decentralized marketplace

DeFi problems and opportunities in 2023: Market Talks

On this week’s episode of Market Talks, Cointelegraph welcomes Grant Shears, founder of Blocmates — an educational and consultancy company that aims to create crypto, decentralized finance (DeFi) and Web3 content that anyone can understand. This week, to kick things off, the show takes a look at the emerging trends of 2023 and what people should look forward to. What industries could really take off this year, and which sector could have the most potential to grow? It’s no secret that 2022 was not a great year for DeFi, an industry that arguably imploded on itself by offering unsustainable high yields that eventually caused the model to collapse. Host Ray Salmond, Cointelegraph’s head of markets, asks Shears if there are any projects this year that plan to fix this problem, and what that f...

New OECD report takes lessons from crypto winter, faults ‘financial engineering’

The Organisation for Economic Cooperation and Development (OECD) analyzed the crypto winter in a new policy paper titled “Lessons from the crypto winter: DeFi versus CeFi,” released Dec. 14. The authors examined the impact of the crypto winter on retail investors and the role of “financial engineering” in the industry’s current problems and found a lot not to like. The paper from the OECD, an intergovernmental body with 38 member states dedicated to economic progress and world trade, concentrated on events in the first three quarters of 2022. It placed the blame for them squarely on a lack of safeguards due to “non-compliant provision of regulated financial activity” and the fact that “some of these activities may fall outside of the existing regulatory frameworks in some jurisdictions.” T...

Mastercard to allow 2.9B cardholders to make direct NFT purchases

International payment processing giant Mastercard is expanding its payment network for nonfungible token (NFT) markets and Web3. The financial service provider announced that it has been working on expanding their payment networks to NFTs over the past year. The firm has partnered with a number of leading NFT marketplaces to allow 2.9 billion cardholders to directly make NFT purchases without buying crypto first. Currently, users need to buy crypto to bid on and buy NFTs. However, with the latest Mastercard partnership, billions of cardholders can now bypass the process of buying a transferring crypto to NFT marketplaces. The firm said: “These integrations are designed to make crypto more accessible and help the NFT ecosystem keep growing, innovating and bringing in more fans.” Mastercard ...

TrueFi launches on Optimism, expanding access to on-chain credit

Unsecured lending protocol TrueFi has become the latest project to launch on Optimism, Ethereum’s popular layer-2 scaling solution, in a move that’s expected to boost demand from non-institutional lenders. By launching on Optimism, TrueFi’s lender community will have access to a faster and cheaper user experience, as well as gain exposure to a wider pool of retail lenders. “TrueFi users can now lend, borrow and launch portfolios on Optimism to enjoy dramatically reduced transaction costs and network speeds,” Rafael Cosman, co-founder of TrustToken, told Cointelegraph in a written statement. He further explained: “Since Optimism transactions are on average 77x cheaper than Ethereum, we expect greater adoption from non-institutional lenders, hopefully increasing global access to TrueFi...

