Decentralization

Japan’s Sumitomo Mitsui to issue soulbound tokens to explore Web3

The Japanese financial group Sumitomo Mitsui Financial Group (SMBC) is moving to explore the benefits of Web3 by issuing soulbond tokens (SBTs). Proposed by Ethereum creator Vitalik Buterin, SBTs refer to digital identity tokens that represent the characteristics or reputation of a person or entity, or a “soul.” Such tokens are non-transferable and are designed for the decentralized society and Web3. SMBC officially announced on Dec. 8 an initiative focused on the practical use of SBTs in partnership with the digital asset firm HashPort. The companies plan to conduct research on SBTs to find out their practical uses for communities, jobs, knowledge sharing services and decentralized autonomous organizations (DAOs). According to SMBC, the development could specifically be useful for individ...

Malta prepares to revise regulatory treatment of NFTs

The Malta Financial Services Authority (MFSA) is currently reviewing requests to revise the “regulatory treatment” of Non-Fungible Tokens (NFTs) within its Virtual Financial Assets Framework. Under the current regulatory framework, NFTs are included within the scope of the Virtual Financial Assets Act, which also includes virtual tokens, virtual financial assets, electronic money, and all financial instruments built, or dependent on, Distributed Ledger Technology (DLT). However, the MFSA is proposing to have NFTs removed from the Virtual Financial Assets framework since they’re unique and nonfungible and therefore incapable of being used as payments for goods and services, or for investment purposes. According to the MFSA, “the inclusion of such assets within the scope of the V...

P2P Financial Systems panel: Crypto core values and transparency are critical for DeFi

As one of the main growing sub-sectors in the crypto industry, decentralized finance (DeFi) has faced a challenging year amid market dynamics, cyberattacks and regulatory uncertainty. Its future demands more transparency and clarity in the regulatory landscape, according to a panel discussion at the International Workshop on P2P Financial Systems 2022 on Dec. 1. Moderated by Cointelegraph’s editor-in-chief Kristina Cornèr with Gaspard Pedruzzi, CEO of APWine; Daniel Perez, co-founder of Mero; Hugo Philion, CEO of Flare, and Niall Roche, CTO-in-residence at the University College London School of Management as panelists, the discussion focused on the DeFi future among a disruptive landscape worldwide. Perez emphasized the need for transparency for DeFi’s long-term success, as we...

What is tokenization and how are banks tapping into its design principles?

Tokenization is the process of converting something with tangible or intangible value into digital tokens. Tangible assets like real estate, stocks or art can be tokenized. In a similar vein, intangible assets like voting rights and loyalty points can be tokenized, too. We see Avios as an example of tokenized loyalty points by the traditional credit card industry. However, when tokens are created on a blockchain, they add a level of transparency that previous iterations of tokens couldn’t achieve. There are several banks that are experimenting with tokenization. But, before diving into the use cases in banking, it would be useful to understand the qualitative advantages that tokenization brings to financial services. As major financial institutions enter the crypto space, they pay spe...

Casper Association launches $25M grant to support developers on its blockchain

Scalable blockchain network Casper announced the launch of its new Casper Accelerate Grant Program on Nov. 23, created to support developers and innovators who are building apps to support infrastructure, end-user applications, and research innovation on its blockchain. JUST IN from @nextblockexpo: We’re glad to announce the launch of a $25M Casper Accelerate Grant Program. This fund will support learning, development, and innovations in Infrastructure, #dApps, #DeFi, #Gaming & NFTs. Learn more https://t.co/jClYyYxRVW pic.twitter.com/V8KszHEjM3 — Casper (@Casper_Network) November 23, 2022 The Casper Network is a Proof-of-Stake (PoS) enterprise-focused blockchain designed to help businesses to build private or permissioned apps, aimed at accelerating businesses and the adopti...

