DappRadar

Mutant Ape Planet creator arrested in NY for alleged $2.9M NFT ‘fraud’

The developer of a Mutant Ape Yacht Club knock-off collection — Mutant Ape Planet — has been arrested in New York, charged with allegedly “defrauding” investors of $2.9 million in a “rug pull scheme.” The arrest took place on Jan. 4 at the John F. International Airport in New York, with homeland security agent Ivan J. Arvelo alleging that French national “Aurelien Michel perpetrated a rug pull scheme” and stole “nearly $3 million from investors for his own personal use,” stating: “Purchasers of Mutant Ape Planet NFTs thought they were investing in a trendy new collectible, but they were deceived and received none of the promised benefits” Internal Revenue Service agent Thomas Fattorusso was also cited in a press release from the Department of Justice, alleging that “Miche...

NFTs still in ‘great demand’ as unique traders rise 18% in Oct: DappRadar

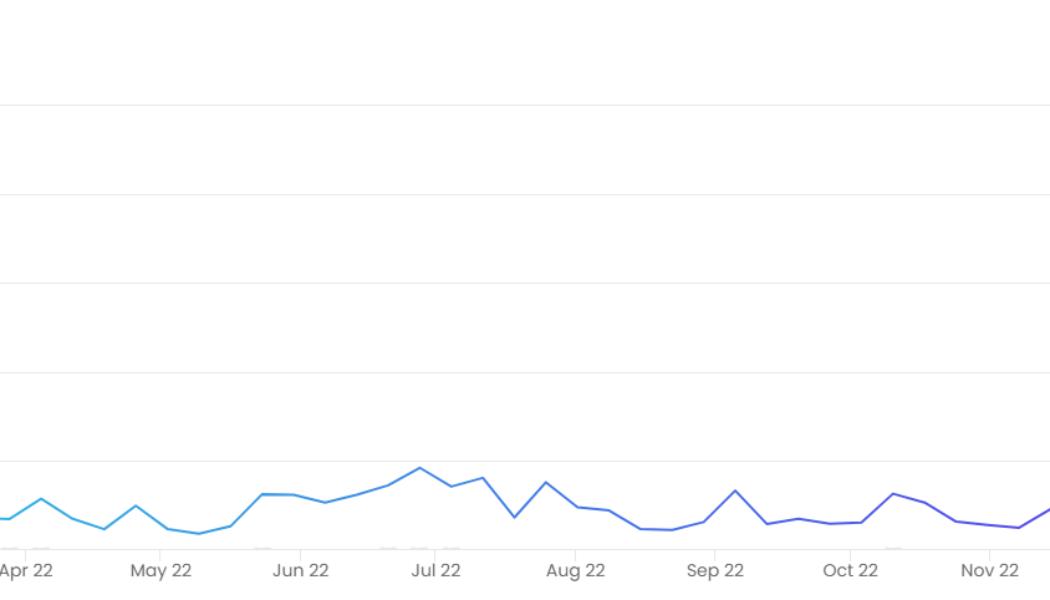

October may have seen a decline in nonfungible token (NFT) trading volume and sales, but analytics firm DappRadar says an 18% growth in monthly unique NFT traders shows the market is still in “great demand.” According to a Nov. 3 report from DappRadar, the number of monthly unique NFT traders in October reached 1.11 million, increasing 18% from September, of approximately 950,000. This is despite trading volumes falling 30% to $662 million in October, the lowest registered in 2022, while the sales count decreased by 30% to 6.13 million, the firm said, adding: “The rise in the unique traders’ count indicates that new people are entering the NFT market, and it is still in great demand.” Number of monthly unique NFT traders (millions). Source: DappRadar The month was a busy one for the ...

Avalanche (AVAX) loses 30%+ in April, but its DeFi footprint leaves room to be bullish

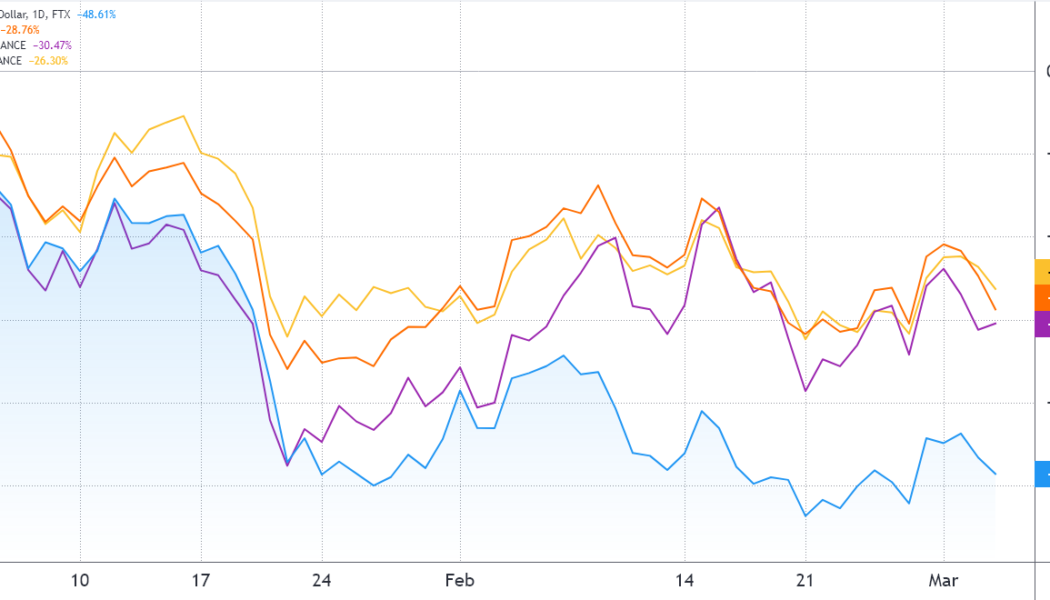

Avalanche (AVAX) price is down more than 30% in April, but despite the negative price move, the smart contract platform remains a top contender for decentralized applications due to its scalability, low-cost transactions and its large footprint in the decentralized finance (DeFi) landscape. AVAX token/USD at FTX. Source: TradingView The network is compatible with the Ethereum Virtual Machine (EVM) and unique in that it does not face the same operational bottlenecks of high transaction fees and network congestion. Avalanche was able to amass over $9 billion in total value locked (TVL) by offering a proof-of-stake (PoS) layer-1 scaling solution. This indicator is extremely relevant because it measures the deposits on the network’s smart contracts. For instance, the BNB Chain, running since S...

US crypto adoption remains high despite global inflation fears

A quantitative analytics report published by DappRadar has unveiled a number of revelatory behavioral market indicators for the global adoption of digital assets. The blockchain data portrays a positive sentiment for the Web3 and metaverse sectors, especially in the United States; a reactionary rise in crypto interest throughout Ukraine and Russia following the outbreak of the conflict and the impact of the well-documented surge i gas prices throughout Europe on inflationary metrics. Bar chart statistics reported a high correlation between the unfavorable economic dynamics witnessed in times of currency deflation and the interest in engaging with cryptocurrencies, with the data suggesting that the latter could serve as an investment hedge. The tumultuous 217.65% deflation of the Brazilian ...

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...