DAO

UNI tokens delegation was a ‘misunderstood situation,’ according to Binance’s CZ

The millions of UNI (UNI) tokens delegated by Binance were a “misunderstood situation,” said Binance CEO Changpeng “CZ” Zhao in a Twitter post, in response to questions about 13.2 million UNI tokens delegated on Oct. 18 that made Binance the second-largest entity by voting power in the Uniswap DAO. According to CZ, a UNI transfer between internal wallets caused the automatic delegation. He denie allegations about the crypto exchange using users’ tokens to vote. UNI transferred between internal Binance wallets, causing the UNI to be automatically delegated. This is part of their protocol, not “we intended”. Binance don’t vote with user’s tokens. Uniswap misunderstood the situation. Tokens come to popular platforms. #Binance https://t.co/KYPqFx5GrW — CZ Bi...

Barely halfway and October already the biggest month in crypto hacks: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. October is historically associated with the bulls, but in 2022, the month has also become the leader in crypto hacks as barely halfway through, and the DeFi ecosystem has already seen nearly a dozen hacks resulting in losses of hundreds of millions of dollars. The largest hack occurred on Solana’s DeFi platform Mango Markets on Oct. 11, resulting in a loss of over $100 million worth of crypto. The hacker has now come out to demand $70 million in USD Coin (USDC) stablecoin as a bounty to return the stolen crypto. In another hack, TempleDAO was exploited for $2 million on the same day as Mango Market’s exploit. Movi...

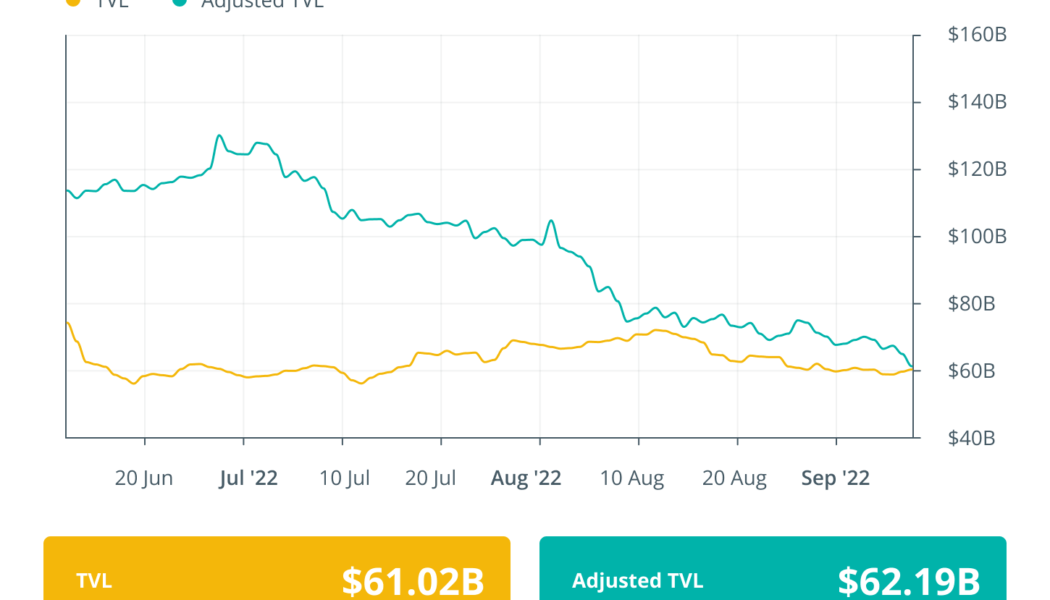

Tornado Cash saga left a void, says Chainalysis chief scientist: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Chainalysis chief scientist shared his views on the Tornado Cash saga and said that the incident has left a void for illicit fund mixing services, but the real impact of the sanctions could be determined in the long run. The staking ecosystem of Ethereum post Merge could have a significant impact on the crypto economy, according to a new report. Institutional lending platform Mapple Finance launched a $300 million lending pool for Bitcoin mining farms. The Tribe DAO, a decentralized autonomous organization, voted in favor of repaying affected users of the $80 million exploit on DeFi platform Rari Capital’s liquidi...

Panda DAO says it will dissolve and return investor’s assets due to internal strife

On Monday, decentralized autonomous organization Panda DAO put forth a new proposal to dissolve itself and return assets back to investors. According to the seven-point referendum, between 500 million and 700 million PANDA tokens out of the 1.292 billion PANDA in circulation would be distributed among investors. Of those remaining, some would be redistributed among liquidity providers. Meanwhile, an estimated 50 million PANDA will be burned, and another 44.56 million PANDA will go toward compensation for eight of the project’s core developers. Should the referendum pass and the dissolution process complete, the Panda dev team plans to remove PANDA from Uniswap, publish all of the project’s open source code and shut down all social media under the Panda DAO umbrella. As for reas...

