DeFi

Why DeFi should expect more hacks this year: Blockchain security execs

Decentralized finance (DeFi) investors should buckle themselves up for another big year of exploits and attacks as new projects enter the market and hackers become more sophisticated. Executives from blockchain security and auditing firms HashEx, Beosin and Apostro were interviewed for Drofa’s An Overview of DeFi Security In 2022 report shared exclusively with Cointelegraph. The executives were asked about the reason behind a significant increase in DeFi hacks last year, and were asked whether this will continue through 2023. Tommy Deng, managing director of blockchain security firm Beosin, said while DeFi protocols will continue to strengthen and improve security, he also admitted that “there is no absolute security,” stating: “As long as there is interest in the crypto market, the number...

BitKeep CEO says some users’ private keys remain at risk after exploit

According to a letter posted on Chinese blockchain news publisher Odaily.com on Dec. 27, Kevin Como, the anonymous CEO of BitKeep, warned that users’ private keys are still at risk after a security incident on Dec. 26 led to over $13 million in losses at the time of publication. BitKeep is one of the more popular noncustodial, decentralized finance multichain wallets with over 6 million users. Specifically, Como wrote: “This was a large and atrocious hacker attack incident. The BitKeep APK 7.2.9 (Android Package Kit) installation package was hijacked and swapped by the hacker, and as a result, some users already installed the APKs that were planted malware by the hackers, leading to a leak of users’ private keys.” Como urged users who had already downloaded the Android APK 7.2.9. to transf...

Andre Cronje says Fantom will focus on DApp ecosystem expansion in 2023

In a new Medium post published on Dec. 26, decentralized finance architect Andre Cronje reaffirmed the goals and priorities for the Fantom ecosystem in 2023. Cronje, who previously created protocols such as Yearn.finance and Keep3rV1, also revealed that he accepted a position as a board member for both Fantom Foundation Ltd and Fantom Operations Ltd, which oversee the namesake directed acrylic graph ecosystem. “Our overarching objective over the next 12 months will be towards creating an environment for dapp developers to build out sustainable businesses, while differentiating ourselves from other layer 1 solutions.” One key point on Cronje’s 2023 Fantom roadmap is gas monetization, which would allow revenue share for decentralized applications, or DApps, as a development incentive. In add...

The all-in-one approach at the foundation of next gen crypto investment platforms

The ongoing FTX saga has injected more uncertainty into an already shaken market. If it was not clear already, even the biggest centralized exchanges can fail. The problem is multi-faceted. On the one hand, just like in traditional finance, centralized institutions are only as good as the people who run them. When investors use services like FTX, they are putting their trust in the people that run the service. Unfortunately, history is rife with examples of powerful people taking advantage of that trust. On the other hand, cryptocurrency is still very new. The vast majority of crypto users are not well-versed in all of the technical underpinnings of how things work. For most, digital assets are simply an alternative means of investing and therefore the most convenient solutions are often t...

ApeCoin geo-blocks US stakers, two Apes sell for $1M each, marketplace launched

United States-based ApeCoin (APE) holders could miss out on staking rewards after the U.S. was added to a list of regions geo-blocked from using an upcoming APE staking service. Blockchain infrastructure company Horizen Labs, which is building the site on behalf of the ApeCoin decentralized autonomous organization (DAO), revealed the news in a Nov. 24 update regarding ApeStake.io on Twitter, saying “unfortunately, in today’s regulatory environment, we had no good alternative.” Ape Staking Update: Big thanks to the talented community devs for their helpful improvements. Bug Bounty AIP delayed us a bit, so we shortened the pre-deposit period by a week to keep our original 12/12 go-live. Alternate front-end sites going live. See card. pic.twitter.com/mgmP7X3SwQ — Horizen Labs (@HorizenLabs) N...

Founders should consider VC firms their allies as they build in the bear market

This year’s bear market trajectory should be looked upon as a favorable opportunity for Web3 founders to raise capital and build cutting-edge products. Some of the most robust businesses today were built during market downturns, and founders now have a real opportunity to ensure they’re building products and services that meet genuine, real-world needs and look beyond oversized checks to find the most suitable business partnership. Determining the best methods to fund your product and company is of paramount importance and not a decision to be rushed into. It is an action that requires due diligence and an acute understanding of how the partnership will function and, more importantly, flourish in the face of adverse markets. Before a founder embarks on the journey of attracting inves...

Bitcoin could become the foundation of DeFi with more single-sided liquidity pools

For many years, Ethereum reigned supreme over the decentralized finance (DeFi) landscape, with the blockchain serving as the destination of choice for many of the most innovative projects serving up their take on decentralized finance. More recently, however, DeFi projects have started to crop up across multiple ecosystems, challenging Ethereum’s hegemony. And, as we look to a future in which the technical problem of interoperability is solved, one unlikely contender for the role of DeFi power player emerges — Bitcoin (BTC). In that future, Bitcoin plays potentially the most important role in DeFi — and not in a triumphalist, maximalist sense. Rather, Bitcoin can complement the rest of crypto as the centerpiece of multichain DeFi. The key to this is connecting it all together so that Bitco...