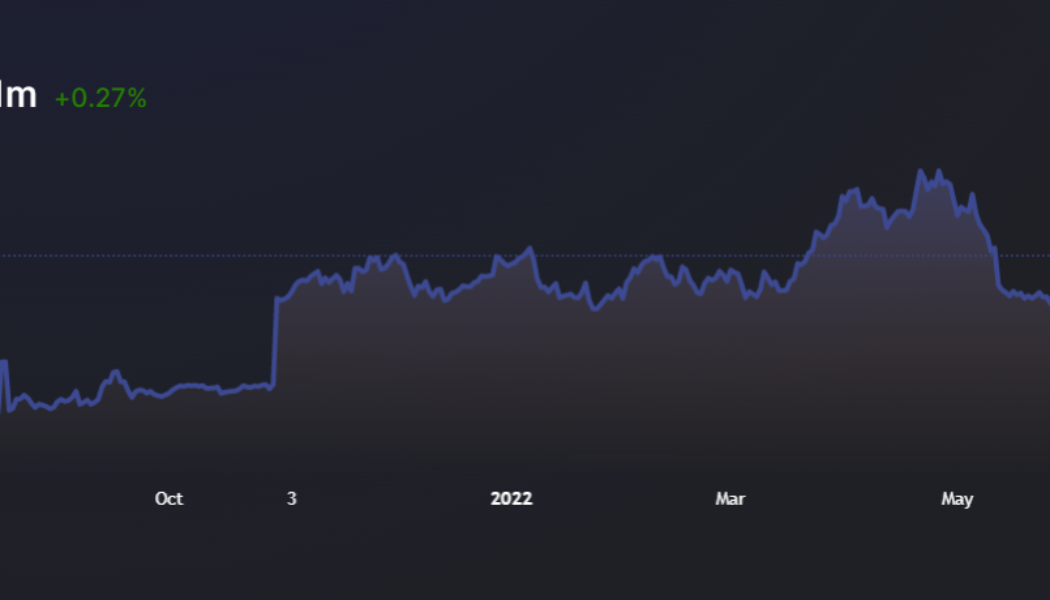

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

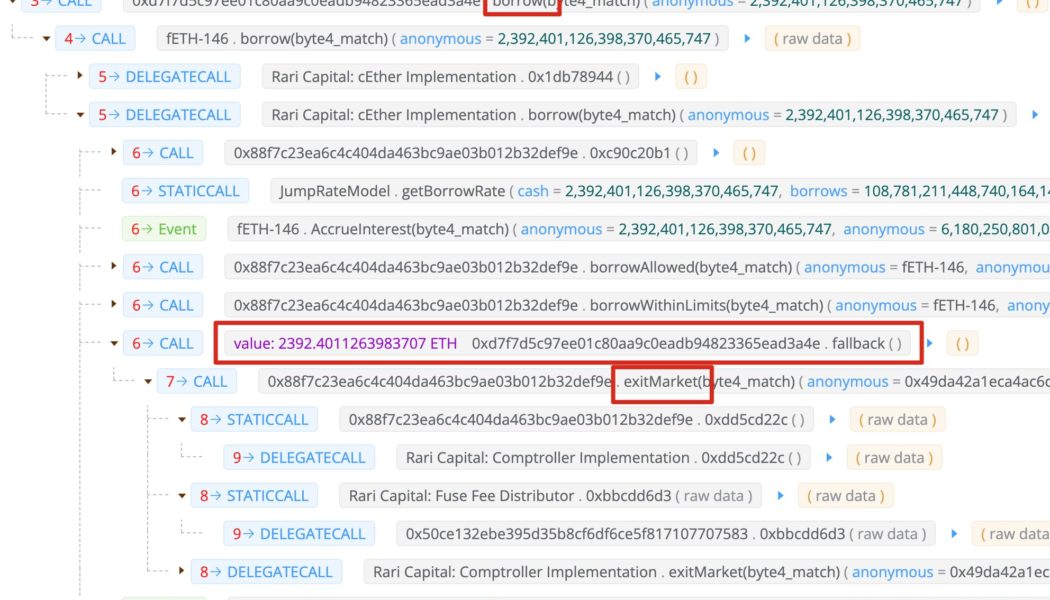

Rari Fuze hacker offered $10M bounty by Fei Protocol to return $80M loot

Decentralized finance (DeFi) platform Fei Protocol offered a $10 million bounty to hackers in an attempt to negotiate and retrieve a major chunk of the stolen funds from various Rari Fuse pools worth $79,348,385.61 — nearly $80 million. On Saturday, Fei Protocol informed its investors about an exploit across numerous Rari Capital Fuse pools while requesting the hackers to return the stolen funds against a $10 million bounty and a “no questions asked” commitment. We are aware of an exploit on various Rari Fuse pools. We have identified the root cause and paused all borrowing to mitigate further damage. To the exploiter, please accept a $10m bounty and no questions asked if you return the remaining user funds. — Fei Protocol (@feiprotocol) April 30, 2022 While the exact losses from the explo...

