Decentralized Exchange

FTX fallout: SBF trial could set precedent for the crypto industry

After the collapse of major cryptocurrency exchange FTX in November 2022, former CEO Sam “SBF” Bankman-Fried was arrested by Bahaman authorities on Dec. 12. Just a day later, the United States Securities and Exchange Commission and Commodity Futures Trading Commission filed charges against him for allegedly defrauding investors and violating securities laws. On Dec. 22, Bankman-Fried was granted bail on a $250 million bond paid by his parents against the equity in their house. The bail order added that he would require “strict pretrial supervision,” including mental health treatment and evaluation. The former CEO faces eight criminal counts in the United States, which could result in 115 years in prison if convicted. Bankman-Fried had been under house arrest at his parent’s home in Califor...

Trust is key to crypto exchange sustainability — CoinDCX CEO

Investor sentiment has always been a critical driver in the crypto space. Both positive and negative sentiment influence ongoing trends — be they price movements, product launches or regulations. In 2022, sentiment worldwide suffered as major crypto firms and ecosystems collapsed, further straining investors amid an unforgiving bear market. While many showed resilience as Terraform Labs, Celsius and Voyager, among others, closed down, Sam Bankman-Fried’s alleged misappropriation of FTX customers’ funds drove even the most die-hard crypto investors to question the integrity of those running the show. A series of scams, crashes, bankruptcy filings and court cases have forced investors to rethink how they store crypto and seek accountability from crypto exchanges. Proof of reserves (PoR) beca...

CFTC files suit against Avraham Eisenberg for market manipulation in Mango exploit

The United States Commodity Futures Trading Commission (CFTC) filed suit against self-described digital artist Avraham Eisenberg on Jan. 9, charging him with two counts of market manipulation in connection with an exploit of decentralized finance platform Mango Markets. Eisenberg was arrested on related charges on Dec. 27 and is currently in custody. The CFTC claimed in its suit that Eisenberg “engaged in a manipulative and deceptive scheme to artificially inflate the price of swaps offered by Mango Markets […] culminating in the misappropriation of over $100 million from the platform” in October. According to the filing, Eisenberg “purchased over 400 million MNGO-USDC Swaps on Mango Markets with a position size of approximately $19 million.” Cast your vote now! Eisenberg then bought “larg...

Crypto layoffs mount as exchanges continue to be ravaged by the prevailing bear market

There’s no denying that the crypto market has been gripped by immense bearish pressure over the past year, as made evident by the fact that the total capitalization of this sector has continued to hover below the $900 billion mark for most of the year after having scaled up to an all-time high of $3 trillion in 2021. These conditions have been characterized by many companies facing insolvency, as well as many of the world’s top exchanges laying off their staff in recent months. Moreover, the recent FTX debacle has set in motion a contagion effect that has continued to have a major effect on several crypto platforms, dissuading newer investors from entering the space in the process. Since Q2 2022, a host of prominent crypto entities (including many digital asset trading and lending platform...

$3.9 billion lost in the cryptocurrency market in 2022: Report

Immunefi, a bug bounty and security services platform for the Web3 ecosystem, published a report on Jan. 6 revealing that the crypto industry lost a total of 3.9 billion dollars in 2022. According to the report, hacks were found to be the main cause of the losses, accounting for 95.6% of the total, with fraud, scams, and rug pulls comprising the remaining 4.4%. Immunefi also found that decentralized finance (DeFi) was the most targeted sector, suffering 80.5% in losses, compared to centralized finance (CeFi) which suffered a loss of 19.5%. According to the report: “DeFi has suffered $3,180,023,103 in total losses in 2022, across 155 incidents. This number represents a 56.2% increase compared to 2021, when DeFi lost $2,036,015,896, in 107 incidents.” BNB and Ethereum were the mos...

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

Uniswap to allow users to buy cryptocurrency using debit and credit cards

Decentralized exchange Uniswap has partnered with fintech company Moonpay to allow users to buy cryptocurrency on its web app using debit cards, credit cards, and bank transfers. The bank transfer option is being rolled out for users within most U.S. states, Brazil, the United Kingdom and the Single Euro Payments Area, also known as SEPA. In the announcement made on Dec. 20, Uniswap shared that its users will now be able to convert fiat to cryptocurrency on the Ethereum mainnet, Polygon, Optimism, and Artibrum in a matter of minutes. 1/ Go direct to DeFi Starting today, you can now purchase crypto on the Uniswap Web App using a credit/debit card or bank transfer at the best rates in web3 thanks to our partnership with @moonpay! https://t.co/YVyk8e6d2h — Uniswap Labs (@Uniswap) Decemb...

DEX token GMX rallies 35% after beating Uniswap on trading fees for the first time

The price of GMX rallied to its second-highest level in history on Dec. 1 as traders assessed the decentralized exchange’s ability to evolve as a serious competitor to its top rival Uniswap (UNI). GMX established an intraday high of $54.50 in a recovery that started on Nov. 29 from $40.50. Its rally’s beginning coincided with crypto research firm Delphi Digital’s tweet on the GMX decentralized exchange, as shown below. GMX/USD four-hour price chart. Source: TradingView GMX beats Uniswap in fees for the first time Notably, GMX had earned about $1.15 million in daily trading fees on Nov. 28, which surpassed Uniswap’s $1.06 million trading fees on the same day. GMX Flipped Uniswap in Daily Fees on Nov. 28. Source: Delphi Digital This seemingly renewed buyin...