Automation opens up pathway to a simplified, more user-friendly DeFi

Few doubt the potential that DeFi has to redefine crucial aspects of finance for all. But, as it stands, using DeFi platforms and protocols is often time consuming and anything but easy. One of the biggest draws of DeFi are the yields users can earn on farming and staking protocols. However, the yields on offer are constantly changing, meaning crypto enthusiasts need to stay locked to their screens to ensure they aren’t missing out. Given the 24-hour nature of this fast-moving industry, keeping on top of things is often easier said than done. Some protocols are also pretty difficult to use, requiring users to monitor a plethora of different pools. And even when you find the best returns that the market has to offer, the process of manual compounding can be quite tedious. In search of...

Scary stats: $3B stolen in 2022 as of ‘Hacktober,’ doubling 2021

The month of October has broken all records for crypto exploits and the amount of digital loot pilfered — living up to its new moniker of “Hacktober” — according to the latest figures. On Oct. 31, blockchain security firm PeckShield tweeted some scary statistics for the month, reporting a total of $2.98 billion in stolen digital assets as of Oct. 31, 2022, which is nearly double the $1.55 billion lost in all of 2021. “Hacktober” saw around 44 exploits affecting 53 protocols, it added. Malicious actors made off with a whopping $760 million in the month, however, $100 million had been returned. #PeckShieldAlert ~44 exploits (53 protocols affected) grabbed ~$760.2M in Oct. 2022, and ~$100M already returned the exploited protocols (Total loss: $657.2M)As of Octobe...

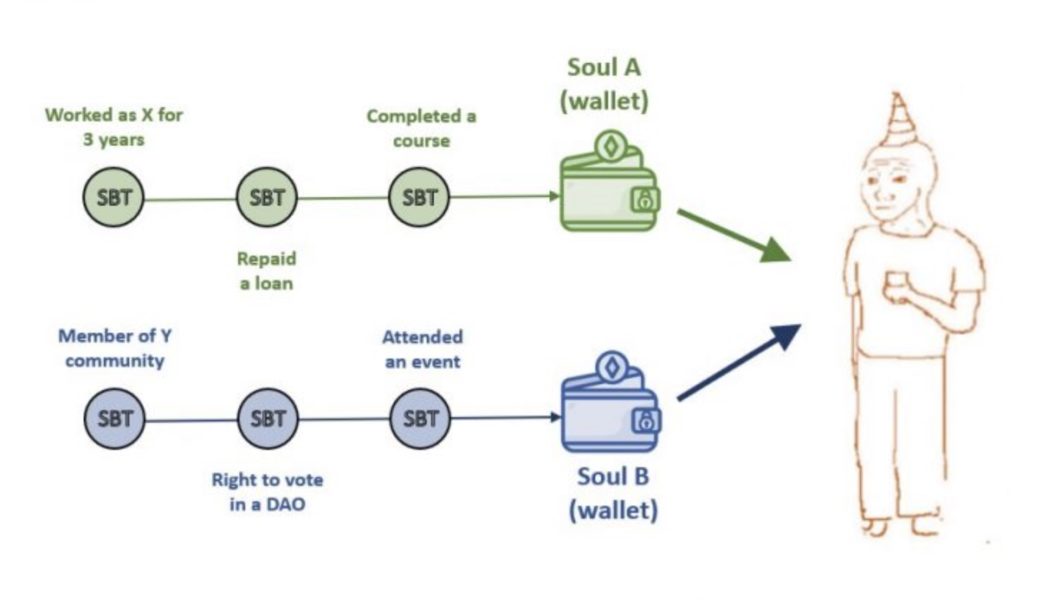

Time to switch from LinkedIn to MetaMask? Not yet, but soon

The function of crypto wallets has changed significantly over the last few years. They initially secured token holdings or served as art galleries with nonfungible tokens (NFTs). Today, they’ve become like bank accounts for many, and soon, they will offer even more functionality by enabling digital curriculum vitae (CVs). In a May 2022 paper, Ethereum co-founder Vitalik Buterin and others introduced the concept of “Soulbound tokens” (SBTs). Buterin and his co-authors argued that credentials on a blockchain offer many advantages to establishing provenance and reputation. Nonfungible tokens will serve as essential building blocks Related: Facebook and Twitter will soon be obsolete thanks to blockchain technology SBTs are like PoAPs, but they are non-transferable and, therefore, bound to a wa...

