Decentralization

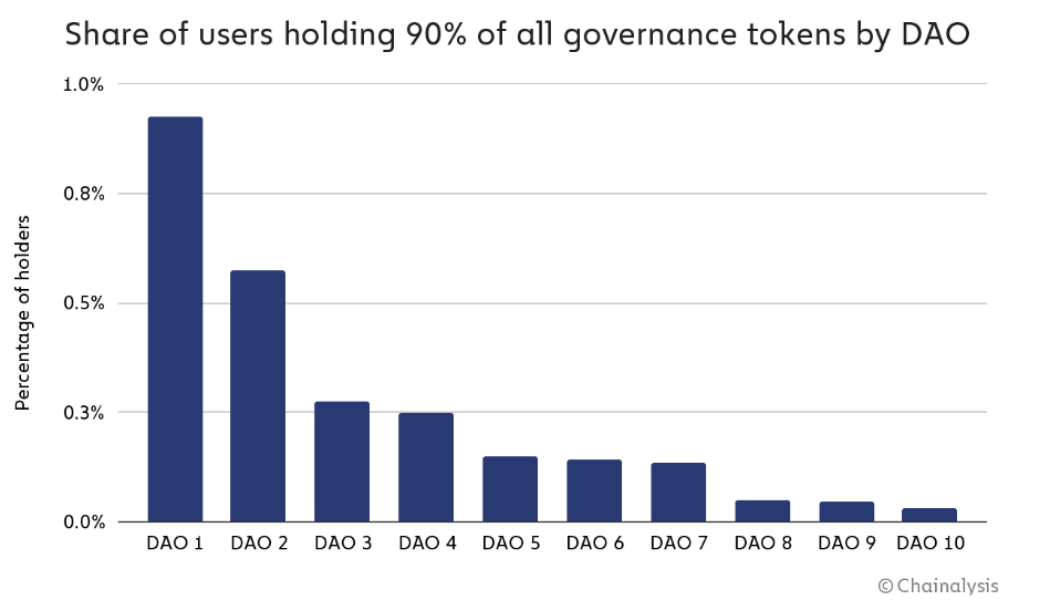

Less than 1% of all holders have 90% of the voting power in DAOs: report

Decentralized autonomous organizations (DAOs) have become a rage in the ever-expanding crypto ecosystem and are often seen as the future of decentralized corporate governance. DAOs are organizations without a centralized hierarchy, intended to work in a bottom-up manner, where the community collectively owns and contributes to an organization’s decision-making process. However, recent research data suggests that these DAOs are not as decentralized as it was intended to be. A recent report from Chainalysis analyzed the workings of ten major DAO projects and found that on average, less than 1% of all holders have 90% of the voting power. The finding highlights a high concentration of decision-making power in the hands of a selected few, an issue DAOs were created to resolve. This...

Axie Infinity to compensate Ronin exploit victims and relaunch bridge

Sky Mavis, the creator of the play-to-earn game Axie Infinity, announced that it will reimburse victims of the Ronin bridge hack and reopen the bridge next week. In March, hackers stole more than $620 million in the heist, which included roughly 17,600 Ether (ETH) and 25.5 million USDC tokens. According to a Bloomberg report on Friday, Once the bridge reopens on June 28, users will be able to withdraw one ETH for each one they possessed before the attack. In April, Cointelegraph reported that Sky Mavis closed $150 million in fresh capital led by Binance to refund hack victims. Animoca Brands,16z, Dialectic, Paradigm, and Accel were among the investors during the funding round. Bridge being refilled on the 28th Now it’s time for @Ronin_Network and @SkyMavisHQ to expand its games portfolio I...

How a DAO for a bank or financial institution will look like

DAOs can provide several services for banks, including asset management, compliance and lending. Banks today are already using blockchain technology for things like payment, clearing and settlement, trade finance, identity and syndicated loans, according to The Financial Times. However, there are still many unexplored areas in banking where a DAO-based model might be useful: Fundraising In the crypto world, initial coin offerings (ICOs) are breaking down the barrier between access to capital and traditional services like capital-raising firms. Likewise, banks can use DAOs to raise capital from a wider pool of investors via ICOs. Loans and Credit Using decentralized technology in banking can eliminate the need for gatekeepers in the lending industry. DAOs provide more secure ways for people...