Decentralization index from Cardano builder, U of Edinburgh will help users understand assets

The University of Edinburgh and Input Output Global (IOG), the builder of the Cardano network, have teamed up to create a blockchain decentralization index, IOG announced on its blog. The new service is the first of its kind and will use a “research-based” methodology developed at the university. The Edinburgh Decentralization Index (EDI) has been in development for several months and was introduced in Edinburgh on Nov. 18, but it is not yet operational, according to IOG: “The first step for the tracker is the creation of research papers detailing decentralization metrics and a considered methodology for compiling them into an index, created by researchers at the University of Edinburgh. It will then operate in the same way as other industry indexes.” When launched, the EDI will...

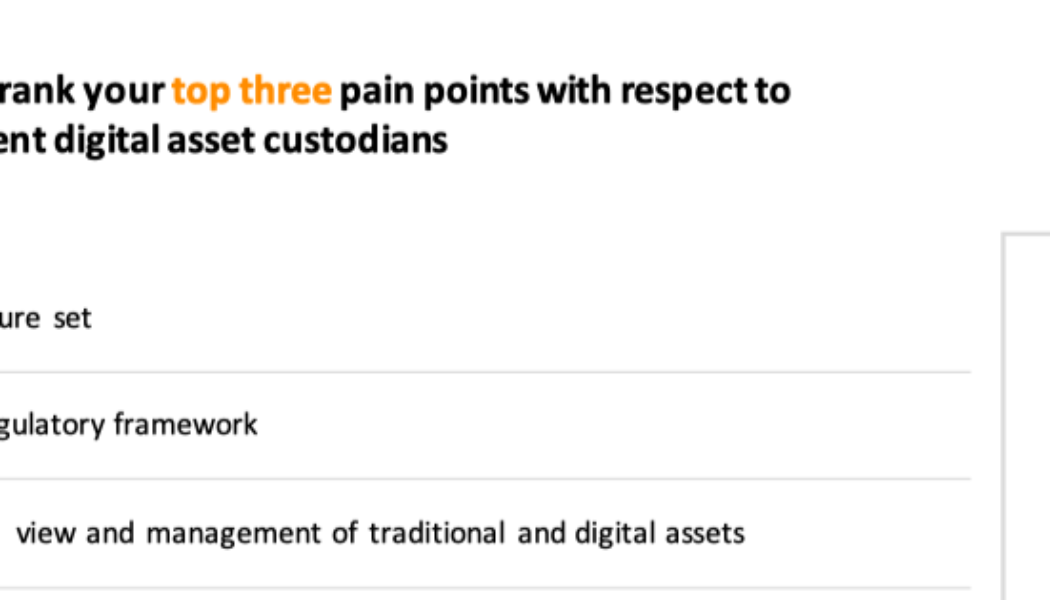

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

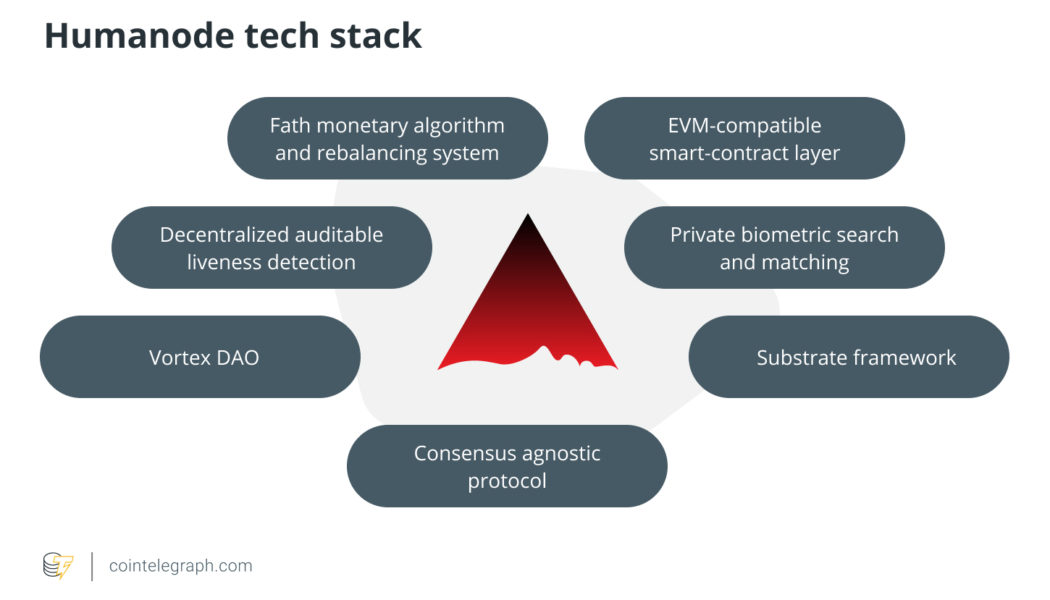

What is Humanode human-powered blockchain?

