Debts

Can Debt Consolidation Help Your Credit Score?

Image sourced from Focus Federal Credit Union. /* custom css */ .tdi_4_37e.td-a-rec-img{ text-align: left; }.tdi_4_37e.td-a-rec-img img{ margin: 0 auto 0 0; } So, you have heaps of debt and finally decided to get help. You’ve settled on debt consolidation, but you’re worried about how the financial strategy might affect your credit. But can debt consolidation actually help your credit score? You may be pleasantly surprised. Why Consolidate Debt? /* custom css */ .tdi_3_d63.td-a-rec-img{ text-align: left; }.tdi_3_d63.td-a-rec-img img{ margin: 0 auto 0 0; } Let’s start there. In short, consolidating your accounts can save you cash. For instance, if you have cards with an aggregate rate of, say, 24%, you can try to consolidate your balances into a new credit card or loan with a lower interest...

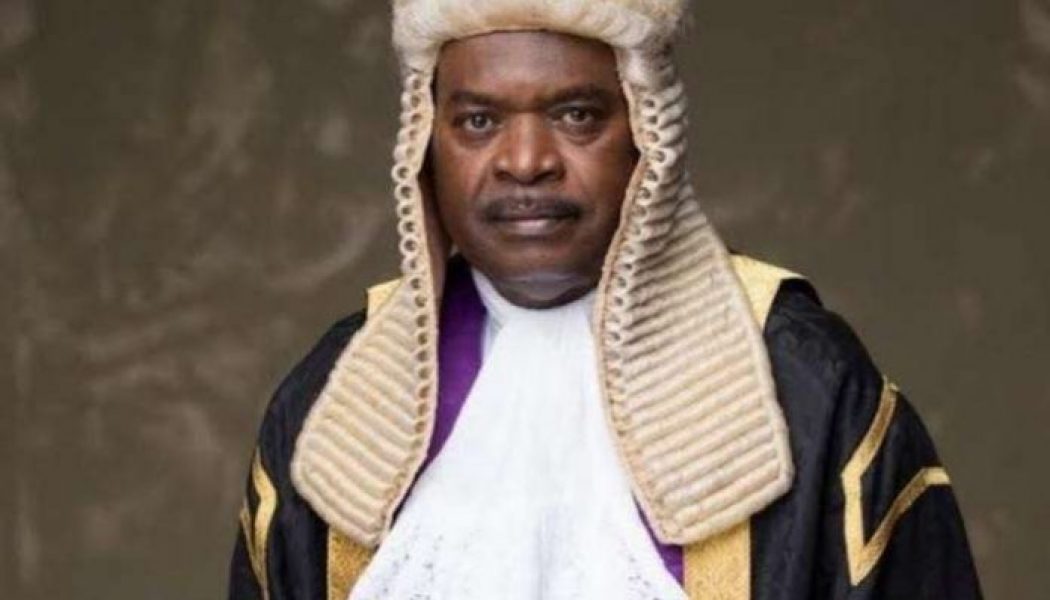

Senate passes amended AMCON bill, empowers agency to seize debtors’ assets

The Senate Wednesday passed the Asset Management Corporation of Nigeria Amendment bill after considering the report of its Committee on Banking, Insurance, and Other Financial Institutions. The amendment bill passed by the upper chamber empowers the Assets Management Corporation of Nigeria to, among others, take possession, manage or sell all properties traced to debtors, whether or not such assets or property is used as security/collateral for obtaining the loan in particular. It also empowers the corporation to access the Special Tribunal established by the BOFIA, 2020 for dealing with financial related matters. Presenting the report, Chairman of the Committee, Senator Uba Sani (APC, Kaduna Central) said the Committee engaged with stakeholders such as AMCON, Federal Ministry of Finance, ...

Seplat issues $650 million oil and gas bond

Seplat Petroleum Development Company, a Nigerian independent oil and gas firm, has issued $650 million in aggregate principal amount of senior notes due in 2026. It is said to be the largest ever Nigerian oil and gas bond issuance. A senior note is a type of bond that must be repaid before most other debts in the event that the issuer declares bankruptcy. It is more secure than other bonds. The dual listed company said the five-year bond was well-received in the market with orders from high quality institutional investors. “The notes priced at a yield of 7.75%, representing a significant pricing reduction from its $350 million debut issuance in 2018, which priced at a yield of 9.50% , with a coupon of 9.25%,” a statement by the company read. “The offering was well oversubscribed with deman...

DMO: Nigerian roads financed with Sukuk not repaying debt as planned

File Photo The Debt Management Office (DMO) has decried the country’s debt service to revenue ratio, describing it as a major issue of concern. Patience Oniha, the Director-General of DMO, said this in Abuja on Thursday at the fifth Budget Seminar (webinar) organised by the Securities and Exchange Commission (SEC). The theme of the budget seminar was, “Financing Nigeria’s Budget and Infrastructure Deficit through the Capital Market.” Oniha stressed the need for infrastructure built with borrowed funds to generate revenue to service the debts. According to her, “We have done the Sukuk, for instance, but the government is the one servicing the debt of those Sukuk. “They (the debts) are not being serviced with revenue from those sources (infrastructure). “I think that when we are talking abou...

Energy firms’ bank debts rise to N5.94 trillion

The debts owed to Nigerian banks by oil and gas operators as well as power companies in the country rose to N5.94tn at the end of 2020 from N5.25tn in December 2019. The N5.94tn represents 29.16 per cent of the N20.37tn loans advanced to the private sector by the banks as of December, according to the sectoral analysis of banks’ credit by the Central Bank of Nigeria. Oil and gas firms, which received the biggest share of the credit from the banks, increased their debt by N600bn to N5.18tn in December 2020 from N4.58tn in December 2019. The debt owed by power firms to the banks rose to N763.22bn in December 2020 from N671.45bn in December 2019, the CBN data showed. Oil firms operating in the downstream, natural gas and crude oil refining subsectors owed N393tn as of December, up from N3.42t...

- 1

- 2