decentralized marketplace

OpenSea smart contract upgrade to delist inactive NFTs on Ethereum

OpenSea, one of the most popular nonfungible token (NFT) marketplace, has rolled out an upgrade to its smart contract, a proactive measure to weed out inactive listings on the platform. As a part of the planned upgrade, all OpenSea users will need to migrate their NFT listings — currently hosted over the Ethereum (ETH) blockchain — to the new smart contract. The new contract is live! Start migrating your listings now: https://t.co/W1w9ciCK2D — OpenSea (@opensea) February 18, 2022 According to the OpenSea announcement, the NFT listings created before Feb. 18 will automatically expire within a week by Feb. 25 by 2 PM ET: “This new upgrade will ensure old, inactive listings on Ethereum securely expire and allow us to offer new safety features in the future.” Upon successful migration, the NFT...

Stealth rulemaking: Is proposed SEC rule with no mention of crypto a threat to DeFi?

On Jan. 26, the United States Securities and Exchange Commission proposed amendments to Rule 3b-16 under the Exchange Act that lacks any mention of digital assets or decentralized finance, which could adversely affect platforms that facilitate crypto transactions. Some cryptocurrency advocates — including SEC Commissioner Hester Peirce — believe that the commission’s extended definition of an exchange could thrust an entire class of crypto entities under the regulator’s jurisdiction, subjecting them to additional registration and reporting burdens. How real is the threat? The proposed change The amendments proposed by the regulator dramatically expand the definition of what an exchange is while eliminating the exemption for systems that merely bring together buyers and sellers of securitie...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