Elusive Bitcoin ETF: Hester Perice criticizes lack of legal clarity for crypto

The crypto sector may be maturing, but regulatory clarity around the treatment of digital assets continues to remain cumbersome. This was recently highlighted by Commissioner Hester Peirce — also known as the United States Securities and Exchange Commission’s (SEC) “crypto mom” — in remarks she made at “The Regulatory Transparency Project Conference on Regulating the New Crypto Ecosystem: Necessary Regulation or Crippling Future Innovation?” Peirce began her speech by emphasizing the importance of “regulating the new crypto ecosystem.” While this may be, Peirce also noted that the crypto industry is still in search of an actual regulator. She said: “A bipartisan bill announced last week attempts to answer that question. Some people in the crypto industry are celebrating the all...

Ankr partners with Optimism to provide a fast and reliable RPC service for users

Ankr, a company that provides one-click node deployment and Web3 infrastructure, has announced that it will become a remote procedure call provider for Optimism. Optimism is an open-source Layer 2 scaling solution for Ethereum that focuses on speed and efficient transactions across the network. It has caught the eyes of many in recent months, including Ethereum co-founder Vitalik Buterin. This is a great example of why I’m so proud of @optimismPBC for adding non-token governance (the Citizen House). Optimism explicitly has goals *other* than just “make OP go up”, and the only way to do that long-term is with explicit representation of non-token-holder interests. pic.twitter.com/vofVVx53mC — vitalik.eth (@VitalikButerin) June 3, 2022 Ankr has assisted many industry leaders...

The crypto industry must do more to promote encryption, says Meltem Demirors

“I like to call myself a future, or aspiring, cult leader,” Meltem Demirors, chief strategy officer of CoinShares — a publicly listed investment firm managing around $5 billion in assets — told Cointelegraph. Demirors, who first entered the Bitcoin (BTC) space in late 2012, further mentioned that it has been “fun to see how big the crypto sector has become,” noting that people from all walks of life are now interested in the cryptocurrency space. As such, Demirors explained that “crypto cults” are bringing people together in a positive manner, especially since it gives people a sense of purpose and belonging. When it comes to regulations — one of the most important topics facing the crypto industry today — Demirors expressed skepticism. “Having been in this industry professiona...

Centralized vs. decentralized digital networks: Key differences

A decentralized digital network is not controlled by a central authority. Instead, control is distributed among its users. There is no single server or point of command. Rather, the network is run on a peer-to-peer basis, with each user wielding equal power and responsibility. A great example of a decentralized network is the internet, itself, which is not controlled by one authority. Rather, it is distributed among its users. However, some argue that the internet is moving toward centralization due to the monopoly of big names within the space—Google, Facebook, WordPress and the like. How so? Data is concentrated within these big players’ servers. As such, everything one needs to access online goes through any one of them. So to answer the question, “Is the internet ...

Corporate evolution: How adoption is changing crypto company structures

Crypto-focused companies have come a long way since their beginnings in terms of corporate structure, employee motivation, decision-making systems, compliance and other aspects of their operations. While the early 2010s saw startups founded by small groups of crypto enthusiasts, the space has since grown to become home to large institutional businesses. Still, crypto companies are engaged in business, and business is alien to anarchy. The rapid growth of the cryptocurrency industry in the 2010s transformed small, independent businesses into huge conglomerates with thousands of employees and offices worldwide. Investment funds and professional investors own shares of them, many have functioning boards of directors, and their corporate structures have dozens of departments and divisions. But...

Crypto’s youngest investors hold firm against headwinds — and headlines

These can be anxious times for holders of cryptocurrencies, especially those who entered the market in late 2021 when prices were cresting. Bitcoin (BTC), Ether (ETH) and especially altcoins now appear to be undergoing a major reset, down 50% or more from November highs. Some worry that a whole generation of crypto adopters could be lost if things crumble further. “If the market decline continues, it will become too painful and retail investors will bail,” Eben Burr, president of Toews Asset Management, told Reuters earlier this month. “Everyone has a breaking point.” But, all the gloom and doom could be overdone. It’s “unnerving,” acknowledged Callie Cox, United States investment analyst at eToro, but it’s only par for the course for a market that scarcely existed a decade ago. Bitcoin, a...

