crypto prices, we have continued to experience tremendous growth in the past three years. We are now one of the fastest-growing Decentralized Finance (DeFi) platforms in Asia. This is only made possible by relentlessly creating value for our ...

Exotic Markets Interview: Generating yield by selling optionality

It has been a turbulent time in the cryptocurrency markets recently. With the macro climate worsening to the point that we have more bearish sentiment than at any time since the Great Financial Crisis, coupled with the now-infamous UST debacle that saw a stablecoin worth $18 billion vanish into thin air, investors are fighting an intensely risk-off environment. It is precisely this environment that highlights how vital diversification and portfolio allocation is. This is part of the thesis behind Exotic Markets, who we interviewed last week following the launch of a Dual Currency Note (DCN) on the Solana network. In short, this product allows investors to generate yield by selling upside. Investors receive upside in their preferred currency, while avoiding the need for wrapped ...

JPMorgan secures DeFi partnership in Singapore as crypto giants leave for Dubai

The Monetary Authority of Singapore is partnering with JPMorgan Chase to lead a pilot program exploring the DeFi niche The move is an initiative to explore the economic potential and value-adding use cases of crypto by the central bank of Singapore The project involves creation of tokenised bonds and deposits in a liquidity pool for DeFi applications The Monetary Authority of Singapore recently announced Project Guardian, a pilot digital asset program to examine the potential of tokenisation of bonds on public blockchains. The project intends to establish a liquidity pool of tokenised bonds and deposits. Involved would be trusted financial players who will serve as trust anchors, including JP Morgan Chase & Co, DBS Bank Ltd, and digital asset venture Marketnode. Project Guardian ...

Tron surpasses $6 billion in TVL, closing in on second-ranked Binance Smart Chain

The Tron network aims to optimise performance despite being rated higher than dominant Ethereum and Bitcoin in terms of transaction processing speed The recent massive growth of the TRX token has been attributed launch of their algorithmic stablecoin USSD, which has seen great adoption levels Tron, the blockchain outfit associated with Justin Sun, has proven to be a worthy investment based on recent market performance. It has not only survived the turbulence that digital assets have been going through but also thrived amidst the prevailing bearish sentiments. In the last two weeks, the total value locked on the Tron blockchain has grown from $4.19 billion (May 17) to an impressive $6.06 billion at the time of writing. This swell, coming against the general market weather, has seen th...

Injective partners with Wormhole to bring 10 new blockchains to the platform

Decentralized finance (DeFi) protocol Injective (INJ) has partnered with Wormhole to integrate “10 new blockchains” to its network. Injective is a Cosmos layer-2 decentralized exchange (DEX) that offers derivatives, token swaps and sports betting prediction markets. It is also focused on interoperability via cross-chain bridging, and currently supports digital assets from Ethereum, Polkadot and IBC-enabled chains such as Cosmos. Injective Labs, the protocol’s developers, noted in a May 25 announcement that the partnership will enable users to transfer and trade assets across any chain that is integrated with Wormhole. “The Wormhole integration will vastly enhance Injective’s capabilities with respect to interoperability. Users will soon find Wormhole integrated into the backend of the Inje...