Finance Redefined: Hacker bungles DeFi exploit, dYdx’s decentralization goals, and more

The decentralized finance (DeFi) ecosystem was filled with ups and downs —mostly the latter— this week, with two very distinct hack attempts and a heartbreaking departure of a DeFi veteran. In this week’s newsletter, we will also look at derivative exchange dYdX’s plans to go fully decentralized by the end of the year. The price momentum of the DeFi tokens remained neutral, with several tokens registering a bullish surge. However, the market volatility meant many of them couldn’t hold onto those gains. Hacker bungles DeFi exploit: Leaves stolen $1M in contract set to self destruct In a rare comedic bungle among DeFi exploits, an attacker has fumbled their heist at the finish line leaving behind over $1 million in stolen crypto. Blockchain security and analytics firm BlockSec shared o...

Kyber Network (KNC) soars after integrating with Uniswap v3 and Avalanche Rush Phase 2

The outlook for projects in the decentralized finance (DeFi) sector has begun to improve in recent months as a combination of global events have highlighted the benefits of holding funds outside of the traditional financial systems. One project that has rallied over the past few months is Kyber Network (KNC), a multi-chain cryptocurrency trading and liquidity hub that aims to offer users the best trading rates. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2.83 on April 6, the price of KNC jumped 55.4% to hit an all-time high of $4.04 on April 8 amid a 253% spike in its 24-hour trading volume. KNC/USDT 1-day chart. Source: TradingView Three reasons for the building momentum of KNC include the integration of support for ten separate blockchain n...

DeFi sector TVL rises as investors return to a bullish crypto market

The month of March has been a tale of two halves for the cryptocurrency market and the weakness seen since the start of the year has began to fade. Bitcoin’s (BTC) strong move above the $40,000 level is helping to lift sentiment across the sector, and DeFi tokens are also beginning to move upward. Crypto Fear & Greed Index. Source: Alternative.me Data from cryptocurrency market intelligence firm Messari shows that a majority of the top tokens in the DeFi sector have posted double-digit gains over the past 30 days, led by THORChain (RUNE), which has increased by 199.81%, and Aave (AAVE), which has seen its price increase 53.95% Top 12 DeFi assets. Source: Messari Here’s a rundown of the state of DeFi as the sector attempts to get back to its former glory and kickstart a new ...

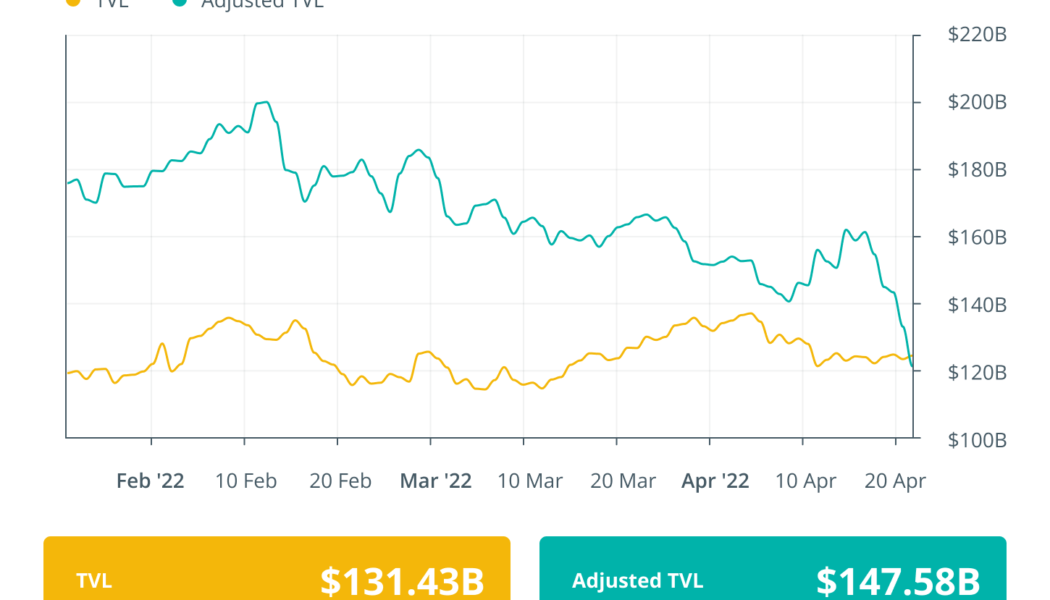

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Bob Dylan goes meta as Sony and Universal partner with Snowcrash NFT platform

