Decentralized Exchange

DeFi flashes early revival signs as retail and institutional inflows trickle in

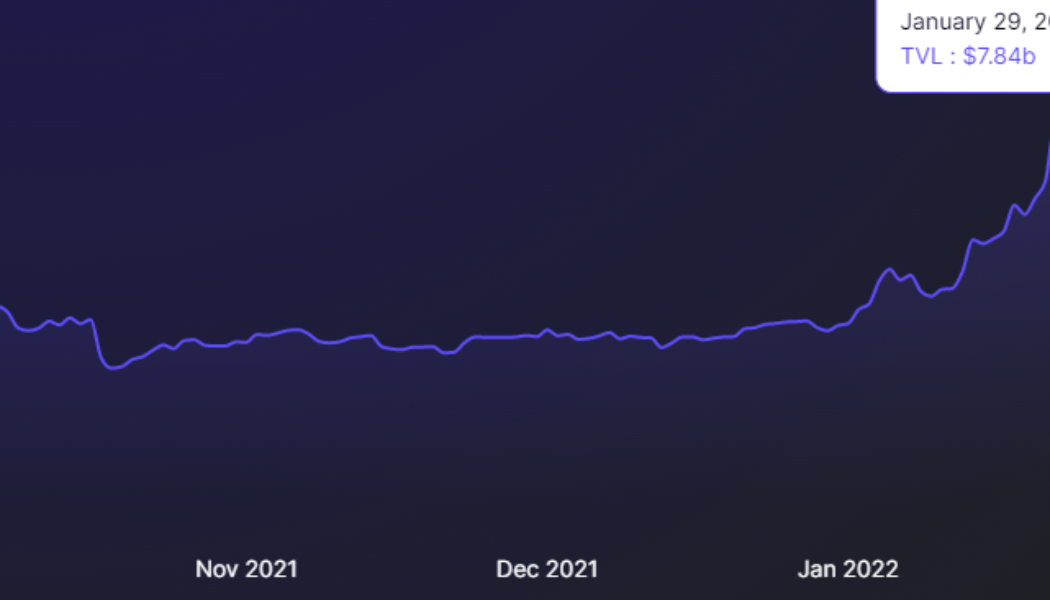

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

Stealth rulemaking: Is proposed SEC rule with no mention of crypto a threat to DeFi?

On Jan. 26, the United States Securities and Exchange Commission proposed amendments to Rule 3b-16 under the Exchange Act that lacks any mention of digital assets or decentralized finance, which could adversely affect platforms that facilitate crypto transactions. Some cryptocurrency advocates — including SEC Commissioner Hester Peirce — believe that the commission’s extended definition of an exchange could thrust an entire class of crypto entities under the regulator’s jurisdiction, subjecting them to additional registration and reporting burdens. How real is the threat? The proposed change The amendments proposed by the regulator dramatically expand the definition of what an exchange is while eliminating the exemption for systems that merely bring together buyers and sellers of securitie...

3 reasons why Telos (TLOS) price hit a new all-time high

It seems crypto winter is upon us and during times like these, projects that continue to forge ahead by focusing on development and expansion are often rewarded by traders who are looking to set up long positions where strong fundamentals trump the absence of short-term gains. One project that has weathered the storm in the crypto markets to establish a new all-time high is Telos (TLOS), a blockchain network created with the EOSIO software that aims to bring speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming and social media. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.42 on Jan. 10, the price of TLOS has soared 229% to a new high of $1.39 thanks in part to a record-high trading volume of...

Altcoin Roundup: Cross-chain bridge tokens moon as crypto shifts toward interoperability

Interoperability is shaping up to be one of the main themes for the cryptocurrency market in 2022 as projects across the ecosystem unveil integrations that make their networks Ethereum (ETH) Virtual Machine (EVM) compatible. While this has been one of the long-term goals of the ecosystem as a step on the path to an interconnected network of protocols, it has also created a new decentralized finance (DeFi) market for multi-chain bridges and decentralized finance. Here are three of the top volume cross-chain bridges that the cryptocurrency community uses to transfer assets between blockchain networks. Multichain Multichain (MULTI), formerly known as Anyswap, is a cross-chain router protocol that aims to become the go-to router for the emerging Web3 ecosystem. According to data from Defi Llam...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

