Decentralized Finance

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...

Income generation on DeFi, explained

Modern tools can improve the earning process by diversifying asset exposure and empowering AI for quicker reaction times. Although DeFi returns appear promising, investors must continue to air on the side of caution and remember even in DeFi, “get-rich-quick” schemes do not exist. Instead, a minimum level of awareness on topics such as how the blockchain works and what an automated market maker (AMMs) is are necessary for users to deploy passive income generation methods. Furthermore, early DeFi projects required users to be highly experienced while having adequate capital at their disposal. SingularityDAO is one of the few platforms that generate yield by trading cryptocurrency assets through an AI-powered DeFi portfolio, giving users access to a diverse range of crypt...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...

YFI price gains 46% in just four days after Yearn Finance’s $7.5M buyback

Yearn Finance (YFI) emerged as one of the best performers in the crypto market this week, rallying by over 46% in just four days to reach a two-week high above $29,100. YFI/USD daily price chart featuring its four-day bull run. Source: TradingView The gains surfaced primarily as Yearn Finance revealed that it has been buying back YFI en masse since November in response to a community vote to improve the YFI token’s economics. The decentralized asset management platform purchased 282.40 YFI at an average price of $26,651 per token — a total of over $7.50 million. Furthermore, Yearn Finance noted that it has more than $45 million saved in its Treasury and has “stronger than ever” earnings. As a result, it would — in the future — could deploy its income to buy...

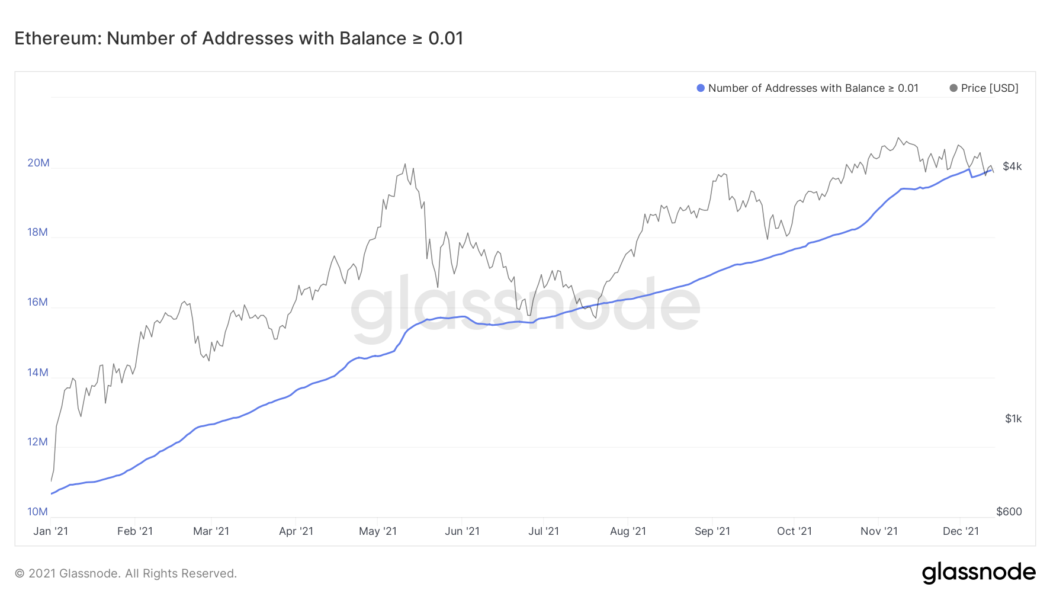

Small Ethereum investors increase exposure as ETH loses $4K level

Ethereum’s native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities. According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4, the day ETH dropped to as low as $3,575 (data from Coinbase). Ethereum addresses with balances less than or equal to 0.01. Source: Glassnode Meanwhile, the number of Ethereum wallets with balances of at least 0.1 ETH also kept climbing despite Ether’s correction from $4,867 to $3,575, eventually hitting a new all-time high of 6.37 million...

- 1

- 2