DeFi

DeFi platform sees strong interest in halal-approved crypto products

Australian-based crypto platform Marhaba DeFi says there has been a strong take-up of Halal-approved cryptocurrency products on its platform, with aims to release a suite of new products which align with Islamic law by the end of 2022. Launched in 2020, the platform is focused on adhering to the rules of “Islamic finance” which refers to how businesses and individuals raise capital in accordance with Sharia, or Islamic law. Speaking to Cointelegraph, Marhaba DeFi founder and CEO Naquib Mohammed said active users of their noncustodial multichain Sahal Wallet have grown to around 40,000 since its launch, stating: “People need a platform where they can trust every token they interact with, so we don’t have to go hunting on different platforms, tapping into different [Islamic] scholars or expe...

Kyber Network offers bounty following $265K hack of decentralized exchange

KyberSwap, the decentralized exchange built on liquidity protocol Kyber Network, has offered a hacker 15% of the funds from a $265,000 exploit as a bug bounty. In a Thursday blog post, Kyber Network said a hacker had used a frontend exploit to pilfer roughly $265,000 worth of user funds from KyberSwap. The protocol said it will compensate all users for any missing funds related to the exploit, and directly addressed the hacker to give them an opportunity to return the funds in exchange for “a conversation with our team” and 15% of what was taken — roughly $40,000. “We know the addresses you own have received funds from central exchanges and we can track you down from there,” said Kyber Network. “We also know the addresses you own have OpenSea profiles and we can track you through the NFT c...

DeFi needs to start creating real-world value if it wants to survive

The total value locked in decentralized finance (DeFi) projects is hovering around $62 billion as of mid-August, down from a peak of over $250 billion in December 2021. Capital is fleeing the crypto space amid war, soaring inflation and whatever other surprises 2022 may still have in store for us. However, unlike previous crypto bull runs, it was not just retail interest that drew in this capital in the first place. Rather, major institutional players, which have recently opened up to crypto, quickly developed an appetite for the yields DeFi is known for. But now that winter is upon us, the pitfalls of high-yield platforms have become more apparent. Value can’t come out of thin air In some sense, value is always somewhat subjective, defined by one’s personal considerations and goals. A pho...

EOS price jumps 20% for biggest gain in 15 months — What’s fueling the uptrend?

EOS rose approximately 20% to reach $1.66 on Aug. 17 and was on track to log its best daily performance since May 2021. Initially, the EOS rally came in the wake of its positive correlation with top-ranking cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which gained over 2% and 3.75%, respectively. But, the upside move was also driven by a flurry of uplifting updates emerging from the EOS ecosystem. EOS/USD daily price chart. Source: TradingView EOS incentive program launch On Aug. 14, the EOS Network Foundation (ENF), a nonprofit organization that oversees the growth and development of the EOS blockchain, opened registrations for its upcoming Yield+ incentive program. The Yield+ is a liquidity incentive and reward program to attract decentralized finance (DeFi) application...

What is CeDeFi, and why does it matter?

Among the advantages of CeDeFi are lower fees, better security, accessibility, speed and lower cost. CeDeFi’s innovative approach to decentralized banking enables users to trade CeDeFi crypto assets without requiring a centralized exchange. This implies that users may transact directly with one another, removing the need for an intermediary. Among CeDeFi’s major advantages is lower fees. CeDeFi transactions cost lower than those on comparable platforms since there are fewer middlemen involved, especially on networks that are not Ethereum-based. Ethereum has very high gas fees, for instance, with DEX transactions running into hundreds of dollars. It also often causes network congestion issues, leading to delays. Binance CeDeFi, on the other hand, has much lower fee...

DeFi needs a ‘killer app’ to go next level, says Ripple exec

A “killer app” for consumers is what will be needed to bring the decentralized finance (DeFi) sector to a level that draws in a mainstream audience, said Ripple Lab’s head of DeFi markets Boris Alergant. Alergant nade the comments during a panel at the Blockchain Futurist Conference titled “The Future of Decentralized Finance” on Aug. 9, which was covered by Cointelegraph reporters on the ground in Toronto, Canada. Alongside Alergant, Aventus Ventures CEO Kevin Hobbs, FLUIDEFI co-founder and CEO Lisa Loud, and Teller Finance CEO and co-founder Ryan Berkin also featured on the panel. The general sentiment among the panelists was that centralized finance institutions will ultimately push DeFi towards mainstream adoption. Alergant suggested that growth will likely come from a user...

