Decentralized Exchange

Former president of the New York Stock Exchange joins Uniswap Labs as an advisor

On Wednesday, Uniswap announced that former New York Stock Exchange president Stacey Cunningham will join the company as an advisor. Cunningham served as the first female president of the New York Stock Exchange after beginning her career as a trader on its floor. She said in a statement that she believes in the potential of Uniswap’s commitment to fairer markets.Uniswap is betting on her experience with TradFi translating over to DeFi to further help them evolve their place in Web3. Cunningham has also been listed as one of BBC’s 100 Women, and joined the NYSE board of directors in December 2021. 1/ We are beyond honored to welcome Stacey Cunningham @stacey_cunning, former president of the New York Stock Exchange @NYSE, as an Advisor to Uniswap Labs. — Uniswap Labs (@Uniswap) J...

Maiar decentralized crypto exchange goes offline after bug discovery

Minutes before 12 a.m. UTC on June 6, the CEO and co-founder of the Elrond Network, Beniamin Mincu, tweeted that he and his team were “investigating a set of suspicious activities” on the Maiar decentralized crypto exchange (DEX). Soon after the exchange was taken offline with Mincu reporting the issue was identified and an “emergency fix” was being implemented. In a Twitter thread posted almost 24 hours later around 11 p.m. UTC on June 6, Mincu said a potentially critical bug was identified which opened “an exploit area that we simply had to address and mitigate immediately.” The suspicious activities have been possibly identified and explained in a Twitter thread by pseudonymous on-chain analyst “Foudres” who revealed the potential attacker deployed a smart contract that someho...

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

Finance Redefined: Hacker bungles DeFi exploit, dYdx’s decentralization goals, and more

The decentralized finance (DeFi) ecosystem was filled with ups and downs —mostly the latter— this week, with two very distinct hack attempts and a heartbreaking departure of a DeFi veteran. In this week’s newsletter, we will also look at derivative exchange dYdX’s plans to go fully decentralized by the end of the year. The price momentum of the DeFi tokens remained neutral, with several tokens registering a bullish surge. However, the market volatility meant many of them couldn’t hold onto those gains. Hacker bungles DeFi exploit: Leaves stolen $1M in contract set to self destruct In a rare comedic bungle among DeFi exploits, an attacker has fumbled their heist at the finish line leaving behind over $1 million in stolen crypto. Blockchain security and analytics firm BlockSec shared o...

Is asymmetric information driving crypto’s wild price swings?

It has long been believed that investors possessing inside knowledge help drive cryptocurrencies’ price volatility, and a number of academic papers have been published on this topic. This is why Coinbase’s intention to regularly publish in advance a catalog of tokens being assessed for listing on its prominent trading platform is noteworthy. Coinbase’s plans, announced in an April 11 blog along with 50 crypto projects “under consideration” for Q2 2022, could help tamp down the pervasive speculation that surrounds small-cap tokens. Meanwhile, this can help alleviate industry concerns about “information asymmetry,” which typically occurs when one party to a transaction — a seller, for instance — is much better informed than another transactional party, such as a buyer. Last week’s pre-...

Kyber Network (KNC) soars after integrating with Uniswap v3 and Avalanche Rush Phase 2

The outlook for projects in the decentralized finance (DeFi) sector has begun to improve in recent months as a combination of global events have highlighted the benefits of holding funds outside of the traditional financial systems. One project that has rallied over the past few months is Kyber Network (KNC), a multi-chain cryptocurrency trading and liquidity hub that aims to offer users the best trading rates. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2.83 on April 6, the price of KNC jumped 55.4% to hit an all-time high of $4.04 on April 8 amid a 253% spike in its 24-hour trading volume. KNC/USDT 1-day chart. Source: TradingView Three reasons for the building momentum of KNC include the integration of support for ten separate blockchain n...