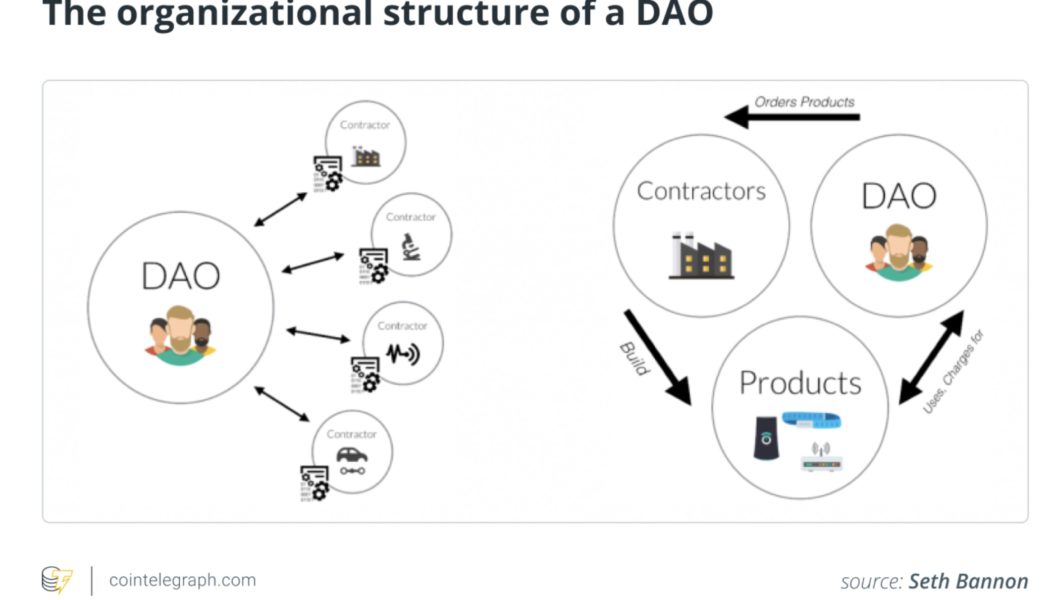

Waves founder: DAOs will never work without fixing governance

Decentralized Autonomous Organizations (DAOs) have been heralded as the future of governance, unlocking a more egalitarian approach to decision-making. However, decentralizing leadership isn’t a magical solution that instantly leads to better results. To truly get the most out of a decentralized organization, steps must be taken to regulate weighted voting and tokenomics. If not carefully balanced, DAOs can implode — and some already have. Decentralized governance explained DAOs offer a model for managing a project or company that distributes voting rights across all members. There is usually no central authority, only the will of the collective. While this sounds equitable in theory, the opposite can be true for certain governance models. Perhaps most problematic of all structures a...

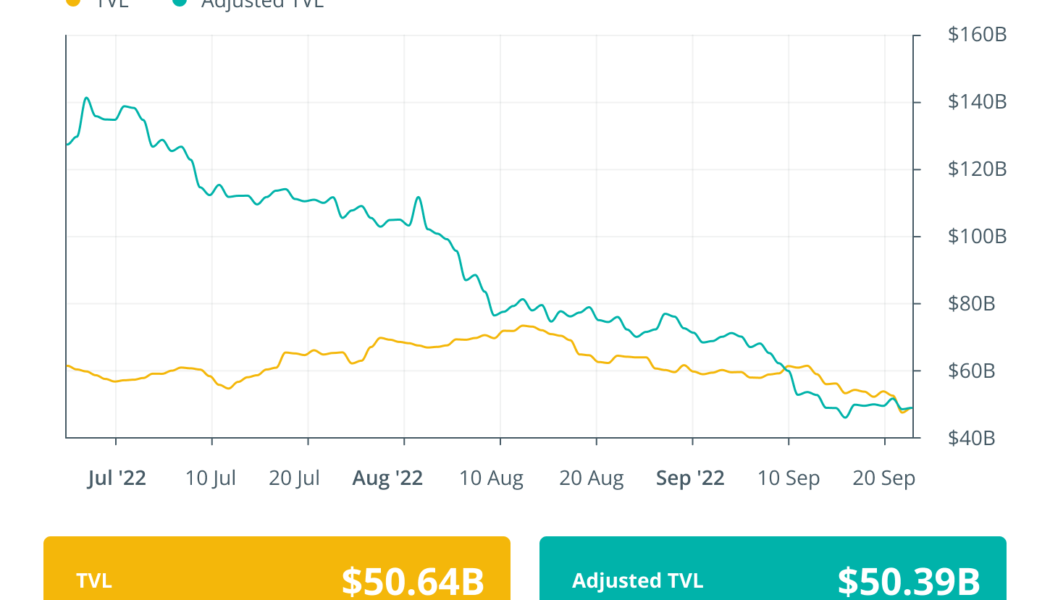

DApp activity rises 3.7% in August for the first time since May: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Decentralized applications, or DApps, finally showed a glimmer of recovery in August as the daily average of unique active wallets rose by 3.7% compared to May. With just under a week left for the Merge, SEBA Bank has opened Ethereum staking services for institutions. On the other side, layer-2 scalability solutions are hopeful of seeing a significant cut in their carbon emissions post Merge. This past week, two DeFi protocols became victims of coordinated flash loan attacks. On Wednesday, Avalanche-based lending protocol Nereus Finance became the victim of a crafty hack that saw a user net $371,000 worth of USD C...