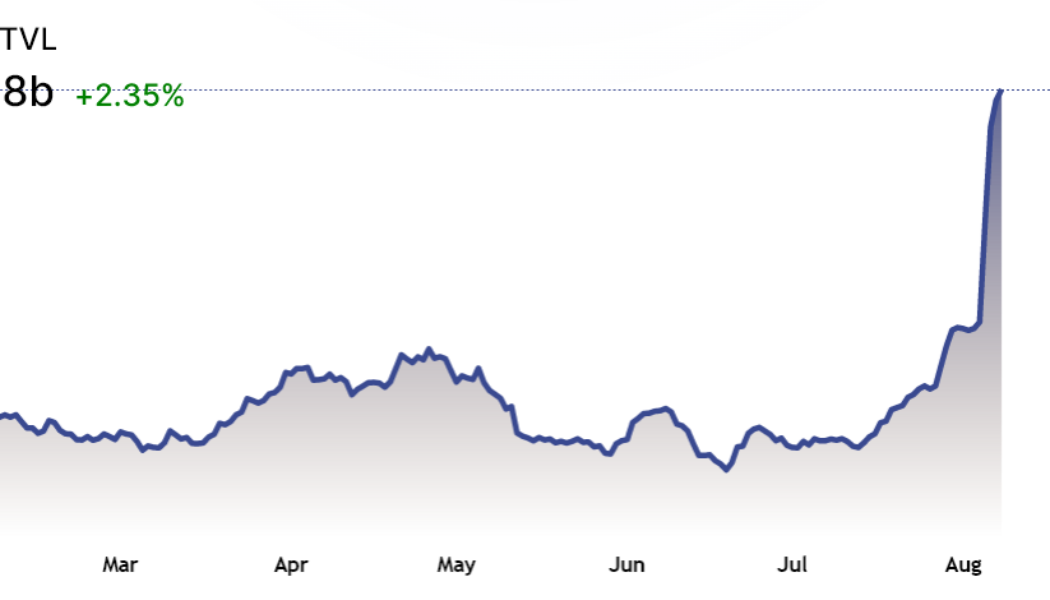

Total value locked in DeFi dropped by 66%, but multiple metrics reflect steady growth

The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient. The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric. In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning...

Contagion only hit firms with ‘poor balance sheet management’ — Kraken Aus boss

The crypto contagion sparked by Terra’s infamous implosion this year only spread to companies and protocols with “poor balance sheet management” and not the underlying blockchain technology, says Kraken Australia’s managing director Jonathon Miller. Speaking with Cointelegraph, the Australian crypto exchange head argued that sectors such as Ethereum-based decentralized finance (DeFi) revealed its fundamental strength this year by weathering severe market conditions: “Some of the contagion that we saw across some of the lending models in the space, [was in] this traditional finance kind of lending model sitting on top of crypto. But what we didn’t see is a kind of catastrophic failure of the underlying protocols. And I think that’s been recognized by a lot of people.” “Platforms...

Gamers plug into DeFi through the new Razer rewards partnership

Gamers and customers of IT and gaming hardware firm Razer are set to plug into the world of decentralized finance (DeFi) through a new rewards swap program in partnership with Cake DeFi. Razer remains a household favorite brand for gamers around the world, with its Razer Gold rewards program allowing gamers to earn and redeem Razer Silver points for a variety of hardware and digital rewards, including Steam games and discount vouchers. Cake DeFi has teamed up with the rewards program from Razer to enable customers the ability to convert Razer Silver points into Cake DeFi vouchers. This essentially provides a bridge from the Razer loyalty program to the world of cryptocurrencies and DeFi products. Related: Crypto gaming and the monkey run: How we should build the future of GameFi Razer game...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

Nonfungible airdrops: Could NFA become the next big acronym in the crypto space?

Airdrops have become the bread and butter of the crypto world — for good reason. They’re an indispensable marketing tool for up-and-coming projects that want to create a buzz around their ecosystems. Done right, distributing free tokens to the public can help elevate demand — and unlock big benefits for recipients. After all, if these altcoins end up being listed on major exchanges at a later date, their value could explode. Unfortunately though, downsides have started to emerge. These campaigns aren’t just reaching enthusiasts who passionately believe in what a project has to offer, but “airdrop hunters” who are merely scouring for ways to turn a quick profit. Airdrop hunters typically want to sell off the tokens they’ve received for free — as soon as they ca...