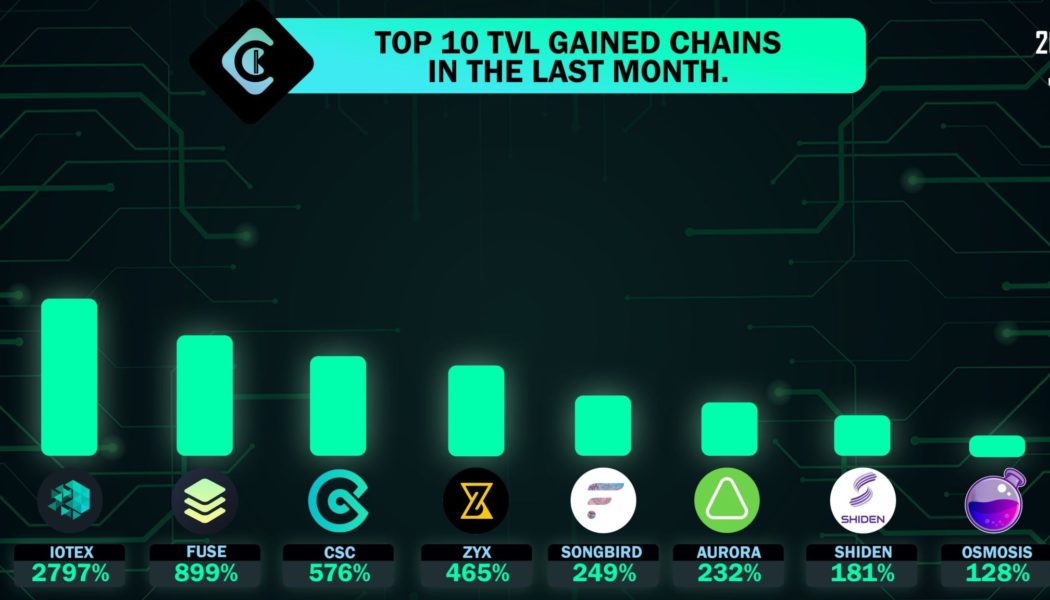

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

Moonbeam (GLMR) launch brings EVM interoperability closer to the Polkadot network

Cross-chain compatibility with the Ethereum (ETH) network has become a necessary component for any layer-one protocol looking to remain relevant because a majority of projects and funds locked in smart contracts are found on the top-ranked smart contract platform. After years of development and promises of interoperability, the Polkadot network moved toward its first Ethereum virtual machine (EVM) compatible smart contract protocol with the launch of Moonbeam (GLMR). The platform is designed to make it easy to use Ethereum developer tools to build or re-deploy Solidity projects in a Substrate-based environment. Data from Cointelegraph Markets Pro and TradingView shows that after a volatile start, which saw its price swing from a low of $8.40 on Jan. 11 to a high of $15.97 on Jan. 14,...

3 reasons why Harmony (ONE) rallied back to its all-time high this week

Bitcoin price is still a ways from its $69,000 all-time high but this isn’t stopping altcoins from moving toward new highs. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.13 on Dec. 4, the price of Harmony (ONE) has risen 163% to establish a new all-time high of $0.38 on Jan. 14 ONE/USDT 1-day chart. Source: TradingView Three reasons for the growing strength of Harmony include an expanding ecosystem, the launch of multiple cross-chain bridges and developers interest in finding Ethereum network alternatives. ONE benefits from Harmony’s $300 million ecosystem development fund One of the biggest boosts to the overall health of the Harmony ecosystem began back in September when the project launched a $300 million developer incentive p...

