DApps

Ferrum Network integrates with Algorand to advance EVM and AVM interoperability

Ferrum’s integration with Algorand provides for seamless Ethereum Virtual Machine (EVM) and Algorand Virtual Machine (AVM) interoperability. The integration expands Ferrum’s staking-as-a-service solutions onto the Algorand blockchain. Ferrum also plans to launch a multi-chain token bridge for Algorand before the end of Q2, 2022. Ferrum Network, a cryptocurrency network that seeks to help existing blockchain networks address interoperability issues via a suite of multi-chain infrastructure solutions, has announced successful integration with the Algorand blockchain. With this integration, the blockchain interoperability platform’s staking-as-a-service solutions are now accessible to projects in the Algrorand ecosystem. The Ferrum Network announced this via a press release shared...

How Web 3.0 apps must adapt to become next-gen of tech, explained

Unlike Web 2.0 applications, offerings built on Web 3.0 are enabling users with true data ownership. Web 2.0 brought about a major change to how the world views the internet, introducing online platforms like TikTok, Twitter, Meta (former Facebook) and Instagram, among others. Although valuable in the number of opportunities made available, Web 2.0 has brought concerns about data ownership. With users spending more time online, their data, including what they like, the content they create and other details about themselves, are being shared with big tech companies, many of which have been caught in data scandals in the past and paid their way out of it. Web 3.0 addresses these concerns by presenting a new reality for application usage. Leveraging verifiable, trustless, self-governing, perm...

AVAX traders anticipate a new ATH even as Avalanche DApp use slows

Avalanche (AVAX) jumped 43.8% between March 14 and March 31 to a $97.50 daily close, which is the highest level since Jan. 5. This layer-1 scaling solution uses a proof-of-stake (PoS) model and has amassed $9 billion in total value locked (TVL) deposited on the network’s smart contracts. AVAX token/USD at FTX. Source: TradingView Subnet adoption propels the recent price rally Some analysts attribute the rally to Avalanche’s incentive program to accelerate the adoption of subnets which was announced on March 9. According to the Avalanche Foundation, subnets enable functions that are only possible with “network-level control and open experimentation.” The program will allocate up to four million AVAX, worth roughly $340 million, to fund decentralized applications focused on gaming, nonfungib...

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

Omnichain developer LayerZero Labs raises $135M

On Wednesday, LayerZero Labs, a firm that develops protocol to enable omnichain decentralized applications, or dApps, to span multiple blockchains, announced that it raised $135 million in its latest funding round. The deal values LayerZero Labs at $1 billion and will accelerate the development of its namesake protocol. The round was led by notable venture groups and investors such as Sequoia Capital, FTX Ventures, Andreessen Horowitz, and with participation from Coinbase Ventures, PayPal Ventures, Tiger Global, Uniswap Labs, and more. It aims to unite applications such as gaming, nonfungible tokens, or NFTs, marketplaces, media apps, etc., so they are operable across multi-chain realms. Potential new use cases via LayerZero include: decentralized finance applications utilizing trading, bo...

Klaytn token down 15% in a month, but network’s TVL shows resilience

Klaytn (KLAY) had a promising start in March 2021, reaching an impressive $11 billion market capitalization following its debut. However, investors have exaggerated their expectations as the token’s current total value stands at $3 billion, down roughly 70%. KLAY/USD on Binance. Source: TradingView Although not as well known as the leading smart contract blockchains, Klaytn remains a top-35 token by capitalization rank. Moreover, the network holds $1.2 billion worth of deposits locked on smart contracts. Capital locked on smart contracts is known in the industry as total value locked, or TVL. Real use cases and strong backing Klaytn is a flexible modular network architecture created by Kakao, a publicly-traded South Korean internet giant. The Asian tech group’s shares are value...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