Solana-based NFT marketplace Snowcrash has announced that Sony Music and Universal Music Group — the two largest music labels in the world — have officially partnered with the upcoming platform. The two music labels will release Bob Dylan and Miles Davis NFT collections later this year, ahead of wider integration with their rosters of artists. Jesse Dylan, who probably not coincidentally is Bob Dylan’s son, is the co-founder of the Snowcrash marketplace, which draws its namesake from Neal Stephenson’s 1992 sci-fi novel that also invented the term Metaverse. Bob Dylan is a major investment by both labels: UMG spent around $400 million on his song catalog in 2020, while Sony bought his recorded music rights for more than $150 million last year. In a statement, Dylan the younger stipulated th...

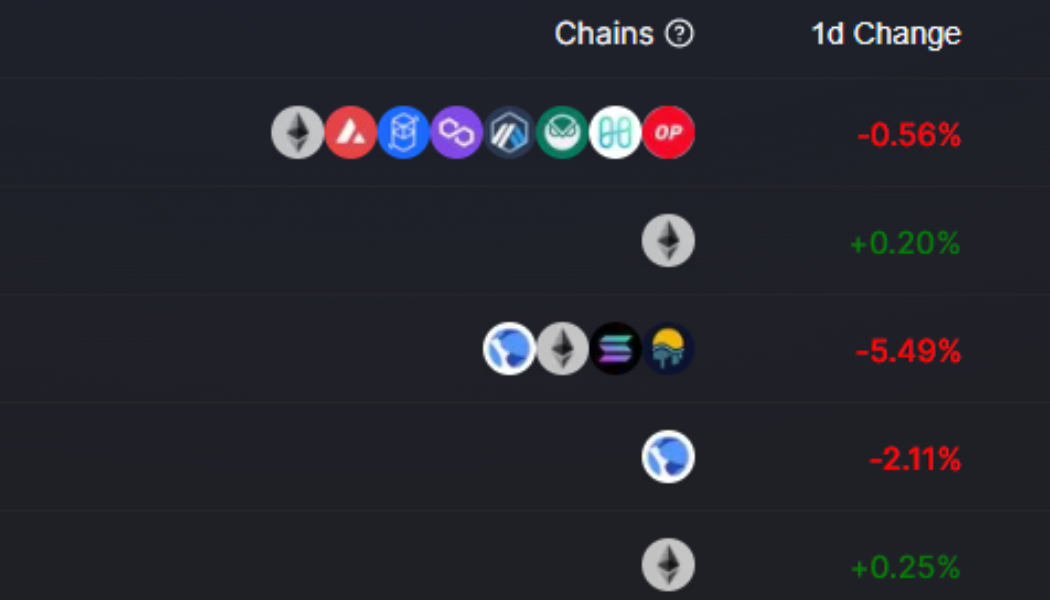

Altcoin Roundup: 3 portfolio trackers NFT and DeFi investors can use to stay organized

The cryptocurrency ecosystem has seen a tremendous amount of growth over the past couple of years, as the introduction of decentralized finance (DeFi) and the popularity of nonfungible tokens (NFT) have led to an explosion of projects on more than a dozen blockchain networks. The rapidly growing ecosystem means investors have to keep track of multiple wallet addresses, making portfolio trackers a popular option for traders needing to manage a diverse multichain portfolio. Here are three portfolio-tracking decentralized applications, or DApps, crypto traders can use to help monitor their investments. Zapper Zapper supports the basic management of cryptocurrencies held on 11 different networks including Ethereum, Polygon, BNB Chain, Fantom, Avalanche and Optimism. The basic layout of t...

- 1

- 2