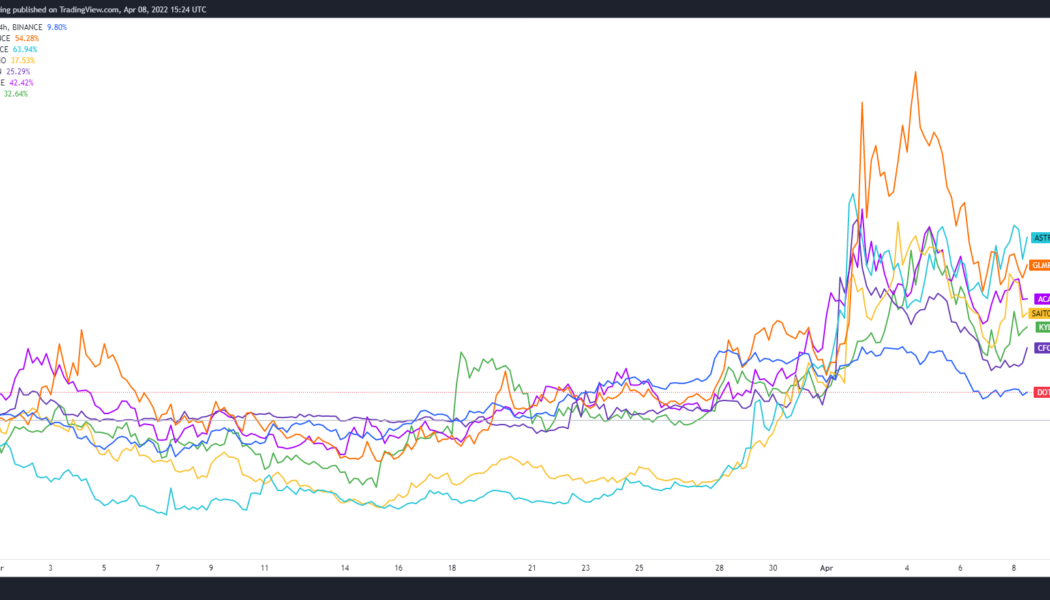

Altcoin Roundup: Interoperability push puts attention back on Polkadot

The Polkadot ecosystem sorely underperformed compared to other layer-1 networks in 2021, while the slow roll-out of parachain auctions and mainnet launches left the network playing catch-up in 2021. It appears that this trend came to an end in mid-March when numerous projects in the Polkadot ecosystem saw their prices climb higher after users began to engage with networks that expanded their offerings and made a push toward Ethereum Virtual Machine (EVM) compatibility. DOT, GLMR, ACA, ASTR, SAITO, CFG and KYL in USDT pairs. Source: TradingView Here’s a look at six top moving protocols in the Polkadot ecosystem that are helping to establish a presence in the cryptocurrency market. Interoperability is the key Interoperability has been one of the driving themes of the cryptocurrency market fo...