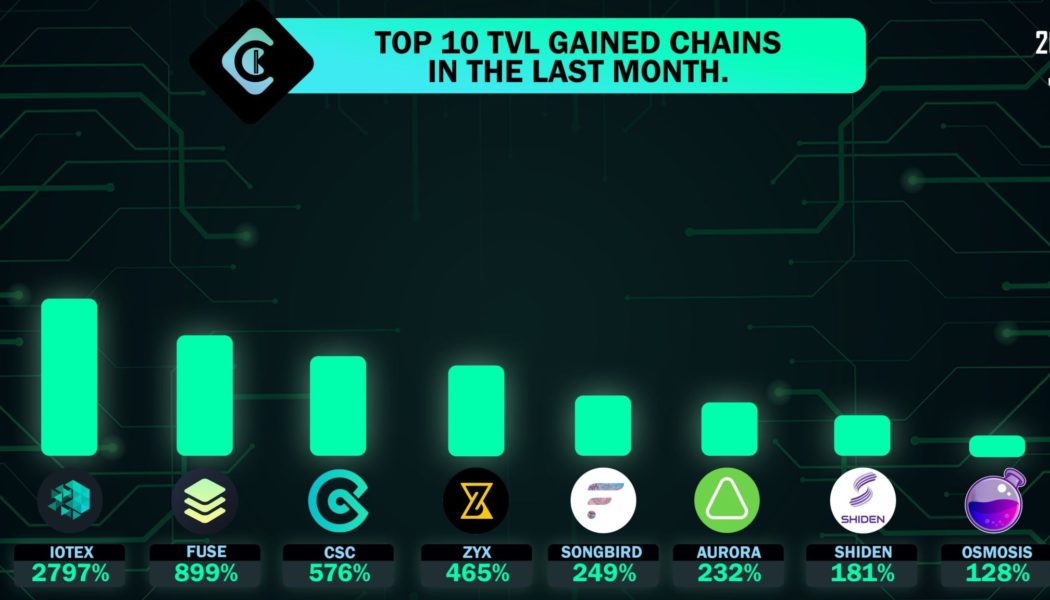

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

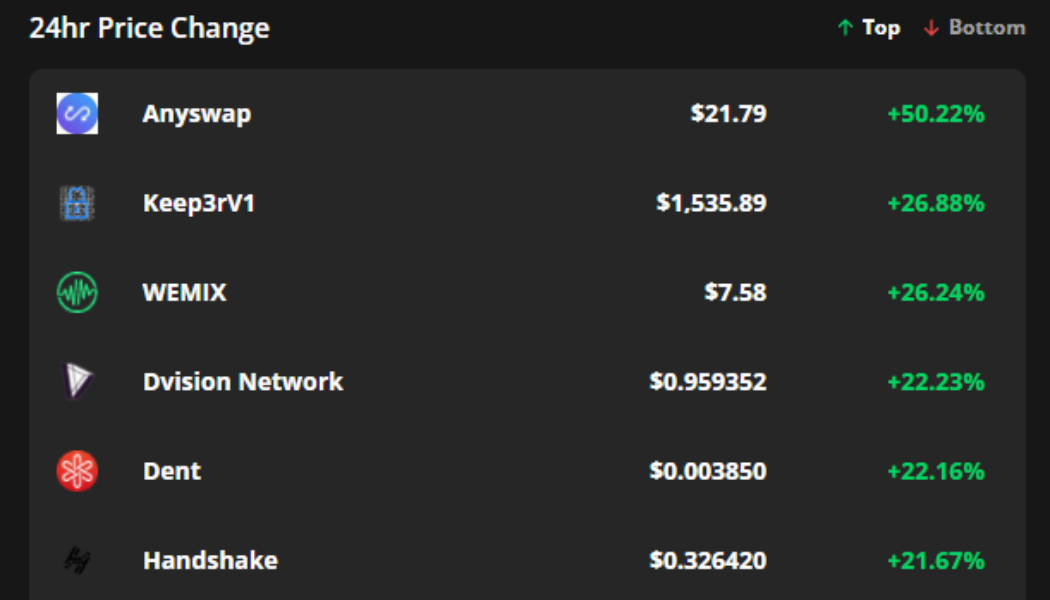

Anyswap, Keep3rV1, WEMIX follow Bitcoin’s move to $44K with double-digit rallies

The cryptocurrency community is back in high spirits on Jan. 12 after a majority of tokens in the top 200 flashed green following Bitcoin’s (BTC) spike to $44,000. The return of bullish momentum has come as a boon to several altcoin projects, with multiple tokens seeing gains in excess of 20%. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Anyswap (ANY), Keep3rV1 (KP3R) and WEMIX (WEMIX). Anyswap expands its list of supported networks Gains in the altcoin market were led by Anyswap, a decentralized exchange that specializes in allowing users to transfer and swap tokens between 25 distinct networks. Data from Cointelegraph Markets Pr...

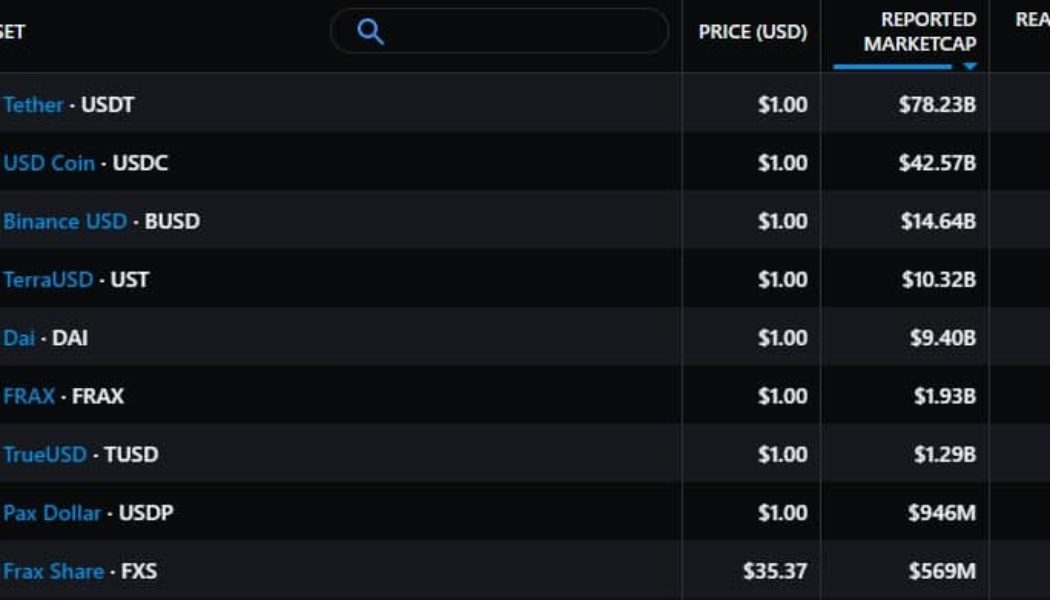

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

Interlay raises $6.5M to accelerate Bitcoin DeFi interoperability

DFG Capital has led a $6.5 million investment in the interoperability start-up Interlay, which is building infrastructure for decentralized finance applications across major blockchains such as Ethereum, Cosmos and Polkadot. As per the announcement, the new funds will be used by Interlay to scale its operations and bring more developers on board with its open-source platform. In a statement, James Wo, DFG Founder and CEO, said Interlay’s solution will “expand the cross-chain possibilities for Bitcoin.” Interlay aims to integrate cryptocurrencies like Bitcoin (BTC) with DeFi platforms such as Polkadot and Ethereum. InterBTC, the company’s main product, is a fully crypto-based Bitcoin-backed asset. It’s backed by multiple collaterals and functions li...

- 1

- 2