FTX funds on the move as thief converts thousands of ETH into Bitcoin

According to blockchain analysis company Chainalysis, funds stolen from the FTX crypto exchange are now being converted from ETH into Bitcoin. On Nov. 20, Chainalysis took to Twitter to encourage exchanges to freeze these coins, should the thief attempt to convert them into fiat or further obfuscate the assets through other means. 1/ Funds stolen from FTX are on the move and exchanges should be on high alert to freeze them if the hacker attempts to cash out — Chainalysis (@chainalysis) November 20, 2022 Amid the controversial collapse and bankruptcy of FTX, news broke that an unknown actor had stolen 228,523 ETH from the exchange. The ownership of these coins, worth a whopping $268,057,479 USD at time of publication, currently rank the thief as one of the largest owners of ETH in the world...

What directional liquidity pooling brings to DeFi

Modern decentralized exchanges (DEXs) mainly rely on liquidity providers (LP) to provide the tokens that are being traded. These liquidity providers are rewarded by receiving a portion of the trading fees generated on the DEX. Unfortunately, while liquidity providers earn an income via fees, they’re exposed to impermanent loss if the price of their deposited assets changes. Directional liquidity pooling is a new method that is different from the traditional system used by DEXs and aims to reduce the risk of impermanent loss for liquidity providers. What is directional liquidity pooling? Directional liquidity pooling is a system developed by Maverick automated market maker (AMM). The system lets liquidity providers control how their capital is used based on predicted price changes. In the t...

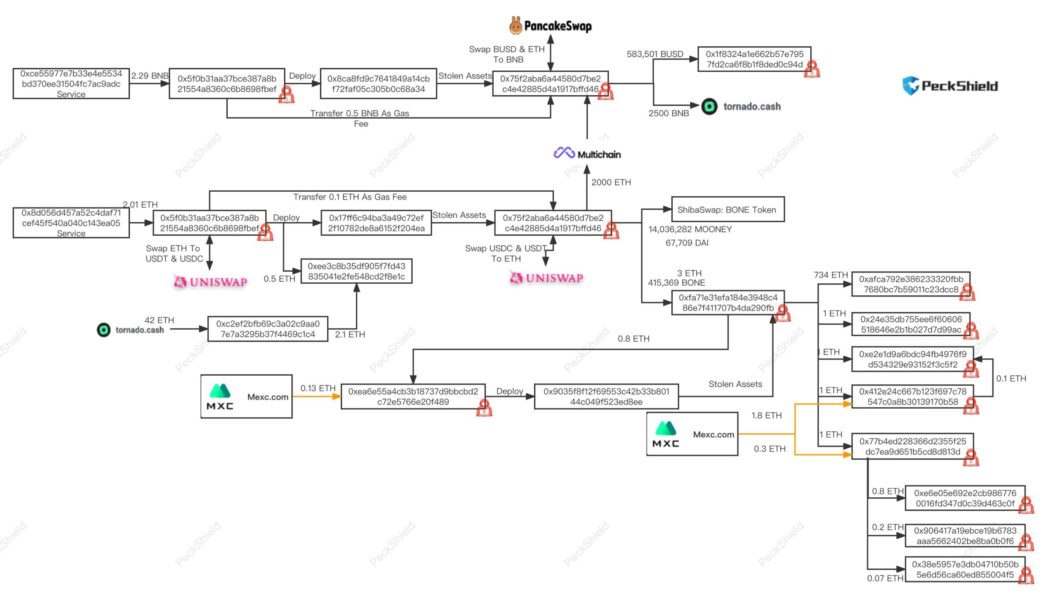

Transit Swap loses over $21M due to internal bug hack, issues apology

Transit Swap, a multi-chain decentralized exchange (DEX) aggregator, lost roughly $21 million after a hacker exploited an internal bug on a swap contract. Following the revelation, Transit Swap issued an apology to the users while efforts to track down and recover the stolen funds are underway. “We are deeply sorry,” stated Transit Swap while revealing that a bug in the code allowed a hacker to make away with an estimated $21 million. Blockchain investigator Peckshield narrowed down the attack to a compatibility issue or misplaced trust in the swap contract. pic.twitter.com/KJ7u5xoxBp — Transit Swap | Transit Buy | NFT (@TransitFinance) October 2, 2022 Peckshield, along with other investigators, including SlowMist, Bitrace and TokenPocket joined in on the pursuit to track down the hacker. ...

Blurring the line between crypto and TradFi could redefine global finance

Despite the current struggle in the global economy, the gap between traditional finance (TradFi) and crypto seems to be closing with each passing day. For example, earlier this month, Vienna-based fintech unicorn Bitpanda announced that it was adding commodities to its list of investment options, thus allowing investors to rake in profits from short-term price fluctuations related to traditional instruments such as oil, natural gas and wheat. In a recent interview with Cointelegraph, the company’s CEO, Eric Demuth, noted that the bear market had had no major impact on investor demand. He claims that more people are now looking for solutions that can bring the world of TradFi and decentralized finance (DeFi) together. Not only that, there are lessons to be learned about what works out...