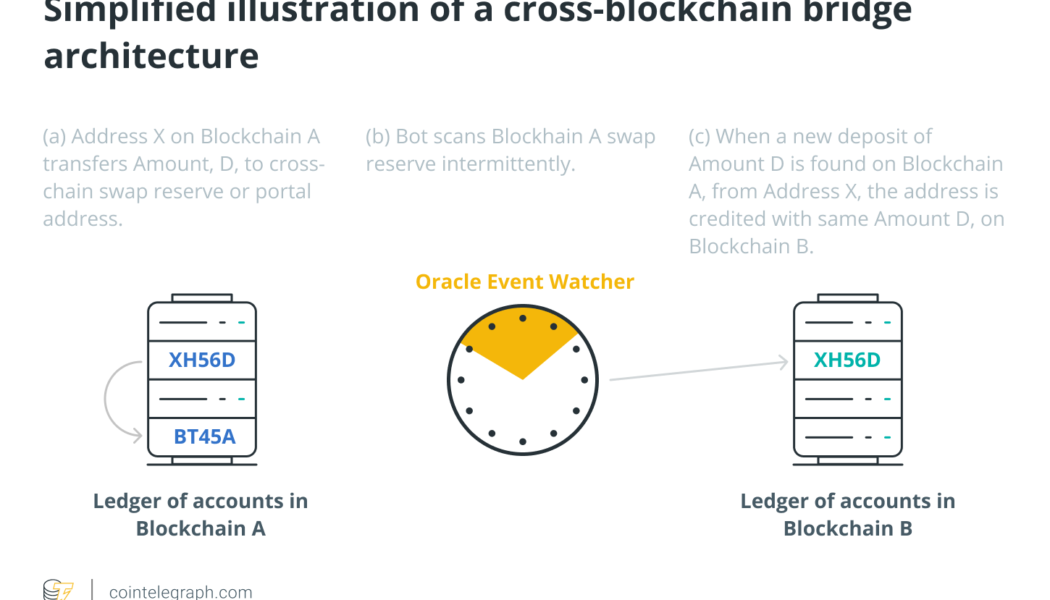

Is there a secure future for cross-chain bridges?

The plane touches down and comes to a halt. Heading to passport control, one of the passengers stops at a vending machine to buy a bottle of soda — but the device is absolutely indifferent to all of their credit cards, cash, coins and everything else. All of that is part of a foreign economy as far as the machine is concerned, and as such, they can’t buy even a droplet of Coke. In the real world, the machine would have been quite happy with a Mastercard or a Visa. And the cash exchange desk at the airport would have been just as happy to come to the rescue (with a hefty markup, of course). In the blockchain world, though, the above scenario hits the spot with some commentators, as long as we swap traveling abroad for moving assets from one chain to another. While blockchains as decentraliz...

Identity and the Metaverse: Decentralized control

“The Metaverse” and “Web3” are the buzzwords of the moment, with their concepts permeating across the worlds of fintech, blockchain, and now even mainstream media. With decentralization thought to be at the core of the Web3 Metaverse, the promise of a better user experience, security and control for consumers is what’s driving its growth. But with users’ identities at the heart of the Metaverse, coupled with unprecedented amounts of data online, there are concerns over data security, privacy and interoperability. This has the potential to hinder the development of the Metaverse, but both regulated and self-sovereign identities could play an important role in ensuring that we truly own our identity and data within this new space. Related: Digital sovereignty: Reclaiming your private data in...

Brazil’s Federal Revenue now requires citizens to pay taxes on like-kind crypto trades

Brazil’s Federal Reserve (RFB) has declared that Brazilian investors in the crypto-asset market must pay income tax on transactions that involve the like-kind exchange of cryptocurrencies; for example, Bitcoin (BTC) for Ethereum (ETH). The RFB’s declaration was published in the Diário Oficial da União and was the result of a consultation made by a citizen of the country to the regulator. At the end of last year, the group issued an opinion in which it claimed that trading between cryptocurrency pairs is taxable even if there is no conversion to the real (Brazil’s national currency). Although it does not specify what can be understood as “profit,” since in the exchange of one crypto asset for another there is no capital gain in fiat currency, it points out...