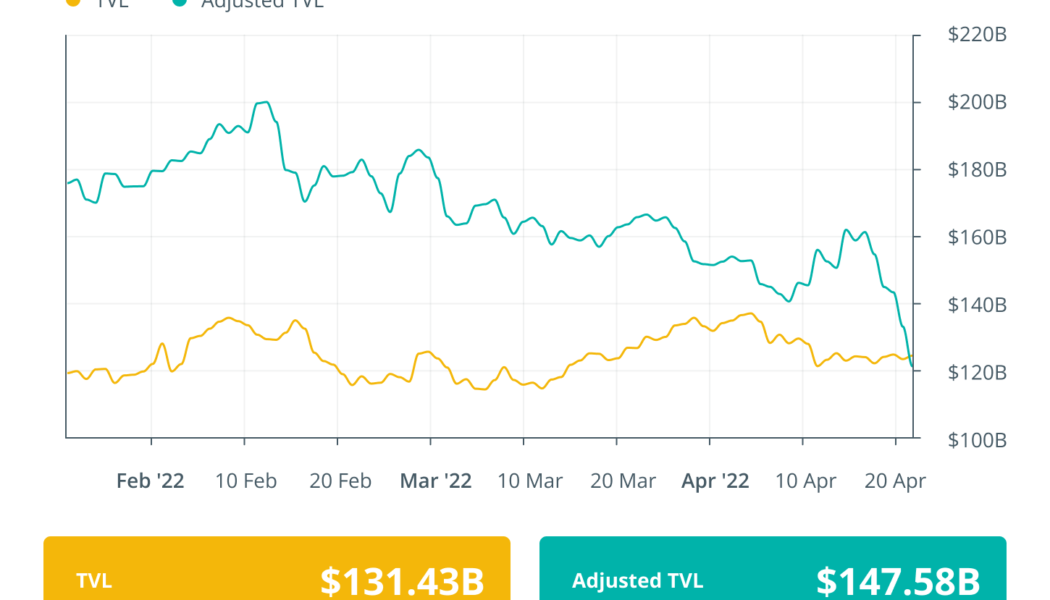

Finance Redefined: Axie Infinity creator raises $150M, DApp daily users surge to 2.4M and more

The decentralized finance (DeFi) world saw another week of increased on-chain and developer activity even when the overall market cap took a slight dip amid overall market retrace. The creators of the popular play-to-earn nonfungible token (NFT) game Axie Infinity raised $150 million to reimburse hack victims of the Ronin bridge exploit. The decantralized application, o daily user count surged to 2.4 million in the first quarter of 2022, while SushiSwap (SUSHI) and Synthetix (SNX) were booted out of Grayscale’s popular Decentralized Finance Fund. The widely-popular DeFi protocol Yearn.finance announced its support for the newly-passed ERC-4626 tokenized vault standard. The price momentum of the majority of DeFi tokens remained in red over the past week, as the overall crypto market registe...

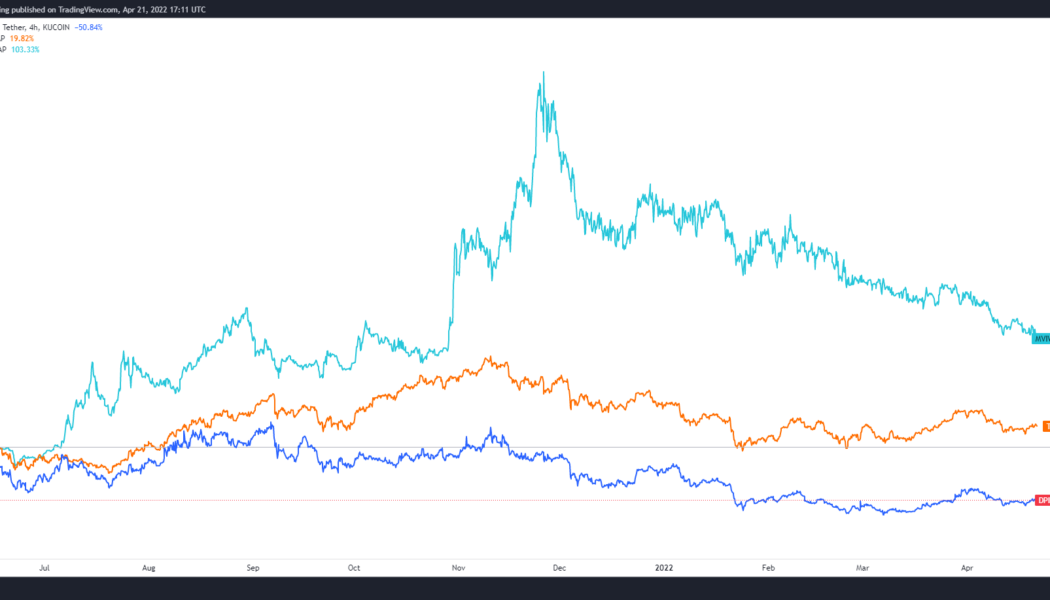

Astar (ASTR) price doubles as the network prepares to add 15 new projects in April

Following the successful completion of its initial parachain auctions, the Polkadot (DOT) ecosystem has begun to gain traction with the cryptocurrency community as the first chains begin to come online and integrate with Ethereum (ETH). Astar (ASTR) is one such Polkadot-based project that finished off the month of March on a hot streak after the multi-chain smart contract platform attracted the attention of retail and institutional crypto investors. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.107 on March 22, the price of ASTR has climbed 104% to a daily high at $0.208 on April 1 as demand for the token increased 20-fold. ASTR/USDT 4-hour chart. Source: TradingView Three reasons for the rally include the completion of a $22 million funding...