Humanode is a project that gracefully combines different technological stacks including blockchain and biometrics. Humanode tech encompasses a bunch of layers such as a blockchain layer represented by a Substrate module: a biometric authorization module based on cryptographically secure neural networks for the private classification of three-dimensional (3D) templates of users’ faces, a private liveness detection mechanism for identifying real human beings, a Vortex decentralized autonomous organization (DAO) and a monetary algorithm named Fath, where monetary supply reacts to real value growth and emission is proportional. Let’s look at them in more detail. Substrate framework Humanode is a layer-1 blockchain whose architecture lies on the Substrate open-sour...

CBDCs are a declaration of war against the banking system claims economist

CBDCs are a declaration of war against the banking system, Richard Werner — development economist and professor at De Montfort University — told Cointelegraph at Web Summit on Nov. 4. Known for his quantitative easing theory, published almost 30 years ago, Werner is an advocate for a decentralized economy. In an exclusive interview with Cointelegraph’s editor-in-chief Kristina Lucrezia Cornèr, he discussed the challenges that surround decentralization, the role of central banks, and how blockchain can help promote transparency in economies. This interview was part of Cointelegraph’s extensive coverage at Web Summit in Lisbon — one of the world’s leading tech conferences. Cointelegraph: Do you think that a decentralized financial system is actually possible? Richard Werner:...

Self-sovereignty in the creator economy and Web3 — Is there room for both?

On Oct. 28, NFT Steez, a biweekly Twitter Spaces hosted by Alyssa Expósito and Ray Salmond, met with Web3 content writer Julie Plavnik to discuss the importance of self-sovereignty while building a digital identity in Web3. Plavnik referenced author Gavin Wood when describing Web3 and said that “communication” is a core tenant in the subsequent iteration of the internet. “Web3 is the communication of encrypted channels between decentralized identities,” Plavnik affirmed. According to Plavnik, the emerging concept of Web3 placed a magnifying glass on user data and ownership, especially concerning the creator economy. Plavnik described the creator economy as a place with “no entry barriers or casting.” During the show, Plavnik explored how users are coming around to the notion that the...

What directional liquidity pooling brings to DeFi

Modern decentralized exchanges (DEXs) mainly rely on liquidity providers (LP) to provide the tokens that are being traded. These liquidity providers are rewarded by receiving a portion of the trading fees generated on the DEX. Unfortunately, while liquidity providers earn an income via fees, they’re exposed to impermanent loss if the price of their deposited assets changes. Directional liquidity pooling is a new method that is different from the traditional system used by DEXs and aims to reduce the risk of impermanent loss for liquidity providers. What is directional liquidity pooling? Directional liquidity pooling is a system developed by Maverick automated market maker (AMM). The system lets liquidity providers control how their capital is used based on predicted price changes. In the t...

BoE policy talk: DeFi had better implement good governance before it’s too late

The lack of regulation and good governance in the crypto sector is more than a hindrance to businesses and lack of protection for users, it is an existential threat, Bank of England Financial Policy Committee external member Carolyn Wilkins said in a talk on Oct. 19. Decentralized finance (DeFi) would be a good place to start getting affairs in order, she said. Speaking at the University College London Centre for Blockchain Technologies, Wilkins said that the most common complaints about scamming that reach the Financial Conduct Authority, the U.K. financial regulator, are about crypto. In addition to that financial risk, investors are also concerned about reputational risk, which, according to Wilkins, is present in DeFi in abundance. Today, UCL CBT hosted the talk given by Carolyn ...