Decentralized Finance

Why DeFi should expect more hacks this year: Blockchain security execs

Decentralized finance (DeFi) investors should buckle themselves up for another big year of exploits and attacks as new projects enter the market and hackers become more sophisticated. Executives from blockchain security and auditing firms HashEx, Beosin and Apostro were interviewed for Drofa’s An Overview of DeFi Security In 2022 report shared exclusively with Cointelegraph. The executives were asked about the reason behind a significant increase in DeFi hacks last year, and were asked whether this will continue through 2023. Tommy Deng, managing director of blockchain security firm Beosin, said while DeFi protocols will continue to strengthen and improve security, he also admitted that “there is no absolute security,” stating: “As long as there is interest in the crypto market, the number...

Automation opens up pathway to a simplified, more user-friendly DeFi

Few doubt the potential that DeFi has to redefine crucial aspects of finance for all. But, as it stands, using DeFi platforms and protocols is often time consuming and anything but easy. One of the biggest draws of DeFi are the yields users can earn on farming and staking protocols. However, the yields on offer are constantly changing, meaning crypto enthusiasts need to stay locked to their screens to ensure they aren’t missing out. Given the 24-hour nature of this fast-moving industry, keeping on top of things is often easier said than done. Some protocols are also pretty difficult to use, requiring users to monitor a plethora of different pools. And even when you find the best returns that the market has to offer, the process of manual compounding can be quite tedious. In search of...

DeFi needs to start creating real-world value if it wants to survive

The total value locked in decentralized finance (DeFi) projects is hovering around $62 billion as of mid-August, down from a peak of over $250 billion in December 2021. Capital is fleeing the crypto space amid war, soaring inflation and whatever other surprises 2022 may still have in store for us. However, unlike previous crypto bull runs, it was not just retail interest that drew in this capital in the first place. Rather, major institutional players, which have recently opened up to crypto, quickly developed an appetite for the yields DeFi is known for. But now that winter is upon us, the pitfalls of high-yield platforms have become more apparent. Value can’t come out of thin air In some sense, value is always somewhat subjective, defined by one’s personal considerations and goals. A pho...

Investors shifting toward lower-risk crypto yields: Block Earner GM

Block Earner, an Australian fintech company, says the fall of Terra Luna in May has led to “positive surprises” for his company, with investors beginning to find their way toward the lower-risk crypto yield products they offer. Speaking to Cointelegraph, the company’s general manager Apurva Chiranewala revealed that the company has seen a surge of investors previously seeking double-digit returns but now wants a “less risky version” of those returns. “Given that the risks have gone up significantly for those returns, those guys have actually started coming in engaging with us because we look like the less riskier version of those double-digit return products.” Before their collapse, crypto lending platforms such as Celsius and Anchor Protocol offered annual percentage yields (APYs) o...

Gamers plug into DeFi through the new Razer rewards partnership

Gamers and customers of IT and gaming hardware firm Razer are set to plug into the world of decentralized finance (DeFi) through a new rewards swap program in partnership with Cake DeFi. Razer remains a household favorite brand for gamers around the world, with its Razer Gold rewards program allowing gamers to earn and redeem Razer Silver points for a variety of hardware and digital rewards, including Steam games and discount vouchers. Cake DeFi has teamed up with the rewards program from Razer to enable customers the ability to convert Razer Silver points into Cake DeFi vouchers. This essentially provides a bridge from the Razer loyalty program to the world of cryptocurrencies and DeFi products. Related: Crypto gaming and the monkey run: How we should build the future of GameFi Razer game...