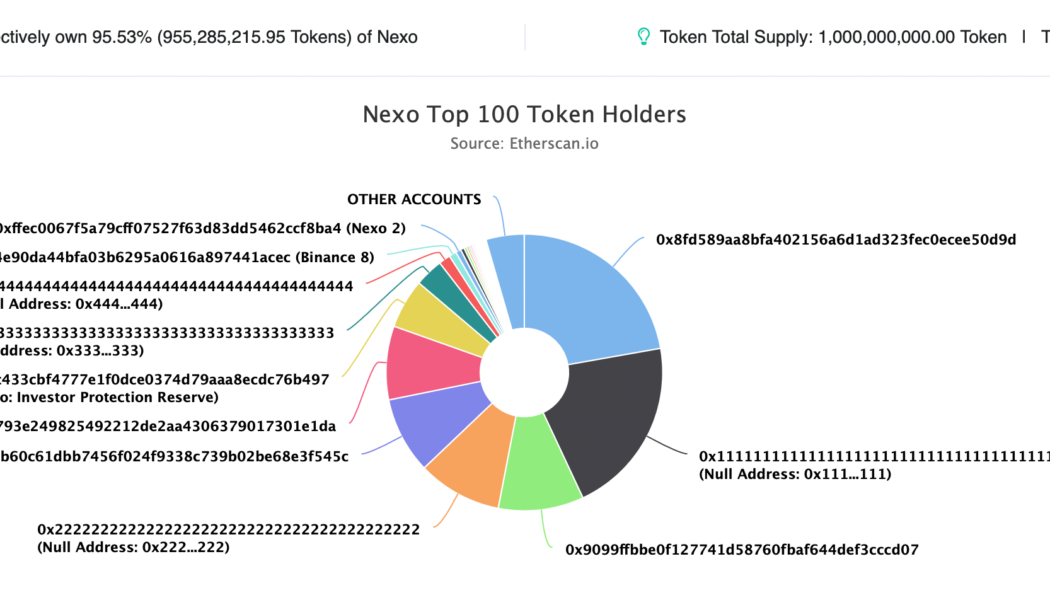

NEXO risks 50% drop due to regulatory pressure and investor concerns

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

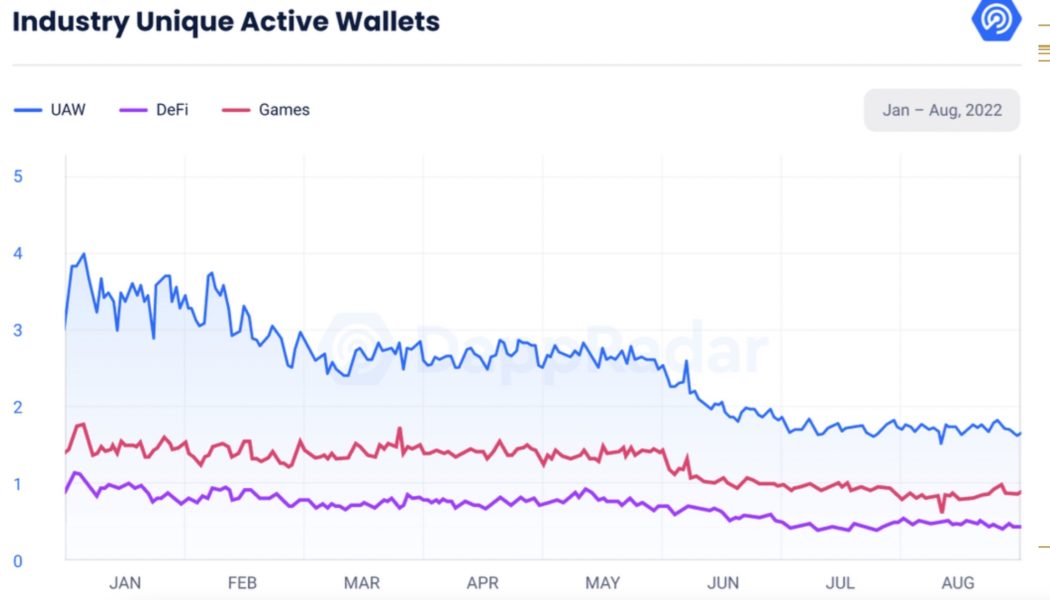

Crypto gaming sucks — But devs can fix it

What we have today in terms of Web3 gaming is not working. Play-to-earn has not worked and neither will play-to-earn or any X-to/and-earn. On top of that, traditional gamers view nonfungible tokens (NFTs) with suspicion. They dunk on expensive apes and are skeptical of large game publishers applying the lipstick of NFTs for further monetization. Nobody knows what a successful Web3 game will look like yet. To get there, we need more developers to experiment with more models. We need infrastructure that will lower the barriers to Web3 game development and make it easy for developers to experiment. That’s why it’s imperative to invest in developing the underlying infrastructure rather than getting carried away by the speculative hype. The Web3 gaming infrastructure can be broken into two phas...