MakerDAO co-founder recommends DAI-USD depegging to limit attack surface

In light of the recent discussions around depegging its native token from USD Coin (USDC) amid sanctioning of Tornado Cash, MakerDAO co-founder Rune Christensen reached out to the community explaining why free-floating DAI may be the only choice for the decentralized autonomous organization (DAO). In his blog post, “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai,” Christensen disclosed miscalculating the risks related to risk-weighted assets (RWA). He stated: “Physical crackdown against crypto can occur with no advance notice and with no possibility of recovery even for legitimate, innocent users. This violates two core assumption that we used to understand RWA risk, making the authoritarian threat a lot more serious.” Whil...

Fei Protocol founder proposes ghosting Tribe DAO following hack repayment

An attack in April 2022, which drained off nearly $80 million from various Rari Fuse pools, required the decentralized finance (DeFi) platform Fei Protocol to come up with a solution that minimizes damage to the ecosystem. Fei Labs’ latest proposal, which partly recommends revoking participation from Tribe DAO, received mixed sentiments from the community. Fei Protocol founder Joey Santoro announced the latest proposal, TIP-121: Proposal for the future of the Tribe DAO, revealing the company’s intent to reimburse Fuze victims. It also details plans for asset redemption and the distribution of protocol-controlled value (PCV) assets that manage the liquidity and yield. I hope this proposal resonates with the community and thank you for your support.https://t.co/RjpS9j4x2H — Joey ’s ERC-4626 ...

Tornado Cash DAO goes down without explanation following vote on treasury funds

The Tornado Cash DAO went offline after many social media users reported the community discussing ways to challenge sanctions recently imposed by the United States Treasury Department’s Office of Foreign Asset Control. At the time of publication, the Tornado Cash DAO was offline reportedly following a discussion in which community members voted unanimously to add its governance layer as a signatory to its treasury’s multisig wallet, which manages a reported $21.6 million. It’s unclear what was responsible for the decentralized autonomous organization (DAO) going dark, but it followed a series of actions taken by different authorities and private entities in the wake of U.S. sanctions announced against the controversial mixer on Monday. In the last four days, Circle froze more than 75,000 U...

MakerDAO should ‘seriously consider’ depegging DAI from USD: Founder

MakerDAO founder Rune Chirstensen has urged members of the decentralized autonomous organization (DAO) to “seriously consider” preparing for the depeg of its DAI stablecoin from the United States dollar (USD). The founder’s comments came in light of the recently announced sanctions on crypto mixer Tornado Cash, noting to MakerDAO’s Discord channel on Aug. 11 that the sanctions are “unfortunately more serious than I first thought,” adding that they should prepare to depeg its native stablecoin DAI from the USD to avoid any risk’s relating to Circle’s recent freezing of sanctioned USD Coin (USDC) addresses. “I think we should seriously consider preparing to depeg from USD. It is almost inevitable it will happen and it is only realistic to do with huge amounts of preparation.” On Aug. 8, the ...

Multicoin Capital raises $430M for new crypto startup fund

Prominent crypto investor Multicoin Capital has launched a new venture fund valued at $430 million, further demonstrating venture capital’s growing interest in the blockchain economy amid the bear market. Multicoin’s Venture Fund III will invest between $500,000 and $25 million in early-stage companies across various crypto- and blockchain-focused industries, the company announced Tuesday. It’s also willing to invest values of up to $100 million or greater for later-stage projects with an established brand and market presence. Related: VC Roundup: ‘Web5,’ Metaverse sports and Bitcoin monetization startups generate buzz Venture Fund III will place greater emphasis on crypto projects that have demonstrated “proof of physical work,” or protocols that have created economic incentives for...

US crypto regulation bill aims to bring greater clarity to DAOs

On June 7, United States Senators Cynthia Lummis and Kirsten Gillibrand launched the much anticipated Responsible Financial Innovation Act, proposing a comprehensive set of regulations that address some of the biggest questions facing the digital assets sector. By providing holistic guidance to the rapidly growing industry, the bill offers a bipartisan response to President Biden’s call for a whole-of-government approach to regulating crypto. Among its many proposals, the bill establishes basic definitions, provides an exemption for digital currency transactions and harmonizes the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), delineating regulatory swim lanes and granting a significant jurisdictional expansion to the CFTC. The bi...