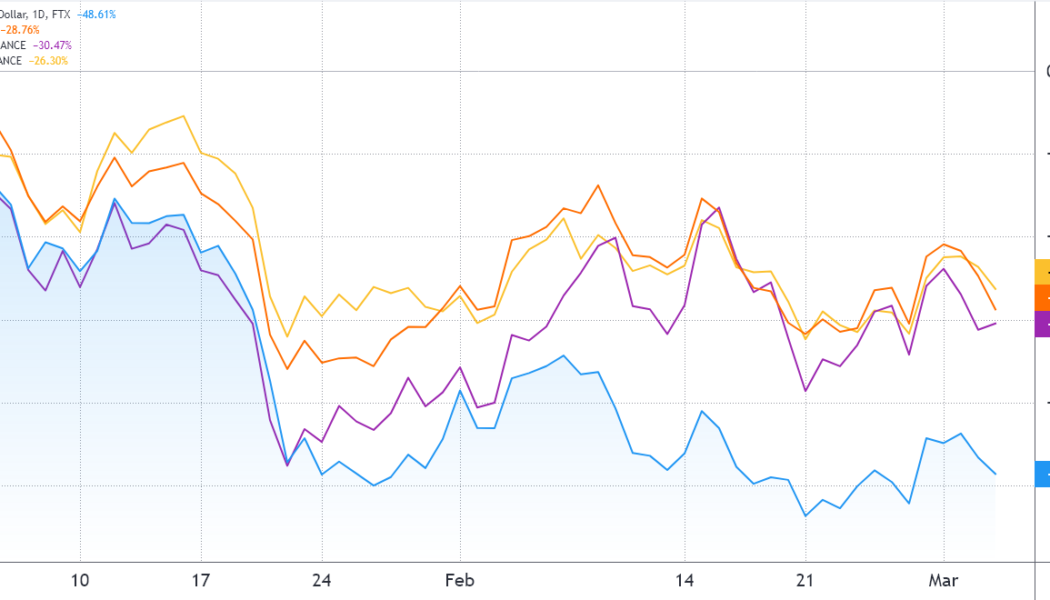

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...

Inside the blockchain developers’ mind: Can EOS deliver a killer social DApp?

Cointelegraph is following the development of an entirely new blockchain from inception to mainnet and beyond through its series, Inside the Blockchain Developer’s Mind, written by Andrew Levine of Koinos Group. In my first article in this series, I explained why Ethereum and Steem haven’t been able to deliver a mainstream social decentralized application (DApp), despite taking two very different approaches and how this makes the solution seem. Therefore, why not combine the fee-less system developed for Steem with the flexibility of a blockchain with smart contracts like Ethereum? Then, we could give developers the best of both worlds, enabling them to create free-to-use applications with the freedom to add new features whenever they want. One could argue that this is exactly what Dan Lar...

GALA gains 117% in February as P2E crypto gaming goes mainstream

The play-to-earn (P2E) gaming sector of the cryptocurrency ecosystem has been one of the most resilient sectors to the volatility and price declines seen in the past couple of months as gamers are jumping on the ability to earn income while playing tokenized videogames. One project that has seen its token price climb rapidly in the first week of February is Gala (GALA), a protocol focused on utilizing blockchain technology to give players control of the games they play and in-game items they acquire. Data from Cointelegraph Markets Pro and TradingView shows that the price of GALA climbed 117% after hitting a low of $0.177 on Feb. 2 to hit a daily high of $0.384 on Feb. 7. GALA/USDT 4-hour chart. Source: TradingView Three reasons for the rapid recovery in GALA price include the upcoming lau...

3 reasons why Telos (TLOS) price hit a new all-time high

It seems crypto winter is upon us and during times like these, projects that continue to forge ahead by focusing on development and expansion are often rewarded by traders who are looking to set up long positions where strong fundamentals trump the absence of short-term gains. One project that has weathered the storm in the crypto markets to establish a new all-time high is Telos (TLOS), a blockchain network created with the EOSIO software that aims to bring speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming and social media. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.42 on Jan. 10, the price of TLOS has soared 229% to a new high of $1.39 thanks in part to a record-high trading volume of...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 3

Tristan is the core contributor to Zeta Markets, an under-collateralized DeFi derivatives platform, providing liquid derivatives trading to individuals and institutions alike. “We’ve seen a Cambrian explosion in the DeFi ecosystem in 2021, with peak TVL approaching $300 billion vs the 2020 peak of $21 billion. This sounds like the growth surely has to slow. Yet, DeFi still represents just a fraction of CeFi trading volumes. At Zeta, we see a clear opportunity for more and more CeFi infrastructure to be built on-chain in a permissionless manner. This will unlock innovative products that have previously been impossible to implement. The following has already started to happen: Composability trumps the siloed products of CeFi, which has created really powerful network effe...