DCG

Digital Currency Group halts dividends in an effort to preserve liquidity

Venture capital firm Digital Currency Group (DCG) has told shareholders it is halting its quarterly dividend payments until further notice as it attempts to preserve liquidity. According to the letter sent to shareholders on Jan. 17, the firm is focused on “strengthening our balance sheet by reducing operating expenses and preserving liquidity.” DCG said it was also considering selling some of the assets within its portfolio. Its financial issues are derived from the woes of a subsidiary, crypto broker Genesis Global Trading, which reportedly owes creditors more than $3 billion. Customers are currently unable to withdraw funds from Genesis after it halted withdrawals on Nov. 16, which has prompted Cameron Winklevoss — on behalf of his exchange Gemini and its users with fund...

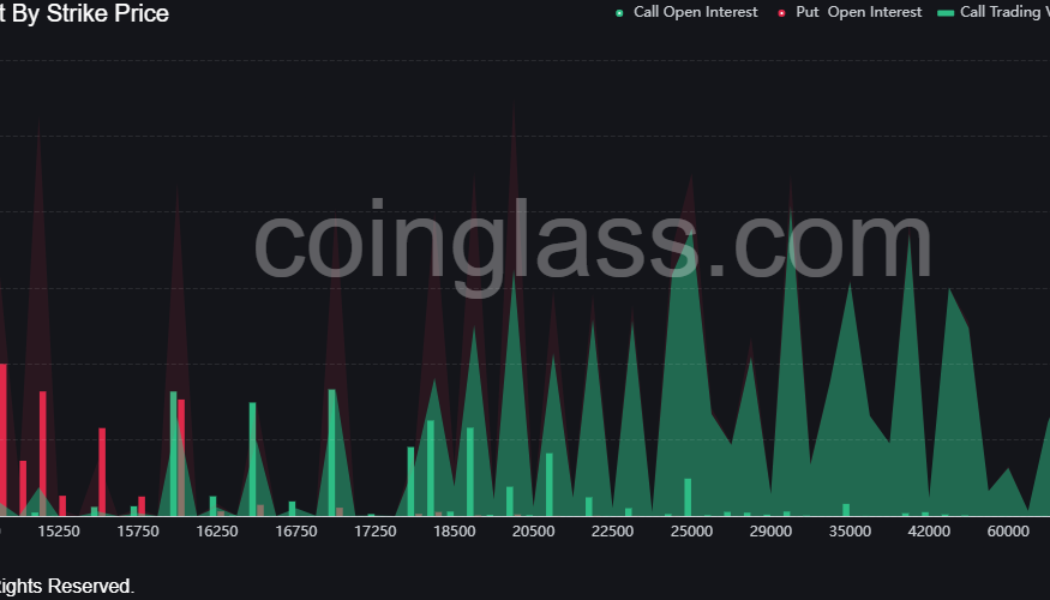

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...