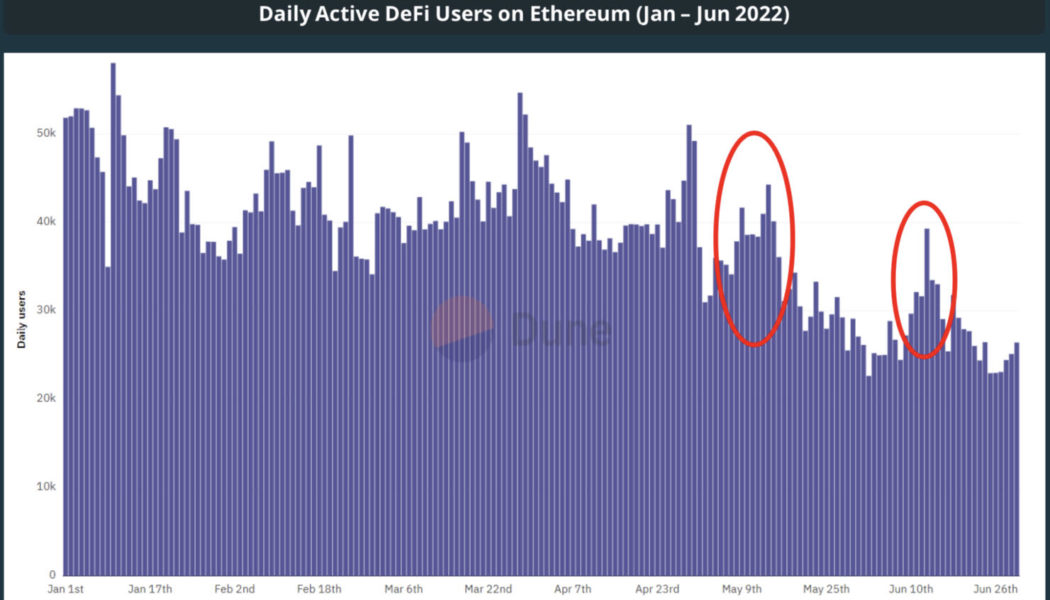

DeFi market fell off cliff in Q2 but users haven’t given up hope: Report

Despite the decentralized finance (DeFi) market suffering a 74.6% market cap decline in Q2, user activity has remained relatively resilient, says CoinGecko. In a report published by the crypto data aggregator on Wednesday, CoinGecko reported that the overall DeFi market cap fell from $142 million to $36 million over the second quarter, due mainly to the collapse of Terra and its stablecoin TerraUSD Classic (USTC) in May. CoinGecko also noted a rise in DeFi exploits in the quarter contributed to the fall, including Inverse Finance and Rari, which suffered hacks of $1.2 million and $11 million, respectively: “These attacks have negatively impacted token prices as investors lose faith in these hacked protocols.” However, CoinGecko also noted that while on-chain activity slowed down, the...

Nonfungible airdrops: Could NFA become the next big acronym in the crypto space?

Airdrops have become the bread and butter of the crypto world — for good reason. They’re an indispensable marketing tool for up-and-coming projects that want to create a buzz around their ecosystems. Done right, distributing free tokens to the public can help elevate demand — and unlock big benefits for recipients. After all, if these altcoins end up being listed on major exchanges at a later date, their value could explode. Unfortunately though, downsides have started to emerge. These campaigns aren’t just reaching enthusiasts who passionately believe in what a project has to offer, but “airdrop hunters” who are merely scouring for ways to turn a quick profit. Airdrop hunters typically want to sell off the tokens they’ve received for free — as soon as they ca...

Which decentralized finance innovations are expected by the DeFi community?

While the broader crypto market is on a downward spiral and social media is plagued with fears and complaints, some are choosing to focus on the decentralized finance (DeFi) space’s potential for the future. In a DeFi subreddit, Redditor Popular_Rub9075 asked community members what they want to see more of in the DeFi space. According to the Redditor, while negative discussions are prevalent in social channels, it’s a “great time” to look into projects that have potential, while the market is down. In response to the thread, Reddit user Crumbedsausage said that he wishes to see more Liquid Ether (ETH) staking projects that are non-custodial. In addition, the Redditor said that being able to run an Ethereum node with “1 ETH or less” may be good for ...

German BaFin official calls for ‘innovative’ EU-wide DeFi regulation

Birgit Rodolphe, an executive director at Germany’s Federal Financial Supervisory Authority (BaFin) has called for innovative and uniform regulation of the decentralized finance (DeFi) space throughout the European Union (EU). BaFin is Germany’s financial regulatory body responsible for regulating banks, insurance firms, and financial institutions including cryptocurrency companies. BaFin is the issuer of “crypto custody licenses,” a permit required for firms wanting to offer cryptocurrency services within Germany. In an article on BaFin’s website Rodolphe warned of the risks to consumers of the unregulated DeFi space and called for standardized regulatory considerations across EU member countries. Birgit Rodolphe, Executive Director Processing and Prevention of Money Laundering at B...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

DeFi token AAVE eyes 40% rally in May but ‘bull trap’ risks remain

A sharp rebound move witnessed in the Aave (AAVE) market in the last three days has raised its potential to rise further in May, a technical indicator suggests. AAVE price rebounds from key support Dubbed a “rising wedge,” the pattern appears when the price rises inside a range defined by two ascending, contracting trendlines. It typically resolves after the price breaks below the lower trendline with convincingly rising volumes. AAVE has been painting a similar ascending channel since early February 2022. The AAVE/USD pair has bounced in the past few days after testing the wedge’s lower trendline as support. This means the bulls are now eyeing the pattern’s upper trendline near $280, up over 40% from April 20’s price. AAVE/USD daily price chart. Sou...

Binance launches Binance Bridge 2.0 to integrate CeFi and DeFi

On Tuesday, centralized cryptocurrency exchange Binance announced the rollout of Binance Bridge 2.0. The feature enables users to bridge assets from any blockchain, including tokens not listed on the Binance app, to the BNB Chain. Bridged tokens listed on Binance will be stored in the Funding or Spot Wallet, while unlisted bridged tokens will be transferred to the Funding Wallet only. Users can bridge-in or bridge-out tokens between their native blockchains and BNB Chain via regular deposit and withdrawal functions. In the future, Binance also plans to create a better version of its mobile app to allow users to facilitate such conversion via a single click. Regarding the development, Mayur Kamat, head of product at Binance, said: “With Binance Bridge 2.0, we can make decentralized fi...

- 1

- 2