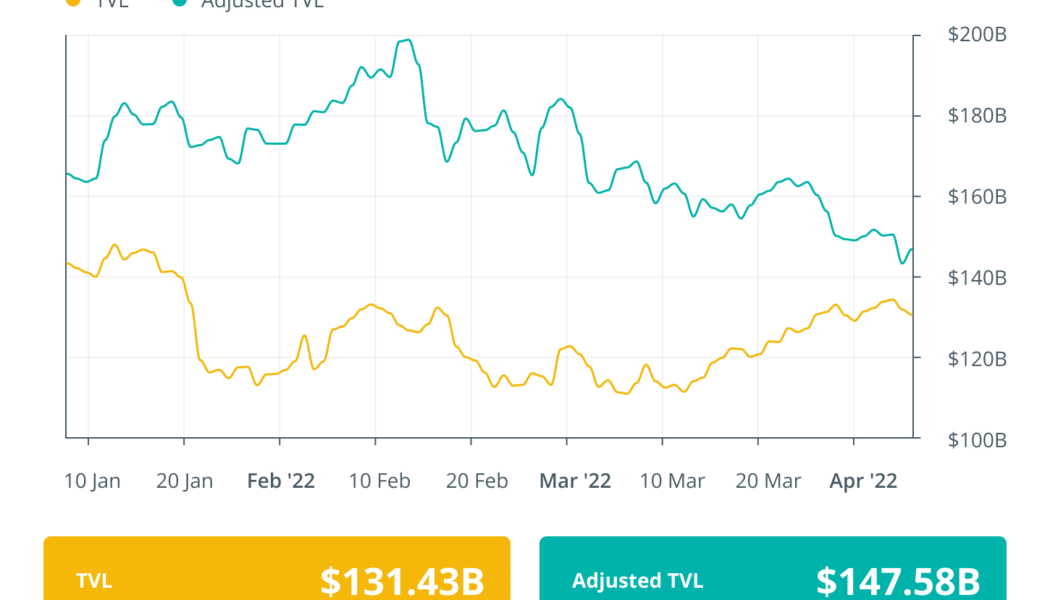

DeFi sector TVL rises as investors return to a bullish crypto market

The month of March has been a tale of two halves for the cryptocurrency market and the weakness seen since the start of the year has began to fade. Bitcoin’s (BTC) strong move above the $40,000 level is helping to lift sentiment across the sector, and DeFi tokens are also beginning to move upward. Crypto Fear & Greed Index. Source: Alternative.me Data from cryptocurrency market intelligence firm Messari shows that a majority of the top tokens in the DeFi sector have posted double-digit gains over the past 30 days, led by THORChain (RUNE), which has increased by 199.81%, and Aave (AAVE), which has seen its price increase 53.95% Top 12 DeFi assets. Source: Messari Here’s a rundown of the state of DeFi as the sector attempts to get back to its former glory and kickstart a new ...

Interoperability-focused Stargate Finance (STG) aims to kick off DeFi 3.0

“Stargate Finance” has been trending on Twitter for the past week and while it’s too early to call for a full-blown DeFi bull market, traders have been shoveling funds into the project, which claims to be a “composable omni-chain native asset bridge.” Data from Cointelegraph Markets Pro and TradingView shows STG was listed on exchanges on March 17 and its price has climbed 438% from a low of $0.665 to a high of $3.58 on March 25. STG/USDC 1-hour chart. Source: TradingView Here’s a look at some of the developments with the protocol that have attracted DeFi users and boosted the price of STG ahead of its initial community auction. Cross-chain composability Interoperability has been a growing theme across the cryptocurrency ecosystem and this theme continues to expand as inv...