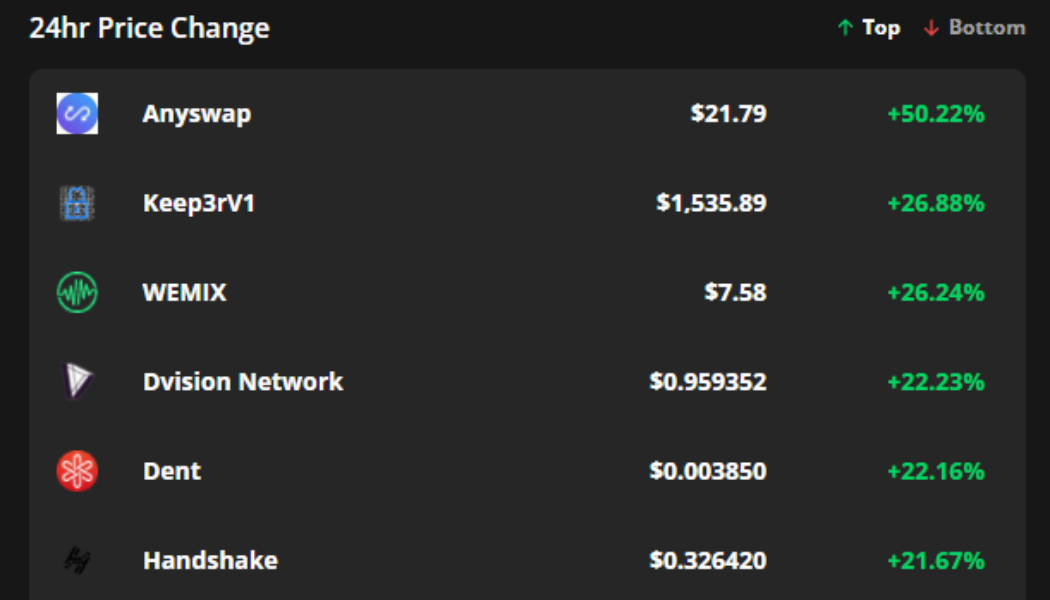

Anyswap, Keep3rV1, WEMIX follow Bitcoin’s move to $44K with double-digit rallies

The cryptocurrency community is back in high spirits on Jan. 12 after a majority of tokens in the top 200 flashed green following Bitcoin’s (BTC) spike to $44,000. The return of bullish momentum has come as a boon to several altcoin projects, with multiple tokens seeing gains in excess of 20%. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Anyswap (ANY), Keep3rV1 (KP3R) and WEMIX (WEMIX). Anyswap expands its list of supported networks Gains in the altcoin market were led by Anyswap, a decentralized exchange that specializes in allowing users to transfer and swap tokens between 25 distinct networks. Data from Cointelegraph Markets Pr...

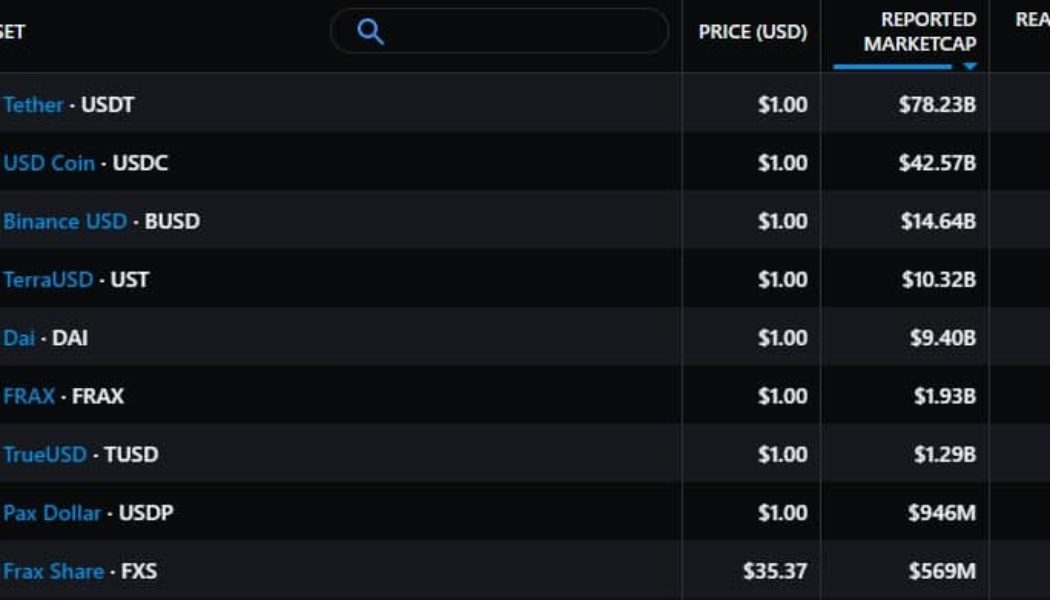

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

3 reasons why Cosmos (ATOM) price is near a new all-time high

Blockchain network interoperability is shaping up to be one of the main themes for the cryptocurrency ecosystem in 2022. New users are continuing to onboard into the growing world of crypto while both new and established projects search for the chain that will best serve the needs of their protocol and community. One project that has 2022 off to a bullish start thanks to its focus on facilitating the communication between separate networks is Cosmos (ATOM). This project bills itself as “the internet of blockchains” and seeks to facilitate the development of an interconnected decentralized economy. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $25.06 on Dec. 30, the price of ATOM has rallied 75% to hit a daily high at $43.98 on Jan. 4 as its 24-...